|

市場調查報告書

商品編碼

1740853

航太和國防熱管理系統市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Aerospace and Defense Thermal Management Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

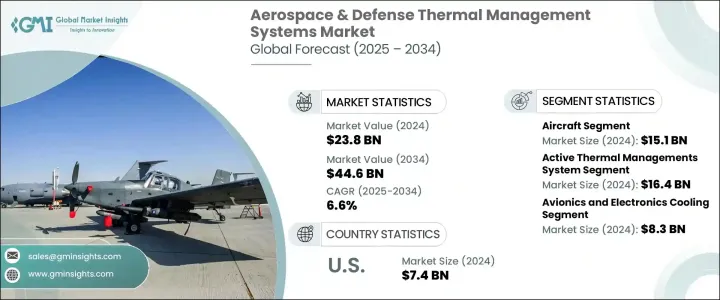

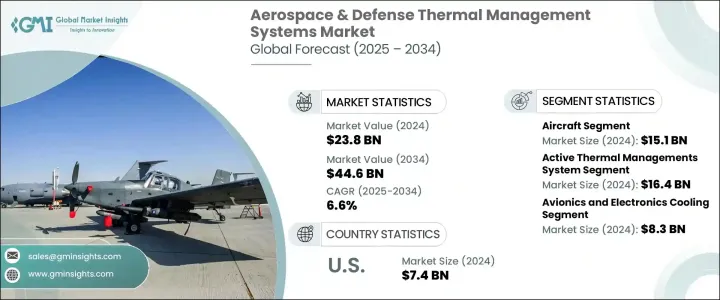

2024年,全球航太與國防熱管理系統市場規模達238億美元,預估年複合成長率為6.6%,到2034年將達到446億美元,這得益於先進軍事裝備投資的不斷增加以及下一代飛機的快速生產。隨著世界各國政府增加國防預算以增強國家安全和戰場優勢,該產業正經歷轉型。隨著日益緊湊和高功率密度平台的部署,熱管理不再只是一個支援系統,而是一個關鍵任務元件。隨著高性能電子設備、航空電子設備和推進系統的不斷發展,對確保設備運作穩定性和長期耐用性的熱解決方案的需求也在不斷成長。人工智慧、定向能武器、高超音速系統和電力推進技術的融合,為熱調節增添了新的複雜性,使其成為原始設備製造商(OEM)和國防承包商的首要任務之一。隨著國防平台互聯互通和資料驅動程度的提高,熱管理系統的設計必須兼顧適應性、冗餘性和智慧控制。這種轉變促使製造商開發符合現代戰爭需求的動態、輕量化和模組化冷卻系統。

貿易政策也在塑造市場成長曲線方面發揮重要作用。進口航太零件和原料的關稅顯著影響了製造成本,尤其是在美國。鋁、鋼和熱界面材料等必需投入品價格上漲,導致採購波動,交貨週期延長。儘管一些貿易激勵措施鼓勵了本地採購,但許多製造商正在重新評估其供應鏈策略,以減少對進口的依賴,並建立更具韌性的生產生態系統。關稅和貿易協定的不可預測性推動了市場向更聰明的物流、本地化生產和自適應採購策略的方向發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 238億美元 |

| 預測值 | 446億美元 |

| 複合年成長率 | 6.6% |

飛機繼續引領航太和國防熱管理系統市場平台細分市場,2024 年市場規模將達 151 億美元。下一代軍用噴射機和無人機將配備強大的航空電子設備、電子戰系統和監視技術,這些技術會產生大量熱量。為了保持任務就緒狀態並延長平台使用壽命,這些飛機需要高效、輕量化的冷卻系統。隨著電力推進和混合動力配置的普及,對節能且不影響性能的熱解決方案的需求變得愈發重要。雖然飛機在平台細分市場中佔據主導地位,但陸基系統和海軍艦艇正在迅速採用先進的熱技術,以滿足機載通訊、電子設備和武器系統日益成長的電力需求。

