|

市場調查報告書

商品編碼

1801951

電動摩托車和踏板車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Motorcycle and Scooters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

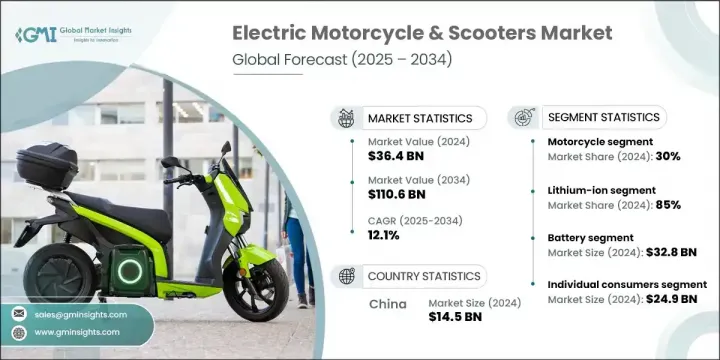

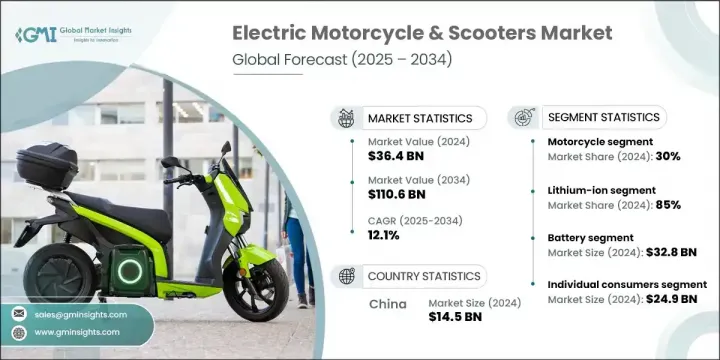

2024年,全球電動摩托車和踏板車市場規模達364億美元,預計到2034年將以12.1%的複合年成長率成長,達到1106億美元。受政府政策、大量基礎設施投資以及日益成長的環保出行需求的推動,該市場正在快速擴張。電動二輪車(E2W)已成為傳統汽油驅動車的永續且經濟高效的替代品,尤其是在交通堵塞日益嚴重的城市地區。在中國和印度等國家,由於政府補貼、激勵措施以及旨在促進綠色出行的項目,電動摩托車和踏板車的普及率正在迅速上升。

政府政策在這一轉變中發揮了關鍵作用,透過提供各種補貼、稅收優惠和設立低排放區來鼓勵電動車的使用。中國、印度和一些歐洲國家引領了這項轉變。長期以來,中國一直是電動車生產和銷售的市場領導者,而印度則憑藉積極的電氣化目標和優惠政策實現了爆炸性成長。印度的「電動出行」計畫等項目以及各種供給側激勵措施顯著推動了電動二輪車的普及,從而提高了市場滲透率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 364億美元 |

| 預測值 | 1106億美元 |

| 複合年成長率 | 12.1% |

2024年,電動摩托車市場佔據了30%的市場佔有率,預計在2025年至2034年期間的成長率將達到13%。在這一領域,合作正變得越來越普遍,尤其是在傳統摩托車製造商之間,因為他們尋求共享資源並降低與研發和供應鏈挑戰相關的成本。這些合作旨在加速電動摩托車的市場准入,同時在不斷變化的監管環境中管控風險。

鋰離子電池領域在2024年佔據了85%的市場佔有率,並將在2025年至2034年期間以10%的複合年成長率成長。鋰離子電池因其能源效率高且重量相對較輕而成為電動滑板車的首選。由於過熱和效能下降一直是用戶關注的關鍵問題,供應商正致力於提升這些電池的效能,尤其是在安全性、熱管理和電池壽命方面。

2024年,中國電動摩托車和踏板車市場佔55%的市場佔有率,規模達145億美元。中國的主導地位得益於其大規模生產汽車的能力和先進的電池技術。中國也受惠於高度整合的供應鏈,這使得價格更具競爭力,本土品牌更容易打入國內和國際市場。雅迪、愛瑪和小牛等品牌憑藉其製造能力和高效的生產成本,繼續在本土和全球市場保持領先地位。

