|

市場調查報告書

商品編碼

1721620

奢華眼鏡市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Luxury Eyewear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

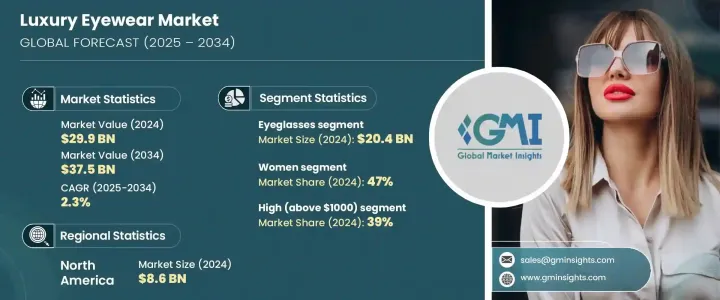

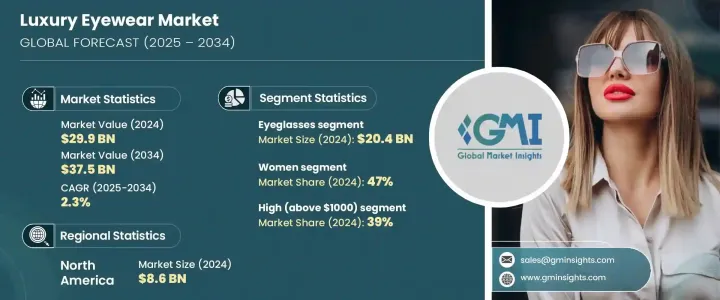

2024 年全球奢侈眼鏡市場價值為 299 億美元,預計到 2034 年將以 2.3% 的複合年成長率成長,達到 375 億美元。這一成長主要得益於可支配收入的增加以及對高階產品的日益成長的偏好,尤其是在發展中經濟體。隨著越來越多的消費者轉向高階生活方式的選擇,對奢華眼鏡的需求持續上升。數位螢幕曝光率的增加和全球人口老化也導致視力相關問題的盛行率上升,促使更多人尋求具有奢華吸引力的處方眼鏡和防護眼鏡。這些不斷發展的需求正在突破傳統眼鏡的界限,將功能與時尚融合,提供精緻而實用的解決方案。

市場上也出現了越來越多的消費者將眼鏡視為必不可少的時尚配件,而不僅僅是醫療工具。精湛的工藝、創新的設計和品牌形象的融合使得奢華眼鏡備受追捧。從個人化配件到優質包裝,增強的消費者體驗現在在品牌忠誠度中發揮著至關重要的作用。消費者願意投資能夠體現其個人風格、社會地位和生活方式選擇的產品。數位通路和電子商務平台擴大了全球訪問範圍,使亞太地區、拉丁美洲和中東地區的更多客戶能夠探索優質眼鏡產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 299億美元 |

| 預測值 | 375億美元 |

| 複合年成長率 | 2.3% |

隨著全球時尚潮流和高階產品的接觸增多,購買意願不斷增強,這些地區已成為重要的成長中心。為了滿足日益成長的需求,製造商不斷推出更新的產品系列,專注於限量版發布、獨家線上銷售和設計師合作,以提升品牌價值和客戶參與度。基於人工智慧的虛擬試穿和客製化工具等技術升級幫助品牌提供沉浸式購物體驗,尤其是在線上環境中。同時,永續性和道德生產實踐的重要性日益增加,塑造了品牌敘事並影響了整個奢侈眼鏡市場的購買決策。

在該產品類別中,預計到 2034 年太陽眼鏡將以 2.1% 的複合年成長率穩步成長。這種成長源自於人們對兼具功能性的時尚配件的興趣日益濃厚。鏡片技術的新進步,例如藍光防護和防眩光塗層,使得奢華太陽眼鏡對注重健康的消費者更具吸引力。輕質鏡架和增強舒適度的材料越來越受到人們的青睞,尤其是那些長時間佩戴的買家。眼鏡款式不斷演變,包括更戲劇性的形狀和大膽的設計,在提供眼睛保護的同時也能彰顯個性。當代系列專注於超大輪廓和有棱角的鏡框,吸引了那些追求時尚價值的出眾單品的潮流購物者。人們對獨特外觀的追求日益成長,推動著奢侈品牌在保持高耐用性和性能標準的同時,不斷進行設計創新。

