|

市場調查報告書

商品編碼

1714093

2025-2035年全球航空航太與國防部門工程與研發Global Aerospace & Defense ER&D Market 2025-2035 |

||||||

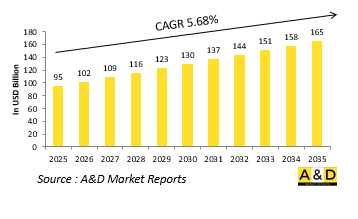

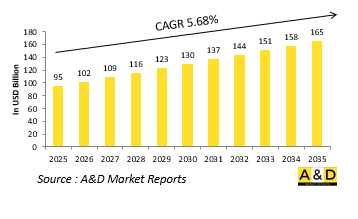

全球航空航太和國防 ER&D(工程研究、開發和發展)市場規模預計將從 2025 年的 950 億美元增長到 2035 年的 1,650 億美元,預測期內的複合年增長率為 5.68%。

全球航空航太與國防工程設計與研發市場:簡介

全球航空航太和國防部門的工程研究與開發 (ER&D) 正在根據戰略需求和不斷發展的技術進步而快速發展。隨著傳統航空航太與網路防禦、自主系統和低地球軌道太空應用等新興領域之間的界限變得模糊,ER&D 正在被重新定義,以支援多領域功能和綜合任務能力。ER&D 曾經主要由國防公司和國家航太機構的內部開發主導,現在則包括來自新創公司、私人航太公司、學術智庫和其他機構的敏捷貢獻。這些協作生態系統旨在加速創新,同時遵守嚴格的安全標準。此外,隨著太空領域競爭日益激烈、商業化程度不斷提高,工程與研發的範圍也不斷擴大。具體來說,這些包括衛星耐用性、可重複使用的太空船和空間態勢感知(SSA:Space Situational Awareness) 技術。此外,隨著國際緊張局勢加劇和商用航空市場多樣化,ER&D 不再只是一項技術支援職能;它作為各國和各企業在日益多極化的世界中確保優勢的戰略工具,正變得越來越重要。

航空航太與國防工程設計與研發市場:技術的影響

現代航空航太和國防工程設計與開發正在被一系列相互關聯的新興技術重塑。這些技術不僅在系統效能上而且在開發方法本身上帶來重大變化。如今,先進的模擬和建模平台使工程師能夠在建立實體原型之前評估系統在虛擬戰鬥和自然環境中的表現。這樣,從實體驗證到數位驗證的轉變對縮短設計週期和降低開發風險做出了重大貢獻。此外,在國防領域,感測器融合技術整合了紅外線、雷達和聲學感測器等多種感測器的信息,提供了卓越的態勢感知和目標識別能力。在航空航太領域,由即時分析驅動的機載健康監測系統正在徹底改變飛機的可靠性和維護計畫。此外,用於協調自主無人機和無人水下航行器操作的群體智慧正在為監視和作戰任務開闢新的作戰範式。人機協作也是一個熱門的研究領域,駕駛艙和指揮介面的發展可以動態適應人類的行為、壓力程度和任務條件。這些技術的整合正在使航空航太和國防工程與研發發展到系統能夠即時預測、學習和適應的程度。這正在創建一個能夠確保自主性和彈性的發展框架,這在未來將變得越來越重要。

航空航太與國防工程與研發市場:關鍵推動因素

全球航空航太和國防部門工程與研發的演變受到多種戰略、營運和市場推動因素的影響。最重要的推動因素之一是在競爭日益激烈的全球安全環境中需要具備韌性。對手在 A2/AD(反介入/區域拒止)技術方面的進步迫使國防組織重新思考系統的生存能力、冗餘度和任務連續性。因此,分散式平台、隱形技術和彈性空間基礎設施的研究和開發激增。此外,對即時情報和全球部署能力的需求日益增長,這需要具有高網路連接性的系統能夠跨陸地、空中、海上、網路空間和太空等多個領域運作。同時,在商用航空航太領域,乘客期望的變化、城市交通的進步和永續發展目標正在加速超音速旅行、降噪技術和混合電力推進系統等新技術的研發。此外,國防採購模式也在發生變化,強調模組化和開放式架構設計。這使得快速升級和技術更新週期成為可能,使開發從傳統的線性流程轉變為持續的、數據驅動的創新過程。

本報告研究了航空航太和國防部門的全球 ER&D(工程研究與開發)市場,並概述了當前的市場狀況、技術趨勢、市場影響因素分析、市場規模趨勢和預測、按地區進行的詳細分析、競爭格局和主要公司的概況。

目錄

全球航空航太與國防工程研發市場內容

全球航空航太與國防部門工程與研發市場:報告定義

全球航空航太與國防工程設計與研發市場:細分

按地區

按類型

按平台

按用途

全球航空航太與國防工程設計與研發市場分析:10 年預測

全球航空航太與國防工程研發市場技術

全球航空航太和國防領域工程研發市場預測

航空航太與國防工程設計與開發 (ER&D) 市場趨勢及各地區預測

北美

推動因素、阻礙因素與課題

阻礙因素

市場預測與情境分析

主要公司

供應商層級格局

企業標竿管理

歐洲

中東

亞太地區

南美洲

各國門禁市場分析

美國

國防計劃

最新消息

專利

目前技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳大利亞

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

市場機會矩陣

專家意見

概述

關於航空和國防市場報告

The global Aerospace & Defense ER&D market is estimated at USD 95 billion in 2025, projected to grow o USD 165 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.68% over the forecast period 2025-2035.

