|

市場調查報告書

商品編碼

1716649

人工智慧即服務 (AIaaS) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Artificial Intelligence as a Service (AIaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

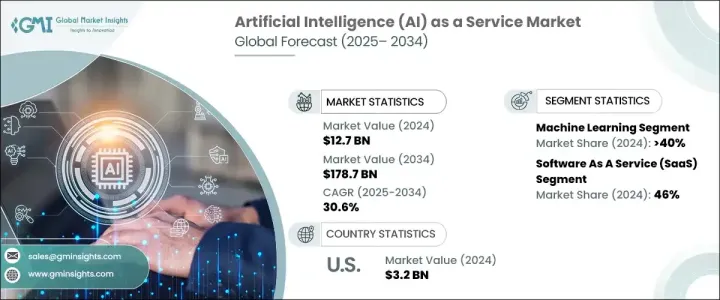

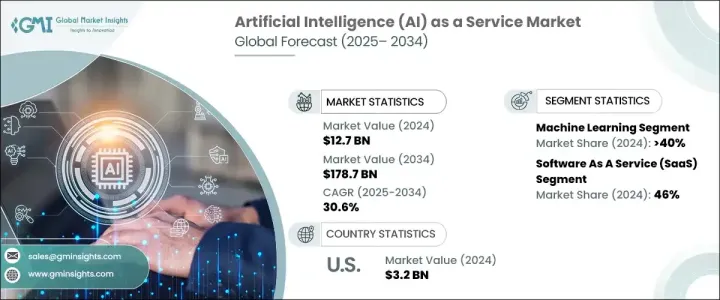

2024 年全球人工智慧即服務市場價值為 127 億美元,預計 2025 年至 2034 年期間的複合年成長率為 30.6%。隨著人工智慧成為數位轉型的基石,各行各業的企業都在迅速採用 AIaaS 解決方案,以保持競爭力和敏捷性。對自動化、數據驅動決策和增強客戶體驗的不斷成長的需求正在推動 AIaaS 平台的廣泛採用。這些解決方案使公司無需建造昂貴的內部基礎設施即可存取先進的 AI 工具,從而使 AI 整合更加可行且可擴展。

AIaaS 平台正在透過幫助企業簡化流程、最佳化營運和減少重複性任務中的人為干預來徹底改變產業。隨著人工智慧能力的進步,越來越多的公司利用 AIaaS 開發創新應用程式、個人化客戶互動並獲得即時洞察以便做出更好的決策。企業擴大尋求能夠提供靈活、經濟高效的模型的 AIaaS 供應商,以解決越來越多的用例——從智慧聊天機器人和詐欺檢測到預測分析和供應鏈最佳化。對數位化的日益重視和持續創新的需求,使得 AIaaS 成為業務成長和卓越營運的關鍵推動因素,吸引了大型企業和中小型企業。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 127億美元 |

| 預測值 | 1787億美元 |

| 複合年成長率 | 30.6% |

推動 AIaaS 市場成長的主要因素是各個垂直產業對自動化的需求不斷成長。 AIaaS 為組織提供了提高生產力、最佳化客戶服務、高效管理大量資料和降低營運成本的基本工具。隨著企業尋求更聰明的方法來提高效能和簡化營運,對 AIaaS 平台的需求持續激增。工業自動化和控制系統市場的不斷擴大進一步加速了人工智慧驅動技術的採用。醫療保健、零售、金融、製造和物流等行業的公司正在採用 AIaaS 來自動化客戶支援、資料輸入、庫存管理等關鍵功能,從而提高效率並推動創新。

AIaaS 市場按技術細分為機器學習 (ML)、自然語言處理 (NLP)、電腦視覺等。其中,機器學習領域佔據主導地位,佔 40%,到 2024 年將創造 50 億美元的產值。機器學習是眾多人工智慧應用的支柱,包括推薦引擎、詐欺偵測系統、預測分析和流程自動化。隨著企業尋求更深入的洞察力並實現決策自動化,ML 跨多個行業的適應性使其成為 AIaaS 產品不可或缺的一部分。

就產品而言,市場分為基礎設施即服務、平台即服務和軟體即服務 (SaaS)。 2024 年,SaaS 領域佔據 46% 的市場佔有率,為企業提供基於訂閱的強大 AI 工具存取權限,無需對內部部署解決方案進行高額的前期投資。 SaaS 模型提供了無與倫比的可擴展性和靈活性,使各種規模的組織更容易採用 AI,從而進一步推動 AIaaS 市場的成長。

2024年,北美佔據全球AIaaS市場的34%。美國憑藉其先進的雲端運算生態系統脫穎而出,成為AIaaS部署的支柱。美國領先的供應商提供強大、可擴展的雲端平台,使企業能夠無縫整合 AI 解決方案,降低成本並擴大各行各業對尖端 AI 工具的存取。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- AIaaS 供應商

- 技術整合商和顧問

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 人工智慧技術的進步

- 自動化需求不斷成長

- 提高成本效率和可擴展性

- 雲端採用率不斷上升

- 對個人化客戶體驗的需求日益成長

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 缺乏內部專業知識

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 機器學習(ML)

- 電腦視覺

- 自然語言處理(NLP)

- 其他

第6章:市場估計與預測:按雲類型,2021 - 2034 年

- 主要趨勢

- 民眾

- 混合

- 私人的

第7章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第8章:市場估計與預測:按供應量,2021 - 2034 年

