|

市場調查報告書

商品編碼

1740754

混合動力電動滑板車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hybrid E-Scooter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

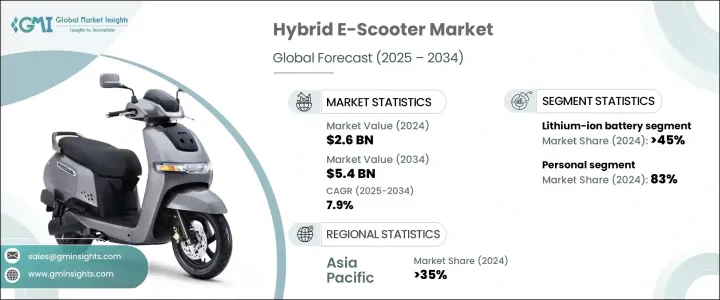

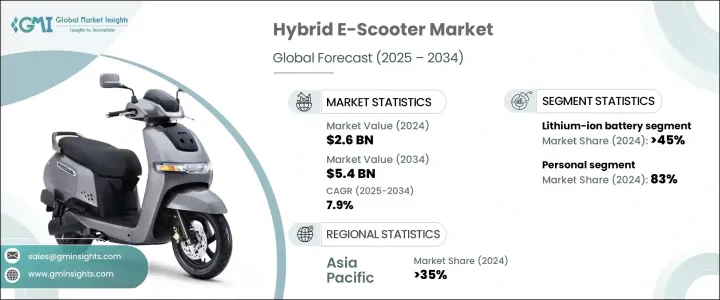

2024 年全球混合動力電動滑板車市場價值為 26 億美元,預計到 2034 年將以 7.9% 的複合年成長率成長,達到 54 億美元,這得益於電池技術的進步、電機效率的提高以及環保意識的增強。隨著城市交通不斷發展,越來越注重永續性和便利性,混合動力電動滑板車產業正在獲得顯著發展勢頭。隨著城市交通日益堵塞,燃油價格持續波動,消費者正積極尋找更聰明、更環保的替代品,同時又不影響性能或續航里程。混合動力電動滑板車結合了電動和燃油技術,對於那些尋求延長出行距離而又不完全依賴充電基礎設施的人來說,它正成為一種可靠的解決方案。這些雙模滑板車為城市通勤者、送貨人員以及追求高效、經濟實惠和低碳足跡的日常用戶提供了無與倫比的靈活性。

清潔交通領域投資的不斷增加,加上政府對電動車的支持力度不斷加大,正在塑造這個市場的未來。目前,許多州和聯邦政府的政策都提供稅收減免、激勵措施和補貼,以減輕消費者和製造商的成本負擔。與此同時,公共和私營部門的利益相關者正在加緊努力,打造一體化充電和加油基礎設施,以支持混合動力出行。共享出行平台的成長以及最後一哩配送服務的日益普及,也在推動混合動力電動滑板車的銷售方面發揮了關鍵作用。這一趨勢在人口稠密的城市中心尤其明顯,因為這些城市對快速、經濟且符合排放標準的交通工具的需求很高。混合動力電動滑板車不僅是一種生活方式的升級,而且正迅速成為實現更智慧城市出行的策略工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 7.9% |

混合動力電動滑板車的獨特優勢在於,它允許騎乘者在電動和燃油模式之間無縫切換。這種雙重功能確保了更長的續航里程、更少的充電焦慮,並在交通堵塞區域提供更順暢的騎乘體驗。城市騎行者和零工經濟工作者尤其被這些優勢所吸引,因為他們需要低維護且高性能的車輛。鋰離子電池的日益普及進一步刺激了這項需求。這些電池以其更高的能量密度、更快的充電時間和更長的使用壽命而聞名,顯著提升了混合動力滑板車的實用性。其輕巧緊湊的設計改善了操控性並提升了能源效率,完美契合了現代通勤者的需求。

環境問題是另一個關鍵的成長動力。隨著空氣品質惡化和氣候變遷加劇,世界各國政府正在實施更嚴格的排放標準,以遏制車輛污染。混合動力電動滑板車的排放量遠低於純汽油電動滑板車,正迅速成為注重環保的消費者的首選。這些滑板車滿足了人們對清潔交通的需求,同時又不犧牲續航里程或動力,使其成為那些正在嚴厲打擊高排放車輛的地區頗具吸引力的解決方案。越來越多的消費者選擇混合動力電動滑板車作為中短途出行的經濟實惠且環保的替代方案。

