|

市場調查報告書

商品編碼

1740991

汽車貸款發放軟體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Auto Loan Origination Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

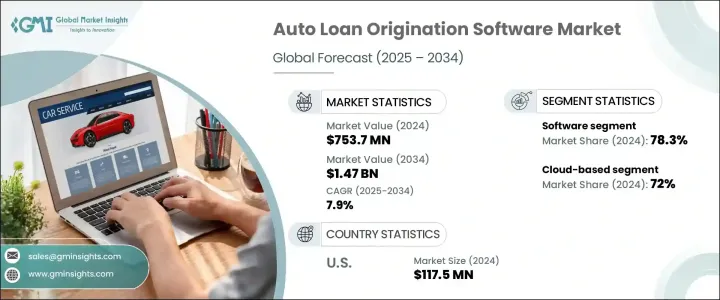

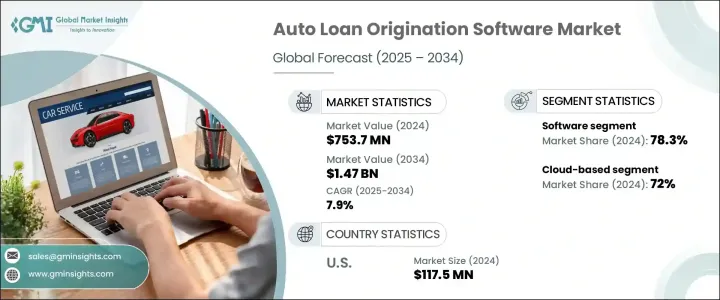

2024年,全球汽車貸款發放軟體市場規模達7.537億美元,預計2034年將以7.9%的複合年成長率成長,達到14.7億美元。隨著對更有效率、更準確、更流暢的貸款流程的需求不斷成長,金融機構正轉向技術,以滿足當今數位化世界中消費者的期望。汽車貸款發放軟體在自動化處理申請受理、文件驗證、信用評估和最終核准等複雜任務方面發揮著至關重要的作用,為貸款機構提供端到端的數位貸款解決方案。隨著越來越多的貸款機構致力於減少處理時間和營運成本,同時提高借款人滿意度,汽車貸款市場發展勢頭強勁。推動這一成長的關鍵因素是越來越重視客戶體驗。如今,借款人期望獲得快速批准、減少文書工作和個人化服務,而貸款發放平台正是實現這些目標的平台。透過提供簡化、透明和直覺的數位貸款流程,這些解決方案可幫助金融機構在競爭日益激烈的市場中吸引和留住客戶。金融機構也優先考慮安全、可擴展且自適應的解決方案,這些解決方案能夠提供高度客製化,使其能夠在藉款人行為變化和法規不斷演變的情況下保持敏捷。隨著貸款申請數位化管道的日益普及,對靈活的雲端系統的需求變得比以往任何時候都更加迫切。

市場根據組件細分為軟體和服務。 2024年,軟體類別佔約78.3%的主導市場佔有率,預計在整個預測期內將以超過8.3%的複合年成長率成長。軟體平台因其可擴展性、靈活性以及簡化從申請到批准的貸款流程的能力而越來越受到青睞。這些系統旨在自動執行風險分析、身份驗證和信用評分等耗時任務,並無縫整合到現有的金融基礎設施中。金融機構擴大選擇融合了先進功能的智慧平台,包括基於人工智慧的評分模型、CRM系統和即時應用程式追蹤。這些整合解決方案不僅加快了貸款發放流程,還有助於建立更安全、更合規的貸款生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.537億美元 |

| 預測值 | 14.7億美元 |

| 複合年成長率 | 7.9% |

從部署角度來看,市場分為本地部署平台和雲端平台。 2024年,雲端部署佔據72%的市場佔有率,佔據市場主導地位,預計到2034年將維持8.4%以上的成長率。由於雲端解決方案能夠支援動態擴展、即時更新和跨系統無縫整合,因此越來越受到貸款機構的青睞。透過利用雲端技術,機構可以降低基礎設施成本,受益於定期安全補丁,並為員工和客戶提供更優質的存取體驗。這些平台還能增強資料隱私,並促進更順暢地遵守本地和國際法規,這在當前數據驅動型金融的環境下尤其具有吸引力。