主動式熱管理系統憑藉其卓越的高密度熱負荷調節能力,在2024年以164億美元的估值領先市場。液體冷卻裝置、熱電模組和蒸汽壓縮系統等技術如今已成為高風險國防行動的關鍵。這些系統的獨特之處在於其即時自適應性——這得益於智慧感測器、嵌入式控制和人工智慧整合。這些特性使平台能夠動態調整熱負荷,即使在長時間高強度任務中也能保持最佳性能。國防應用日益複雜,使得主動系統成為軍事和航太利益相關者的首選,旨在確保其技術堆疊面向未來。

2024年,美國航太與國防熱管理系統市場產值達74億美元,這得益於高超音速飛彈、先進隱形轟炸機和定向能武器等高科技國防平台的快速創新。這些技術產生巨大的熱量輸出,需要具備精準度和可擴展性的下一代冷卻系統。美國國防計畫日益重視整合式熱架構,以支援海陸空無縫協同作戰。從無人地面車輛到驅逐艦和隱形飛機,軍方優先考慮符合數位轉型目標和戰場準備狀態的冷卻解決方案。因此,製造商正在大力投資模組化、可重構的系統,這些系統可以根據任務需求進行演進,並縮短整合時間。

霍尼韋爾國際、西嘉航太、馬洛塔控制、萊爾德熱力系統、巴斯科姆·亨特和英國航宇系統等主要參與者正在加倍投入研發,以打造更智慧、更輕、更具可擴展性的散熱解決方案。他們正在與國防承包商和新興科技公司建立戰略合作夥伴關係,共同開發兼具性能與靈活性的智慧冷卻系統。各公司也紛紛採用積層製造技術,以簡化生產流程並縮短高需求專案的交付週期,從而進一步提升其在這個快速發展的市場中的競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 先進軍用飛機產量上升

- 電動和混合動力推進系統的採用日益增多

- 衛星和太空任務的擴展

- 無人機和無人駕駛飛機業務的成長

- 全球軍費開支不斷增加

- 產業陷阱與挑戰

- 開發和整合成本高

- 網路安全和系統漏洞風險

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按平台,2021 - 2034 年

- 主要趨勢

- 飛機

- 陸地系統

- 海軍系統

第6章:市場估計與預測:按系統類型,2021 - 2034 年

- 主要趨勢

- 主動熱管理系統

- 被動式熱管理系統

第7章:市場估計與預測:按組成部分,2021 - 2034 年

- 主要趨勢

- 冷板

- 熱交換器

- 風扇和鼓風機

- 泵浦和壓縮機

- 閥門和感測器

- 隔熱材料

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 航空電子設備和電子設備冷卻

- 引擎冷卻

- 儲能冷卻

- 武器系統冷卻

- 客艙舒適度

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Advanced Cooling Technologies

- AMETEK

- BAE Systems

- Bascom Hunter

- Boyd Corporation

- Collins Aerospace

- Crane Aerospace and Electronics

- Honeywell International

- Laird Thermal Systems

- Liebherr Aerospace

- Marotta Controls

- Meggitt

- Signia Aerospace

- TAT Technologies

The Global Aerospace and Defense Thermal Management Systems Market was valued at USD 23.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 44.6 billion by 2034, fueled by rising investments in advanced military equipment and the rapid production of next-gen aircraft. The industry is undergoing a transformation as governments across the globe increase their defense budgets to enhance national security and battlefield superiority. With the deployment of increasingly compact and power-dense platforms, thermal management is no longer just a support system-it's now a mission-critical component. As high-performance electronics, avionics, and propulsion systems continue to evolve, so does the demand for thermal solutions that ensure both operational stability and long-term equipment durability. The integration of artificial intelligence, directed energy weapons, hypersonic systems, and electric propulsion technologies is adding new layers of complexity to thermal regulation, making it one of the top priorities for OEMs and defense contractors. As defense platforms become more interconnected and data-driven, thermal management systems must be engineered with adaptability, redundancy, and smart control in mind. This shift is pushing manufacturers to develop dynamic, lightweight, and modular cooling systems that align with modern warfare requirements.

