|

市場調查報告書

商品編碼

1750551

乾式真空幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dry Vacuum Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

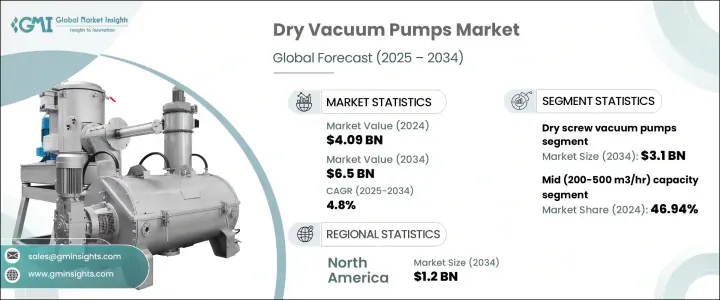

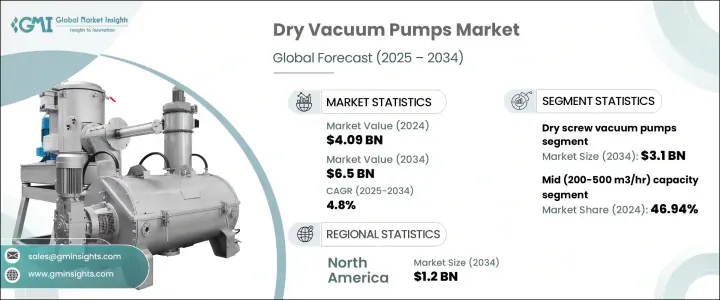

2024 年全球乾式真空幫浦市場價值為 40.9 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長,達到 65 億美元,這得益於汽車、電子和航太等各個製造業領域不斷成長的需求。這些行業依靠乾式真空泵進行塗層、成型和材料處理等基本應用。製藥和生物技術領域也為市場擴張做出了重大貢獻,將乾式真空幫浦用於冷凍乾燥、蒸餾和滅菌等製程。此外,化學工業對可靠、無污染真空解決方案的需求日益成長,進一步推動了需求,尤其是在溶劑回收和氣體提取等應用方面。食品加工和包裝行業也採用乾式真空泵,因為它們操作清潔,從而支持了對加工和包裝食品日益成長的需求。

雖然乾式真空幫浦具有諸多優勢,包括節能和低維護成本,但其技術複雜性也帶來了挑戰。安裝、操作和故障排除需要專業知識和培訓。此外,乾式真空幫浦並非適合所有應用,尤其是在需要極高真空度或特定環境條件的應用,油封幫浦在這些情況下可能表現較佳。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 40.9億美元 |

| 預測值 | 65億美元 |

| 複合年成長率 | 4.8% |

2024年,乾式螺桿真空幫浦佔最大市場佔有率,產值達19億美元。這類泵浦因其高抽速和高真空度而備受青睞,這在化學加工、半導體製造和冶金等行業中至關重要。其節能運作、高可靠性和長使用壽命使其成為注重降低能耗和營運成本的行業的理想選擇。

2024年,中等容量乾式真空幫浦(容量範圍為200-500立方公尺/小時)佔據了市場主導地位,佔據了46.94%的佔有率。這些幫浦在食品包裝和加工中至關重要,因為它們能夠確保穩定的真空度,這對於保持產品完整性和延長保存期限至關重要。製藥和生物加工產業也依賴這些幫浦來提供符合嚴格監管標準的清潔、無油真空源。

2024年,北美乾式真空幫浦市場規模達7億美元。該地區的生物技術和製藥行業推動了乾式真空幫浦的需求,因為它們需要乾式真空幫浦用於冷凍乾燥和藥品生產等關鍵應用。此外,美國的環境法規鼓勵各行各業採用節能環保的技術,包括乾式真空幫浦。

為了鞏固市場地位,阿特拉斯·科普柯、阿法拉伐和安捷倫科技等主要參與者正專注於節能高效真空解決方案的創新。這些公司正在大力投資研發,以提高產品的效率和可靠性。為了擴大市場覆蓋範圍和客戶群,策略合作夥伴關係、併購也很常見。此外,企業擴大採用數位技術來提供整合解決方案,以滿足各行各業日益成長的自動化需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 衝擊力

- 成長動力

- 對能源效率的需求增加

- 技術進步

- 製藥業需求不斷成長

- 半導體產業的成長

- 產業陷阱與挑戰

- 某些應用中的效能有限

- 維護和維修費用

- 成長動力

- 成長潛力分析

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 乾式螺桿真空泵

- 乾式渦旋真空泵

- 乾式隔膜泵

- 乾爪和鉤泵

- 其他

第6章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 低(高達 200m3/小時)

- 中(200-500 立方米/小時)

- 高(超過 500 立方米/小時)

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 電子和半導體

- 製藥

- 化工和石化

- 石油和天然氣

- 食品和飲料

- 其他

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Agilent Technologies

- Alfa Laval

- Atlas Copco

- Becker Vacuum Pumps

- DEKKER Vacuum Technologies

- Ebara Corporation

- Edwards Vacuum

- Flowserve Corporation

- Graham Corporation

- Grundfos

- KNF Neuberger

- Leybold GmbH

- Tuthill Corporation

- ULVAC

- Welch Vacuum

The Global Dry Vacuum Pumps Market was valued at USD 4.09 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 6.5 billion by 2034, driven by the increasing demand across various manufacturing industries, including automotive, electronics, and aerospace. These industries rely on dry vacuum pumps for essential applications such as coating, molding, and material handling. The pharmaceutical and biotechnology sectors also contribute significantly to market expansion, utilizing dry vacuum pumps for processes such as lyophilization, distillation, and sterilization. Additionally, the growing need for reliable and contamination-free vacuum solutions in the chemical industry further propels demand, especially for applications like solvent recovery and gas extraction. The food processing and packaging industries are also adopting dry vacuum pumps due to their clean operation, supporting the rising demand for processed and packaged foods.

