|

市場調查報告書

商品編碼

1716470

替代蛋白質市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Alternative Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

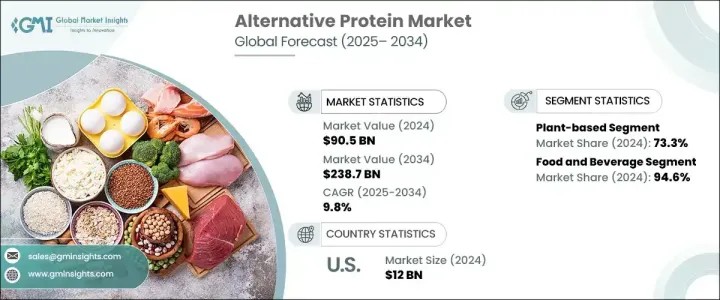

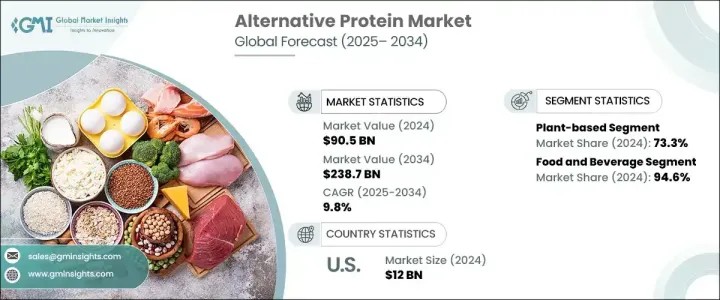

2024 年全球替代蛋白質市場規模達 905 億美元,預計 2025 年至 2034 年期間的複合年成長率為 9.8%。隨著人們尋求永續且營養的替代品,消費者對更健康、富含蛋白質的食品的偏好日益增加,推動了這一顯著成長。隨著人們對環境永續性、動物福利和個人健康意識的增強,消費者開始傾向於植物性、昆蟲性以及培養細胞蛋白質。這些替代品提供了符合不斷變化的消費者價值觀的環保解決方案。此外,國家支持更健康、更永續的食品系統政策進一步推動了向替代蛋白質的轉變,為市場擴張創造了有利的環境。

主要食品產業參與者正大力投資研發,推出滿足不同飲食偏好和生活方式選擇的創新蛋白質產品。食品科技公司和知名食品品牌之間日益成長的合作正在推動替代蛋白質的商業化,使其更容易獲得並吸引更廣泛的消費者群體。此外,食品加工技術的不斷進步正在改善替代蛋白質產品的口感、質地和營養成分,從而促進更高的採用率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 905億美元 |

| 預測值 | 2387億美元 |

| 複合年成長率 | 9.8% |

2024 年,植物蛋白佔據了市場主導地位,佔有 73.3% 的佔有率,這得益於其廣泛的可用性、成熟的供應鏈以及純素食和彈性素食消費者不斷成長的需求。隨著越來越多的人養成以植物為基礎的飲食習慣,製造商紛紛推出各種創新的純素蛋白產品來滿足日益成長的需求。雖然植物蛋白繼續佔據主導地位,但其他來源的蛋白,包括昆蟲蛋白、微生物蛋白和培養細胞蛋白,正在穩定成長。這些替代蛋白質類別仍然較小,但隨著技術進步改善其生產流程並降低成本,逐漸佔領市場佔有率。

食品和飲料領域在2024年貢獻了94.6%的市場佔有率,成為替代蛋白質產業中最大的應用領域。隨著消費者擴大尋求符合道德和永續的食品來源,製造商正在擴大其產品組合以包括各種替代蛋白質產品。這些蛋白質被融入各種各樣的產品中,包括肉類替代品、不含乳製品的飲料和植物性零食。此外,它們還可以滿足特殊飲食的營養需求,例如運動營養、醫療食品和飲食限制個人的產品。人們越來越重視永續性和道德採購,導致多個消費者群體擴大採用替代蛋白質,為產品多樣化創造了新的機會。

