|

市場調查報告書

商品編碼

1716665

引擎氣門市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Engine Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

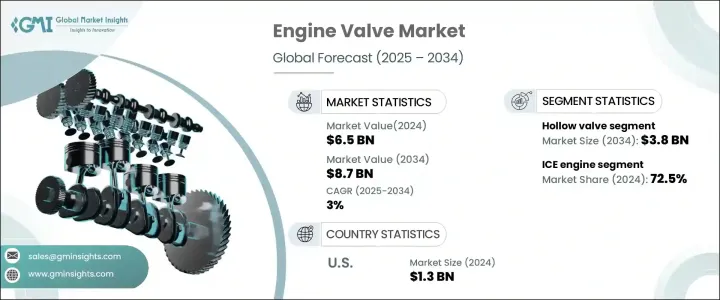

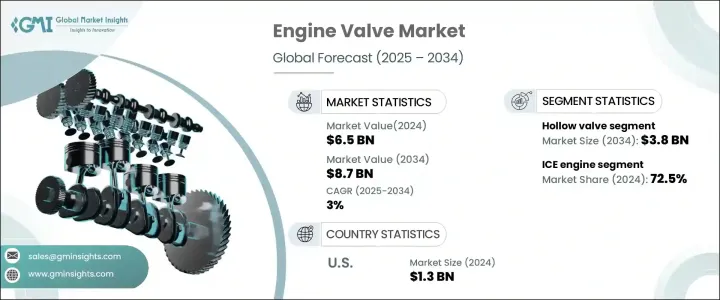

2024 年全球引擎氣門市場價值為 65 億美元,預計將經歷穩定成長,預計 2025 年至 2034 年期間的複合年成長率為 3%。全球對節能汽車的需求不斷成長是影響市場擴張的主要因素。隨著世界各國政府實施更嚴格的燃油經濟性和排放法規,汽車製造商正迅速採用先進的引擎技術。這導致對高性能引擎部件的需求激增,特別是在燃燒效率和排放控制中發揮關鍵作用的閥門。引擎設計的持續創新,包括渦輪增壓和可變氣門正時,進一步推動了對精密設計閥門的需求,以最佳化燃料燃燒並提高車輛整體性能。隨著汽車製造商專注於輕質耐用的引擎部件以滿足嚴格的監管要求,引擎氣門市場正在見證材料科學和製造過程的重大進步。

根據閥門類型,市場分為空心閥門、單金屬閥門和雙金屬閥門。空心閥門市場在 2024 年的市場規模為 29 億美元,因其卓越的輕量化特性而備受青睞。空心閥門比實心閥門具有顯著優勢,能夠實現更快、更精確的閥門運動,從而提高引擎效率。這些閥門對於速度和熱管理至關重要的高性能和賽車引擎特別有用。空心閥門改善散熱的能力可確保引擎在最佳溫度下運行,從而延長承受高應力和極端條件的引擎零件的使用壽命。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 3% |

就引擎類型而言,市場分為內燃機(ICE)和電動引擎。 2024 年,內燃機佔據了 72.5% 的主導佔有率,預計到 2034 年將以 2.8% 的複合年成長率成長。雖然電動車正在逐漸重塑汽車格局,但內燃機汽車憑藉其廣泛的基礎設施和持續的技術進步繼續保持領先地位。汽車製造商正在整合直接燃油噴射和氣缸停用等節油技術,以提高汽油引擎的效率。同時,更嚴格的排放標準正在推動輕質、耐熱引擎氣門的發展,以在不影響性能的情況下最大限度地減少排放。

2024 年,美國引擎氣門市場價值 13 億美元,預計 2025 年至 2034 年的複合年成長率將達到 2.4%。儘管汽車電氣化進程正在加速,但對包括引擎氣門在內的 ICE 零件的需求仍然強勁。美國汽車製造商正在投資先進的閥門材料和塗層,以提高耐用性和效率,確保符合嚴格的排放法規,同時滿足消費者對高性能汽油動力汽車的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:市場洞察

- 產業生態系統分析

- 原料分析

- 重要新聞和舉措

- 夥伴關係/合作

- 合併/收購

- 投資

- 產品發布與創新

- 監管格局

- 衝擊力

- 成長動力

- 增加車輛產量

- 加大閥門技術創新力度

- 排放法規愈發嚴格

- 成長動力

- 產業陷阱與挑戰

- 汽車閥門製造過程涉及環境問題

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 交易分析

- 匯出資料

- 導入資料

第4章:競爭格局

- 介紹

- 公司市佔率

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按閥門類型 2021 - 2034

- 主要趨勢

- 空洞的

- 單金屬

- 雙金屬

第6章:市場估計與預測:按用途 2021 - 2034

- 主要趨勢

- 進氣門

- 排氣閥

第7章:市場估計與預測:依引擎類型 2021 - 2034

- 主要趨勢

- 冰

- 電的

第8章:市場估計與預測:按材料 2021 - 2034

- 主要趨勢

- 鎳合金

- 鍍鉻

- 不銹鋼

- 其他(硝酸鹽、司太立合金等)

第9章:市場估計與預測:依技術分類 2021 - 2034

- 主要趨勢

- 氣動

- 油壓

- 電的

第 10 章:市場估計與預測:按應用 2021 年至 2034 年

- 主要趨勢

- 汽車

- 商用車

- 搭乘用車

- 二輪車

- 船舶應用

- 天然氣引擎

- 軍事和國防應用

- 農業和土方機械

- 鐵路和機車應用

- 發電機和工業引擎

- 其他

第 11 章:市場估計與預測:按配銷通路2021 - 2034

- 主要趨勢

- OEM

- 售後市場

第 12 章:市場估計與預測:按地區 2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第13章:公司簡介

