|

市場調查報告書

商品編碼

1721443

放射學報告品質保證服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Radiology Report Quality Assurance Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

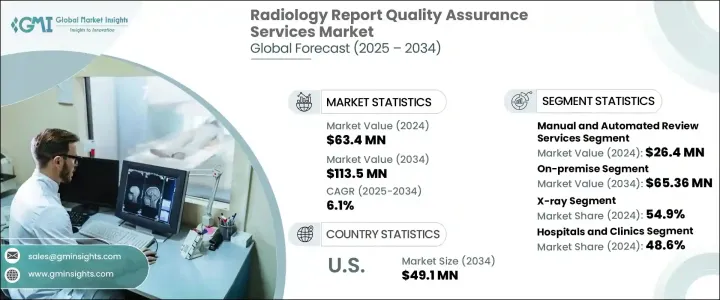

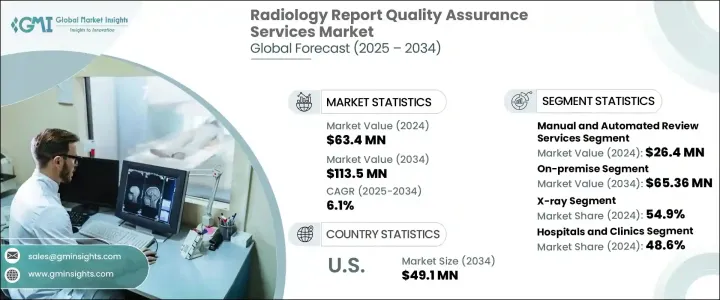

2024 年全球放射學報告品質保證服務市場價值為 6,340 萬美元,預計到 2034 年將以 6.1% 的複合年成長率成長,達到 1.135 億美元。隨著各臨床學科對診斷影像的依賴性日益增強,放射學報告準確性的重要性已成為人們關注的焦點。醫療保健提供者、遠距放射網路和診斷影像中心更加重視減少錯誤和病患安全,從而推動對強大的放射學報告品質保證 (QA) 服務的需求。這些服務在驗證放射學解釋的準確性、完整性和臨床一致性方面發揮關鍵作用,確保診斷結果符合高臨床標準。隨著影像成為患者管理和治療途徑中不可或缺的一部分,由於減少誤診、改善臨床決策和支持更好的醫療保健結果的需求不斷成長,市場正在獲得發展動力。

消除診斷報告中的差異的壓力越來越大,特別是在大容量成像環境中,這繼續推動市場的發展。隨著醫院和診斷中心向基於價值的護理模式轉變,放射學品質保證服務正擴大被採用。這些框架依賴一致的、高品質的解釋來最大限度地降低風險並改善報銷結果。市場正在經歷策略轉變,供應商不僅關注錯誤檢測,還關注提高工作流程效率和審計透明度。隨著技術進步和監管審查的不斷加強,利害關係人正在採用 QA 計劃來確保遵守國家和國際臨床指南。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6340萬美元 |

| 預測值 | 1.135億美元 |

| 複合年成長率 | 6.1% |

放射學發現中的誤解、註釋不準確和溝通不良等錯誤加劇了對品質保證機制的需求。手動和自動審查服務均整合到診斷工作流程中。 2024 年人工審查服務部門的收入為 2,640 萬美元,顯示對複雜或邊緣成像案例的專家人力洞察的需求強勁。雖然人工智慧工具在常規錯誤檢測中顯示出潛力,但人工主導的審計仍然不可或缺,特別是在細緻的臨床場景或需要第二意見時。

市場也按部署模式細分,其中內部部署解決方案部分在 2024 年佔 58.5% 的佔有率。許多醫療機構更喜歡內部部署系統,因為它們能夠更好地控制基礎設施、增強資料安全性並根據內部政策進行客製化。擁有內部 IT 部門和嚴格合規要求的設施尤其傾向於使用這些系統來滿足其營運和監管目標。

預計到 2034 年,美國放射學報告品質保證服務市場規模將達到 4,910 萬美元。消除診斷錯誤的壓力越來越大以及監管機構對標準化報告的日益關注是主要的成長動力。美國各地的醫院和診所正在採用 QA 解決方案來滿足合規標準並提高臨床品質。

全球市場領先的公司包括 RadNet、ONRAD、Aster Medical Imaging、PROBICS Informatics Solutions、National Diagnostic Imaging、HealthLevel、INFINITT North America、Teleradiology Solutions、Intelerad、Ventura Teleradiology、Envision Healthcare、Virtual Radiologic (vRad)、Volancoiology、Virtual Radiologyology。這些公司正在透過增強 AI 整合 QA 平台、支援遠端放射學操作以及客製化品質協議以適應不同的成像模式來鞏固其市場地位。與影像提供者的策略聯盟、對基於雲端的部署的投資以及與 PACS/RIS 系統的互通性的提高有助於簡化診斷工作流程並提高報告準確性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 放射學報告錯誤發生率不斷上升

