|

市場調查報告書

商品編碼

1740845

石墨烯塗層漁具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Graphene Coated Fishing Gear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

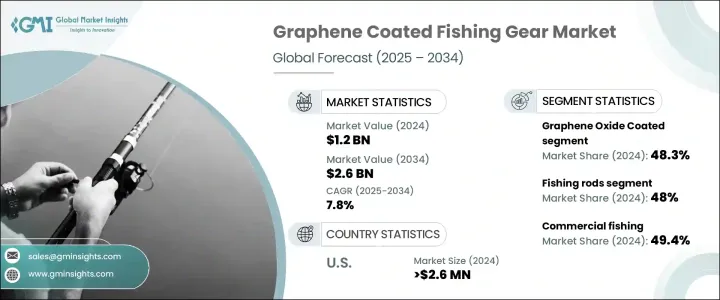

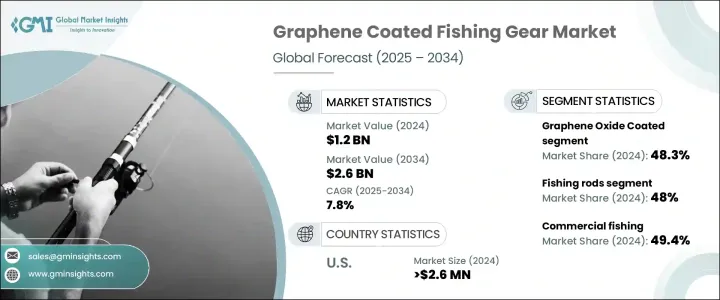

2024年,全球石墨烯塗層漁具市場規模達12億美元,預計到2034年將以7.8%的複合年成長率成長,達到26億美元。這一成長軌跡主要源自於休閒和商業領域對先進漁具日益成長的需求。釣客和商業漁民都在尋求輕便、高性能的工具,這些工具既要堅固耐用,又要兼顧靈敏度和靈活性。石墨烯塗層以其卓越的機械性能而聞名,憑藉其卓越的重量強度比,滿足了這些需求。這使得漁具不僅更加耐用,而且反應更快——這些特性對於追求持久耐用和高性能漁具的用戶來說至關重要。

休閒和競技釣魚群體日益成長的興趣,進一步提升了石墨烯塗層的吸引力。隨著越來越多的用戶意識到石墨烯塗層漁具的益處,其需求也持續成長。對創新和耐用性的追求,促使許多製造商將石墨烯作為戰略性產品升級融入漁具之中。這些塗層能夠提高靈敏度,減少長時間使用帶來的疲勞,並顯著延長產品使用壽命。由於釣客通常追求精準度、耐用性和反應速度,石墨烯塗層漁具正迅速成為首選。此外,隨著商業捕魚作業規模的不斷擴大,對堅固耐用且耐腐蝕漁具的需求也日益成長。產品性能與市場需求之間的這種契合,推動了該領域的大量投資和產品開發。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 7.8% |

2024年,市場按產品類型細分為魚竿、釣線輪、魚線、漁網和陷阱以及其他產品。其中,魚竿佔最大佔有率,貢獻了48%的市場總值。其主導地位源自於其在運動釣魚和休閒釣魚中的廣泛應用。石墨烯塗層在魚竿製造中被擴大採用,以在不增加重量的情況下增強強度和柔韌性。這使得它們成為尋求能夠重複使用並在各種釣魚條件下可靠運行的裝備的釣魚者的首選。增強的耐用性和機械彈性,加上更高的靈敏度,使石墨烯塗層釣竿成為市場上的高階產品。

根據材料類型,2024 年的市場細分為氧化石墨烯塗層、石墨烯奈米片 (GNP)、還原氧化石墨烯 (rGO) 等。氧化石墨烯塗層產品佔最大市場佔有率,為 48.3%,其次是基於 rGO 的塗層。氧化石墨烯塗層的受歡迎程度源自於其在聚合物基質中優異的分散性,以及強大的機械性能和阻隔功能。這些塗層特別適用於需要防潮防腐的釣竿、釣線輪和釣線。氧化石墨烯材料的另一個顯著優勢是易於整合到現有的製造系統中,為生產商提供了一種經濟高效的產品改進途徑,無需進行大規模的營運變更。

按應用領域分類,2024 年的市場細分為運動釣魚、商業釣魚、休閒釣魚和其他。商業釣魚佔據主導地位,佔 49.4%。其主要原因是商業作業中常見的重型設備和嚴苛的環境。該領域使用的漁具必須能夠承受長期暴露在惡劣的海洋環境中並頻繁操作。石墨烯塗層可以延長設備壽命,減少更換或維修需求,從而降低營運成本。這使得它們成為尋求簡化維護週期和延長漁具使用壽命的商業船隊營運商越來越受歡迎的選擇。

在美國,石墨烯塗層漁具的需求顯著成長。這歸因於人們越來越意識到使用兼具強度和長期耐用性的高性能材料的優勢。美國的商業和休閒漁業都越來越傾向於採用能夠確保可靠性、效率和卓越用戶體驗的先進漁具。市場競爭環境持續鼓勵創新,許多公司專注於擴展其石墨烯增強產品線,以滿足不斷變化的消費者偏好。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對耐用且持久的釣魚設備的需求不斷成長

- 技術進步和研發資金

- 產業陷阱與挑戰

- 生產和材料成本高

- 缺乏行業意識和採用

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 釣竿

- 釣魚捲軸

- 釣魚線

- 網和陷阱

- 其他

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 氧化石墨烯塗層

- 還原氧化石墨烯(rGO)

- 石墨烯奈米片(GNP)

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 商業捕魚

- 釣魚運動

- 休閒娛樂

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Century Fishing

- Garware Technical Fibres Ltd.