市場主要按電池類型細分,其中鋰離子電池在2024年佔據主導地位,創造10億美元的收入。這類電池因其能源效率、耐用性和持續性能而備受青睞。它們將更大的能量融入更小、更輕的單元中,有助於提升整體續航里程並減輕車輛重量,從而提高燃油效率和機動性——這些特性對於城市道路行駛至關重要。

按最終用途分類,個人混合動力電動滑板車在2024年佔據了83%的市場佔有率,佔據了市場主導地位。都市化進程和對靈活通勤方式日益成長的需求,促使消費者尋求既經濟高效又低排放的個人交通解決方案。這些滑板車短程行駛時提供電動輔助,長途行駛時提供燃油輔助,是日常城市出行的理想選擇。與傳統滑板車或汽車相比,它們更低的燃油和維護成本尤其受到注重預算的消費者的青睞。

2024年,亞太地區混合動力電動滑板車市場佔據了35%的市場佔有率,這得益於該地區對二輪車的嚴重依賴以及人口密集的城市中心。隨著交通堵塞日益加劇、停車位日益緊張,混合動力電動滑板車成為實用且環保的交通選擇。中國憑藉其強大的本土製造能力、穩健的供應鏈以及優惠的政府法規,繼續引領產業發展。

雅迪集團、雅馬哈、光陽和小牛電動等主要參與者正在大力投資產品創新,擴大生產線,並強化分銷管道。這些公司專注於打造節能、以用戶為中心、功能先進的踏板車,以滿足消費者日益成長的期望。與本地經銷商和國際供應商建立策略合作夥伴關係,對於提升其全球市場佔有率並在競爭中保持領先地位至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件供應商

- 技術提供者

- 最終用途

- 利潤率分析

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 定價分析

- 地區

- 電池

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 配送和物流中的商業用途

- 里程焦慮和基礎設施差距

- 環境法規和排放標準

- 電池和馬達效率的技術進步

- 產業陷阱與挑戰

- 初始成本高

- 維護問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 鋰離子電池

- 鉛酸電池

- 鎳氫電池

- 固態電池

第6章:市場估計與預測:依航程容量,2021 年至 2034 年

- 主要趨勢

- 短距離(15-30公里)

- 中距離(31-60公里)

- 長距離(60公里以上)

第7章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人的

- 商業的

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Gogoro

- Green Tiger Mobility

- Honda

- Jiangsu Xinri E-Vehicle

- Kymco

- Meladath Auto Components

- NIU Technologies

- Okinawa Autotech

- Piaggio Group

- Sanyang Motor

- Silence Urban Ecomobility

- Sunra Electric Vehicle

- Verge Motors

- Yadea Group

- Yamaha

- Zhejiang Luyuan Electric Vehicle

The Global Hybrid E-Scooter Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.4 billion by 2034, driven by advancements in battery technology, improved motor efficiency, and rising environmental awareness. The hybrid e-scooter industry is gaining significant momentum as urban mobility continues to evolve with a strong focus on sustainability and convenience. With cities becoming more congested and fuel prices remaining volatile, consumers are actively looking for smarter, greener alternatives that do not compromise on performance or range. Hybrid e-scooters, which combine electric and fuel-powered technologies, are emerging as a reliable solution for individuals seeking extended travel distances without being entirely dependent on charging infrastructure. These dual-mode scooters provide unmatched flexibility for urban commuters, delivery personnel, and everyday users who demand efficiency, affordability, and a lower carbon footprint.