Introduction to Global Aerospace & Defense ER&D market:

The global aerospace and defense ER&D sector is evolving rapidly as industry stakeholders adapt to new strategic imperatives and technological frontiers. As the boundaries between traditional aerospace domains and emerging verticals like cyber defense, autonomous systems, and low-earth orbit operations blur, ER&D is being redefined to support cross-domain functionality and integrated mission capabilities. No longer confined to in-house development by defense contractors and national space agencies, ER&D now includes agile contributions from startups, private space companies, and academic think tanks. These collaborative ecosystems aim to accelerate innovation while maintaining rigorous compliance with security and safety protocols. Moreover, with space becoming an increasingly contested and commercialized domain, ER&D programs are broadening in scope to include satellite resilience, reusable space vehicles, and space situational awareness technologies. As global tensions rise and commercial aviation markets diversify, ER&D is positioned not just as a support function, but as a strategic lever that enables nations and corporations to stay ahead in an era of multipolar competition.

Technology Impact in Aerospace & Defense ER&D Market:

Modern aerospace and defense ER&D is being reshaped by a wave of interconnected technologies that are changing both the capabilities of systems and the methods used to develop them. Advanced simulation and modeling platforms now allow engineers to evaluate system performance in virtual combat and environmental scenarios long before a prototype is built. This shift from physical to digital validation accelerates design cycles and reduces development risk. Sensor fusion-combining data from infrared, radar, acoustic, and other sources-is enabling superior situational awareness and target recognition in defense applications. In the aerospace sector, onboard health monitoring systems powered by real-time analytics are revolutionizing aircraft reliability and maintenance planning. Furthermore, swarm intelligence-used in coordinating autonomous drones and unmanned underwater vehicles-introduces new operational paradigms for surveillance and combat operations. Human-machine teaming, another area of intense research, is driving the development of cockpits and command interfaces that dynamically adapt to human behavior, stress levels, and mission context. The convergence of these technologies is elevating aerospace and defense ER&D to a level where systems can anticipate, learn, and adapt in real time, aligning with future needs for autonomy and resilience.

Key Drivers in Aerospace & Defense ER&D Market:

A number of strategic, operational, and market-driven forces are shaping the trajectory of aerospace and defense ER&D worldwide. One of the most critical drivers is the imperative for resilience in an increasingly contested global security environment. Adversaries' advancements in anti-access/area denial (A2/AD) technologies are pushing defense organizations to rethink system survivability, redundancy, and mission continuity. This is leading to a surge in R&D for distributed platforms, stealth technologies, and resilient space architectures. Another influential driver is the growing demand for real-time intelligence and global reach, necessitating highly networked systems that can operate across multiple domains-land, air, sea, cyber, and space. Meanwhile, in the commercial aerospace realm, evolving passenger expectations, urban mobility trends, and sustainability goals are spurring ER&D into developing supersonic travel, noise-reduction technologies, and hybrid-electric propulsion systems. Additionally, defense procurement models are increasingly favoring modular and open-architecture designs, enabling rapid upgrades and technology refresh cycles. These shifts are encouraging more iterative and collaborative engineering models, which is transforming ER&D into a continuous, data-driven innovation process rather than a linear development cycle.

Regional Trends in Aerospace & Defense ER&D Market:

The global distribution of aerospace and defense ER&D efforts reveals how different regions prioritize and approach innovation based on their strategic needs, industrial base, and geopolitical outlook. In North America, particularly the United States, ER&D remains focused on maintaining a technological edge in multi-domain operations, with heavy investment in hypersonics, counter-space capabilities, and digital engineering environments. Canada complements this with initiatives in aerospace sustainability and dual-use technologies. In Europe, innovation is being shaped by increased emphasis on sovereignty and collective defense, particularly through frameworks such as the European Defence Fund. Programs like the Tempest fighter jet in the UK and the joint Franco-German FCAS demonstrate Europe's growing ambition in developing indigenous platforms supported by robust ER&D ecosystems. In Asia-Pacific, regional dynamics vary significantly-China prioritizes self-reliance in military technologies and space dominance, while India expands its indigenous programs like the Gaganyaan mission and the Tejas fighter. Japan and South Korea, meanwhile, are increasing their R&D investments in space security and next-gen surveillance systems to keep pace with regional threats. In the Middle East, nations like the UAE and Saudi Arabia are shifting from being customers to co-developers of defense systems, establishing R&D centers and forming technology transfer partnerships to build homegrown capabilities. This growing regional diversification in ER&D efforts is contributing to a more fragmented but highly competitive global landscape.