- mackenzieflyfishing

- MITO Materials

- Moonshine Rod Company

- St. Croix Fly

- Vision Group Oy

The Global Graphene Coated Fishing Gear Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 2.6 billion by 2034. This growth trajectory is largely driven by the increasing demand for advanced fishing equipment in both recreational and commercial sectors. Anglers and commercial fishers alike are seeking lightweight, high-performance tools that offer strength without sacrificing sensitivity or flexibility. Graphene-based coatings, known for their superior mechanical attributes, are meeting these needs by offering exceptional weight-to-strength ratios. This results in gear that is not only more durable but also highly responsive-qualities that are becoming essential for users demanding long-lasting and performance-driven fishing equipment.

Increased interest from recreational and competitive fishing communities has amplified the appeal of graphene coatings. As more users become aware of the benefits offered by graphene-infused gear, the demand continues to expand. The push for innovation and durability has driven many manufacturers to incorporate graphene into fishing tools as a strategic product upgrade. These coatings enhance sensitivity, reduce fatigue during prolonged use, and significantly increase the product lifespan. With anglers often seeking precision, durability, and responsiveness, graphene-coated gear is quickly becoming the preferred choice. Moreover, as commercial fishing operations continue to scale, the requirement for robust and corrosion-resistant tools is growing. This alignment between product capability and market demand has fueled substantial investments and product developments in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 7.8% |

In 2024, the market was segmented by product type into fishing rods, reels, lines, nets & traps, and others. Among these, fishing rods accounted for the largest share, contributing 48% to the total market value. Their dominance is due to their extensive use in both sport and leisure fishing. Graphene coatings are being increasingly adopted in rod manufacturing to reinforce strength and flexibility without increasing weight. This makes them highly desirable for anglers looking for equipment that can endure repeated use and perform reliably across various fishing conditions. Enhanced durability and mechanical resilience, paired with increased sensitivity, are positioning graphene-coated rods as a premium offering in the market.

Based on material type, the market in 2024 was segmented into Graphene Oxide Coated, Graphene Nanoplatelets (GNPs), Reduced Graphene Oxide (rGO), and others. Graphene Oxide Coated products held the largest market share at 48.3%, followed by rGO-based coatings. The preference for graphene oxide coatings stems from their excellent dispersion characteristics in polymer matrices, along with robust mechanical properties and barrier functions. These coatings are particularly suitable for rods, reels, and lines, where protection from moisture and corrosion is essential. Another significant advantage is the ease with which graphene oxide materials can be integrated into current manufacturing systems, offering producers a cost-effective path to product enhancement without large-scale operational changes.

By application, the 2024 market was broken down into sports fishing, commercial fishing, recreational, and others. Commercial fishing led the segment with a share of 49.4%. The primary reason for this dominance is the heavy equipment usage and demanding environments common in commercial operations. Gear used in this segment must withstand prolonged exposure to harsh marine conditions and frequent handling. Graphene coatings extend equipment life and reduce the need for replacements or repairs, thereby cutting operational costs. This has made them an increasingly popular choice for commercial fleet operators looking to streamline maintenance cycles and enhance gear longevity.

In the United States, demand for graphene-coated fishing gear has seen notable growth. This is attributed to the rising awareness about the advantages of using high-performance materials that offer both strength and long-term durability. Both the commercial and recreational fishing sectors in the US are showing a growing inclination toward adopting advanced gear that ensures reliability, efficiency, and superior user experience. The market's competitive environment continues to encourage innovation, with numerous companies focusing on expanding their graphene-enhanced product lines to capture evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for durable and long-lasting fishing equipment

- 3.7.1.2 Technological advancements and r&d funding

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production and material costs

- 3.7.2.2 Lack of industry awareness and adoption

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fishing rods

- 5.3 Fishing reels

- 5.4 Fishing lines

- 5.5 Nets & traps

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Graphene oxide coated

- 6.3 Reduced graphene oxide (rGO)

- 6.4 Graphene nanoplatelets (GNPs)

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial fishing

- 7.3 Sports fishing

- 7.4 Recreational

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Century Fishing

- 9.2 Garware Technical Fibres Ltd.

- 9.3 mackenzieflyfishing

- 9.4 MITO Materials

- 9.5 Moonshine Rod Company

- 9.6 St. Croix Fly

- 9.7 Vision Group Oy