|

市場調查報告書

商品編碼

1755343

放射治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Radiotherapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

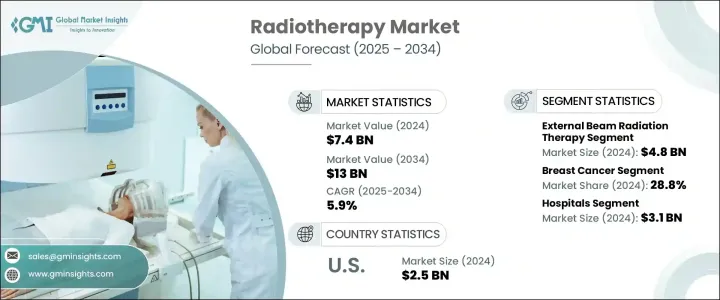

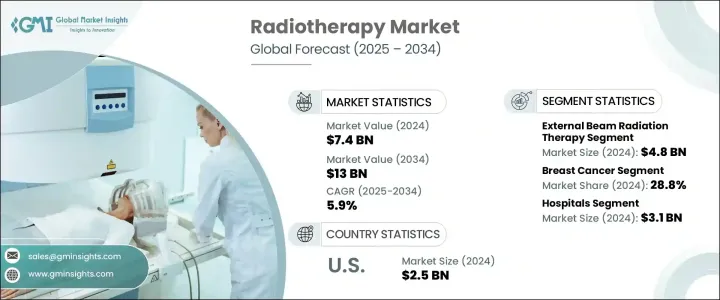

2024年,全球放射治療市場規模達74億美元,預估年複合成長率為5.9%,2034年將達130億美元。這主要得益於癌症治療,即使用高劑量放射線縮小腫瘤或清除癌細胞。這種療法的原理是破壞癌細胞的DNA,阻止其分裂和生長。放射治療主要分為兩種:體內放射治療(又稱近距離放射治療),即將放射性物質置於體內腫瘤附近;體外放射治療,即使用直線加速器等設備將體外放射線束對準癌細胞。

市場成長主要源自於大眾對各種癌症治療方案(包括放射治療)認知的提升。許多政府和非營利組織進行宣傳活動,向公眾宣傳早期癌症檢測和治療方案的重要性。此外,調強放射治療 (IMRT)、影像導引放射治療 (IGRT) 和質子治療等技術進步顯著提高了放射治療的精確度,使其能夠精準靶向癌細胞,同時保護健康組織。這些創新使放射治療越來越成為癌症患者的首選治療方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 74億美元 |

| 預測值 | 130億美元 |

| 複合年成長率 | 5.9% |

2024年,外束放射治療市場規模達到48億美元,預計2034年將以5.9%的複合年成長率持續成長。這一成長主要歸因於各種局部癌症的發生率上升,包括乳腺癌、前列腺癌、肺癌和結腸癌。先進質子治療(一種外束放射治療)的日益普及,也促進了該市場的擴張。

由於採用直線加速器和質子治療系統等先進放射治療技術的普及,醫院放射治療領域在2024年創造了31億美元的市場規模。醫院是癌症治療的綜合中心,提供化療、免疫療法和手術等多種療法。醫院與製造商合作開發和應用尖端放射治療設備,進一步推動了該領域的成長。

受美國癌症發生率上升的推動,美國放射治療市場在2024年將達到25億美元。隨著癌症確診人數的不斷增加,對先進治療方案的需求也日益成長,而放射治療是最有效且應用最廣泛的治療方法之一。人們對放射治療的有效性及其在治癒性和安寧療護中的作用的認知不斷提高,進一步促進了其應用。

放射治療市場的知名企業包括 Mevion Medical Systems、Accuray、東芝能源系統及解決方案、Brainlab、三菱電機、IBA Radiopharma Solutions、Isoray Inc.、日立高新技術、RefleXion、Curium、Elekta、佳能醫療系統、Nordion、NTP Radioisotopes 和瓦里安醫療系統。為了鞏固市場地位,放射治療產業的公司正致力於擴大產品組合併提高設備的技術能力。許多市場參與者正在投資開發整合精密成像、即時引導和質子治療等先進功能的創新放射治療系統。製造商和醫療機構之間的合作正在加強,以提高治療中心獲得先進技術的可及性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 放射治療技術進步

- 全球癌症病例不斷增加

- 大眾對癌症治療的認知不斷提高

- 增加醫療基礎建設和研發投資

- 產業陷阱與挑戰

- 發展中和低度開發地區缺乏熟練且經驗豐富的醫療保健專業人員

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 體外放射治療

- 調強放射治療(IMRT)

- 影像導引放射治療(IGRT)

- 質子治療

- 其他外部放射療法

- 內部放射治療

- 全身放射治療

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 肺癌

- 攝護腺癌

- 乳癌

- 子宮頸癌

- 頭頸癌

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 放射治療中心及門診手術中心

- 癌症研究機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

第9章:公司簡介

- Accuray

- Brainlab

- Curium

- Canon Medical Systems

- Elekta

- Hitachi High-Tech

- IBA Radiopharma Solutions

- Isoray Inc.

