|

市場調查報告書

商品編碼

1740789

水冷式變壓器市場機會、成長動力、產業趨勢分析及2025-2034年預測Water Cooled Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

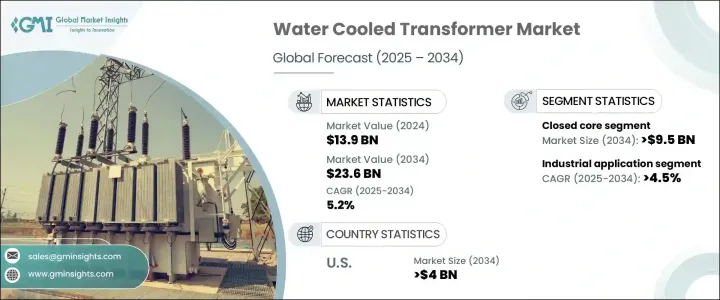

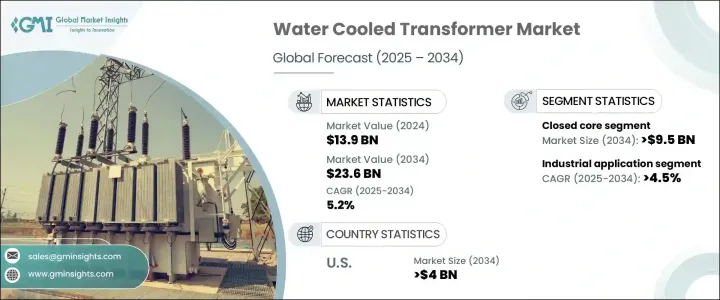

2024年,全球水冷變壓器市場規模達139億美元,預計2034年將以5.2%的複合年成長率成長,達到236億美元。這得益於能源需求的激增、熱管理系統的創新以及重型工業和公用事業領域對高性能解決方案的迫切需求。隨著全球電力基礎設施的不斷發展,各行各業都在積極尋求能夠確保效率、可靠性和使用壽命的技術。對於需要緊湊且高容量電力裝置的企業,尤其是在散熱至關重要的情況下,水冷變壓器正成為首選。隨著最佳化能源使用和最大限度減少設備停機時間的壓力日益增大,企業正在大力投資於能夠在不影響佔地面積或可擴展性的情況下提供卓越熱管理的冷卻解決方案。都市化、智慧城市計畫和再生能源整合的趨勢進一步擴大了對緊湊型模組化變電站的需求,在這些變電站中,有效的熱控制和更長的使用壽命是不可或缺的。

當今的工業格局正見證著變壓器設計向先進熱工學方向的決定性轉變,旨在最大限度地降低鐵芯損耗和雜散損耗,同時提高能量傳輸效率。在空間受限、能源負荷高的城市環境中,對先進水冷系統的需求正在重塑變壓器技術。同時,即時監控、物聯網感測器和預測性診斷的整合正在改變公用事業和工業領域的維護策略。營運商越來越重視基於狀態的維護和早期故障檢測,以減少非計劃性停機並改善資產管理。數位化、永續性和營運效率的強大聯合,將繼續推動下一代水冷變壓器系統的廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 139億美元 |

| 預測值 | 236億美元 |

| 複合年成長率 | 5.2% |

閉式變壓器佔據產品市場的主導地位,預計到2034年將創造95億美元的市場價值,這得益於其卓越的負載承受能力以及與基於物聯網的維護技術的無縫整合。貝里和殼式變壓器設計也因其緊湊的外形和高效的效率優勢而備受關注,完美契合再生能源設施和智慧城市電網不斷發展的需求。工業應用領域在2024年佔據了50.1%的市場佔有率,並以4.5%的複合年成長率成長,這主要得益於重型製造、石化和大規模生產等行業,這些行業需要在極端運行負載下提供穩定可靠的電力輸送。包括資料中心和高層建築在內的商業領域正在採用更空間最佳化的水冷系統,以確保能源效率和營運連續性,同時減少對環境的影響。公用事業公司正在加大對改造項目和數位化升級的投資,以支持再生能源與現有電網的無縫整合。

美國水冷變壓器市場在2024年的產值為21億美元,預計到2034年將達到40億美元,這得益於積極的電網現代化建設、可再生能源項目的激增以及更嚴格的能源效率法規。然而,貿易限制和材料關稅構成潛在挑戰,短期內將影響設備成本和交付進度。特變電工、中電電氣、Neeltran、Control Transformer、RoMan Manufacturing、Crossmars Energy、Noratel、Sensata Technologies、Jackson Transformer Company、保變電氣、BEST Transformer、Automation International、GPD Transformers 和 ARCHIT ELECTRICAL 等主要參與者正在引領市場創新。策略性舉措圍繞著自動化、模組化設計開發、區域供應鏈最佳化和物聯網支援的效能追蹤展開,使該產業能夠提供高效能變壓器解決方案,滿足全球能源格局快速變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依核心,2021 - 2034

