|

市場調查報告書

商品編碼

1740962

電動二輪車共享市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Two-Wheeler Sharing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

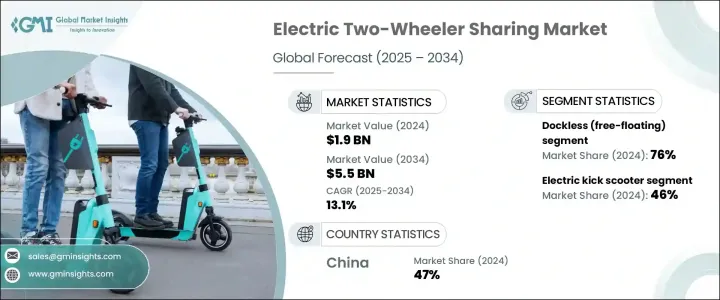

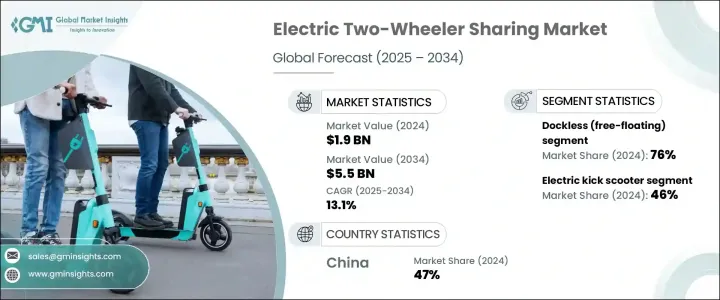

2024 年全球電動二輪車共享市場價值為 19 億美元,預計到 2034 年將以 13.1% 的複合年成長率成長,達到 55 億美元。隨著城市人口不斷成長以及大城市面臨日益嚴重的交通堵塞問題,傳統的公共交通和私家車在解決短距離和最後一英里連接方面往往顯得力不從心。這時電動二輪車共享服務就派上用場了。這些解決方案提供了一種快速、靈活且環保的替代方案,可無縫融入日常通勤,尤其是在人口稠密的地區。現在,消費者優先考慮便利性、機動性和成本效益,而不是擁有汽車的責任。透過使用者友善的應用程式提供共享電動出行服務,乘客可以即時使用滿足其日常交通需求的電動車,而不會造成交通堵塞或污染。城市交通行為的轉變也受到更年輕、更精通技術的人群的影響,他們更喜歡移動即服務 (MaaS) 平台,從而將採用率推向新的高度。

日益增強的環保意識和全球對清潔出行的追求已成為該市場的主要成長動力。隨著碳排放、空氣品質惡化和城市交通堵塞的加劇,電動車作為合理且永續的解決方案應運而生。共享電動車零廢氣排放,與傳統的燃氣驅動汽車相比,維護需求顯著降低。這些優勢既吸引了希望減少碳足跡的消費者,也吸引了致力於實現永續發展目標的城市官員。政府的支持也發揮著至關重要的作用,從補貼和稅收優惠,到零排放區和電動車充電基礎設施的建設。這些舉措正在推動電動車的普及,同時也與向智慧綠色城市轉型的大趨勢相契合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 55億美元 |

| 複合年成長率 | 13.1% |

2024年,電動滑板車佔據市場主導地位,佔46%的佔有率,預計到2034年將以12.5%的複合年成長率成長。電動滑板車體積小巧、易於使用且價格實惠,使其成為城市騎乘者的首選。在傳統車輛難以駕馭的狹窄城市空間中,電動滑板車尤其實用;此外,電動滑板車維護成本低廉,對於尋求快速擴張的出行服務提供者而言,它也是一個極具吸引力的選擇。

無樁共享單車系統(或稱自由浮動式共享單車系統)在2024年佔據了76%的市場佔有率,佔據了市場主導地位,預計將保持強勁成長勢頭,到2034年將以13%的複合年成長率成長。這些系統允許使用者在指定區域內的任何地點取車和還車,提供無與倫比的便利。基於應用程式的平台可實現無縫預訂、追蹤和支付,而城市也支援這些系統,因為它們在減少交通堵塞和推進清潔出行目標方面發揮了重要作用。

由於快速的城鎮化進程、政府主導的電動車政策以及強大的電動車基礎設施,中國電動二輪車共享市場規模在2024年達到3.185億美元。電池更換站、智慧充電網路以及行動融合服務使得共享電動出行更有效率、便利。

Bird.co、TIER Mobility、Yulu、Bolt、GrabWheels、Voi Technology、Revel、Dott、Lime Micromobility 和 Helbiz 等領先企業正在擴大車隊規模、提昇路線和電池效率,並與市政府合作。許多公司正在投資人工智慧車隊管理、動態定價和公共交通整合,以提升用戶體驗並降低成本。環保營運和循環經濟實踐也日益普及,幫助企業遵守法規並吸引環保意識的使用者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 電動二輪車製造商

- 電池和充電基礎設施供應商

- 技術和軟體平台開發商

- 共享出行營運商

- 市政當局和監管機構

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 成本細分分析

- 價格趨勢

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 城市擁擠加劇,最後一哩需求增加

- 日益成長的環境議題和永續性重點

- 經濟高效的行動選擇

- 電動車補貼、優惠法規與基礎設施投資

- 技術進步和應用程式整合

- 產業陷阱與挑戰

- 初期投資高

- 充電基礎設施有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 電動摩托車

- 電動滑板車

- 電動自行車

- 電動滑板車

第6章:市場估計與預測:按共享系統,2021 - 2034 年

- 主要趨勢

- 停靠

- 無碼頭(自由浮動)

