|

市場調查報告書

商品編碼

1851756

人工智慧即服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Artificial Intelligence As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

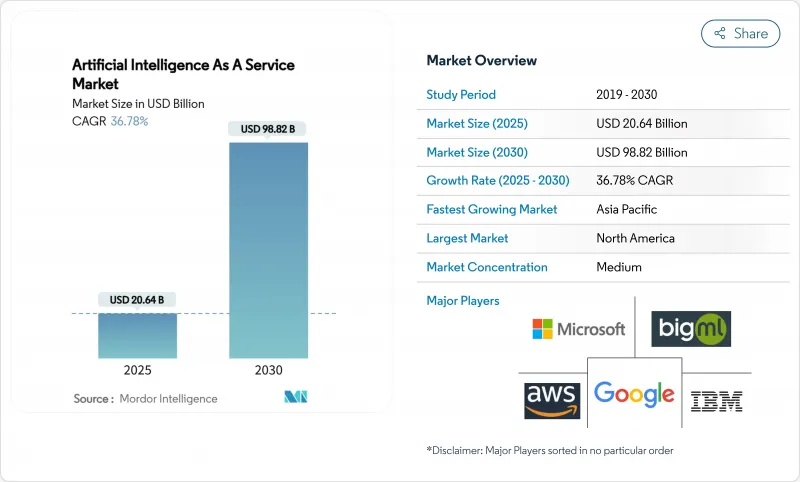

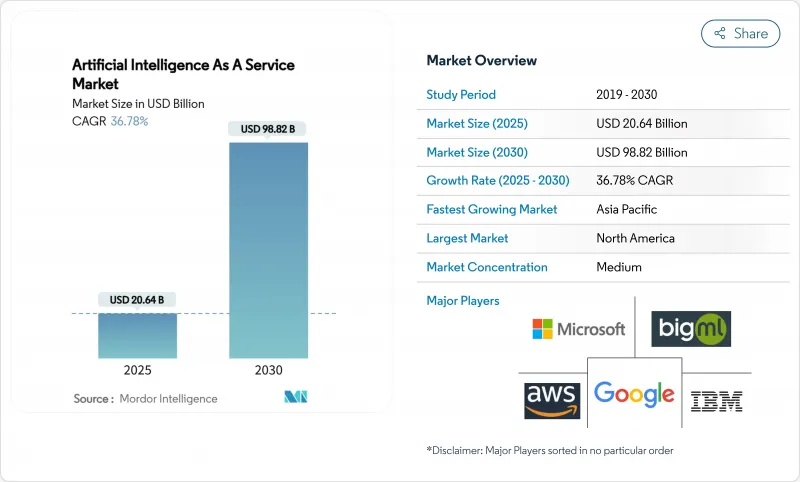

預計到 2025 年,人工智慧即服務市場規模將達到 206.4 億美元,到 2030 年將達到 988.2 億美元,預測期(2025-2030 年)複合年成長率為 36.78%。

企業將生成式人工智慧API整合到面向客戶和後勤部門系統中,推動了人工智慧從先導計畫向生產工作負載的快速過渡,從而促進了這一成長。訂閱定價降低了小型企業的進入門檻,而客製化人工智慧加速器可將推理成本降低高達80%,從而擴大了服務提供者的淨利率。日本650億美元的人工智慧計畫等政府獎勵策略正在加速推進,儘管短期內電力供應緊張,但超大規模資料中心的建設仍在持續擴大運算能力。這些因素共同推動人工智慧即服務市場在各行各業得到廣泛應用。

全球人工智慧即服務市場趨勢與洞察

對預測性和規範性分析的需求日益成長

如今,企業更重視前瞻性而非後見之明。採用主導分析的製造商收入成長了61%,供應鏈最佳化使物流成本降低了15%。醫療系統透過放射科工作流程自動化,在五年內實現了451%的投資報酬率。銀行利用人工智慧預測改進了詐欺偵測,預計到2028年將額外創造1700億美元的利潤。即時資料擷取和基於代理的人工智慧系統將保持這一發展勢頭,使預測分析成為人工智慧即服務市場的核心成長引擎。

訂閱式人工智慧工具可降低中小企業的整體擁有成本

低門檻定價模式打破了以往的進入障礙。全球中小企業對生成式人工智慧工具的採用率已達18%。在美國,擁有四名員工的公司中,人工智慧的使用率在一年內從4.6%成長至5.8%。零售商已展現出切實的回報:塔吉特百貨在400家門市推出了人工智慧員工輔助工具,在無需大量資本支出的情況下提高了生產力。訂閱平台透過將人工智慧從資本支出轉變為固定資產投資,拓展了面向微企業的「人工智慧即服務」市場。