Rising investments in clean transportation, coupled with growing government support for electric mobility, are shaping the future of this market. Numerous state and federal policies now offer tax rebates, incentives, and subsidies that reduce the cost burden for consumers and manufacturers alike. At the same time, public and private stakeholders are ramping up efforts to create integrated charging and refueling infrastructure to support hybrid mobility. The growth of shared mobility platforms and the increasing adoption of last-mile delivery services have also played a pivotal role in driving hybrid e-scooter sales. This trend is particularly noticeable in densely populated urban hubs where quick, affordable, and emission-compliant transport is in high demand. Hybrid e-scooters are not just a lifestyle upgrade-they're fast becoming a strategic tool for achieving smarter urban mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 7.9% |

Hybrid e-scooters offer a distinct edge by allowing riders to switch seamlessly between electric and fuel modes. This dual functionality ensures a longer range, reduced charging anxiety, and a smoother riding experience in traffic-heavy zones. Urban riders and gig economy workers are especially drawn to these benefits, as they need vehicles that are low-maintenance yet high-performing. The rising use of lithium-ion batteries has further fueled the demand. Known for their higher energy density, faster charging time, and extended lifespan, these batteries significantly enhance the practicality of hybrid scooters. Their lightweight and compact design improves handling and boosts energy efficiency, aligning perfectly with the needs of modern-day commuters.

Environmental concerns are another key growth driver. As air quality worsens and climate change intensifies, governments worldwide are enforcing stricter emission norms to curb vehicular pollution. Hybrid e-scooters, which emit significantly less than their gasoline-only counterparts, are quickly becoming the go-to option for eco-conscious consumers. These scooters meet the demand for cleaner transport without compromising on range or power, making them an attractive solution in regions that are clamping down on high-emission vehicles. Consumers are increasingly choosing hybrid e-scooters as a cost-effective and environmentally friendly alternative for short to mid-range travel.

The market is primarily segmented by battery type, with lithium-ion batteries taking the lead in 2024, generating USD 1 billion in revenue. These batteries are favored for their energy efficiency, durability, and ability to deliver consistent performance. They pack more power into a smaller, lighter unit, helping boost the overall range and reducing the vehicle's weight, which in turn improves fuel efficiency and maneuverability-critical features for urban use.

By end-use, personal hybrid e-scooters dominated the market with an 83% share in 2024. Urbanization and rising demand for flexible commuting options are pushing consumers toward personal transport solutions that are both cost-efficient and low-emission. These scooters offer electric riding for short distances and fuel-powered assistance for longer routes, making them ideal for daily city travel. Budget-conscious consumers are especially drawn to them due to their lower fuel and maintenance costs compared to traditional scooters or cars.

The Asia Pacific Hybrid E-Scooter Market accounted for 35% share in 2024, thanks to the region's heavy reliance on two-wheelers and its densely populated urban centers. With increasing traffic congestion and limited parking availability, hybrid e-scooters present a highly practical and eco-friendly transport alternative. China, in particular, continues to lead the way due to its strong local manufacturing capabilities, robust supply chain, and favorable government regulations.

Key players such as Yadea Group, Yamaha, Kymco, and NIU Technologies are investing heavily in product innovation, expanding their production lines, and strengthening distribution channels. These companies focus on creating energy-efficient, user-centric scooters with advanced features, aiming to meet rising consumer expectations. Strategic partnerships with both local distributors and international suppliers are central to boosting their global market presence and staying ahead in the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Technology providers

- 3.2.4 End-use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Pricing analysis

- 3.7.1 Region

- 3.7.2 Battery

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Commercial use in delivery & logistics

- 3.10.1.2 Range anxiety & infrastructure gaps

- 3.10.1.3 Environmental regulations & emission norms

- 3.10.1.4 Technological advancements in battery and motor efficiency

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 Maintenance issues

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid batter

- 5.4 Nickel-metal hydride

- 5.5 Solid-state battery

Chapter 6 Market Estimates & Forecast, By Range Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Short range (15-30 km)

- 6.3 Medium range (31-60 km)

- 6.4 Long range (above 60 km)

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Gogoro

- 10.2 Green Tiger Mobility

- 10.3 Honda

- 10.4 Jiangsu Xinri E-Vehicle

- 10.5 Kymco

- 10.6 Meladath Auto Components

- 10.7 NIU Technologies

- 10.8 Okinawa Autotech

- 10.9 Piaggio Group

- 10.10 Sanyang Motor

- 10.11 Silence Urban Ecomobility

- 10.12 Sunra Electric Vehicle

- 10.13 Verge Motors

- 10.14 Yadea Group

- 10.15 Yamaha

- 10.16 Zhejiang Luyuan Electric Vehicle