第7章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 可拆卸/可更換電池

- 固定/整合電池

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人消費者

- 遊客

- 企業/機構用戶

第9章:市場估計與預測:依商業模式,2021 - 2034 年

- 主要趨勢

- B2C(企業對消費者)

- B2B(企業對企業)

- P2P(點對點)共享

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Bird.co

- Bolt

- Bounce Infinity

- Cityscoot

- Cooltra

- Dott

- emmy Sharing

- Felyx

- GoShare (by Gogoro)

- GrabWheels

- Grin

- Helbiz

- HelloBike

- Lime Micromobility

- Meituan (Mobike)

- Revel

- Spin

- TIER Mobility

- Voi Technology

- Yulu

The Global Electric Two-Wheeler Sharing Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 5.5 billion by 2034. As urban populations continue to rise and major cities face mounting congestion issues, traditional public transport, and personal vehicles often fall short when it comes to addressing short-distance and last-mile connectivity. That's where electric two-wheeler sharing services come in. These solutions offer a fast, flexible, and eco-friendly alternative that fits seamlessly into daily commutes, particularly in densely populated areas. Consumers now prioritize convenience, mobility, and cost-efficiency over the responsibilities of vehicle ownership. With shared e-mobility services available through user-friendly apps, riders enjoy real-time access to electric vehicles that meet their daily transport needs without contributing to traffic congestion or pollution. The shift in urban transport behavior is also being shaped by the younger, tech-savvy demographic that prefers mobility-as-a-service (MaaS) platforms, pushing adoption to new heights.

Rising environmental awareness and a global push for clean mobility have become major growth drivers for this market. As carbon emissions, poor air quality, and urban traffic jams escalate, electric mobility emerges as a logical and sustainable solution. Shared electric vehicles produce zero tailpipe emissions and come with significantly lower maintenance demands compared to traditional gas-powered alternatives. These benefits appeal to both consumers looking to reduce their carbon footprint and city officials working toward sustainability targets. Government support is playing a crucial role as well-ranging from subsidies and tax incentives to the rollout of zero-emission zones and electric vehicle charging infrastructure. These initiatives are boosting adoption while also aligning with the broader shift toward smart, green cities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 13.1% |

In 2024, electric kick scooters led the market, holding a 46% share, and are projected to grow at a CAGR of 12.5% through 2034. Their compact size, ease of use, and affordability make them a go-to option for urban riders. They're especially useful in tight urban spaces where traditional vehicles struggle, and their low maintenance costs make them an attractive choice for mobility providers looking to scale quickly.

Dockless, or free-floating, systems dominated the market with a 76% share in 2024 and are expected to maintain strong momentum, growing at a 13% CAGR through 2034. These systems let users pick up and drop off vehicles anywhere within approved areas, offering unmatched convenience. App-based platforms enable seamless booking, tracking, and payment, while cities support these systems for their role in reducing congestion and advancing clean mobility goals.

China's Electric Two-Wheeler Sharing Market reached USD 318.5 million in 2024, thanks to rapid urbanization, government-led EV policies, and strong EV infrastructure. Battery-swapping stations, smart charging networks, and mobile-integrated services have made shared e-mobility efficient and widely accessible.

Leading players like Bird.co, TIER Mobility, Yulu, Bolt, GrabWheels, Voi Technology, Revel, Dott, Lime Micromobility, and Helbiz are expanding fleets, enhancing route and battery efficiency, and partnering with city governments. Many are investing in AI-powered fleet management, dynamic pricing, and public transit integration to improve user experience and cut costs. Eco-conscious operations and circular economy practices are also gaining ground, helping companies comply with regulations and appeal to green-minded users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Electric two-wheeler manufacturers

- 3.2.2 Battery and charging infrastructure providers

- 3.2.3 Technology and software platform developers

- 3.2.4 Shared mobility operators

- 3.2.5 City authorities and regulatory bodies

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Cost breakdown analysis

- 3.7 Price trends

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising urban congestion and last-mile needs

- 3.11.1.2 Growing environmental concerns and sustainability focus

- 3.11.1.3 Cost-effective mobility option

- 3.11.1.4 Subsidies on electric vehicles, favorable regulations, and infrastructure investments

- 3.11.1.5 Technological advancements and app integration

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial investment

- 3.11.2.2 Limited charging infrastructure

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Electric motorcycle

- 5.3 Electric scooter

- 5.4 E-bikes

- 5.5 Electric kick scooter

Chapter 6 Market Estimates & Forecast, By Sharing System, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Key trends

- 6.2 Docked

- 6.3 Dockless (Free-Floating)

Chapter 7 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 Removable/swappable battery

- 7.3 Fixed/integrated battery

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Tourists

- 8.4 Corporate/institutional users

Chapter 9 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 B2C (Business-to-Consumer)

- 9.3 B2B (Business-to-Business)

- 9.4 P2P (Peer-to-Peer) sharing

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bird.co

- 11.2 Bolt

- 11.3 Bounce Infinity

- 11.4 Cityscoot

- 11.5 Cooltra

- 11.6 Dott

- 11.7 emmy Sharing

- 11.8 Felyx

- 11.9 GoShare (by Gogoro)

- 11.10 GrabWheels

- 11.11 Grin

- 11.12 Helbiz

- 11.13 HelloBike

- 11.14 Lime Micromobility

- 11.15 Meituan (Mobike)

- 11.16 Revel

- 11.17 Spin

- 11.18 TIER Mobility

- 11.19 Voi Technology

- 11.20 Yulu