在申請方面,市場分為乘用車貸款和商用車貸款。乘用車貸款在申請細分領域中佔據領先地位,並且由於該類別處理的汽車貸款量巨大,預計將繼續佔據主導地位。大多數尋求個人汽車融資的借款人都希望獲得簡單快速的數位化流程,而這些平台完全可以滿足這項需求。個人消費者對簡化、行動優先的貸款申請系統的需求特別強烈,這促使貸款機構在採用或升級其貸款發放軟體時優先考慮乘用車貸款。

從地理上看,北美在全球汽車貸款發放軟體市場中佔據領先地位。 2024年,美國貢獻了約1.175億美元的收入,約佔該地區市佔率的79.6%。美國龐大的汽車購買量、汽車信貸的廣泛使用以及先進的金融基礎設施,共同促成了這一主導地位。美國的金融機構也迅速採用人工智慧系統、數位文件處理和即時分析技術,使其成為汽車貸款技術領域的關鍵創新者。

隨著市場的發展,軟體供應商優先考慮端到端加密、即時詐欺偵測和自動合規性檢查等功能,以滿足日益成長的資料安全性和透明度需求。人工智慧和機器學習如今已成為信用風險分析、貸款決策和投資組合最佳化的核心。與保險公司、經銷商和監管機構等第三方生態系統的整合,進一步實現了即時協作和統一的貸款體驗。這項技術轉型正在重塑汽車貸款流程,使其更具回應性、更有效率、更以客戶為中心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 金融機構及貸款人

- 軟體供應商

- 服務提供者

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 用例

- 成本結構分析

- 對部隊的影響

- 成長動力

- 對精簡高效的貸款處理解決方案的需求

- 注重提升顧客體驗與滿意度

- 監理合規要求推動軟體採用

- 轉向基於雲端的解決方案以實現可擴展性

- 產業陷阱與挑戰

- 處理敏感資訊時的隱私問題

- 監管變化導致軟體頻繁更新

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 軟體

- 服務

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第8章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 銀行

- 信用合作社

- 抵押貸款人和經紀人

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Avant

- Axcess Consulting Group

- Black Knight Technologies

- Byte Software

- Calyx Technology

- Financial Industry Computer Systems

- Finastra

- Fiserv

- ICE Mortgage Technology

- ISGN Corporation

- Juris Technologies

- Lending Qb

- Mortgage Builder Software

- Mortgage Cadence

- Pegasystems

- SPARK

- Tavant

- Turnkey Lender

- VSC

- Wipro

The Global Auto Loan Origination Software Market was valued at USD 753.7 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 1.47 billion by 2034. As demand rises for more efficient, accurate, and seamless lending processes, financial institutions are turning to technology to meet consumer expectations in today's digitally driven world. Auto loan origination software plays a vital role in automating complex tasks such as application intake, document verification, credit evaluation, and final approval, offering lenders an end-to-end digital lending solution. The market is gaining momentum as more lenders aim to cut down on processing time and operational overhead while improving borrower satisfaction. A key factor fueling this growth is the rising focus on customer experience. Borrowers today expect quick approvals, minimal paperwork, and personalized services, and loan origination platforms are enabling exactly that. By providing streamlined, transparent, and intuitive digital lending journeys, these solutions help financial institutions attract and retain customers in an increasingly competitive market. Institutions are also prioritizing secure, scalable, and adaptive solutions that offer a high degree of customization, allowing them to remain agile amid changing borrower behaviors and evolving regulations. With the growing popularity of digital channels for loan applications, the need for flexible and cloud-based systems has become more critical than ever.