- AVR (Vikram) Valves

- Bosch

- Continental AG

- Denso

- Eaton Corporation

- Federal-Mogul

- Fuji Oozx

- Grindtech

- Hitachi Ltd

- Rane

The Global Engine Valve Market, valued at USD 6.5 billion in 2024, is set to experience steady growth, projected to expand at a CAGR of 3% between 2025 and 2034. The increasing global demand for fuel-efficient vehicles is a major factor influencing market expansion. With governments worldwide enforcing stricter fuel economy and emissions regulations, automakers are rapidly adopting advanced engine technologies. This has led to a surge in demand for high-performance engine components, particularly valves, which play a pivotal role in combustion efficiency and emission control. Ongoing innovations in engine design, including turbocharging and variable valve timing, are further boosting the need for precision-engineered valves that optimize fuel combustion and enhance overall vehicle performance. As automakers focus on lightweight and durable engine components to meet stringent regulatory requirements, the engine valve market is witnessing significant advancements in material science and manufacturing processes.

The market is segmented based on valve type into hollow, monometallic, and bimetallic valves. The hollow valve segment accounted for USD 2.9 billion in 2024, gaining traction due to its superior lightweight characteristics. Hollow valves offer a significant advantage over solid valves by enabling faster and more precise valve movement, which enhances engine efficiency. These valves are particularly beneficial in high-performance and racing engines where speed and thermal management are crucial. The ability of hollow valves to improve heat dissipation ensures that engines operate at optimal temperatures, thereby extending the lifespan of engine components subjected to high stress and extreme conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 3% |

In terms of engine type, the market is categorized into internal combustion engines (ICE) and electric engines. ICE engines held a dominant 72.5% share in 2024 and are projected to grow at a CAGR of 2.8% through 2034. While electric vehicles are gradually reshaping the automotive landscape, ICE vehicles continue to lead due to their widespread infrastructure and ongoing technological advancements. Automakers are integrating fuel-efficient technologies such as direct fuel injection and cylinder deactivation to enhance the efficiency of gasoline-powered engines. At the same time, stricter emission norms are driving the development of lightweight, heat-resistant engine valves that minimize emissions without compromising performance.

U.S. Engine Valve Market generated USD 1.3 billion in 2024 and is forecasted to expand at a CAGR of 2.4% from 2025 to 2034. Despite the accelerating shift toward vehicle electrification, the demand for ICE components, including engine valves, remains strong. Automakers in the U.S. are investing in advanced valve materials and coatings that enhance durability and efficiency, ensuring compliance with stringent emission regulations while meeting consumer demand for high-performance gasoline-powered vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Market 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Regional trends

- 2.4 Product type trends

- 2.5 End use trends

- 2.6 Distribution channel trends

Chapter 3 Market Insights

- 3.1 Industry ecosystem analysis

- 3.2 Raw material analysis

- 3.3 Key news and initiatives

- 3.3.1 Partnership/Collaboration

- 3.3.2 Merger/Acquisition

- 3.3.3 Investment

- 3.3.4 Product launch & innovation

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Increase production of vehicles

- 3.5.1.2 Increase innovation in valve technology

- 3.5.1.3 Rise in stringent emission regulations

- 3.5.1 Growth drivers

- 3.6 Industry pitfalls & challenges

- 3.6.1.1 Manufacturing process of automotive valves involves environmental concerns

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Trade analysis

- 3.10.1 Export data

- 3.10.2 Import data

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share, 2024

- 4.3 Competitive analysis of major market players, 2024

- 4.4 Competitive positioning matrix, 2024

- 4.5 Strategic outlook matrix, 2024

Chapter 5 Market Estimates & Forecast, By Valve Type 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Hollow

- 5.3 Monometallic

- 5.4 Bimetallic

Chapter 6 Market Estimates & Forecast, By Purpose 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Intake valves

- 6.3 Exhaust valves

Chapter 7 Market Estimates & Forecast, By Engine type 2021 - 2034, (USD Billion)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

Chapter 8 Market Estimates & Forecast, By Material 2021 - 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Nickel alloy

- 8.3 Chrome plated

- 8.4 Stainless steel

- 8.5 Others (Nitrate, Stellite Alloy, etc.)

Chapter 9 Market Estimates & Forecast, By Technology 2021 - 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Pneumatic

- 9.3 Hydraulic

- 9.4 Electric

Chapter 10 Market Estimates & Forecast, By Application 2021 - 2034, (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.2.1 Commercial vehicle

- 10.2.2 Passenger vehicle

- 10.2.3 Two wheelers

- 10.3 Marine applications

- 10.4 Natural gas engines

- 10.5 Military & defense applications

- 10.6 Agricultural & earth moving machinery

- 10.7 Railway & locomotive applications

- 10.8 Generators & industrial engines

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel 2021 - 2034, (USD Billion)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region 2021 - 2034, (USD Billion)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Malaysia

- 12.4.7 Indonesia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 AVR (Vikram) Valves

- 13.2 Bosch

- 13.3 Continental AG

- 13.4 Denso

- 13.5 Eaton Corporation

- 13.6 Federal-Mogul

- 13.7 Fuji Oozx

- 13.8 Grindtech

- 13.9 Hitachi Ltd

- 13.10 Rane