|

市場調查報告書

商品編碼

1740760

飛機感測器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aircraft Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

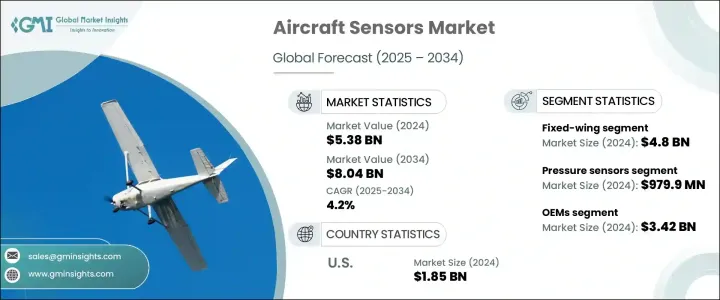

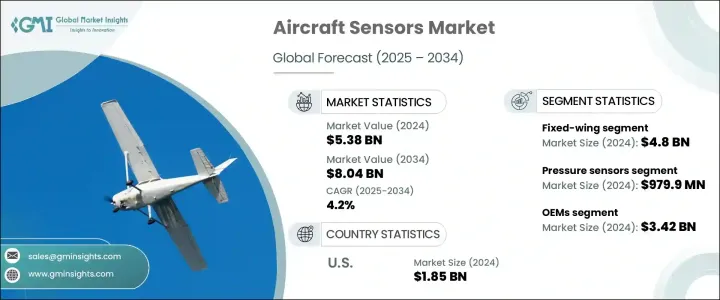

2024 年全球飛機感測器市場規模為 53.8 億美元,預計到 2034 年將以 4.2% 的複合年成長率成長,達到 80.4 億美元。推動這一成長的主要動力之一是航空業日益重視提高燃油效率,這導致對創新可靠的感測器技術的需求增加。這些感測器在最佳化飛機性能、提高安全性以及支援商用和軍用航空中使用的先進系統方面發揮關鍵作用。然而,地緣政治緊張局勢和貿易限制(包括對飛機感測器零件徵收關稅)已導致供應鏈嚴重中斷。這些中斷推高了許多感測器生產商的製造成本,並壓縮了利潤率,同時也導致飛機交付延遲。

近年來徵收的關稅對北美製造商的影響尤其嚴重,迫使一些公司將業務轉移回國內。同時,歐洲供應商被迫重新評估和重組其供應鏈,導致短期效率低落。另一方面,亞洲製造商發展在地化能力,以減少對進口的依賴,這表明全球生產區域化趨勢正在興起。儘管回流有助於穩定供應鏈的某些環節,但整體市場對某些感測器技術的接受度有所放緩,尤其是在無人系統中使用的技術。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53.8億美元 |

| 預測值 | 80.4億美元 |

| 複合年成長率 | 4.2% |

相較之下,在無人機 (UAV) 和電動垂直起降 (eVTOL) 等快速成長的領域,對感測器的需求激增。這些平台需要高度專業化的感測器來實現導航、避障和操作安全。隨著這些技術日益普及,尤其是在城市和商業場景中,對超可靠和節能感測器的需求將持續成長。此外,自動化程度的提高和人工智慧的整合,正推動製造商開發更複雜的感測器系統,以支援自主功能和即時決策。

另一個主要成長動力在於航空公司和維修供應商實施的預測性維護計畫。這些計劃依靠物聯網感測器即時監控飛機系統,檢測磨損的早期跡象。這種方法顯著減少了意外維護事件,並延長了飛機的使用壽命。測量振動、聲音和腐蝕的感測器在監控老舊機隊方面尤其有用。這些技術正在推動從被動維護到主動維護的轉變,從而刺激了售後市場的需求。

同時,全球國防預算持續成長,刺激了對適用於下一代飛機的堅固耐用、高性能感測器的需求。軍用飛機依賴雷達、電子戰和熱成像感測器等必須在極端條件下運作的先進技術。對隱形技術和無人機能力的投資不斷增加,正在加速國防領域的感測器創新,使其成為更廣泛的飛機感測器市場中成長最快的領域之一。

為了保持競爭力,製造商優先研發專為節油飛機和自動駕駛平台設計的輕量化、節能型感測器技術。隨著各公司致力於滿足無人機和自動駕駛的需求,基於MEMS和LiDAR(LiDAR)系統的開發勢頭強勁。利用人工智慧驅動的物聯網感測器來增強預測性維護能力也正成為關注的焦點,尤其是對於即將達到使用壽命的機隊而言。