在政府舉措、技術創新和蓬勃發展的食品產業的推動下,美國替代蛋白質市場將在 2024 年創造 120 億美元的收入。隨著越來越多的美國消費者開始注重健康和環境永續的飲食,對替代蛋白質產品的需求持續成長。社群媒體、目標廣告以及對植物營養的認知不斷提高,正在影響消費者的購買決策,並幫助替代蛋白質在零售和食品服務領域獲得關注。植物性和培養蛋白質的日益普及正在鼓勵零售商擴大其產品範圍,確保消費者能夠輕鬆獲得各種永續的蛋白質選擇。因此,替代蛋白質正在成為美國家庭的主食,促進美國市場的快速成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 富含蛋白質的家禽飼料容易消化,不含抗營養因子(ANFS)

- 該地區牛肉出口的增加將促進產業成長

- 工業化畜牧業生產的成長將推動動物飼料蛋白質的需求

- 高蛋白健康產品的需求不斷成長

- 政府採取措施促進藻類產品生產,支持藻類蛋白質市場成長

- 食用昆蟲在食品中的應用日益廣泛,以支持昆蟲蛋白質市場的成長

- 提高對純素飲食的認知

- 產業陷阱與挑戰

- 食用昆蟲在食品工業的應用缺乏明確的監管,限制了以昆蟲為基礎的蛋白質的成長

- 與不同替代蛋白質(例如植物性蛋白質和昆蟲性蛋白質)相關的過敏

- 嚴格遵守飼料法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按來源,2021-2034 年

- 主要趨勢

- 植物性

- 大豆分離蛋白

- 大豆濃縮蛋白

- 發酵大豆蛋白

- 浮萍蛋白

- 其他

- 基於昆蟲

- 基於微生物

- 細菌

- 酵母菌

- 藻類

- 真菌

- 其他

- 其他

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 肉類似物

- 麵包店

- 乳製品替代品

- 穀物和零食

- 飲料

- 其他

- 動物飼料

- 家禽

- 肉雞

- 層

- 土耳其

- 豬

- 起動機

- 種植者

- 母豬

- 牛

- 乳製品

- 小牛

- 水產養殖

- 鮭魚

- 鱒魚

- 蝦

- 鯉魚

- 寵物食品

- 馬

- 其他

- 家禽

第7章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- AB Mauri

- AMCO Proteins

- Angel Yeast

- Archer Daniel Midland Company

- Axiom Foods

- Calysta Inc.

- Cargill Incorporation

- Darling Ingredients

- Hamlet Protein

- Ingredion

- Innovafeed

- Lallemand Inc

- Royal DSM NV

- Ynsect

The Global Alternative Protein Market generated USD 90.5 billion in 2024 and is projected to grow at a CAGR of 9.8% between 2025 and 2034. This remarkable growth is fueled by an increasing consumer preference for healthier, protein-rich foods as individuals seek sustainable and nutritious alternatives. As awareness around environmental sustainability, animal welfare, and personal health gains momentum, consumers are gravitating toward plant-based, insect-based, and cultured cell proteins. These alternatives offer eco-friendly solutions that align with evolving consumer values. In addition, national policies supporting healthier and more sustainable food systems are further propelling this shift toward alternative proteins, creating a favorable environment for market expansion.

Major food industry players are investing heavily in research and development to introduce innovative protein products catering to diverse dietary preferences and lifestyle choices. Growing collaborations between food tech companies and established food brands are driving the commercialization of alternative proteins, making them more accessible and appealing to a broader consumer base. Additionally, ongoing advancements in food processing technologies are improving the taste, texture, and nutritional profile of alternative protein products, encouraging higher adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.5 Billion |

| Forecast Value | $238.7 Billion |

| CAGR | 9.8% |

Plant-based proteins dominated the market in 2024, holding a 73.3% share due to their wide availability, established supply chains, and rising demand among vegan and flexitarian consumers. As more people embrace plant-based eating habits, manufacturers are responding by introducing a diverse range of innovative vegan protein products to meet this growing demand. While plant-based proteins continue to lead the segment, other sources, including insect-based, microbial-based, and cultured cell proteins, are steadily gaining momentum. These alternative protein categories remain smaller but are gradually capturing market share as technological advancements improve their production processes and reduce costs.

