|

市場調查報告書

商品編碼

1721414

碳化矽半導體裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Silicon Carbide Semiconductor Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

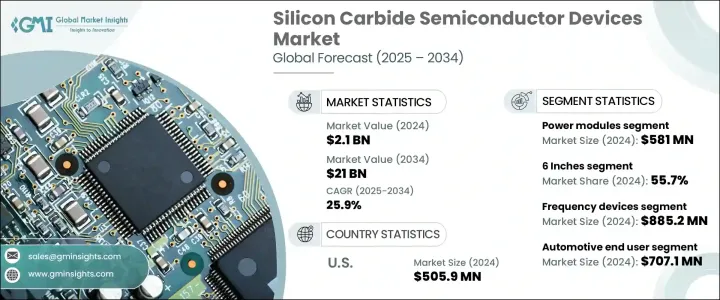

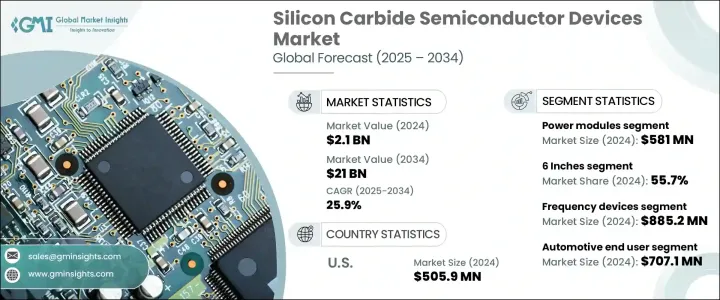

2024 年全球碳化矽半導體元件市場價值為 21 億美元,預計到 2034 年將以 25.9% 的複合年成長率成長,達到 210 億美元。這一顯著成長源自於全球大力推動脫碳和採用清潔能源技術,尤其是在交通和發電領域。隨著產業和政府優先考慮能源效率、永續性和長期成本節約,碳化矽 (SiC) 半導體越來越被視為高性能電力電子的未來。它們具有優異的導熱性、高擊穿電場以及在更高頻率下運作的能力,這使得它們在需要在惡劣操作環境下保持可靠性的應用中至關重要。從智慧電網和再生能源裝置到工業驅動器和快速充電基礎設施,基於 SiC 的設備正在重新定義操作標準和性能期望。

隨著 SiC 技術在電動車 (EV)、航太和國防系統以及大規模電網現代化計劃中的日益普及,全球需求持續受到推動。向電動車的加速轉變尤其重要,因為汽車製造商面臨著提供行駛里程更長、充電時間更短的汽車的壓力。 SiC 裝置透過最大限度地減少能量損失、提高功率轉換效率以及實現緊湊、輕量化的系統來幫助滿足這些需求。 SiC 半導體在太陽能逆變器和風力渦輪機中的作用也在不斷擴大,其中高效率和堅固性對於最佳化能量輸出和系統耐用性至關重要。同時,國防和航太領域也越來越青睞基於 SiC 的電力系統,因為它們在關鍵任務和高溫環境中具有強大的性能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 210億美元 |

| 複合年成長率 | 25.9% |

市場根據組件進行細分,其中電源模組佔據主導地位,2024 年市場規模達 5.81 億美元。這些模組因其緊湊的架構、減少的外部冷卻需求以及在各種終端應用中的提高效率而被廣泛採用,包括電動車傳動系統、攜帶式電子設備和工業電源。電動車銷量的激增也同時增加了對超快速充電解決方案的需求,而 SiC 功率模組憑藉其低開關損耗和出色的電壓處理能力在該領域表現出色。

另一個關鍵部分是晶圓尺寸,預計 6 吋晶圓將佔據市場主導地位,到 2024 年將佔據 55.7% 的佔有率。這些晶圓支援更高的吞吐量和更好的生產經濟性,使其成為製造汽車和再生能源行業高壓、節能設備的首選。

受美國對清潔能源轉型和尖端行動解決方案的戰略重點的支持,美國碳化矽半導體裝置市場規模到 2024 年將達到 5.059 億美元。美國電動車製造商正在採用基於 SiC 的系統來提高能源效率和車輛性能,以滿足消費者對更快充電和更長續航里程日益成長的需求。

該領域的主要參與者包括安森美、意法半導體、羅姆半導體、Wolfspeed 和英飛凌科技。這些公司正在大力投資研發,以提高設備性能,同時降低製造成本。產能擴張、與汽車原始設備製造商的合作以及與再生能源公司的合作仍然是其市場策略的核心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- SiC半導體裝置在消費性電子產品的新興應用

- 電動車需求激增

- 工業自動化傾向日益增強

- 碳化矽半導體裝置在航太和國防領域的應用日益廣泛

- 電網現代化和再生能源專案數量不斷增加

- 產業陷阱與挑戰

- 新興市場的認知度和採用率有限

- 來自矽和氮化鎵(GaN)的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組件,2021-2034

- 主要趨勢

- 肖特基二極體

- FET/MOSFET電晶體

- 積體電路

- 整流器/二極體

- 電源模組

- 其他

第6章:市場預估與預測:依晶圓尺寸,2021-2034

- 主要趨勢

- 1英寸到4英寸

- 6吋

- 8吋

第7章:市場估計與預測:依產品,2021-2034

- 主要趨勢

- 光電裝置

- 功率半導體

- 頻率裝置

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 能源與電力

- 消費性電子產品

- 航太與國防

- 醫療器材

- 數據和通訊設備

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Alpha & Omega Semiconductor

- Analog Devices

- Bosch Semiconductors

- Coherent Corp.

