|

市場調查報告書

商品編碼

1684594

自行車電子傳動系統市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Bicycle Electronic Drivetrain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

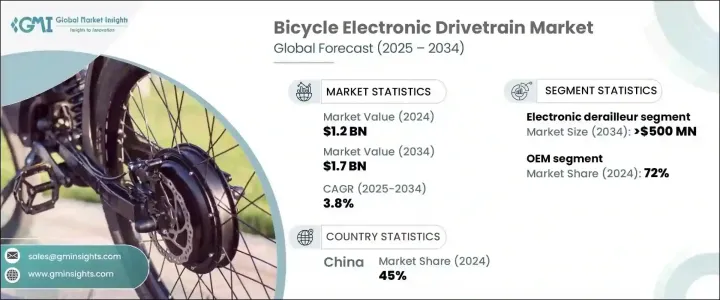

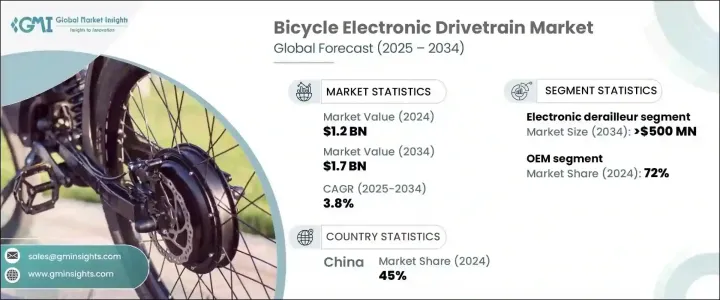

2024 年全球自行車電子傳動系統市場價值為 12 億美元,預計 2025 年至 2034 年期間將以 3.8% 的複合年成長率穩步成長。電動自行車很大程度上依賴先進的電子傳動系統,提供平穩而高效的動力傳輸,為騎乘者提供一種環保、便捷的交通方式,尤其是在城市環境中。隨著越來越多的消費者選擇永續的出行方式,在擁擠的城市中尋求比傳統車輛更環保的替代品,這種日益成長的需求正在重塑自行車行業。此外,電動自行車不僅在日常通勤中越來越受歡迎,而且成為解決日益嚴重的城市堵塞和環境影響問題的一種方法。

隨著自行車運動在全球範圍內持續受到關注,高性能自行車越來越受歡迎,進一步推動了自行車電子傳動系統市場的成長。運動員和自行車愛好者現在期望他們的齒輪系統具有更高的精度和可靠性。電子傳動系統旨在實現完美的換檔,使其成為需要最佳性能的競技自行車手的理想選擇。自動換檔、無線連接和可調節設定等功能增強了騎乘體驗,無論是在訓練期間還是在競賽中。這些進步將騎自行車從休閒活動轉變為高科技運動,滿足了專業運動員和休閒騎乘者的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 17億美元 |

| 複合年成長率 | 3.8% |

市場分為關鍵零件,包括電子變速箱、電子變速器、電池系統和控制單元。到 2034 年,僅電子變速箱領域預計將創造 5 億美元的產值,到 2024 年佔據 35% 以上的市場佔有率。隨著消費者不斷優先考慮環保的交通選擇,配備先進電子傳動系統(如電子變速箱)的自行車正在提供有吸引力的解決方案。這些組件使電動自行車和自行車作為永續出行方式的吸引力日益增強。

市場也按分銷管道細分,即OEM (原始設備製造商)和售後市場。 2024年, OEM領域佔72%的市佔率。OEM)需求的激增是由競技自行車手和愛好者推動的,他們擴大選擇配備尖端傳動系統的高性能自行車。對自行車運動的精確性、耐用性和速度的需求推動了電子傳動系統組件的成長。電子變速箱對於實現卓越的換檔精度至關重要,可確保騎乘者獲得最佳的騎乘體驗。

從地理位置來看,中國佔據自行車電子傳動系統市場的主導地位,到 2024 年將佔有 45% 的市場佔有率。隨著城市的發展和交通堵塞的加劇,對高效、環保的交通解決方案的需求也日益增加。配備先進電子傳動系統的電動自行車完全滿足這一新興需求,為在擁擠的街道上行駛提供了一種快速、便捷的方式。隨著城市中心的擴大和自行車基礎設施的改善,對高科技電動自行車的需求預計將推動該地區市場的持續成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 最終客戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 親子市場分析