雲端處理成本不斷上漲

人工智慧工作負載對基礎設施經濟帶來巨大壓力。到2030年,資料中心可能消耗美國9%的電力。到2025年,人工智慧的能源需求將超過比特幣挖礦,達到23吉瓦。目前,財富2000強企業中有47%選擇在企業內部開發生成式人工智慧,以避免不斷上漲的電費。電價上漲和晶片供應緊張將在短期內降低人工智慧的可負擔性,並限制人工智慧即服務市場的成長。

細分市場分析

2024年,公共雲端將維持78%的市場佔有率,人工智慧即服務(AIaaS)市場仍將以超大規模基礎設施為核心。然而,混合雲才是明顯的成長引擎,預計2025年至2030年的複合年成長率將達到32.1%。許多財富2000強企業選擇在雲端訓練大型模型,同時在本地運行推理,從而在規模和自主性之間取得平衡。

混合部署正在改變採購方向。醫院正在採用雲端爆發架構,將個人識別醫療資料保存在本地伺服器上,同時利用彈性運算能力進行模型訓練,從而在不影響價值實現時間的前提下遵守 HIPAA 法規。製造商也正在效仿這種模式,將邊緣節點用於對延遲敏感的視覺任務,同時將大量分析任務推送到區域雲區域。因此,合規性和預算確定性的雙重優先性,使得混合模式成為人工智慧即服務 (AIaaS) 市場格局的核心。

到2024年,機器學習平台將佔總收入的42%,而人工智慧基礎設施服務將以44.5%的複合年成長率加速成長。這項轉變使得運算最佳化型叢集和網路架構成為不斷擴展的人工智慧即服務(AIaaS)市場的核心,為骨幹工作負載提供支援。客製化晶片的普及也推動了這一趨勢:Google的TPU和亞馬遜的Trainium晶片在性價比方面實現了數倍提升,因此客戶更傾向於選擇提供此類晶片的供應商。

軟體層也將同步演進。託管分發包現在將最佳化的核心與編配工具結合,以促進多重雲端擴展。供應商正在整合自癒功能、自動修補程式和效能儀表板,以減少運維工作量。這些增強功能加強了底層基礎設施與開發人員生產力之間的聯繫,從而推動了人工智慧即服務市場這一細分領域的收入成長。

AI 即服務市場按部署模式(公共雲端、私有雲端、混合雲端)、服務類型(機器學習平台服務、認知服務(自然語言處理、電腦視覺、語音)、其他)、組織規模(中小企業、大型企業)、最終用戶業(銀行、金融服務和保險、零售/電子商務、製造業、其他)和地區進行細分。

區域分析

北美擁有龐大的超大規模資料中心和深厚的新興企業生態系統,預計2024年將佔全球營收的38%。雲端服務巨頭承諾在2025年新增超過2,500億美元的容量,但電網瓶頸日益凸顯,預計到2030年,美國資料中心的電力消耗將佔全國總電力供應的9%。此外,美國聯邦貿易委員會(FTC)對雲端運算和人工智慧協定的調查也可能重塑競爭格局。

亞太地區以27.9%的複合年成長率 (CAGR) 實現了最快成長。日本在人工智慧和晶片領域累計了650億美元,而Softbank Corporation投資了9.6億美元用於生成式人工智慧的基礎架構。中國的阿里巴巴向雲端模型服務投入了3800億元人民幣,位元組跳動的火山引擎處理了中國近一半的公共模型呼叫。一項企業調查發現,亞太地區54%的企業目前已製定了長期人工智慧支付目標,顯示人工智慧的應用已超越了試點階段。

在擬議的人工智慧監管框架下,歐洲正經歷穩定成長,在創新與嚴格監管之間尋求平衡。中東和非洲正積極推行自主的人工智慧策略:微軟向G42國家注資15億美元,而阿拉伯聯合大公國預計到2030年,該產業的市場規模將達到463.3億美元。沙烏地阿拉伯設立的1,000億美元人工智慧基金凸顯了該地區的雄心壯志,海灣合作理事會(GCC)成員國中75%的企業已部署生成式模型,高於全球平均。便利的能源供應和積極的政策框架使該地區成為連接歐洲、非洲和南亞的橋樑市場,非常適合部署人工智慧即服務(AIaaS)。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對預測性和規範性分析的需求日益成長