電動摩托車和踏板車市場的主要參與者包括雅馬哈摩托車、英雄摩托車、川崎摩托車、哈雷戴維森、零摩托車、本田摩托車、Energica 摩托車、凱旋摩托車、雅迪和 Ola Electric。為了加強在電動摩托車和踏板車市場的地位,各公司正專注於技術創新、合作夥伴關係和市場多元化。許多公司正在大力投資研發,以提高電池性能、安全性和能源效率。與其他 OEM(原始設備製造商)合作是共享生產平台、降低研發成本和解決供應鏈問題的常見策略。各公司也在擴大其產品組合,以包括更廣泛的電動二輪車,以滿足從精打細算的買家到高階消費者等不同客戶群的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 電池技術的進步

- 降低營運成本

- 城市交通趨勢日益成長

- 增強技術和連結性

- 產業陷阱與挑戰

- 有限的續航里程和充電基礎設施

- 初始成本高

- 市場機會

- 擴大電池更換網路

- 再生能源與智慧電網融合

- 成長動力

- 成長潛力分析

- 監管格局

- 全球監管框架的演變與策略影響

- 區域政策趨同與趨異分析

- 政府獎勵計畫和市場刺激策略

- 環境法規和合規策略要求

- 波特的分析

- PESTEL分析

- 策略技術路線圖與創新管道

- 電池技術革命與競爭影響

- 下一代鋰離子最佳化策略

- 固態電池商業化時程與市場影響

- 替代電池技術和戰略定位

- 電池即服務商業模式的演變

- 充電基礎設施戰略發展

- 直流快速充電網路擴展策略

- 電池更換生態系與平台競爭

- 無線充電技術與市場準備狀況

- 基礎設施投資需求與投資報酬率分析

- 電機技術與動力總成創新分析

- 永磁同步馬達技術領先

- 無刷直流(BLDC)馬達成本最佳化策略

- 輪轂馬達與鏈條傳動的戰略定位

- 馬達效率和性能基準測試

- 充電技術標準與基礎設施生態系統

- 直流快速充電標準區域採用分析

- 專有充電解決方案和市場分散

- 無線充電技術商業化時程

- 車輛到電網整合和智慧充電

- 市場策略與分銷

- 市場進入策略比較與最佳實踐

- 配銷通路與服務生態系分析

- 傳統經銷商網路轉型策略

- 直接面對消費者的銷售模式演變

- 服務網路擴展及能力需求

- 售後零件供應鏈

- 風險與策略評估

- 技術風險評估和策略緩解

- 電池技術過時風險分析

- 電機技術發展及投資影響

- 軟體和連接平台風險

- 製造技術中斷評估

- 專利格局與智慧財產權策略

- 全球專利申請趨勢與技術重點領域

- 主要專利持有者及智慧財產權集中度分析

- 依技術領域進行專利訴訟風險評估

- 交叉許可機會和合作影響

- 零件供應商生態系統和供應安全

- 馬達及控制器供應商分析

- 底盤和車架製造生態系統

- 電子和連接組件供應

- 供應鏈風險評估與緩解

- 技術風險評估和策略緩解

- 消費者行為與市場偏好

- 人口統計資料和目標客戶分析

- 購買決策因素與購買歷程

- 使用模式和移動行為

- 品牌忠誠度和轉換模式

- 價格敏感度與價值感知分析

- 專利格局

- 價格趨勢

- 按國家

- 按產品

- 成本細分分析

- 生產統計

- 進出口

- 主要進口國家

- 主要出口國家

- 數位化與永續性融合

- 數位轉型與智慧行動融合

- 永續發展的必要性與循環經濟機遇

- 依車輛類型評估生命週期碳足跡

- 電池回收和二次利用

- 製造業永續性和綠色生產

- 供應鏈ESG風險評估

- 永續性分析

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭威脅評估和市場進入壁壘

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 摩托車

- 巡洋艦

- 運動

- 巡迴演出

- 標準/裸

- 冒險/雙重運動

- 越野/泥土

- 踏板車

- 馬克西

- 輕型摩托車式

第6章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 服務等級協定

- 鋰離子

- 其他

第7章:市場估計與預測:按電壓,2021 - 2034 年

- 主要趨勢

- 24伏

- 36伏

- 48伏

- 其他

第8章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 外掛

- 電池

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人消費者

- 商業用戶

第 10 章:市場估計與預測:按銷售管道,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 土耳其

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- BMW Motorrad

- Energica Motor

- Gogoro

- Harley-Davidson (LiveWire)

- NIU Technologies

- Yadea

- Zero Motorcycles

- 區域參與者

- AIMA Technology

- Ather Energy

- Bajaj Auto

- Hero Motor

- Honda Motor

- Jiangsu Xinri E-Vehicle

- Kawasaki

- KTM

- KYMCO

- Luyuan Electric

- Ola Electric

- Peugeot Motorcycles

- Piaggio

- TVS

- Yamaha Motor

- 新興玩家

- Arc Motorcycles

- Cake

- Damon Motors

- Dust Moto

- Juiced Bikes

- Lightning Motorcycles

- Matter Motor

- Onyx Motorbikes

- Revolt Motors

- Simple Energy

- Super73

- Tork Motors

- Ultraviolette Automotive

- Verge Motorcycles

- Zapp Electric