- 遵守監管要求的需求不斷成長

- 強調基於價值的護理

- 對有效管理放射實驗室日益增加的負擔的需求不斷成長

- 產業陷阱與挑戰

- 同儕審查服務成本高昂

- 熟練放射科醫生的數量有限。

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按服務類型,2021 - 2034 年

- 主要趨勢

- 手動和自動審核服務

- 審計與合規服務

- 錯誤檢測與糾正服務

- 其他服務類型

第6章:市場估計與預測:依部署類型,2021 - 2034 年

- 主要趨勢

- 本地部署

- 基於雲端

第7章:市場估計與預測:按方式,2021 - 2034 年

- 主要趨勢

- CT掃描

- X光

- 磁振造影

- 超音波

- 乳房X光檢查

- 正子斷層掃描

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 醫學影像中心

- 遠距放射學公司

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Aster Medical Imaging

- Envision Healthcare

- HealthLevel

- INFINITT North America

- Intelerad

- National Diagnostic Imaging

- ONRAD

- PROBICS Informatics Solutions

- PurDes Radiology

- RadNet

- RamSoft

- Teleradiology Solutions

- Ventura Teleradiology Services

- Vesta Teleradiology

- Virtual Radiologic (vRad)

The Global Radiology Report Quality Assurance Services Market was valued at USD 63.4 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 113.5 million by 2034. With the increasing dependence on diagnostic imaging across various clinical disciplines, the importance of accuracy in radiology reporting has become a central concern. Healthcare providers, teleradiology networks, and diagnostic imaging centers are placing greater emphasis on error reduction and patient safety, driving demand for robust radiology report quality assurance (QA) services. These services play a pivotal role in validating the accuracy, completeness, and clinical consistency of radiology interpretations, ensuring that diagnostic outcomes align with high clinical standards. As imaging becomes an integral part of patient management and treatment pathways, the market is gaining momentum due to the rising need to reduce misdiagnoses, improve clinical decisions, and support better healthcare outcomes.

Growing pressure to eliminate discrepancies in diagnostic reports, especially in high-volume imaging environments, continues to fuel the market. Radiology QA services are increasingly being adopted as hospitals and diagnostic centers transition to value-based care models. These frameworks rely on consistent, high-quality interpretations to minimize risks and improve reimbursement outcomes. The market is witnessing a strategic shift, with providers not only focusing on error detection but also on enhancing workflow efficiency and audit transparency. With technological advancements and rising regulatory scrutiny, stakeholders are adopting QA programs to ensure compliance with national and international clinical guidelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.4 Million |

| Forecast Value | $113.5 Million |

| CAGR | 6.1% |

Errors such as misinterpretations, annotation inaccuracies, and miscommunications in radiology findings are intensifying the need for quality assurance mechanisms. Both manual and automated review services are being integrated into diagnostic workflows. The manual review services segment generated USD 26.4 million in 2024, indicating strong demand for expert human insight in complex or borderline imaging cases. While AI-powered tools have shown potential in routine error detection, human-led audits remain indispensable, especially in nuanced clinical scenarios or when a second opinion is required.

The market is also segmented by deployment model, with the on-premise solutions segment accounting for a 58.5% share in 2024. Many healthcare institutions prefer on-premise systems due to their ability to offer greater control over infrastructure, enhanced data security, and customization according to internal policies. Facilities with in-house IT departments and stringent compliance mandates are particularly inclined toward these systems to meet their operational and regulatory goals.

The United States Radiology Report Quality Assurance Services Market is projected to reach USD 49.1 million by 2034. Increasing pressure to eliminate diagnostic errors and a growing focus by regulatory agencies on standardized reporting are among the primary growth drivers. Hospitals and clinics across the U.S. are embracing QA solutions to meet compliance standards and elevate clinical quality.

Leading companies in the global market include RadNet, ONRAD, Aster Medical Imaging, PROBICS Informatics Solutions, National Diagnostic Imaging, HealthLevel, INFINITT North America, Teleradiology Solutions, Intelerad, Ventura Teleradiology, Envision Healthcare, Virtual Radiologic (vRad), Vesta Teleradiology, PurDes Radiology, and RamSoft. These companies are strengthening their market positions by enhancing AI-integrated QA platforms, supporting remote teleradiology operations, and tailoring quality protocols to fit diverse imaging modalities. Strategic alliances with imaging providers, investments in cloud-based deployment, and increased interoperability with PACS/RIS systems are helping streamline diagnostic workflows and improve report accuracy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing incidence of radiology reporting errors

- 3.2.1.2 Rising demand to comply with regulatory requirements

- 3.2.1.3 Emphasis on value-based care

- 3.2.1.4 Growing demand to efficiently manage increasing burden on radiology labs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of peer-review services

- 3.2.2.2 Limited availability of skilled radiologists.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manual and automated review services

- 5.3 Audit and compliance services

- 5.4 Error detection and correction services

- 5.5 Other service types

Chapter 6 Market Estimates and Forecast, By Deployment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud-based

Chapter 7 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CT scan

- 7.3 X-ray

- 7.4 MRI

- 7.5 Ultrasound

- 7.6 Mammography

- 7.7 PET-CT

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Medical imaging centers

- 8.4 Teleradiology corporations

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aster Medical Imaging

- 10.2 Envision Healthcare

- 10.3 HealthLevel

- 10.4 INFINITT North America

- 10.5 Intelerad

- 10.6 National Diagnostic Imaging

- 10.7 ONRAD

- 10.8 PROBICS Informatics Solutions

- 10.9 PurDes Radiology

- 10.10 RadNet

- 10.11 RamSoft

- 10.12 Teleradiology Solutions

- 10.13 Ventura Teleradiology Services

- 10.14 Vesta Teleradiology

- 10.15 Virtual Radiologic (vRad)