- 為中小企業降低整體擁有成本的訂閱式人工智慧工具

- 客製化AI加速器(TPU/Trainium)可降低推理成本

- 受監管產業的AIaaS套餐垂直化

- 內建於低程式碼平台中的生成式人工智慧 API

- 市場限制

- 雲端處理成本不斷上漲

- MLOps人才持續短缺

- 加強對模型來源的監管審查

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按部署模式

- 公有雲

- 私有雲端

- 混合雲

- 按服務類型

- 機器學習平台服務

- 認知服務(自然語言處理、電腦視覺、語音辨識)

- AI基礎設施服務(GPU/TPU)

- 託管式及專業人工智慧服務

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 零售與電子商務

- 醫療保健和生命科學

- 資訊科技/通訊

- 製造業

- 能源與公用事業

- 其他(媒體、農業、公共)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲、紐西蘭

- 東南亞

- 中東和非洲

- 中東

- 海灣合作理事會(沙烏地阿拉伯、阿拉伯聯合大公國、卡達)

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services(AWS)

- Microsoft Corporation

- Google LLC(Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp.(DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI

第7章 市場機會與未來展望

The Artificial Intelligence As A Service Market size is estimated at USD 20.64 billion in 2025, and is expected to reach USD 98.82 billion by 2030, at a CAGR of 36.78% during the forecast period (2025-2030).

Rapid migration from pilot projects to production workloads fuels this rise as enterprises embed generative-AI APIs in customer-facing and back-office systems. Subscription pricing lowers entry costs for small firms, while custom AI accelerators cut inference expenses by up to 80%, widening margins for providers. Government stimulus packages, such as Japan's USD 65 billion AI plan, add momentum, and hyperscale data-center build-outs keep compute capacity expanding despite near-term power constraints. Together, these forces push the Artificial Intelligence as a Service market toward broad, cross-industry penetration.

Global Artificial Intelligence As A Service Market Trends and Insights

Growing Demand for Predictive & Prescriptive Analytics

Enterprises now prize foresight over hindsight. Manufacturers using AI-driven analytics posted 61% revenue premiums, while supply-chain optimization shaved 15% off logistics costs. Healthcare systems gained 451% ROI over five years by automating radiology workflows. Banks boosted fraud-detection accuracy and see USD 170 billion additional profits by 2028 through AI forecasting. Real-time data ingestion plus agentic AI systems sustain this momentum, positioning predictive analytics as a core growth engine for the Artificial Intelligence as a Service market.

Subscription-Based AI Tools Lowering TCO for SMEs

Low-commitment pricing dismantles historic entry barriers. Global SME adoption of generative-AI tools reached 18%. In the United States, AI usage among firms with four workers rose from 4.6% to 5.8% in a single year. Retailers illustrate practical returns: Target deployed AI employee-assistance tools across 400 stores to raise productivity without large capital outlays. By turning AI from capex to opex, subscription platforms broaden the Artificial Intelligence as a Service market across micro-enterprise segments.

Escalating Cloud-Compute Cost Inflation

AI workloads strain infrastructure economics. Data centers may draw 9% of the United States' electricity by 2030. AI energy needs are set to top Bitcoin mining in 2025, reaching 23 GW. Forty-seven percent of Fortune 2000 firms now develop generative AI on-premises to tame runaway bills. Rising power prices plus tight chip supply lower near-term affordability and clip growth in the Artificial Intelligence as a Service market.

Other drivers and restraints analyzed in the detailed report include:

- Custom AI Accelerators Slashing Inference Cost

- Verticalised AIaaS Bundles for Regulated Sectors

- Persistent MLOps Talent Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud delivery retained 78% share in 2024, ensuring the Artificial Intelligence as a Service market remains anchored to hyperscale infrastructure. Hybrid cloud, however, is the clear growth engine, registering a 32.1% CAGR for 2025-2030 as boards demand tighter cost control and regulators press for data residency safeguards. Many Fortune 2000 firms now train large models in the cloud yet run inference on-premises, balancing scale with sovereignty.

Hybrid uptake redirects procurement. Hospitals adopt cloud-burst architectures to keep personally identifiable health data within local servers while exploiting elastic compute for model training, meeting HIPAA rules without losing time-to-value. Manufacturers mirror this pattern, reserving edge nodes for latency-sensitive vision tasks while pushing bulk analytics to regional cloud zones. The twin priorities of compliance and budget certainty thus keep hybrid models central to the Artificial Intelligence as a Service market outlook.