- 主要趨勢

- 關閉

- 殼

- 莓果

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 配電變壓器

- 電源變壓器

- 其他

第7章:市場規模及預測:按繞組類型,2021 - 2034

- 主要趨勢

- 兩繞組

- 自耦變壓器

第8章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- 中壓

- 高壓

第9章:市場規模及預測:依絕緣材料,2021 - 2034

- 主要趨勢

- 氣體

- 油

- 堅硬的

- 其他

第 10 章:市場規模與預測:按評級,2021 年至 2034 年

- 主要趨勢

- ≤10兆伏安

- > 10 MVA 至 ≤ 100 MVA

- > 100 MVA 至 ≤ 600 MVA

- > 600 兆伏安

第 11 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 商業的

- 工業的

- 公用事業

第 12 章:市場規模與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第13章:公司簡介

- ARCHIT ELECTRICAL

- Automation International

- Baobian Electric

- BEST Transformer

- CEEG

- Control Transformer

- Crossmars Energy

- GPD Transformers

- Jackson Transformer Company

- Neeltran

- Noratel

- RoMan Manufacturing

- Sensata Technologies

- TBEA

The Global Water-Cooled Transformer Market was valued at USD 13.9 billion in 2024 and is projected to grow at a CAGR of 5.2% to reach USD 23.6 billion by 2034, fueled by surging energy demands, innovations in thermal management systems, and the urgent need for high-performance solutions in heavy-duty industrial and utility settings. As the global power infrastructure evolves, industries are pushing for technologies that ensure efficiency, reliability, and longevity. Water-cooled transformers are becoming the go-to choice for operations that require compact yet high-capacity power setups, especially where heat dissipation is critical. With increasing pressure to optimize energy use and minimize equipment downtime, companies are investing heavily in cooling solutions that deliver superior thermal management without compromising on footprint or scalability. The trend toward urbanization, smart city projects, and renewable energy integration further amplifies the demand for compact, modular substations where effective heat control and extended operational life are non-negotiable.

Today's industrial landscape is witnessing a decisive shift toward advanced thermal engineering in transformer design, aiming to minimize core and stray losses while boosting energy transfer efficiency. In urban environments where space constraints and energy loads are intense, the need for sophisticated water-cooled systems is reshaping transformer technology. Meanwhile, the integration of real-time monitoring, IoT-enabled sensors, and predictive diagnostics is transforming maintenance strategies across utilities and industrial sectors. Operators are increasingly prioritizing condition-based maintenance and early fault detection to limit unplanned outages and improve asset management. This strong convergence of digitalization, sustainability, and operational efficiency continues to drive the widespread adoption of next-generation water-cooled transformer systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.9 Billion |

| Forecast Value | $23.6 Billion |

| CAGR | 5.2% |

Closed core transformers dominate the product landscape and are projected to generate USD 9.5 billion by 2034, thanks to their superior load tolerance and seamless integration with IoT-based maintenance technologies. Berry and shell core designs are also capturing attention for their compact profiles and efficiency advantages, aligning perfectly with the evolving needs of renewable energy facilities and smart city grids. The industrial applications segment captured a 50.1% market share in 2024 and is growing at a 4.5% CAGR, driven by sectors such as heavy manufacturing, petrochemicals, and large-scale production that require rugged, reliable power delivery under extreme operational loads. Commercial segments, including data centers and high-rise developments, are adopting more space-optimized water-cooled systems to ensure energy efficiency and operational continuity while reducing their environmental impact. Utilities are intensifying investments in retrofit programs and digital upgrades to support the seamless integration of renewables into existing grids.

The U.S. water-cooled transformer market generated USD 2.1 billion in 2024 and is forecasted to reach USD 4 billion by 2034, propelled by aggressive grid modernization efforts, a surge in renewable energy projects, and tighter energy efficiency regulations. However, trade restrictions and material tariffs pose potential challenges, impacting equipment costs and delivery schedules in the short term. Key players such as TBEA, CEEG, Neeltran, Control Transformer, RoMan Manufacturing, Crossmars Energy, Noratel, Sensata Technologies, Jackson Transformer Company, Baobian Electric, BEST Transformer, Automation International, GPD Transformers, and ARCHIT ELECTRICAL are leading market innovation. Strategic initiatives revolve around automation, modular design development, regional supply chain optimization, and IoT-enabled performance tracking, empowering the sector to deliver high-performance transformer solutions that meet the rapidly evolving demands of the global energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Core, 2021 - 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Closed

- 5.3 Shell

- 5.4 Berry

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Distribution transformer

- 6.3 Power transformer

- 6.4 Others

Chapter 7 Market Size and Forecast, By Winding, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Two winding

- 7.3 Auto transformer

Chapter 8 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Medium voltage

- 8.3 High voltage

Chapter 9 Market Size and Forecast, By Insulation, 2021 - 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 Gas

- 9.3 Oil

- 9.4 Solid

- 9.5 Others

Chapter 10 Market Size and Forecast, By Rating, 2021 - 2034 (USD Million, ‘000 Units)

- 10.1 Key trends

- 10.2 ≤ 10 MVA

- 10.3 > 10 MVA to ≤ 100 MVA

- 10.4 > 100 MVA to ≤ 600 MVA

- 10.5 > 600 MVA

Chapter 11 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, ‘000 Units)

- 11.1 Key trends

- 11.2 Commercial

- 11.3 Industrial

- 11.4 Utility

Chapter 12 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, ‘000 Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 Russia

- 12.3.4 UK

- 12.3.5 Italy

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.5 Middle East & Africa

- 12.5.1 Saudi Arabia

- 12.5.2 UAE

- 12.5.3 Qatar

- 12.5.4 Egypt

- 12.5.5 South Africa

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

Chapter 13 Company Profiles

- 13.1 ARCHIT ELECTRICAL

- 13.2 Automation International

- 13.3 Baobian Electric

- 13.4 BEST Transformer

- 13.5 CEEG

- 13.6 Control Transformer

- 13.7 Crossmars Energy

- 13.8 GPD Transformers

- 13.9 Jackson Transformer Company

- 13.10 Neeltran

- 13.11 Noratel

- 13.12 RoMan Manufacturing

- 13.13 Sensata Technologies

- 13.14 TBEA