|

市場調查報告書

商品編碼

1699342

寬頻隙半導體市場機會、成長動力、產業趨勢分析及2025-2034年預測Wide Bandgap Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

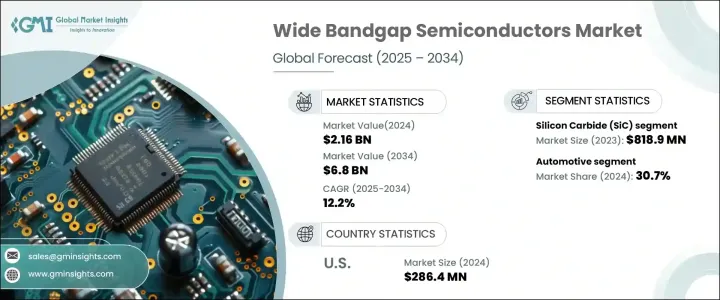

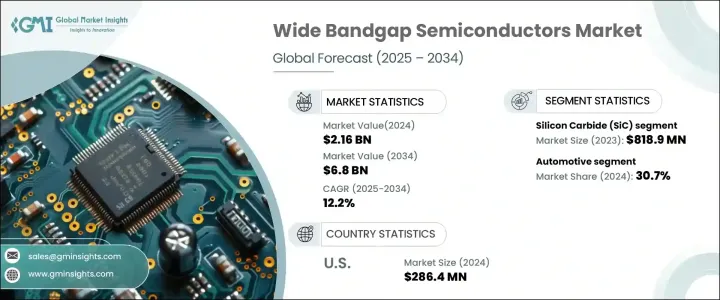

2024 年全球寬頻隙半導體市場價值為 21.6 億美元,預計 2025 年至 2034 年的複合年成長率為 12.2%。這項顯著擴張是由各行各業對電力電子技術的日益普及以及全球向電動車的轉變所推動的。隨著各行各業對能源效率高效能解決方案的需求,對以在高電壓和高溫下運作的卓越能力而聞名的寬頻隙半導體的需求將激增。

再生能源系統的普及、汽車行業電氣化的不斷成長以及半導體技術的不斷進步是推動市場成長的關鍵因素。政府推動清潔能源的舉措、嚴格的效率法規以及 5G 基礎設施的加速推出也推動了對這些高功率半導體的需求。技術創新不斷擴大寬頻隙半導體的應用範圍,使其成為高耗電產業不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21.6億美元 |

| 預測值 | 68億美元 |

| 複合年成長率 | 12.2% |

市場主要按材料類型細分,其中碳化矽(SiC)和氮化鎵(GaN)佔據行業領先地位。碳化矽因其高熱導率、高擊穿電壓和寬頻隙特性等優異特性,在 2023 年創造了 8.189 億美元的銷售額。與傳統矽相比,SiC 具有更高的效率,可承受更高的溫度和電壓水平,因此成為電動車和再生能源應用中電力電子的首選。隨著製造商努力開發高性能半導體解決方案,SiC 繼續主導高功率和高頻應用。另一種重要材料 GaN 因其快速切換能力和能源效率而越來越受到關注,尤其是在射頻和微波應用方面。

市場根據最終用途產業進一步細分,包括汽車、電信、消費性電子、能源、航太和國防。受電動車廣泛普及的推動,汽車產業到 2024 年將佔據 30.7% 的市場。基於 SiC 和 GaN 的電力電子技術提高了電動車的能源效率,減少了功率損耗並實現了更快的開關速度。隨著汽車製造商擴大將寬頻隙半導體整合到車輛系統中,這些組件在實現能源效率目標和延長電池壽命方面發揮關鍵作用。先進駕駛輔助系統(ADAS) 和快速充電基礎設施的需求不斷成長,進一步加速了汽車產業對這些高功率半導體的應用。

2024 年美國寬頻隙半導體市場價值為 2.864 億美元,隨著美國在半導體製造業地位的加強,預計該市場將經歷強勁成長。對能源節約的關注,加上半導體製造技術的不斷進步,使美國成為全球市場的重要參與者。在政府支持國內半導體生產的激勵措施和不斷增加的研發投資下,美國製造商獲得了競爭優勢。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對節能解決方案的需求不斷增加

- 電動車市場的擴張

- 部署5G和先進通訊

- 政府支持和投資舉措

- 工業自動化和電氣化日益興起

- 產業陷阱與挑戰

- 生產成本高、製造複雜

- 供應鏈限制和材料可用性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 碳化矽(SiC)

- 氮化鎵(GaN)

- 氮化鋁(AlN)

- 鑽石

- 其他

第6章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 汽車

- 消費性電子產品

- 電信

- 能源與公用事業

- 航太與國防

- 其他

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- CISSOID

- Diodes Incorporated

- Fuji Electric Co., Ltd.