While dry vacuum pumps offer several advantages, including energy efficiency and low maintenance, their complexity in terms of technology can pose challenges. Specialized knowledge and training are required for installation, operation, and troubleshooting. Moreover, dry vacuum pumps may not be the best fit for all applications, particularly those requiring extremely high vacuum levels or specific environmental conditions where oil-sealed pumps may perform better.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.09 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 4.8% |

In 2024, dry screw vacuum pumps held the largest market share, generating USD 1.9 billion. These pumps are preferred for high pumping speeds and deep vacuum levels, which are essential in sectors such as chemical processing, semiconductor manufacturing, and metallurgy. Their energy-efficient operation, combined with high reliability and long service life, makes them an attractive option for industries focused on reducing energy consumption and operational costs.

Mid-capacity dry vacuum pumps, with a capacity range of 200-500 m3/hr, dominated the market in 2024, capturing 46.94% share. These pumps are crucial in food packaging and processing, as they ensure consistent vacuum levels, which are essential for maintaining product integrity and extending shelf life. The pharmaceutical and bioprocessing industries also rely on these pumps for clean, oil-free vacuum sources that comply with stringent regulatory standards.

North America Dry Vacuum Pumps Market generated USD 700 million in 2024. The biotechnology and pharmaceutical industries in the region drive demand, as they require dry vacuum pumps for critical applications such as freeze-drying and pharmaceutical production. Furthermore, environmental regulations in the U.S. are encouraging industries to adopt energy-efficient, environmentally friendly technologies, including dry vacuum pumps.

To strengthen their presence in the market, key players such as Atlas Copco, Alfa Laval, and Agilent Technologies are focusing on innovations in energy-efficient and high-performance vacuum solutions. These companies are investing heavily in research and development to enhance the efficiency and reliability of their products. Strategic partnerships and mergers, and acquisitions are also common, as players aim to expand their market reach and customer base. Additionally, companies are increasingly adopting digital technologies to offer integrated solutions that cater to the growing demand for automation in various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 1.1 Industry ecosystem analysis

- 1.1.1 Factors affecting the value chain

- 1.1.2 Profit margin analysis

- 1.1.3 Disruptions

- 1.1.4 Future outlook

- 1.1.5 Manufacturers

- 1.1.6 Distributors

- 1.1.7 Retailers

- 1.2 Trump administration tariffs analysis

- 1.3 Impact on trade

- 1.3.1 Trade volume disruptions

- 1.3.2 Retaliatory measures

- 1.4 Impact on the industry

- 1.4.1 Supply-side impact (raw materials)

- 1.4.2 Price volatility in key materials

- 1.4.3 Supply chain restructuring

- 1.4.4 Production cost implications

- 1.4.5 Demand-side impact (selling price)

- 1.4.6 Price transmission to end markets

- 1.4.7 Market share dynamics

- 1.4.8 Consumer response patterns

- 1.5 Key companies impacted

- 1.6 Strategic industry responses

- 1.6.1 Supply chain reconfiguration

- 1.6.2 Pricing and product strategies

- 1.6.3 Policy engagement

- 1.7 Outlook and future considerations

- 1.8 Impact forces

- 1.8.1 Growth drivers

- 1.8.1.1 Increased demand for energy efficiency

- 1.8.1.2 Technological advancements

- 1.8.1.3 Rising demand in pharmaceutical industry

- 1.8.1.4 Growth of semiconductor industry

- 1.8.2 Industry pitfalls & challenges

- 1.8.2.1 Limited performance in certain applications

- 1.8.2.2 Maintenance and repair costs

- 1.8.1 Growth drivers

- 1.9 Growth potential analysis

- 1.10 Pricing analysis

- 1.11 Porter's analysis

- 1.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 2.1 Introduction

- 2.2 Company market share analysis

- 2.3 Competitive positioning matrix

- 2.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 3.1 Key trends

- 3.2 Dry screw vacuum pump

- 3.3 Dry scroll vacuum pump

- 3.4 Dry diaphragm pump

- 3.5 Dry claw and hook pumps

- 3.6 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 4.1 Key trends

- 4.2 Low (upto 200m3/hr)

- 4.3 Mid (200-500 m3/hr)

- 4.4 High (more than 500 m3/hr)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Electronics and semiconductors

- 5.3 Pharmaceutical

- 5.4 Chemical and petrochemical

- 5.5 Oil and gas

- 5.6 Food and beverages

- 5.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Direct sales

- 6.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 10 Company Profiles

- 8.1 Agilent Technologies

- 8.2 Alfa Laval

- 8.3 Atlas Copco

- 8.4 Becker Vacuum Pumps

- 8.5 DEKKER Vacuum Technologies

- 8.6 Ebara Corporation

- 8.7 Edwards Vacuum

- 8.8 Flowserve Corporation

- 8.9 Graham Corporation

- 8.10 Grundfos

- 8.11 KNF Neuberger

- 8.12 Leybold GmbH

- 8.13 Tuthill Corporation

- 8.14 ULVAC

- 8.15 Welch Vacuum