Key Aerospace & Defense ER&D Program:

The British Army recently conducted its largest-ever trial of a UK-developed radiofrequency directed energy weapon (RF DEW) system, successfully testing it against drone swarms. Held at a weapons range in West Wales, the trial saw UK troops use the system to bring down two drone swarms in a single engagement. In total, the system tracked, engaged, and neutralized over 100 drones throughout the series of tests. The project was spearheaded by Team Hersa, a collaboration between Defence Equipment & Support and the Defence Science and Technology Laboratory, with Thales UK developing the system under a £40 million ($50 million) government investment.

Table of Contents

Global aerospace and defense engineering and R&D (ER&D) Market - Table of Contents

Global aerospace and defense engineering and R&D (ER&D) market Report Definition

Global aerospace and defense engineering and R&D (ER&D) market Segmentation

By Region

By Type

By Platform

By Application

Global aerospace and defense engineering and R&D (ER&D) market Analysis for next 10 Years

The 10-year Globalaerospace and defense engineering and R&D (ER&D) market analysis would give a detailed overview of Globalaerospace and defense engineering and R&D (ER&D) market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global aerospace and defense engineering and R&D (ER&D)

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global aerospace and defense engineering and R&D (ER&D) market Forecast

The 10-year Globalaerospace and defense engineering and R&D (ER&D) market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional aerospace and defense engineering and R&D (ER&D) market Trends & Forecast

The regional Globalaerospace and defense engineering and R&D (ER&D) market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global aerospace and defense engineering and R&D (ER&D) market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global aerospace and defense engineering and R&D (ER&D) market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology Focus, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Domain, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology Focus, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Domain, 2025-2035

List of Figures

- Figure 1: Global Aerospace and Defense R&D Forecast, 2025-2035

- Figure 2: Global Aerospace and Defense R&D Forecast, By Region, 2025-2035

- Figure 3: Global Aerospace and Defense R&D Forecast, By Technology Focus, 2025-2035

- Figure 4: Global Aerospace and Defense R&D Forecast, By Application, 2025-2035

- Figure 5: Global Aerospace and Defense R&D Forecast, By Domain, 2025-2035

- Figure 6: North America, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 7: Europe, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 8: Middle East, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 9: APAC, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 10: South America, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 11: United States, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 12: United States, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 13: Canada, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 14: Canada, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 15: Italy, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 16: Italy, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 17: France, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 18: France, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 19: Germany, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 20: Germany, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 21: Netherlands, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 23: Belgium, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 24: Belgium, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 25: Spain, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 26: Spain, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 27: Sweden, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 28: Sweden, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 29: Brazil, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 30: Brazil, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 31: Australia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 32: Australia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 33: India, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 34: India, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 35: China, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 36: China, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 39: South Korea, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 40: South Korea, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 41: Japan, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 42: Japan, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 43: Malaysia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 45: Singapore, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 46: Singapore, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Aerospace and Defense R&D, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Aerospace and Defense R&D, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Aerospace and Defense R&D, By Technology Focus (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Aerospace and Defense R&D, By Technology Focus (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Aerospace and Defense R&D, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Aerospace and Defense R&D, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Aerospace and Defense R&D, By Domain (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Aerospace and Defense R&D, By Domain (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Aerospace and Defense R&D, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Aerospace and Defense R&D, Global Market, 2025-2035

- Figure 59: Scenario 1, Aerospace and Defense R&D, Total Market, 2025-2035

- Figure 60: Scenario 1, Aerospace and Defense R&D, By Region, 2025-2035

- Figure 61: Scenario 1, Aerospace and Defense R&D, By Technology Focus, 2025-2035

- Figure 62: Scenario 1, Aerospace and Defense R&D, By Application, 2025-2035

- Figure 63: Scenario 1, Aerospace and Defense R&D, By Domain, 2025-2035

- Figure 64: Scenario 2, Aerospace and Defense R&D, Total Market, 2025-2035

- Figure 65: Scenario 2, Aerospace and Defense R&D, By Region, 2025-2035

- Figure 66: Scenario 2, Aerospace and Defense R&D, By Technology Focus, 2025-2035

- Figure 67: Scenario 2, Aerospace and Defense R&D, By Application, 2025-2035

- Figure 68: Scenario 2, Aerospace and Defense R&D, By Domain, 2025-2035

- Figure 69: Company Benchmark, Aerospace and Defense R&D, 2025-2035