|

市場調查報告書

商品編碼

1740836

複合紡織生產設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Composite Textile Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

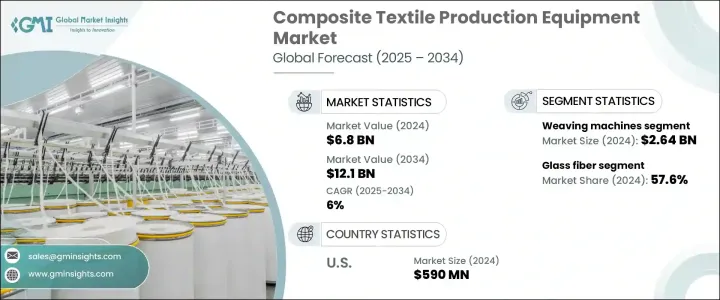

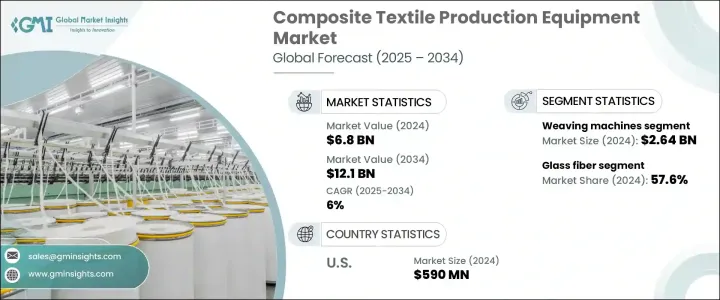

2024 年全球複合紡織品生產設備市場價值為 68 億美元,預計到 2034 年將以 6% 的複合年成長率成長至 121 億美元。各行各業越來越注重提高燃油效率和減輕結構重量,這推動了對複合紡織品的需求,進而推動了生產設備的成長。航太、汽車、風能和體育等行業正在採用這些先進材料,因為它們具有出色的強度重量比和耐腐蝕性。這些特性有助於製造商提高性能、提高能源效率並減少排放。在交通運輸和航空等領域,更輕的材料與更好的燃油經濟性和更低的碳排放直接相關,使複合紡織品成為現代製造業的關鍵組成部分。用於製造這些材料的設備也在快速發展,並整合了自動化和智慧技術,可提高生產率和精度。

現代複合紡織機械擴大融入數控功能和自動化機器人技術。這些系統能夠減少人為錯誤,提高生產效率,並維持穩定的產品品質。它們還支援不同紡織圖案或結構之間的快速轉換,使製造商能夠快速適應不斷變化的生產需求。隨著客製化和複雜複合材料需求的不斷成長,這種靈活性尤其重要。隨著各行各業對精度和可擴展性的重視,自動化解決方案對於滿足市場預期至關重要。即時微調操作的能力使這些系統在不犧牲一致性或效率的情況下擴大生產規模至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 68億美元 |

| 預測值 | 121億美元 |

| 複合年成長率 | 6% |

就設備類型而言,市場細分為織布機、針織機、編織機、預浸機等。織布機在2024年成為主導細分市場,營收達26.4億美元,預計到2034年將以約6.4%的複合年成長率成長。織造仍然是複合紡織品生產的核心過程之一,因為它能夠將紗線轉化為高強度、結構穩定的織物。與針織或非織造方法相比,機織紡織品具有更好的耐用性和抗應力性,使其成為高要求應用的理想選擇。它們能夠使用碳纖維、玻璃纖維和芳綸等材料來處理複雜的纖維交織圖案,這進一步增強了它們在性能關鍵型環境中的重要性。對能夠確保精度和速度的先進織造設備的需求日益成長,尤其是在生產高性能複合織物方面。

依纖維類型,市場可分為碳纖維、玻璃纖維、芳綸、天然纖維和其他纖維。 2024年,玻璃纖維佔據了該細分市場的主導地位,佔據了57.6%的市場。由於其價格實惠且在各種應用中性能可靠,玻璃纖維將繼續廣泛應用。與更昂貴的纖維不同,玻璃纖維兼具成本效益、強度和耐用性,非常適合汽車、船舶和建築等行業的大規模生產。它能夠適應各種紡織加工工藝,例如機織、針織和不織布,這進一步提升了它的吸引力。製造商受益於其與現有機械的兼容性,從而減少了對專用生產設備的需求,並最大限度地減少了資本投入。