- Navitas Semiconductor

- Infineon Technologies AG

- Littelfuse, Inc.

- Microsemi Corporation.

- Mitsubishi Electric Corporation

- Nexperia

- Renesas Electronics Corporation

- ROHM Semiconductor

- SEMIKRON

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Electronic Devices & Storage Corporation

- Vishay Intertechnology Inc.

- Wolfspeed, Inc.

The Global Wide Bandgap Semiconductors Market was valued at USD 2.16 billion in 2024 and is projected to grow at a CAGR of 12.2% from 2025 to 2034. This remarkable expansion is fueled by the rising adoption of power electronics across industries and the global transition toward electric vehicles. As industries demand high-performance solutions for energy efficiency, the need for wide bandgap semiconductors, known for their superior ability to operate at high voltages and temperatures, is set to surge.

The proliferation of renewable energy systems, growing electrification in the automotive sector, and increasing advancements in semiconductor technologies are key factors propelling market growth. Government initiatives promoting clean energy, stringent efficiency regulations, and the accelerating rollout of 5G infrastructure are also driving demand for these high-power semiconductors. Technological innovations continue to expand the application scope of wide bandgap semiconductors, making them indispensable for power-hungry industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.16 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 12.2% |

The market is primarily segmented by material type, with Silicon Carbide (SiC) and Gallium Nitride (GaN) leading the industry. SiC generated USD 818.9 million in 2023, owing to its exceptional characteristics such as high thermal conductivity, high breakdown voltage, and wide bandgap properties. Compared to traditional silicon, SiC delivers superior efficiency, withstanding higher temperatures and voltage levels, making it a preferred choice for power electronics in electric vehicles and renewable energy applications. As manufacturers strive to develop high-performance semiconductor solutions, SiC continues to dominate high-power and high-frequency applications. GaN, another prominent material, is gaining traction due to its rapid switching capabilities and energy efficiency, particularly in RF and microwave applications.

The market is further segmented based on end-use industries, including automotive, telecommunications, consumer electronics, energy, aerospace, and defense. The automotive sector accounted for a 30.7% market share in 2024, driven by the widespread adoption of electric vehicles. SiC and GaN-based power electronics enhance energy efficiency in EVs, reducing power losses and enabling faster switching speeds. As automakers increasingly integrate wide bandgap semiconductors into vehicle systems, these components play a pivotal role in meeting energy efficiency goals and achieving longer battery life. The rising demand for advanced driver assistance systems (ADAS) and fast-charging infrastructure further accelerates the adoption of these high-power semiconductors in the automotive industry.

The U.S. wide bandgap semiconductors market was valued at USD 286.4 million in 2024 and is expected to experience robust growth as the country strengthens its position in semiconductor manufacturing. The focus on energy conservation, coupled with ongoing advancements in semiconductor fabrication, positions the U.S. as a key player in the global market. With government-backed incentives for domestic semiconductor production and increasing investments in research and development, U.S. manufacturers gain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for energy-efficient solutions

- 3.6.1.2 Expansion of electric vehicle market

- 3.6.1.3 Deployment of 5G and advanced communications

- 3.6.1.4 Government support and investment initiatives

- 3.6.1.5 Rising industrial automation and electrification

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs and complex manufacturing

- 3.6.2.2 Supply chain constraints and material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Silicon Carbide (SiC)

- 5.3 Gallium Nitride (GaN)

- 5.4 Aluminum Nitride (AlN)

- 5.5 Diamond

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Consumer electronics

- 6.4 Telecommunications

- 6.5 Energy & utility

- 6.6 Aerospace & defense

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 CISSOID

- 8.2 Diodes Incorporated

- 8.3 Fuji Electric Co., Ltd.

- 8.4 Navitas Semiconductor

- 8.5 Infineon Technologies AG

- 8.6 Littelfuse, Inc.

- 8.7 Microsemi Corporation.

- 8.8 Mitsubishi Electric Corporation

- 8.9 Nexperia

- 8.10 Renesas Electronics Corporation

- 8.11 ROHM Semiconductor

- 8.12 SEMIKRON

- 8.13 STMicroelectronics N.V.

- 8.14 Texas Instruments Inc.

- 8.15 Toshiba Electronic Devices & Storage Corporation

- 8.16 Vishay Intertechnology Inc.

- 8.17 Wolfspeed, Inc.