2024年,固定翼飛機感測器市場佔總市場價值的48億美元。由於這些飛機在商業和軍事領域廣泛應用,它們在全球需求中佔據主導地位。此類感知器對於飛行控制、引擎監控和燃油管理至關重要。隨著技術更先進的飛機的推出,輕型、數據驅動感測器的採用也加速發展。此外,高續航無人機在監視和軍事行動中的應用日益廣泛,進一步擴大了對高性能感測器系統的需求。

壓力感知器對於維持座艙壓力、引擎性能和液壓系統的完整性至關重要,按感測器類型分類,其市場規模最大,2024 年估值達 9.799 億美元。這些感測器廣泛應用於所有類型的飛機,是航空業不可或缺的零件。技術進步使這些部件變得更小、更耐用、更節能,從而進一步提升了它們在現代飛機系統中的作用。

在終端用戶方面, OEM細分市場在 2024 年佔據市場主導地位,價值達 34.2 億美元。這些原始設備製造商負責將高可靠性感測器整合到新開發的飛機系統中。他們專注於引擎診斷、航空電子設備和先進的飛行控制感知器。然而,認證延遲和原料短缺等挑戰持續影響著他們的營運效率。

從地區來看,美國在飛機感測器市場佔據主導地位,2024 年估值達 18.5 億美元。美國在航太創新領域的領導地位,得益於強大的製造能力和大量的國防投資,確保了對尖端感測器的強勁需求。監管框架也鼓勵安全和預測性維護技術的持續改進,從而促進整體市場的成長。

競爭格局依然激烈,領先公司合計佔48.5%的市佔率。這些公司正投入資源,開發人工智慧增強型、可客製化且環保的感測器解決方案,以滿足市場需求和不斷發展的監管標準。他們的策略包括建立聯盟、採用數位化製造流程以及實現產品線多元化,以支援從傳統噴射機到新興自動駕駛飛行器系統等各種飛機平台。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 對節油飛機的需求不斷增加

- 無人機(UAV)和電動垂直起降飛機(eVTOL)的成長

- 預測性維護的採用率不斷上升

- 軍事現代化與太空探索

- 產業陷阱與挑戰

- 研發成本高

- 嚴格的認證延遲

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依飛機類型,2021-2034

- 主要趨勢

- 固定翼

- 旋翼機

第6章:市場估計與預測:按感測器類型,2021-2034

- 主要趨勢

- 壓力感測器

- 溫度感測器

- 力感測器

- 扭力感測器

- 速度感測器

- 位置和位移感測器

- 液位感測器

- 接近感測器

- 流量感測器

- 光學感測器

- 運動感應器

- 雷達感測器

- GPS感應器

- 其他

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 原始設備製造商

- 售後市場

- 國防和航太機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Honeywell International Inc.

- Safran SA

- Thales

- TE Connectivity

- Collins Aerospace

- RTX

- Meggitt PLC.

- AMETEK.Inc.

- Curtiss-Wright Corporation

- L3Harris Technologies, Inc.

- Saywell International

- Garmin Ltd.

- HBK, Inc

- PCB Piezotronics

- Kistler Group

- Bosch Sensortec GmbH

- Eaton

- Baker Hughes Company

- Humanetics

The Global Aircraft Sensors Market was valued at USD 5.38 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 8.04 billion by 2034. A major force behind this expansion is the aviation industry's increasing focus on improving fuel efficiency, which has led to higher demand for innovative and reliable sensor technologies. These sensors play a critical role in optimizing aircraft performance, enhancing safety, and supporting advanced systems used in both commercial and military aviation. However, geopolitical tensions and trade restrictions, including tariffs on aircraft sensor components, have caused significant supply chain disruptions. These disruptions have driven up manufacturing costs and strained profit margins for many sensor producers, while also leading to delays in aircraft deliveries.

Tariffs imposed in recent years particularly impacted North American manufacturers, prompting some companies to shift operations back domestically. Meanwhile, European suppliers were forced to reevaluate and restructure their supply chains, creating short-term inefficiencies. On the other hand, manufacturers in Asia developed local capabilities to reduce reliance on imports, signaling a global trend toward regionalizing production. Although reshoring helped stabilize some aspects of the supply chain, the overall market experienced slower uptake in certain sensor technologies, especially those used in unmanned systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.38 Billion |

| Forecast Value | $8.04 Billion |

| CAGR | 4.2% |

In contrast, demand for sensors has surged in rapidly growing segments such as unmanned aerial vehicles (UAVs) and electric vertical takeoff and landing (eVTOL) aircraft. These platforms require highly specialized sensors for navigation, obstacle avoidance, and operational safety. As these technologies become more prevalent, particularly in urban and commercial use cases, the need for ultra-reliable and energy-efficient sensors will continue to rise. Furthermore, increasing levels of automation and integration of artificial intelligence are pushing manufacturers to develop more sophisticated sensor systems that can support autonomous functions and real-time decision-making.