The Global Electric Motorcycle & Scooters Market was valued at USD 36.4 billion in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 110.6 billion by 2034. This market is witnessing rapid expansion driven by government policies, substantial infrastructure investments, and the growing demand for eco-friendly transportation options. Electric two-wheelers (E2Ws) have emerged as a sustainable and cost-effective alternative to traditional gasoline-powered vehicles, especially in urban areas with increasing traffic congestion. In countries like China and India, the adoption of electric motorcycles and scooters is rising quickly, aided by government subsidies, incentives, and programs aimed at promoting green mobility.

Government policies have played a key role in this transition by offering various subsidies, tax benefits, and low-emission zones to encourage the use of electric vehicles. Countries such as China, India, and several European nations have led this shift. China has long been the market leader in terms of production and sales, while India has witnessed explosive growth due to aggressive electrification targets and favorable policies. Programs like India's Go Electric initiative and various supply-side incentives have significantly boosted the adoption of electric two-wheelers, leading to greater market penetration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.4 Billion |

| Forecast Value | $110.6 Billion |

| CAGR | 12.1% |

In 2024, the electric motorcycle segment accounted for 30% share and is expected to see a growth rate of 13% between 2025 and 2034. Collaborative efforts are becoming more common in this segment, especially between traditional motorcycle manufacturers, as they seek to share resources and reduce costs associated with research, development, and supply chain challenges. These collaborations aim to accelerate the market entry of electric motorcycles while managing risks amid an evolving regulatory environment.

The Lithium-ion batteries segment held 85% share in 2024 and will grow at a CAGR of 10% from 2025 to 2034. Lithium-ion batteries are preferred for electric scooters due to their energy efficiency and relatively low weight. Suppliers are focusing on enhancing the performance of these batteries, especially in terms of safety, thermal management, and battery life, as overheating and degradation have been key concerns for users.

China Electric Motorcycle & Scooters Market held 55% share and USD 14.5 billion in 2024. The country's dominance is fueled by its ability to produce vehicles at large scale and its advanced battery technology. China also benefits from a well-integrated supply chain, which enables competitive pricing, making it easier for local brands to penetrate both domestic and international markets. Brands like Yadea, AIMA, and NIU continue to lead in both local and global markets, leveraging their manufacturing capabilities and cost-efficient production.