- 衝擊力

- 成長動力

- 對高性能自行車的需求不斷增加

- 動力傳動系統的技術進步

- 電動自行車和電動自行車的成長

- 更好的使用者體驗與換檔精度

- 產業陷阱與挑戰

- 電子傳動系統的初始成本高

- 維護和電池壽命問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 電子換檔器

- 電子變速器

- 電池系統

- 控制單元

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公路自行車

- 登山車

- 賽車

- 礫石自行車

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 職業自行車手

- 業餘自行車手

- 通勤

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Bafang

- Bosch

- Campagnolo

- Cervelo

- Factor Bikes

- Fazua GmbH

- Focus Bikes

- FSA

- Giant

- Look Cycle

- MAGURA

- Ridley Bikes

- Rotor Bike Components

- Scott Sports

- Shimano

- Specialized Bicycle

- SRAM

- TranzX

- Valeo

- Wilier Triestina

The Global Bicycle Electronic Drivetrain Market, valued at USD 1.2 billion in 2024, is projected to expand at a steady CAGR of 3.8% from 2025 to 2034. A major driving force behind market expansion is the increasing adoption of e-bikes. E-bikes, which rely heavily on advanced electronic drivetrains, offer a smooth and efficient power transfer, providing riders with an eco-friendly, convenient mode of transportation-especially in urban environments. This growing demand is reshaping the bicycle industry as more consumers embrace sustainable travel options, seeking greener alternatives to traditional vehicles in congested cities. Additionally, e-bikes are gaining popularity not only for everyday commuting but also as a solution to the rising concerns of urban congestion and environmental impact.

As cycling sports continue to gain traction globally, high-performance bicycles are becoming more sought after, further fueling the growth of the bicycle electronic drivetrain market. Athletes and cycling enthusiasts now expect a higher level of precision and reliability from their gear systems. Electronic drivetrains are designed to deliver flawless gear shifting, making them ideal for competitive cyclists who require peak performance. Features such as automatic gear shifting, wireless connectivity, and adjustable settings are enhancing the cycling experience, both during training and in competitive races. These advancements are transforming cycling from a recreational activity into a high-tech sport, catering to the needs of professional athletes and casual riders alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $1.7 Billion |

| CAGR | 3.8% |

The market is divided into key components, including electronic shifters, electronic derailleurs, battery systems, and control units. By 2034, the electronic derailleur segment alone is expected to generate USD 500 million, holding more than 35% of the market share in 2024. This rise in demand is closely tied to the increasing focus on sustainability within the cycling sector. As consumers continue to prioritize environmentally friendly transportation options, bicycles with advanced electronic drivetrains, such as electronic derailleurs, are offering an attractive solution. These components contribute to the growing appeal of e-bikes and bicycles as a sustainable mode of travel.

The market is also segmented by distribution channels, namely OEM (Original Equipment Manufacturer) and aftermarket. In 2024, the OEM segment accounted for 72% of the market share. This surge in OEM demand is driven by competitive cyclists and enthusiasts who are increasingly opting for high-performance bicycles equipped with cutting-edge drivetrain systems. The demand for precision, durability, and speed in cycling is fueling the growth of electronic drivetrain components. Electronic derailleurs, in particular, have become essential for achieving superior shifting accuracy, ensuring riders get the most out of their cycling experience.

Geographically, China dominates the bicycle electronic drivetrain market, holding a 45% market share in 2024. The rapid urbanization of the Asia-Pacific region is a major factor driving this trend. As cities grow and traffic congestion intensifies, there is a rising demand for efficient and eco-friendly transportation solutions. E-bikes equipped with advanced electronic drivetrains are the perfect fit for this emerging need, offering a fast, convenient way to navigate crowded streets. With expanding urban centers and better cycling infrastructure, the demand for high-tech e-bikes is expected to fuel continued market growth in this region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Parent and child market analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for high-performance bicycles

- 3.9.1.2 Technological advancements in drivetrain systems

- 3.9.1.3 Growth of e-bikes and electric bicycles

- 3.9.1.4 Better user experience and precision in shifting

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of electronic drivetrains

- 3.9.2.2 Maintenance and battery life concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 electronic shifter

- 5.3 electronic derailleur

- 5.4 battery system

- 5.5 control unit

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bike

- 6.3 Mountain bike

- 6.4 Racing bike

- 6.5 Gravel bike

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Professional cyclist

- 7.3 Amateur cyclist

- 7.4 Commuter

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Nordics

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bafang

- 10.2 Bosch

- 10.3 Campagnolo

- 10.4 Cervelo

- 10.5 Factor Bikes

- 10.6 Fazua GmbH

- 10.7 Focus Bikes

- 10.8 FSA

- 10.9 Giant

- 10.10 Look Cycle

- 10.11 MAGURA

- 10.12 Ridley Bikes

- 10.13 Rotor Bike Components

- 10.14 Scott Sports

- 10.15 Shimano

- 10.16 Specialized Bicycle

- 10.17 SRAM

- 10.18 TranzX

- 10.19 Valeo

- 10.20 Wilier Triestina