Machine-learning platforms supplied 42% of 2024 revenue, but AI infrastructure services are growing faster at 44.5% CAGR. This shift places compute-optimized clusters and networking fabrics at the heart of the Artificial Intelligence as a Service market size expansion for backbone workloads. Custom chip adoption underpins the trend: Google's TPUs and Amazon's Trainium deliver multi-fold price-performance gains, prompting clients to favor providers offering such silicon.

Software layers evolve in lockstep. Managed distribution bundles now pair optimized kernels with orchestration tooling to ease multi-cloud scaling. Vendors embed self-healing functions, automated patching, and performance dashboards to shrink operational toil. Together, these enhancements tighten the nexus between raw infrastructure and developer productivity, reinforcing the revenue trajectory in this segment of the Artificial Intelligence as a Service market.

The Artificial Intelligence As A Service Market is Segmented by Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Service Type (Machine-Learning Platform Services, Cognitive Services (NLP, CV, Speech) and More), Organisation Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, Manufacturing and More) and Geography

Geography Analysis

North America held 38% of global revenue in 2024, buoyed by an installed base of hyperscale data centers and a deep startup ecosystem. Cloud majors pledged more than USD 250 billion in fresh capacity during 2025, yet grid constraints loom as US data-center power draw may hit 9% of national supply by 2030. FTC probes into cloud-AI pacts could also recalibrate competitive boundaries.

Asia-Pacific charts the fastest ascent with a 27.9% CAGR. Japan earmarked USD 65 billion for AI and chips, and SoftBank invested USD 960 million in a generative-AI backbone. China's Alibaba allocated 380 billion yuan to cloud model services, while ByteDance's Volcano Engine processed nearly half of the country's public model calls. Corporate surveys show 54% of APAC firms now target long-term AI payouts, signalling depth beyond pilot activity.

Europe grows steadily, balancing innovation with strict oversight under draft AI regulations. The Middle East and Africa ride sovereign-AI strategies: the UAE expects USD 46.33 billion in sector value by 2030 as Microsoft injects USD 1.5 billion into G42. Saudi Arabia's USD 100 billion AI fund underscores regional ambition, and 75% of GCC enterprises deploy generative models, eclipsing global averages. Access to affordable energy and proactive policy frameworks position the region as a bridge market linking Europe, Africa, and South-Asia for Artificial Intelligence as a Service market rollouts.

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC (Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp. (DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study AssumptionsandMarket Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for predictiveandprescriptive analytics (mainstream)

- 4.2.2 Subscription-based AI tools lowering TCO for SMEs (mainstream)

- 4.2.3 Custom AI accelerators (TPU/Trainium) slashing inference cost (under-radar)

- 4.2.4 Verticalised AIaaS bundles for regulated sectors (under-radar)

- 4.2.5 Generative-AI APIs embedded in low-code platforms (mainstream)

- 4.3 Market Restraints

- 4.3.1 Escalating cloud-compute cost inflation (mainstream)

- 4.3.2 Persistent MLOps talent shortage (under-radar)

- 4.3.3 Heightened regulatory scrutiny on model provenance (mainstream)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Machine-Learning Platform Services

- 5.2.2 Cognitive Services (NLP, CV, Speech)

- 5.2.3 AI Infrastructure Services (GPU/TPU)

- 5.2.4 ManagedandProfessional AI Services

- 5.3 By Organisation Size

- 5.3.1 SmallandMedium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 RetailandE-commerce

- 5.4.3 HealthcareandLife Sciences

- 5.4.4 ITandTelecom

- 5.4.5 Manufacturing

- 5.4.6 EnergyandUtilities

- 5.4.7 Others (Media, Agriculture, Public)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 AustraliaandNew Zealand

- 5.5.4.6 South-East Asia

- 5.5.5 Middle EastandAfrica

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, ProductsandServices, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS)

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC (Google Cloud)

- 6.4.4 IBM Corporation

- 6.4.5 Oracle Corporation

- 6.4.6 Salesforce Inc.

- 6.4.7 SAS Institute Inc.

- 6.4.8 H2O.ai Inc.

- 6.4.9 DataRobot Inc.

- 6.4.10 Dataiku SAS

- 6.4.11 BigML Inc.

- 6.4.12 OpenAI LP

- 6.4.13 Anthropic PBC

- 6.4.14 C3.ai Inc.

- 6.4.15 NVIDIA Corp. (DGX Cloud)

- 6.4.16 Alibaba Cloud

- 6.4.17 Tencent Cloud

- 6.4.18 Baidu AI Cloud

- 6.4.19 Huawei Cloud

- 6.4.20 Craft AI

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-spaceandUnmet-need Assessment