The market is segmented based on components into software and services. In 2024, the software category held a dominant market share of approximately 78.3% and is projected to grow at a CAGR exceeding 8.3% throughout the forecast period. Software platforms are gaining preference for their scalability, flexibility, and ability to streamline loan processing from application to approval. These systems are engineered to automate time-intensive tasks such as risk analysis, identity validation, and credit scoring, integrating seamlessly into existing financial infrastructure. Financial organizations are increasingly opting for intelligent platforms that combine advanced functionalities, including AI-based scoring models, CRM systems, and real-time application tracking. These integrated solutions not only speed up the origination process but also contribute to a more secure and compliant lending ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $753.7 Million |

| Forecast Value | $1.47 Billion |

| CAGR | 7.9% |

Deployment-wise, the market is split into on-premises and cloud-based platforms. In 2024, cloud-based deployment led the market with a commanding 72% share and is expected to maintain a growth rate of over 8.4% through 2034. Lenders are increasingly favoring cloud solutions due to their ability to support dynamic scaling, real-time updates, and seamless integration across systems. By leveraging the cloud, institutions can cut down on infrastructure costs, benefit from regular security patches, and enable better access for both employees and customers. These platforms also enhance data privacy and facilitate smoother compliance with local and international regulations, making them particularly attractive in the current landscape of data-driven finance.

In terms of application, the market is divided between loans for passenger cars and commercial vehicles. The passenger car segment leads the application breakdown and is forecasted to continue its dominance due to the large volume of auto loans processed in this category. Most borrowers looking for personal vehicle financing seek easy and quick digital processes, which these platforms are well-equipped to deliver. The demand for simplified, mobile-first loan application systems is particularly strong among individual consumers, pushing lenders to prioritize the passenger vehicle segment when adopting or upgrading their origination software.

Geographically, North America leads the global auto loan origination software market, with the United States contributing around USD 117.5 million in revenue and accounting for roughly 79.6% of the regional share in 2024. The country's large volume of vehicle purchases, widespread use of credit for auto financing, and advanced financial infrastructure have contributed to this dominance. Financial institutions in the U.S. are also rapidly embracing AI-enabled systems, digital document handling, and real-time analytics, positioning the nation as a key innovator in auto lending technology.

As the market evolves, software providers are prioritizing features such as end-to-end encryption, real-time fraud detection, and automated compliance checks to meet the growing need for data security and transparency. Artificial intelligence and machine learning are now central to credit risk analysis, loan decisioning, and portfolio optimization. Integration with third-party ecosystems-including insurance firms, dealerships, and regulatory bodies-is further enabling real-time collaboration and a unified loan experience. This technology transformation is reshaping auto lending into a more responsive, efficient, and customer-focused process.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.2.1 Total Addressable Market (TAM), 2025-2034

- 2.3 Regional trends

- 2.4 Component trends

- 2.5 Deployment trends

- 2.6 Application trends

- 2.7 Enterprise Size trends

- 2.8 End use trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Financial Institutions and Lenders

- 3.2.2 Software provider

- 3.2.3 Service provider

- 3.2.4 End use

- 3.3 Impact of trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Use cases

- 3.9 Cost structure analysis

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Demand for streamlined efficient loan processing solutions

- 3.10.1.2 Focus on enhancing customer experience and satisfaction

- 3.10.1.3 Regulatory compliance requiremen driving software adoption

- 3.10.1.4 Shift toward cloud-based solutions for scalability

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Privacy concerns in handling sensitive information

- 3.10.2.2 Regulatory changes lead to frequent software updates

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light duty

- 7.3.2 Medium duty

- 7.3.3 Heavy duty

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Banks

- 9.3 Credit unions

- 9.4 Mortgage lenders & brokers

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Avant

- 11.2 Axcess Consulting Group

- 11.3 Black Knight Technologies

- 11.4 Byte Software

- 11.5 Calyx Technology

- 11.6 Financial Industry Computer Systems

- 11.7 Finastra

- 11.8 Fiserv

- 11.9 ICE Mortgage Technology

- 11.10 ISGN Corporation

- 11.11 Juris Technologies

- 11.12 Lending Qb

- 11.13 Mortgage Builder Software

- 11.14 Mortgage Cadence

- 11.15 Pegasystems

- 11.16 SPARK

- 11.17 Tavant

- 11.18 Turnkey Lender

- 11.19 VSC

- 11.20 Wipro