The key players in the Electric Motorcycle & Scooters Market include Yamaha Motor, Hero Motor, Kawasaki Motors, Harley-Davidson, Zero Motorcycles, Honda Motor, Energica Motor, Triumph Motorcycles, Yadea, and Ola Electric. To strengthen their presence in the electric motorcycle and scooter market, companies are focusing on technological innovation, partnerships, and market diversification. Many firms are investing heavily in R&D to enhance battery performance, safety, and energy efficiency. Collaboration with other OEMs (Original Equipment Manufacturers) is a common strategy to share production platforms, reduce R&D costs, and address supply chain issues. Companies are also expanding their product portfolios to include a wider range of electric two-wheelers, catering to various customer segments, from budget-conscious buyers to high-end consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Battery

- 2.2.4 Voltage

- 2.2.5 Technology

- 2.2.6 End use

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1 Industry impact forces

- 3.1.1 Growth drivers

- 3.1.1.1 Advancements in battery technology

- 3.1.1.2 Lower operating costs

- 3.1.1.3 Growing urban mobility trends

- 3.1.1.4 Increased technology and connectivity

- 3.1.2 Industry pitfalls & challenges

- 3.1.2.1 Limited range and charging infrastructure

- 3.1.2.2 High initial cost

- 3.1.3 Market opportunities

- 3.1.3.1 Expansion of battery-swapping networks

- 3.1.3.2 Integration with renewable energy & smart grid

- 3.1.1 Growth drivers

- 3.2 Growth potential analysis

- 3.3 Regulatory landscape

- 3.3.1 Global regulatory framework evolution and strategic implications

- 3.3.2 Regional policy convergence and divergence analysis

- 3.3.3 Government incentive programs and market stimulation strategies

- 3.3.4 Environmental regulations and compliance strategic requirements

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Strategic technology roadmap and innovation pipeline