根據消費者人口統計數據,2024 年女性佔據全球市場的 47% 主導佔有率。這個細分市場繼續受到獨特的鏡框款式、鮮豔的色彩和富有表現力的設計的影響。對許多女性買家來說,眼鏡已經成為她們衣櫃裡不可或缺的一部分,既實用又精緻。貓眼形、圓形和幾何形鏡框由於兼具實用性和視覺衝擊力,仍然是首選。設計師將優質材料與裝飾相結合,特別受到那些希望透過配件展現個人風格的女性的歡迎。隨著眼鏡成為個性和優雅的體現,市場也紛紛推出滿足不同偏好的眼鏡系列,進一步推動了這一領域的成長。

2024 年,美國奢侈眼鏡市場規模達 86 億美元,佔北美地區 83% 的佔有率。該國消費者的行為反映出人們具有強烈的眼部健康意識,並且對時尚、引人注目的眼鏡的需求日益成長。隨著戶外活動和數位螢幕使用時間的增加,對時尚且具有防護作用的眼鏡的需求持續攀升。美國消費者優先考慮符合其生活方式的產品,在美觀性、舒適性和性能方面取得平衡。各大品牌紛紛採用創新設計來應對,將視覺吸引力與防紫外線和可客製化配件等功能融為一體。客製化和數位創新在美國市場尤其受歡迎,消費者期待無縫的、技術支援的購物體驗。此外,道德時尚和永續採購的趨勢日益增強,越來越多的買家在選擇奢侈品時會考慮環境和社會影響。

塑造全球奢侈眼鏡市場的關鍵公司包括大型時裝公司和知名眼鏡專家。這些參與者正在多樣化零售策略、擴展數位平台並投資增強客戶個人化的技術。從擴增實境工具到限量版合作,領先品牌透過提供獨特性和價值來適應現代消費者的期望。競爭格局仍然充滿活力,受不斷發展的時尚意識、高階生活方式的追求以及持續創新的推動。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者可支配所得不斷增加

- 眼部健康意識不斷增強

- 產業陷阱與挑戰

- 消費者偏好的改變

- 仿冒品

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 眼鏡

- 太陽眼鏡

第6章:市場估計與預測:依形狀,2021 - 2034 年

- 主要趨勢

- 圓形的

- 橢圓形

- 方塊

- 其他

第7章:市場估計與預測:依車架尺寸,2021 - 2034

- 主要趨勢

- 小的

- 中等的

- 大的

第8章:市場估計與預測:依價格區間,2021 年至 2034 年

- 主要趨勢

- 低($200 - $500)

- 中型(500 - 1000 美元)

- 高(1000 美元以上)

第9章:市場估計與預測:依消費者群體分類,2021 年至 2034 年

- 主要趨勢

- 男士

- 女性

- 男女通用的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Balenciaga

- Bulgari

- Calvin Klein

- Cartier

- Christian Louboutin

- Dolce & Gabbana

- EssilorLuxottica

- Giorgio Armani

- Gucci

- LVMH

- Moscot

- Porsche Design

- Prada

- Ralph Lauren

- Tom Ford

The Global Luxury Eyewear Market was valued at USD 29.9 billion in 2024 and is estimated to grow at a CAGR of 2.3% to reach USD 37.5 billion by 2034. This growth is being fueled by rising disposable income and a growing preference for premium products, especially across developing economies. As more consumers shift toward high-end lifestyle choices, demand for luxury eyewear continues to rise. Increased digital screen exposure and an aging global population have also contributed to a higher prevalence of vision-related concerns, prompting more people to seek prescription and protective eyewear with luxury appeal. These evolving needs are pushing the boundaries of traditional eyewear, merging function with fashion to deliver refined yet practical solutions.