從最終用途的角度來看,交通運輸業在2024年引領了市場,預計到2034年仍將保持領先地位。該行業對輕質高強度複合材料的需求尤其高,因為結構效率的提高直接轉化為燃油經濟性和安全性能的提升。車輛、火車和輪船正在更廣泛地採用纖維增強紡織品,尤其青睞耐腐蝕和能量吸收性能優異的材料。隨著全球排放法規的日益嚴格,運輸業的製造商擴大轉向複合材料及其規模化生產所需的專用機械。

在北美,美國以5,900億美元的估值(2024年)引領區域市場,複合年成長率達5.9%。國防、汽車和航太領域輕質複合材料應用的興起,持續推動美國國內紡織生產技術的創新。自動化、永續性和數位化領域的投資,正在支持旨在降低能耗和減少浪費的下一代設備的開發。

產業參與者正專注於節能工藝,例如無溶劑系統和精準纖維鋪放。此外,他們也正在努力提高投入品的可回收性,並整合環保材料。對透明度、可追溯性和符合國際環境標準的日益重視,正在影響製造商的採購決策,推動市場朝向更清潔、更負責任的生產方式邁進。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 貿易分析

- 利潤率分析

- 技術概述

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對輕質和節能材料的需求不斷成長

- 自動化和智慧技術的進步

- 航太和國防應用領域的擴展

- 再生能源領域的使用增加

- 產業陷阱與挑戰

- 初始資本投入高

- 環境和監管壓力

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依設備類型,2021-2034

- 主要趨勢

- 織布機

- 針織機

- 編織機

- 預浸料機

- 其他

第6章:市場估計與預測:依纖維類型,2021-2034

- 主要趨勢

- 碳纖維

- 玻璃纖維

- 芳綸纖維

- 天然纖維

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 航太與國防

- 運輸

- 建造

- 運動與休閒

- 醫療的

- 其他

第8章:市場估計與預測:依技術水平,2021-2034 年

- 主要趨勢

- 手動設備

- 半自動化系統

- 全自動設備

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- Cygnet Texkimp

- Dashmesh Jacquard And Powerloom Pvt. Ltd.

- Griffith Textile Machines

- Hangzhou Dengte Textile Machinery Co., Ltd

- IMESA Srl

- Itema Group

- KARL MAYER Holding SE & CO2 KG

- Lamiflex SpA

- Lindauer DORNIER GmbH

- McCO2 Machinery Company, Inc.

- Optima3D Ltd

- Sino Textile Machinery

- Trutzschler Nonwovens GmbH

- TSUDAKOMA Europe srl

The Global Composite Textile Production Equipment Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 12.1 billion by 2034. Increasing focus on improving fuel efficiency and reducing structural weight across multiple industries is driving the demand for composite textiles, which, in turn, fuels the growth of production equipment. Industries like aerospace, automotive, wind energy, and sports are adopting these advanced materials due to their exceptional strength-to-weight ratio and resistance to corrosion. These characteristics help manufacturers enhance performance, improve energy efficiency, and reduce emissions. In sectors like transportation and aviation, lighter materials are directly tied to better fuel economy and lower carbon emissions, making composite textiles a critical component in modern manufacturing. The equipment used to manufacture these materials is also evolving rapidly, integrating automation and smart technologies that improve productivity and precision.