- 3.7 Battery technology revolution and competitive implications

- 3.7.1 Next-generation lithium-ion optimization strategies

- 3.7.2 Solid-state battery commercialization timeline and market impact

- 3.7.3 Alternative battery technologies and strategic positioning

- 3.7.4 Battery-as-a-service business model evolution

- 3.8 Charging infrastructure strategic development

- 3.8.1 Dc fast charging network expansion strategies

- 3.8.2 Battery swapping ecosystem and platform competition

- 3.8.3 Wireless charging technology and market readiness

- 3.8.4 Infrastructure investment requirements and ROI analysis

- 3.9 Motor technology and powertrain innovation analysis

- 3.9.1 Permanent magnet synchronous motor technology leadership

- 3.9.2 Brushless dc (BLDC) motor cost optimization strategies

- 3.9.3 Hub motor vs. Chain drive strategic positioning

- 3.9.4 Motor efficiency and performance benchmarking

- 3.10 Charging technology standards and infrastructure ecosystem

- 3.10.1 Dc fast charging standards regional adoption analysis

- 3.10.2 Proprietary charging solutions and market fragmentation

- 3.10.3 Wireless charging technology commercialization timeline

- 3.10.4 Vehicle-to-grid integration and smart charging

- 3.11 Market Strategy & Distribution

- 3.11.1 Go-to-market strategy comparison and best practices

- 3.11.2 Distribution channel and service ecosystem analysis

- 3.11.2.1 Traditional dealer network transformation strategies

- 3.11.2.2 Direct-to-consumer sales model evolution

- 3.11.2.3 Service network expansion and capability requirements

- 3.11.2.4 Parts and component supply chain for after-sales

- 3.12 Risk & Strategic Assessment

- 3.12.1 Technology risk assessment and strategic mitigation

- 3.12.1.1 Battery technology obsolescence risk analysis

- 3.12.1.2 Motor technology evolution and investment implications

- 3.12.1.3 Software and connectivity platform risks

- 3.12.1.4 Manufacturing technology disruption assessment

- 3.12.2 Patent landscape and intellectual property strategy

- 3.12.2.1 Global patent filing trends and technology focus areas

- 3.12.2.2 Key patent holders and IP concentration analysis

- 3.12.2.3 Patent litigation risk assessment by technology area

- 3.12.2.4 Cross-licensing opportunities and partnership implications

- 3.12.3 Component supplier ecosystem and supply security

- 3.12.3.1 Motor and controller supplier analysis

- 3.12.3.2 Chassis and frame manufacturing ecosystem

- 3.12.3.3 Electronics and connectivity component supply

- 3.12.3.4 Supply chain risk assessment and mitigation

- 3.12.1 Technology risk assessment and strategic mitigation

- 3.13 Consumer behavior and market preferences

- 3.13.1 Demographic profile and target customer analysis

- 3.13.2 Purchase decision factors and buying journey

- 3.13.3 Usage patterns and mobility behavior

- 3.13.4 Brand loyalty and switching patterns

- 3.13.5 Price sensitivity and value perception analysis

- 3.14 Patent landscape

- 3.15 Price trend

- 3.15.1 By country

- 3.15.2 By product

- 3.16 Cost breakdown analysis

- 3.17 Production statistics

- 3.17.1 Import and export

- 3.17.2 Major import countries

- 3.17.3 Major export countries

- 3.18 Digital & Sustainability Integration

- 3.18.1 Digital transformation and smart mobility integration

- 3.18.2 Sustainability imperatives and circular economy opportunities

- 3.18.2.1 Lifecycle carbon footprint assessment by vehicle type

- 3.18.2.2 Battery recycling and second-life applications

- 3.18.2.3 Manufacturing sustainability and green production

- 3.18.2.4 Supply chain ESG risk assessment

- 3.18.3 Sustainability analysis

- 3.18.3.1 Sustainable practices

- 3.18.3.2 Waste reduction strategies

- 3.18.3.3 Energy efficiency in production

- 3.18.3.4 Eco-friendly initiatives

- 3.18.3.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive threats assessment and market entry barriers

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Motorcycle

- 5.2.1 Cruiser

- 5.2.2 Sport

- 5.2.3 Touring

- 5.2.4 Standard/Naked

- 5.2.5 Adventure/Dual-Sport

- 5.2.6 Off-Road/Dirt

- 5.3 Scooters

- 5.3.1 Maxi

- 5.3.2 Moped-Style

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 SLA

- 6.3 Li-ion

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 24V

- 7.3 36V

- 7.4 48V

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Plug-In

- 8.3 Battery

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Individual consumers

- 9.3 Commercial users

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 North America

- 11.1.1 US

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Netherlands

- 11.2.8 Sweden

- 11.2.9 Turkiye

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Vietnam

- 11.3.8 Indonesia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 BMW Motorrad

- 12.1.2 Energica Motor

- 12.1.3 Gogoro

- 12.1.4 Harley-Davidson (LiveWire)

- 12.1.5 NIU Technologies

- 12.1.6 Yadea

- 12.1.7 Zero Motorcycles

- 12.2 Regional Players

- 12.2.1 AIMA Technology

- 12.2.2 Ather Energy

- 12.2.3 Bajaj Auto

- 12.2.4 Hero Motor

- 12.2.5 Honda Motor

- 12.2.6 Jiangsu Xinri E-Vehicle

- 12.2.7 Kawasaki

- 12.2.8 KTM

- 12.2.9 KYMCO

- 12.2.10 Luyuan Electric

- 12.2.11 Ola Electric

- 12.2.12 Peugeot Motorcycles

- 12.2.13 Piaggio

- 12.2.14 TVS

- 12.2.15 Yamaha Motor

- 12.3 Emerging Players

- 12.3.1 Arc Motorcycles

- 12.3.2 Cake

- 12.3.3 Damon Motors

- 12.3.4 Dust Moto

- 12.3.5 Juiced Bikes

- 12.3.6 Lightning Motorcycles

- 12.3.7 Matter Motor

- 12.3.8 Onyx Motorbikes

- 12.3.9 Revolt Motors

- 12.3.10 Simple Energy

- 12.3.11 Super73

- 12.3.12 Tork Motors

- 12.3.13 Ultraviolette Automotive

- 12.3.14 Verge Motorcycles

- 12.3.15 Zapp Electric