The market has also seen a surge in consumers who view eyewear as an essential fashion accessory, not just a medical tool. A blend of craftsmanship, innovative design, and brand identity makes luxury eyewear highly desirable. Enhanced consumer experiences, from personalized fittings to premium packaging, are now playing a vital role in brand loyalty. Consumers are willing to invest in products that reflect their personal style, social status, and lifestyle choices. Digital channels and e-commerce platforms have increased global access, allowing more customers in Asia Pacific, Latin America, and the Middle East to explore premium eyewear offerings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $37.5 Billion |

| CAGR | 2.3% |

These regions have become important growth hubs, as aspirational buying continues to rise with greater exposure to global fashion trends and high-end products. In response to growing demand, manufacturers are continually introducing refreshed collections, focusing on limited-edition launches, exclusive online sales, and designer collaborations to elevate brand value and customer engagement. Technological upgrades like AI-based virtual try-ons and customization tools have helped brands provide immersive shopping experiences, especially in online environments. Meanwhile, the importance of sustainability and ethical production practices is growing, shaping brand narratives and influencing purchasing decisions across the luxury eyewear market.

Within the product category, sunglasses are expected to grow steadily at a CAGR of 2.1% through 2034. This growth stems from rising interest in fashion-driven accessories that also serve a functional purpose. New advancements in lens technology, such as blue light protection and anti-glare coatings, are making luxury sunglasses more appealing to health-conscious consumers. Lightweight frames and comfort-enhancing materials are gaining traction, especially among buyers who wear them for extended periods. Eyewear styles have evolved to include more dramatic shapes and bold designs that make a statement while offering eye protection. Contemporary collections focus on oversized silhouettes and angular frames that appeal to trend-savvy shoppers looking for standout pieces with high fashion value. The rising desire for distinctive looks is pushing luxury brands to innovate with design while maintaining the high standards of durability and performance.

Based on consumer demographics, women accounted for a dominant 47% share of the global market in 2024. This segment continues to be influenced by unique frame styles, vibrant colors, and expressive designs. For many female buyers, eyewear has become an integral part of their wardrobe, offering both utility and sophistication. Shapes like cat-eye, round, and geometric frames remain top choices due to their blend of practicality and visual impact. Designer offerings that combine premium materials with embellishments are especially popular among women seeking to make a personal style statement through their accessories. As eyewear becomes a reflection of individuality and elegance, the market is responding with collections tailored to cater to diverse preferences, further driving growth in this segment.

The U.S. luxury eyewear market stood at USD 8.6 billion in 2024, capturing an 83% share of the North American region. Consumer behavior in the country reflects a strong awareness of eye health paired with a growing appetite for fashionable, statement-making eyewear. As outdoor activities and digital screen time increase, demand for stylish yet protective eyewear continues to climb. American consumers prioritize products that align with their lifestyle, balancing aesthetics with comfort and performance. Brands have responded with innovative designs that blend visual appeal with features like UV protection and customizable fittings. Customization and digital innovation are particularly well-received in the U.S. market, where consumers expect seamless, tech-enabled shopping experiences. Additionally, the trend toward ethical fashion and sustainable sourcing has gained momentum, with more buyers considering environmental and social impact when choosing luxury products.

Key companies shaping the global luxury eyewear landscape include major fashion houses and established eyewear specialists. These players are diversifying retail strategies, expanding across digital platforms, and investing in technologies that enhance customer personalization. From augmented reality tools to limited-edition collaborations, leading brands are adapting to modern consumer expectations by delivering both exclusivity and value. The competitive landscape remains dynamic, driven by evolving fashion sensibilities, premium lifestyle aspirations, and a continuous push toward innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer disposable income

- 3.6.1.2 Growing awareness of eye health

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Changing consumer preferences

- 3.6.2.2 Counterfeits products

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Eyeglasses

- 5.3 Sunglasses

Chapter 6 Market Estimates & Forecast, By Shape, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Round

- 6.3 Oval

- 6.4 Square

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Frame Size, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Small

- 7.3 Medium

- 7.4 Large

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low ($200 - $500)

- 8.3 Medium ($500 - $1000)

- 8.4 High (above $1000)

Chapter 9 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

- 9.4 Unisex

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Balenciaga

- 12.2 Bulgari

- 12.3 Calvin Klein

- 12.4 Cartier

- 12.5 Christian Louboutin

- 12.6 Dolce & Gabbana

- 12.7 EssilorLuxottica

- 12.8 Giorgio Armani

- 12.9 Gucci

- 12.10 LVMH

- 12.11 Moscot

- 12.12 Porsche Design

- 12.13 Prada

- 12.14 Ralph Lauren

- 12.15 Tom Ford