- 主要趨勢

- 基礎設施即服務

- 平台即服務

- 軟體即服務

第9章:市場估計與預測:依產業垂直,2021 - 2034 年

- 主要趨勢

- 銀行、金融和保險(BFSI)

- 醫療保健和生命科學

- 零售

- 資訊科技和電信

- 政府和國防

- 製造業

- 能源與公用事業

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Alibaba Cloud

- Amazon Web Services

- Baidu Cloud

- BigML

- C3.ai

- Datarobot

- Fair Isaac

- H2O.ai

- IBM

- Intel

- Iris.ai

- Meta AI

- Microsoft

- NVIDIA

- Oracle

- Salesforce

- SAP

- Siemens

- Palantir

- Yellow.ai

The Global Artificial Intelligence as a Service Market was valued at USD 12.7 billion in 2024 and is expected to grow at a CAGR of 30.6% between 2025 and 2034. As AI becomes a cornerstone of digital transformation, businesses across industries are rapidly embracing AIaaS solutions to remain competitive and agile. The rising demand for automation, data-driven decision-making, and enhanced customer experiences is fueling the widespread adoption of AIaaS platforms. These solutions allow companies to access advanced AI tools without building expensive in-house infrastructure, making AI integration more feasible and scalable.

AIaaS platforms are revolutionizing industries by helping businesses streamline processes, optimize operations, and reduce human intervention in repetitive tasks. As AI capabilities advance, more companies are leveraging AIaaS to develop innovative applications, personalize customer interactions, and gain real-time insights for better decision-making. Enterprises are increasingly seeking AIaaS providers that offer flexible, cost-efficient models to address a growing range of use cases-from intelligent chatbots and fraud detection to predictive analytics and supply chain optimization. The growing emphasis on digitalization and the need for continuous innovation have positioned AIaaS as a critical enabler of business growth and operational excellence, attracting both large enterprises and small to mid-sized businesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.7 Billion |

| Forecast Value | $178.7 Billion |

| CAGR | 30.6% |

The primary factor driving the AIaaS market's growth is the rising demand for automation across various industry verticals. AIaaS gives organizations the essential tools to enhance productivity, optimize customer service, manage large data volumes efficiently, and reduce operational costs. As businesses look for smarter ways to improve performance and streamline operations, the demand for AIaaS platforms continues to surge. The expanding market for industrial automation and control systems is further accelerating the adoption of AI-driven technologies. Companies across sectors such as healthcare, retail, finance, manufacturing, and logistics are embracing AIaaS to automate key functions like customer support, data entry, inventory management, and more, thereby improving efficiency and driving innovation.

The AIaaS market is segmented by technology into machine learning (ML), natural language processing (NLP), computer vision, and others. Among these, the machine learning segment dominated with a 40% share, generating USD 5 billion in 2024. ML forms the backbone of numerous AI applications, including recommendation engines, fraud detection systems, predictive analytics, and process automation. Its adaptability across multiple industries makes ML an indispensable part of AIaaS offerings, as companies seek to unlock deeper insights and automate decision-making.

In terms of offerings, the market is divided into infrastructure as a service, platform as a service, and software as a service (SaaS). The SaaS segment led with a 46% market share in 2024, providing businesses with subscription-based access to powerful AI tools without the high upfront investment of on-premises solutions. SaaS models offer unparalleled scalability and flexibility, making AI adoption more accessible for organizations of all sizes, further propelling AIaaS market growth.

North America held a 34% share of the global AIaaS market in 2024. The U.S. stands out with its advanced cloud computing ecosystem, which serves as a backbone for AIaaS deployment. Leading U.S.-based providers offer robust, scalable cloud platforms that enable businesses to seamlessly integrate AI solutions, driving down costs and expanding access to cutting-edge AI tools across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 AIaaS Providers

- 3.2.2 Technology integrators and consultants

- 3.2.3 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Advancements in AI technologies

- 3.8.1.2 Increasing demand for automation

- 3.8.1.3 Improved cost efficiency and scalability

- 3.8.1.4 Rising cloud adoption

- 3.8.1.5 Growing need for personalized customer experiences

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Data privacy and security concerns

- 3.8.2.2 Lack of in-house expertise

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Machine Learning (ML)

- 5.3 Computer vision

- 5.4 Natural Language Processing (NLP)

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Cloud Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Public

- 6.3 Hybrid

- 6.4 Private

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprise

Chapter 8 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Infrastructure as a service

- 8.3 Platform as a service

- 8.4 Software as a service

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Banking, Financial, and Insurance (BFSI)

- 9.3 Healthcare and Life Sciences

- 9.4 Retail

- 9.5 IT & Telecommunication

- 9.6 Government and defense

- 9.7 Manufacturing

- 9.8 Energy & Utility

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Alibaba Cloud

- 11.2 Amazon Web Services

- 11.3 Baidu Cloud

- 11.4 BigML

- 11.5 C3.ai

- 11.6 Datarobot

- 11.7 Fair Isaac

- 11.8 Google

- 11.9 H2O.ai

- 11.10 IBM

- 11.11 Intel

- 11.12 Iris.ai

- 11.13 Meta AI

- 11.14 Microsoft

- 11.15 NVIDIA

- 11.16 Oracle

- 11.17 Salesforce

- 11.18 SAP

- 11.19 Siemens

- 11.20 Palantir

- 11.21 Yellow.ai