- Mevion Medical Systems

- Mitsubishi Electric

- Nordion

- NTP Radioisotopes

- RefleXion

- Toshiba Energy Systems and Solutions

- Varian Medical Systems

The Global Radiotherapy Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 13 billion by 2034, driven by the treatment for cancer that involves the use of high doses of radiation to shrink tumors or eliminate cancer cells. It works by damaging the DNA of the cancer cells, preventing them from dividing and growing. There are two primary types of radiotherapy: internal, known as brachytherapy, where radioactive material is placed inside the body near the tumor, and external, where an external beam of radiation is directed at the cancer using equipment like linear accelerators.

The market growth is primarily driven by increased public awareness about various cancer treatment options, including radiotherapy. Numerous government and non-profit organizations run awareness campaigns to educate the public on the importance of early cancer detection and treatment options. Additionally, technological advancements such as intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), and proton therapy are significantly improving the precision of radiotherapy, allowing for the targeting of cancerous cells while sparing healthy tissues. These innovations are making radiotherapy an increasingly preferred treatment option for cancer patients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $13 Billion |

| CAGR | 5.9% |

The external beam radiation therapy segment generated USD 4.8 billion in 2024 and is expected to continue its growth at a CAGR of 5.9% through 2034. This growth is mainly attributed to the rising incidence of various types of localized cancers, including breast, prostate, lung, and colon cancers. The increasing adoption of advanced proton therapy, a form of external beam radiotherapy, contributes to the segment's expansion.

The hospital segment generated USD 3.1 billion in 2024 due to the availability of advanced radiotherapy technologies such as linear accelerators and proton therapy systems. Hospitals serve as comprehensive centers for cancer treatment, offering various therapies like chemotherapy, immunotherapy, and surgeries. The collaboration between hospitals and manufacturers to develop and implement cutting-edge radiotherapy equipment has further fueled the segment's growth.

U.S. Radiotherapy Market generated USD 2.5 billion in 2024 driven by the rising cancer incidence across the country. As the number of cancer diagnoses continues to increase, there is a growing demand for advanced treatment options, with radiotherapy being one of the most effective and widely used methods. The increasing awareness of radiotherapy's effectiveness, along with its role in both curative and palliative treatments, has further contributed to its adoption.

Prominent players in the Radiotherapy Market include Mevion Medical Systems, Accuray, Toshiba Energy Systems and Solutions, Brainlab, Mitsubishi Electric, IBA Radiopharma Solutions, Isoray Inc., Hitachi High-Tech, RefleXion, Curium, Elekta, Canon Medical Systems, Nordion, NTP Radioisotopes, Varian Medical Systems. To strengthen their market position, companies operating in the radiotherapy industry are focusing on expanding their product portfolios and improving the technological capabilities of their equipment. Many market players are investing in developing innovative radiotherapy systems that integrate advanced features such as precision imaging, real-time guidance, and proton therapy capabilities. Collaborations between manufacturers and healthcare facilities are rising to improve the accessibility of state-of-the-art technologies in treatment centers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancement in radiotherapy

- 3.2.1.2 Increasing number of cancer cases globally

- 3.2.1.3 Growing public awareness related to cancer therapy

- 3.2.1.4 Increasing healthcare infrastructure and R&D investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled and experienced healthcare professionals in developing and underdeveloped regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 External beam radiation therapy

- 5.2.1 Intensity-modulated radiation therapy (IMRT)

- 5.2.2 Image-guided radiation therapy (IGRT)

- 5.2.3 Proton therapy

- 5.2.4 Other external radiation therapies

- 5.3 Internal radiation therapy

- 5.4 Systemic radiation therapy

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lung cancer

- 6.3 Prostate cancer

- 6.4 Breast cancer

- 6.5 Cervical cancer

- 6.6 Head and neck cancer

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Radiotherapy centers and ambulatory surgery centers

- 7.4 Cancer research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

Chapter 9 Company Profiles

- 9.1 Accuray

- 9.2 Brainlab

- 9.3 Curium

- 9.4 Canon Medical Systems

- 9.5 Elekta

- 9.6 Hitachi High-Tech

- 9.7 IBA Radiopharma Solutions

- 9.8 Isoray Inc.

- 9.9 Mevion Medical Systems

- 9.10 Mitsubishi Electric

- 9.11 Nordion

- 9.12 NTP Radioisotopes

- 9.13 RefleXion

- 9.14 Toshiba Energy Systems and Solutions

- 9.15 Varian Medical Systems