Another major growth driver lies in the implementation of predictive maintenance programs by airlines and maintenance providers. These programs rely on IoT-enabled sensors to monitor aircraft systems in real time, detecting early signs of wear and tear. This approach significantly reduces unexpected maintenance events and extends aircraft service life. Sensors that measure vibration, sound, and corrosion are particularly useful in monitoring older fleets. These technologies are enabling a shift from reactive to proactive maintenance, boosting demand in the aftermarket segment.

Meanwhile, defense budgets worldwide continue to rise, fueling demand for rugged, high-performance sensors suitable for next-generation aircraft. Military aircraft depend on advanced technologies such as radar, electronic warfare, and thermal imaging sensors that must operate in extreme conditions. Increased investments in stealth technologies and drone capabilities are accelerating sensor innovation in the defense sector, making it one of the fastest-growing areas within the broader aircraft sensors market.

To maintain competitiveness, manufacturers are prioritizing research and development in lightweight, energy-efficient sensor technologies tailored for fuel-efficient aircraft and autonomous platforms. The development of MEMS and LiDAR-based systems is gaining momentum as companies aim to meet the needs of UAVs and automated flight. Enhancing predictive maintenance capabilities using AI-powered IoT sensors is also becoming a central focus, especially for fleets approaching the end of their operational lifespan.

In 2024, the fixed-wing aircraft sensor segment accounted for USD 4.8 billion of the total market value. These aircraft dominate global demand due to their extensive use across both commercial and military applications. Sensors in this category are essential for flight control, engine monitoring, and fuel management. With the introduction of more technologically advanced aircraft, the adoption of lightweight, data-driven sensors has accelerated. Additionally, the growing use of high-endurance UAVs in surveillance and military operations has further amplified the need for high-performance sensor systems.

Pressure sensors, which are vital for maintaining cabin pressure, engine performance, and hydraulic system integrity, represented the largest share by sensor type with a valuation of USD 979.9 million in 2024. These sensors are a staple in aviation due to their wide application across all aircraft types. Technological advancements have made these components smaller, more durable, and more power-efficient, contributing to their expanding role in modern aircraft systems.

On the end-user front, the OEM segment led the market in 2024 with a value of USD 3.42 billion. These original equipment manufacturers are responsible for integrating high-reliability sensors into newly developed aircraft systems. They focus on engine diagnostics, avionics, and advanced flight control sensors. However, challenges such as certification delays and raw material shortages continue to impact their operational efficiency.

Regionally, the United States dominated the aircraft sensors market with a valuation of USD 1.85 billion in 2024. The country's leadership in aerospace innovation, driven by robust manufacturing capabilities and significant defense investments, ensures strong demand for cutting-edge sensors. Regulatory frameworks also encourage continuous improvement in safety and predictive maintenance technologies, contributing to overall market growth.

The competitive landscape remains intense, with leading companies holding a combined 48.5% market share. These firms are channeling resources into developing AI-enhanced, customizable, and eco-friendly sensor solutions, aligning with both market demand and evolving regulatory standards. Their strategies include forming alliances, adopting digital manufacturing processes, and diversifying their product lines to support various aircraft platforms, from traditional jets to emerging autonomous aerial systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for fuel-efficient aircraft

- 3.3.1.2 Growth of unmanned aerial vehicles (UAVs) and eVTOLs

- 3.3.1.3 Rising adoption of predictive maintenance

- 3.3.1.4 Military modernization and space exploration

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High R&D costs

- 3.3.2.2 Stringent certification delays

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Fixed-wing

- 5.3 Rotary-wing

Chapter 6 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Pressure sensors

- 6.3 Temperature sensors

- 6.4 Force sensors

- 6.5 Torque sensors

- 6.6 Speed sensors

- 6.7 Position & displacement sensors

- 6.8 Level sensors

- 6.9 Proximity sensors

- 6.10 Flow sensors

- 6.11 Optical sensors

- 6.12 Motion sensors

- 6.13 Radar sensors

- 6.14 Gps sensors

- 6.15 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

- 7.4 Defense & space agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Honeywell International Inc.

- 9.2 Safran S.A.

- 9.3 Thales

- 9.4 TE Connectivity

- 9.5 Collins Aerospace

- 9.6 RTX

- 9.7 Meggitt PLC.

- 9.8 AMETEK.Inc.

- 9.9 Curtiss-Wright Corporation

- 9.10 L3Harris Technologies, Inc.

- 9.11 Saywell International

- 9.12 Garmin Ltd.

- 9.13 HBK, Inc

- 9.14 PCB Piezotronics

- 9.15 Kistler Group

- 9.16 Bosch Sensortec GmbH

- 9.17 Eaton

- 9.18 Baker Hughes Company

- 9.19 Humanetics