- Diodes Incorporated

- Fuji Electric

- GeneSiC Semiconductor

- Infineon Technologies

- Littelfuse

- Microchip Technology

- Mitsubishi Electric

- NXP Semiconductors

- onsemi

- Power Integrations

- Qorvo

- ROHM Semiconductor

- Semikron Danfoss

- Solitron Devices

- STMicroelectronics

- Toshiba Electronic Devices & Storage

- Vishay Intertechnology

- WeEn Semiconductors

- Wolfspeed

The Global Silicon Carbide Semiconductor Devices Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 25.9% to reach USD 21 billion by 2034. This exceptional growth stems from a strong global push toward decarbonization and the adoption of clean energy technologies, especially in the transportation and power generation sectors. As industries and governments prioritize energy efficiency, sustainability, and long-term cost savings, silicon carbide (SiC) semiconductors are increasingly seen as the future of high-performance power electronics. Their superior thermal conductivity, high breakdown electric field, and ability to operate at higher frequencies make them critical in applications requiring reliability under harsh operating environments. From smart grids and renewable energy installations to industrial drives and fast-charging infrastructure, SiC-based devices are redefining operational standards and performance expectations.

Global demand continues to be fueled by the rising integration of SiC technology in electric vehicles (EVs), aerospace and defense systems, and large-scale grid modernization initiatives. The accelerating shift to EVs is particularly significant, as automakers are under pressure to deliver vehicles with extended driving ranges and reduced charging times. SiC devices help meet these demands by minimizing energy losses, improving power conversion efficiency, and enabling compact, lightweight systems. The role of SiC semiconductors is also expanding in solar inverters and wind turbines, where high efficiency and ruggedness are critical to optimize energy output and system durability. Meanwhile, defense and aerospace sectors increasingly favor SiC-based power systems for their robust performance in mission-critical and high-temperature environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $21 Billion |

| CAGR | 25.9% |

The market is segmented based on components, with power modules leading the charge, accounting for USD 581 million in 2024. These modules are widely adopted for their compact architecture, reduced need for external cooling, and elevated efficiency across various end-use applications, including EV drivetrains, portable electronics, and industrial power supplies. The boom in EV sales has simultaneously heightened the need for ultra-fast charging solutions, a domain where SiC power modules excel thanks to their low switching losses and exceptional voltage handling.

Another pivotal segment is wafer size, with 6-inch wafers expected to dominate the market, capturing a 55.7% share in 2024. These wafers support higher throughput and improved production economics, making them a preferred choice for manufacturing high-voltage, energy-efficient devices across automotive and renewable energy industries.

The U.S. Silicon Carbide Semiconductor Devices Market reached USD 505.9 million in 2024, backed by the nation's strategic focus on clean energy transitions and cutting-edge mobility solutions. U.S.-based EV makers are adopting SiC-based systems to boost energy efficiency and vehicle performance, addressing growing consumer demand for faster charging and longer range.

Key players in this space include onsemi, STMicroelectronics, ROHM Semiconductor, Wolfspeed, and Infineon Technologies. These companies are heavily investing in R&D to enhance device performance while reducing manufacturing costs. Capacity expansions, partnerships with automotive OEMs, and collaborations with renewable energy firms remain central to their market strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Emerging use of SiC semiconductor devices in consumer electronics

- 3.6.1.2 Surge in demand for electric vehicles

- 3.6.1.3 Rising inclination towards industrial automation

- 3.6.1.4 Increasing application of silicon carbide semiconductor devices in aerospace and defense applications

- 3.6.1.5 Growing number of grid modernization and renewable energy projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited awareness and adoption in emerging markets

- 3.6.2.2 Competition from silicon and gallium nitride (GaN)

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Schottky diodes

- 5.3 FET/MOSFET transistors

- 5.4 Integrated circuits

- 5.5 Rectifiers/diodes

- 5.6 Power modules

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Wafer Size, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 1 inch to 4 inches

- 6.3 6 inches

- 6.4 8 inches

Chapter 7 Market Estimates & Forecast, By Product, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Optoelectronic devices

- 7.3 Power semiconductors

- 7.4 Frequency devices

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Energy & power

- 8.4 Consumer electronics

- 8.5 Aerospace & defense

- 8.6 Medical devices

- 8.7 Data & communication devices

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alpha & Omega Semiconductor

- 10.2 Analog Devices

- 10.3 Bosch Semiconductors

- 10.4 Coherent Corp.

- 10.5 Diodes Incorporated

- 10.6 Fuji Electric

- 10.7 GeneSiC Semiconductor

- 10.8 Infineon Technologies

- 10.9 Littelfuse

- 10.10 Microchip Technology

- 10.11 Mitsubishi Electric

- 10.12 NXP Semiconductors

- 10.13 onsemi

- 10.14 Power Integrations

- 10.15 Qorvo

- 10.16 ROHM Semiconductor

- 10.17 Semikron Danfoss

- 10.18 Solitron Devices

- 10.19 STMicroelectronics

- 10.20 Toshiba Electronic Devices & Storage

- 10.21 Vishay Intertechnology

- 10.22 WeEn Semiconductors

- 10.23 Wolfspeed