|

市場調查報告書

商品編碼

1721479

5G企業專用網路市場機會、成長動力、產業趨勢分析及2025年至2034年預測5G Enterprise Private Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

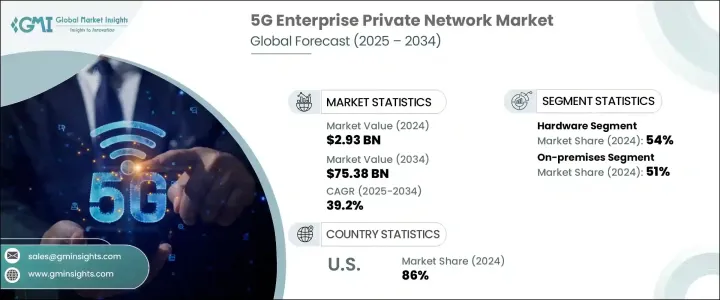

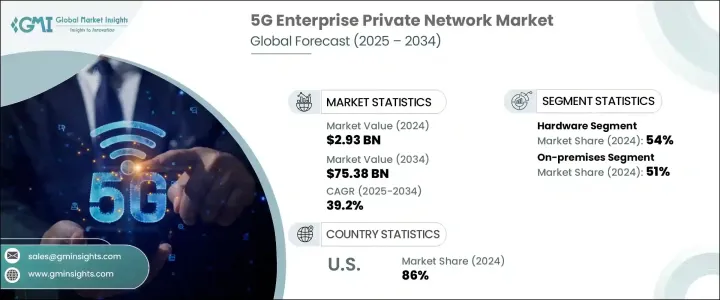

2024 年全球 5G 企業專用網路市場價值為 29.3 億美元,預計到 2034 年將以 39.2% 的複合年成長率成長,達到 753.8 億美元。各個行業的企業擴大採用私人 5G 網路,以更嚴格地控制其數位營運、提高安全性並增強可擴展性。這種需求是由對超可靠、低延遲通訊的日益依賴以及對無縫、高速資料流的需求所驅動的。私人 5G 網路正在透過實現即時決策、不間斷資料流和安全通訊來改變企業連接,特別是對於關鍵任務應用程式。

製造、物流、能源和醫療保健領域的公司正在利用這些網路來實現智慧自動化、工業物聯網、機器人和遠端監控系統。數位轉型的推動,加上有利的監管支持和強勁的研發計劃,進一步加速了市場成長。隨著對智慧城市、互聯基礎設施和邊緣運算的投資不斷增加,私有 5G 網路正成為下一代企業策略的關鍵推動因素。支持數位基礎設施的國家級舉措,包括廣泛的 5G 部署和智慧技術區的創建,在塑造這一格局方面發揮關鍵作用。這些發展為早期採用者創造了競爭優勢,並促進了需要彈性和高度安全的網路解決方案的各個領域的創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29.3億美元 |

| 預測值 | 753.8億美元 |

| 複合年成長率 | 39.2% |

硬體繼續主導 5G 企業專用網路領域,到 2024 年將佔據全球市場的 54%,預計到 2034 年將以 39.9% 的複合年成長率成長。對天線、路由器、小型基地台和基地台等高性能設備日益成長的需求正在推動這一發展勢頭。這些硬體組件對於部署可擴展且安全的私人 5G 基礎設施至關重要,特別是在製造、物流和國防等性能和安全性不能受到影響的領域。企業正在策略性地投資強大的硬體,以確保順暢、不間斷的連接,並適應需要最小延遲和最大可靠性的高級用例。

內部部署模式在 2024 年佔據 51% 的市場佔有率,佔據市場主導地位,預計未來幾年仍將保持強勢地位。管理敏感資料的企業(包括國防、工業製造和醫療保健領域的企業)更喜歡內部部署網路,因為它可以增強控制、改善資料保護並實現即時資料管理。這些網路提供客製化的基礎設施,可實現營運連續性、降低安全風險並與現有企業系統無縫整合。對客製化和遵守嚴格的行業法規的需求日益成長,進一步支持了對現場部署的偏好。

由於先進的研究生態系統、高度的自動化普及率以及積極主動的監管框架,美國將在 2024 年佔據全球 86% 的市場佔有率。該國的私人 5G 網路正在促進國防、能源和醫療保健等關鍵領域的安全高效營運,邊緣運算和機器人技術在這些領域正變得不可或缺。

全球5G企業專網市場的主要參與者包括高通、思科系統、微軟Azure、埃森哲、IBM、NVIDIA、華為技術、AT&T、惠普企業(HPE)和AWS(亞馬遜網路服務)。這些公司正在與電信營運商和雲端服務供應商建立強力的合作夥伴關係,以提供可擴展、安全且特定於產業的 5G 解決方案。許多公司也專注於整合人工智慧最佳化工具和邊緣運算技術,以增強網路效能並滿足即時需求。針對智慧製造、物流和基礎設施開發等領域的客製化服務,以及策略性試點計畫和監管合作,正在幫助企業加強市場影響力並加速全球企業的採用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 設備製造商

- 電信服務供應商

- 系統整合商

- 技術提供者

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 低延遲通訊需求不斷成長

- 邊緣運算的興起

- 日益成長的資料安全和隱私需求

- 物聯網和連網設備激增

- 產業陷阱與挑戰

- 初始部署成本高

- 與遺留系統的整合挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 無線接取網路(RAN)

- 核心網路

- 邊緣運算基礎設施

- 軟體

- 網路管理軟體

- 安全軟體

- 網路切片軟體

- 自動化和編排工具

- 服務

- 諮詢

- 託管服務

- 支援和維護

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

- 混合

第7章:市場估計與預測:按頻段,2021 - 2034 年

- 主要趨勢

- 低於 6 GHz

- 毫米波(mmWave)