Trade policies are also playing a major role in shaping the growth curve of the market. Tariffs on imported aerospace components and raw materials have significantly impacted manufacturing costs, particularly in the United States. Higher prices for essential inputs like aluminum, steel, and thermal interface materials have introduced procurement volatility and stretched lead times. While some trade incentives have encouraged local sourcing, many manufacturers are re-evaluating their supply chain strategies to reduce dependency on imports and build more resilient production ecosystems. The unpredictability of tariffs and trade agreements has driven the market toward smarter logistics, localized production, and adaptive sourcing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.8 Billion |

| Forecast Value | $44.6 Billion |

| CAGR | 6.6% |

Aircraft continue to lead the platform segment of the aerospace and defense thermal management systems market, accounting for USD 15.1 billion in 2024. Next-generation military jets and UAVs are being equipped with powerful avionics, electronic warfare systems, and surveillance technologies that generate substantial heat. To maintain mission readiness and platform longevity, these aircraft require highly efficient, lightweight cooling systems. As electric propulsion and hybrid configurations gain traction, the need for thermal solutions that conserve energy without compromising performance is becoming even more critical. While aircraft dominate the platform segment, land-based systems and naval vessels are rapidly adopting advanced thermal technologies to support the growing power demands of onboard communications, electronics, and weapons systems.

Active thermal management systems led the market with a valuation of USD 16.4 billion in 2024, thanks to their superior ability to regulate high-density thermal loads. Technologies like liquid cooling units, thermoelectric modules, and vapor compression systems are now essential for high-stakes defense operations. What sets these systems apart is their real-time adaptability-enabled by smart sensors, embedded controls, and AI integration. These features allow platforms to adjust thermal loads dynamically, maintaining peak performance even during extended, high-intensity missions. The growing complexity of defense applications has made active systems the go-to choice for military and aerospace stakeholders aiming to future-proof their technology stacks.

The United States Aerospace and Defense Thermal Management Systems Market generated USD 7.4 billion in 2024, driven by rapid innovation in high-tech defense platforms including hypersonic missiles, advanced stealth bombers, and directed energy weapons. These technologies produce massive thermal outputs, demanding next-gen cooling systems that offer precision and scalability. U.S. defense programs are increasingly focusing on integrated thermal architectures that support seamless operation across air, land, and sea domains. From unmanned ground vehicles to destroyers and stealth aircraft, the military is prioritizing cooling solutions that align with digital transformation goals and battlefield readiness. As a result, manufacturers are investing heavily in modular, reconfigurable systems that can evolve with mission requirements and reduce integration timelines.

Key players such as Honeywell International, Signia Aerospace, Marotta Controls, Laird Thermal Systems, Bascom Hunter, and BAE Systems are doubling down on RandD efforts to build smarter, lighter, and more scalable thermal solutions. They're entering into strategic partnerships with defense contractors and emerging tech firms to co-develop intelligent cooling systems that combine performance with flexibility. Companies are also turning to additive manufacturing to streamline production and shorten lead times in high-demand projects, further boosting their competitiveness in this fast-evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price volatility in Key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rise in advanced military aircraft production

- 3.3.1.2 Growing adoption of electric and hybrid-electric propulsion

- 3.3.1.3 Expansion of satellite and space missions

- 3.3.1.4 Growing UAV and drone operations

- 3.3.1.5 Rising military spending globally

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and integration costs

- 3.3.2.2 Cybersecurity and system vulnerability risks

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Aircraft

- 5.3 Land systems

- 5.4 Naval systems

Chapter 6 Market Estimates and Forecast, By System Type, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Active thermal management systems

- 6.3 Passive thermal management systems

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Cold plates

- 7.3 Heat exchangers

- 7.4 Fans & blowers

- 7.5 Pumps & compressors

- 7.6 Valves & sensors

- 7.7 Thermal insulation materials

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Avionics & electronics cooling

- 8.3 Engine cooling

- 8.4 Energy storage cooling

- 8.5 Weapons systems cooling

- 8.6 Cabin comfort

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Cooling Technologies

- 10.2 AMETEK

- 10.3 BAE Systems

- 10.4 Bascom Hunter

- 10.5 Boyd Corporation

- 10.6 Collins Aerospace

- 10.7 Crane Aerospace and Electronics

- 10.8 Honeywell International

- 10.9 Laird Thermal Systems

- 10.10 Liebherr Aerospace

- 10.11 Marotta Controls

- 10.12 Meggitt

- 10.13 Signia Aerospace

- 10.14 TAT Technologies