The food and beverage segment contributed 94.6% of the market share in 2024, making it the largest application segment within the alternative protein industry. As consumers increasingly seek ethical and sustainable food sources, manufacturers are expanding their portfolios to include various alternative protein products. These proteins are being integrated into a wide range of offerings, including meat substitutes, dairy-free beverages, and plant-based snacks. Additionally, they are being tailored to meet the nutritional needs of specialty diets, such as sports nutrition, medical foods, and products for individuals with dietary restrictions. The growing emphasis on sustainability and ethical sourcing has led to increased adoption of alternative proteins across multiple consumer segments, creating new opportunities for product diversification.

The U.S. alternative protein market generated USD 12 billion in 2024, driven by government initiatives, technological innovations, and a robust food industry. As more consumers in the U.S. embrace health-conscious and environmentally sustainable diets, the demand for alternative protein products continues to grow. Social media, targeted advertising, and heightened awareness around plant-based nutrition are influencing consumer purchasing decisions and helping alternative proteins gain traction in the retail and food service sectors. The increasing popularity of plant-based and cultured protein options is encouraging retailers to expand their offerings, ensuring that consumers have easy access to a variety of sustainable protein choices. As a result, alternative proteins are becoming a staple in American households, contributing to the rapid growth of the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Protein rich diets for poultry are highly digestible and devoid of containing less anti-nutritional factors (ANFS)

- 3.6.1.2 Rising beef exports from the region will foster industry growth

- 3.6.1.3 Growing industrial livestock production will drive animal feed protein demand

- 3.6.1.4 Rising demand for healthy products with high protein content

- 3.6.1.5 Government initiatives to boost algae products production, supporting the algae-based protein market growth

- 3.6.1.6 Rising adoption of edible insects in food application to support the insect-based protein market growth

- 3.6.1.7 Increasing awareness towards vegan diet

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Edible insects have a lack of regulatory clarity in the food industry applications restricting the insect-based protein growth

- 3.6.2.2 Allergies associated with different alternative proteins such as plant-based and insect-based

- 3.6.2.3 Stringent feed regulatory compliances

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021–2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based

- 5.2.1 Soy protein isolates

- 5.2.2 Soy protein concentrates

- 5.2.3 Fermented soy protein

- 5.2.4 Duckweed protein

- 5.2.5 Others

- 5.3 Insect-based

- 5.4 Microbial-based

- 5.4.1 Bacteria

- 5.4.2 Yeast

- 5.4.3 Algae

- 5.4.4 Fungi

- 5.4.5 Others

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.2.1 Meat analogs

- 6.2.2 Bakery

- 6.2.3 Dairy alternatives

- 6.2.4 Cereals & snacks

- 6.2.5 Beverages

- 6.2.6 Others

- 6.3 Animal feed

- 6.3.1 Poultry

- 6.3.1.1 Broiler

- 6.3.1.2 Layer

- 6.3.1.3 Turkey

- 6.3.2 Swine

- 6.3.2.1 Starter

- 6.3.2.2 Grower

- 6.3.2.3 Sow

- 6.3.3 Cattle

- 6.3.3.1 Dairy

- 6.3.3.2 Calf

- 6.3.4 Aquaculture

- 6.3.4.1 Salmon

- 6.3.4.2 Trout

- 6.3.4.3 Shrimps

- 6.3.4.4 Carp

- 6.3.5 Pet food

- 6.3.6 Equine

- 6.3.7 Others

- 6.3.1 Poultry

Chapter 7 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AB Mauri

- 8.2 AMCO Proteins

- 8.3 Angel Yeast

- 8.4 Archer Daniel Midland Company

- 8.5 Axiom Foods

- 8.6 Calysta Inc.

- 8.7 Cargill Incorporation

- 8.8 Darling Ingredients

- 8.9 Hamlet Protein

- 8.10 Ingredion

- 8.11 Innovafeed

- 8.12 Lallemand Inc

- 8.13 Royal DSM NV

- 8.14 Ynsect