第8章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 大型企業

- 中小企業

- 化學品和危險品

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製造業

- 衛生保健

- 運輸和物流

- 零售

- 能源和公用事業

- 智慧城市

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Accenture

- AT&T

- AWS (Amazon Web Services)

- BT Group (British Telecom)

- Cisco Systems

- Ericsson

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Intel

- Juniper Networks

- Mavenir

- Microsoft Azure

- Nokia

- NVIDIA

- Qualcomm

- Samsung Electronics

- T-Mobile US

- Verizon Communications

- ZTE

The Global 5G enterprise private network market was valued at USD 2.93 billion in 2024 and is estimated to grow at a CAGR of 39.2% to reach USD 75.38 billion by 2034. Enterprises across sectors are increasingly embracing private 5G networks to gain tighter control over their digital operations, improve security, and enhance scalability. The demand is driven by the growing reliance on ultra-reliable, low-latency communication and the need for seamless, high-speed data flow. Private 5G networks are transforming enterprise connectivity by enabling real-time decision-making, uninterrupted data streaming, and secure communication, particularly for mission-critical applications.

Companies in manufacturing, logistics, energy, and healthcare are leveraging these networks to implement intelligent automation, industrial IoT, robotics, and remote monitoring systems. The push for digital transformation, combined with favorable regulatory support and robust R&D initiatives, is further accelerating market growth. With increasing investments in smart cities, connected infrastructure, and edge computing, private 5G networks are emerging as a key enabler of next-gen enterprise strategies. National-level initiatives that support digital infrastructure, including expansive 5G rollouts and the creation of smart technology zones, are playing a pivotal role in shaping this landscape. These developments are creating a competitive advantage for early adopters and fostering innovation across sectors that demand resilient and highly secure network solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.93 Billion |

| Forecast Value | $75.38 Billion |

| CAGR | 39.2% |

Hardware continues to dominate the 5G enterprise private network space, accounting for 54% of the global market in 2024, and is projected to grow at a CAGR of 39.9% through 2034. The rising need for high-performance equipment such as antennas, routers, small cells, and base stations is fueling this momentum. These hardware components are essential to deploying scalable and secure private 5G infrastructures, particularly in sectors like manufacturing, logistics, and defense, where performance and security cannot be compromised. Businesses are strategically investing in robust hardware to ensure smooth, uninterrupted connectivity and to accommodate advanced use cases that demand minimal latency and maximum reliability.

The on-premises deployment model led the market with a 51% share in 2024 and is expected to retain a strong position in the coming years. Enterprises that manage sensitive data, including those in defense, industrial manufacturing, and healthcare, prefer on-premises networks due to enhanced control, improved data protection, and real-time data management. These networks provide tailored infrastructure that allows for operational continuity, reduced security risks, and seamless integration with existing enterprise systems. The preference for on-site deployment is further supported by the growing demand for customization and compliance with strict industry regulations.

The United States held an 86% share of the global market in 2024, driven by its advanced research ecosystem, high automation penetration, and proactive regulatory framework. Private 5G networks in the country are facilitating secure and efficient operations across critical sectors like defense, energy, and healthcare, where edge computing and robotics are becoming integral.

Major players in the global 5G enterprise private network market include Qualcomm, Cisco Systems, Microsoft Azure, Accenture, IBM, NVIDIA, Huawei Technologies, AT&T, Hewlett Packard Enterprise (HPE), and AWS (Amazon Web Services). These companies are forging strong partnerships with telecom operators and cloud service providers to deliver scalable, secure, and industry-specific 5G solutions. Many are also focusing on integrating AI-powered optimization tools and edge computing technologies to enhance network performance and meet real-time demands. Tailored offerings for sectors such as smart manufacturing, logistics, and infrastructure development, along with strategic pilot programs and regulatory collaborations, are helping firms strengthen their market footprint and accelerate adoption across global enterprises.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Equipment manufacturers

- 3.2.2 Telecom service providers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for low-latency communication

- 3.8.1.2 Rise in edge computing

- 3.8.1.3 Growing data security & privacy needs

- 3.8.1.4 Surge in IoT and connected devices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial deployment costs

- 3.8.2.2 Integration challenges with legacy systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Radio Access Network (RAN)

- 5.2.2 Core network

- 5.2.3 Edge computing infrastructure

- 5.3 Software

- 5.3.1 Network management software

- 5.3.2 Security software

- 5.3.3 Network slicing software

- 5.3.4 Automation and orchestration tools

- 5.4 Services

- 5.4.1 Consulting

- 5.4.2 Managed services

- 5.4.3 Support and maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Sub-6 GHz

- 7.3 Millimeter Wave (mmWave)

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

- 8.4 Chemicals & hazardous materials

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Healthcare

- 9.4 Transportation and logistics

- 9.5 Retail

- 9.6 Energy and utilities

- 9.7 Smart cities

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Accenture

- 11.2 AT&T

- 11.3 AWS (Amazon Web Services)

- 11.4 BT Group (British Telecom)

- 11.5 Cisco Systems

- 11.6 Ericsson

- 11.7 Hewlett Packard Enterprise (HPE)

- 11.8 Huawei Technologies

- 11.9 IBM

- 11.10 Intel

- 11.11 Juniper Networks

- 11.12 Mavenir

- 11.13 Microsoft Azure

- 11.14 Nokia

- 11.15 NVIDIA

- 11.16 Qualcomm

- 11.17 Samsung Electronics

- 11.18 T-Mobile US

- 11.19 Verizon Communications

- 11.20 ZTE