Modern composite textile machinery increasingly incorporates CNC capabilities and automated robotics. These systems reduce human error, boost output efficiency, and maintain consistent product quality. They also support quick transitions between different textile patterns or structures, enabling manufacturers to adapt quickly to shifting production needs. This agility is especially important as demand for customized and complex composite materials continues to rise. As industries prioritize precision and scalability, automated solutions are becoming essential for meeting market expectations. The ability to fine-tune operations in real-time makes these systems vital in scaling production without sacrificing consistency or efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $12.1 Billion |

| CAGR | 6% |

In terms of equipment type, the market is segmented into weaving machines, knitting machines, braiding machines, prepreg machines, and others. Weaving machines emerged as the dominant segment in 2024, accounting for USD 2.64 billion in revenue and projected to grow at a CAGR of approximately 6.4% through 2034. Weaving remains one of the core processes in composite textile production due to its ability to transform yarn into high-strength, structurally stable fabric. Compared to knitted or nonwoven methods, woven textiles offer better durability and stress resistance, making them ideal for demanding applications. Their capability to handle complex fiber interlacing patterns using materials like carbon, glass, and aramid reinforces their importance in performance-critical environments. The need for advanced weaving equipment that ensures accuracy and speed is growing, particularly for producing high-performance composite fabrics.

The market is also categorized based on fiber type into carbon fiber, glass fiber, aramid fiber, natural fibers, and others. Glass fiber dominated this segment in 2024, representing 57.6% of the market share. It continues to be widely used due to its affordability and reliable performance across a range of applications. Unlike more expensive fibers, glass fiber offers an ideal combination of cost-efficiency, strength, and endurance. It suits large-scale production in sectors such as automotive, marine, and construction. Its adaptability to various textile processing techniques-such as weaving, knitting, and nonwoven formats-adds to its appeal. Manufacturers benefit from its compatibility with existing machinery, reducing the need for specialized production equipment and minimizing capital investment.

From an end-use perspective, the transportation sector led the market in 2024 and is expected to maintain its leadership through 2034. Demand for lightweight, high-strength composite materials is particularly high in this industry, where structural efficiency translates directly into improved fuel economy and safety performance. Vehicles, trains, and ships are incorporating fiber-reinforced textiles more extensively, favoring materials that offer corrosion resistance and energy absorption. As emissions regulations tighten globally, manufacturers in the transportation sector are increasingly turning to composite materials and the specialized machinery required to produce them at scale.

In North America, the United States led the regional market with a valuation of USD 590 billion in 2024, growing at a CAGR of 5.9%. The rise in lightweight composite applications across defense, automotive, and aerospace sectors continues to drive domestic innovation in textile production technologies. Investments in automation, sustainability, and digitalization are supporting the development of next-generation equipment designed for minimal energy use and waste reduction.

Industry players are focusing on energy-efficient processes such as solvent-free systems and precision-based fiber placement. Efforts are also being made to enhance the recyclability of inputs and integrate eco-friendly materials. Growing emphasis on transparency, traceability, and compliance with international environmental standards is influencing the purchasing decisions of manufacturers, pushing the market toward cleaner, more responsible production methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade Analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight and fuel-efficient materials

- 3.9.1.2 Advancements in automation and smart technologies

- 3.9.1.3 Expansion in aerospace and defense applications

- 3.9.1.4 Increasing use in renewable energy sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Environmental and regulatory pressures

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Weaving machines

- 5.3 Knitting machines

- 5.4 Braiding machines

- 5.5 Prepreg machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Carbon fiber

- 6.3 Glass fiber

- 6.4 Aramid fiber

- 6.5 Natural fibers

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Aerospace & defense

- 7.3 Transportation

- 7.4 Construction

- 7.5 Sports & leisure

- 7.6 Medical

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology Level, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manual equipment

- 8.3 Semi-automated systems

- 8.4 Fully automated equipment

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- 11.2 Cygnet Texkimp

- 11.3 Dashmesh Jacquard And Powerloom Pvt. Ltd.

- 11.4 Griffith Textile Machines

- 11.5 Hangzhou Dengte Textile Machinery Co., Ltd

- 11.6 IMESA S.r.l.

- 11.7 Itema Group

- 11.8 KARL MAYER Holding SE & CO2 KG

- 11.9 Lamiflex S.p.A.

- 11.10 Lindauer DORNIER GmbH

- 11.11 McCO2 Machinery Company, Inc.

- 11.12 Optima3D Ltd

- 11.13 Sino Textile Machinery

- 11.14 Trutzschler Nonwovens GmbH

- 11.15 TSUDAKOMA Europe s.r.l.