|

市場調查報告書

商品編碼

1750305

電動雪地摩托車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Snowmobile Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

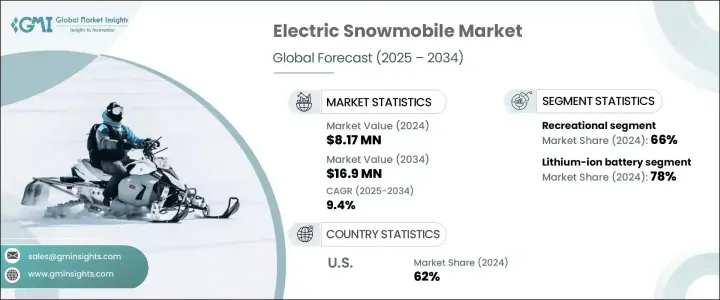

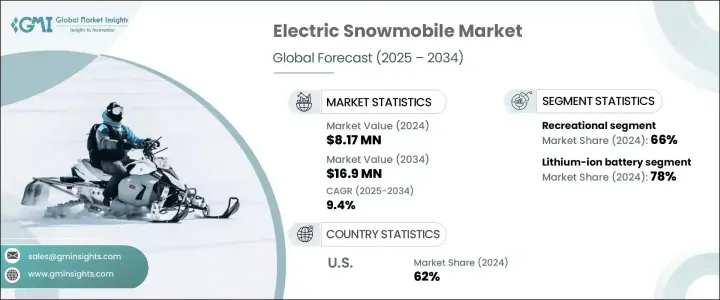

2024年,全球電動雪地摩托車市場規模達817萬美元,預計到2034年將以9.4%的複合年成長率成長,達到1,690萬美元,這主要得益於休閒車產業的永續發展和消費者的購買決策。隨著環保意識的不斷增強,消費者選擇更乾淨、更安靜、零排放的雪地摩托車,取代傳統的化石燃料雪地摩托車。隨著自然保護區和步道對噪音和排放的限制日益嚴格,電動雪地摩托車正成為極具吸引力的解決方案。這些車輛既環保,又能提供更平穩、更平和的駕駛體驗,對個人消費者和商業業者都極具吸引力。

旅遊和戶外休閒產業正大幅轉向永續交通,這推動了雪量豐富的目的地對電動雪地摩托車的需求。隨著電池技術日益可靠,寒冷天氣下性能的提升,度假村和導遊服務機構正積極擁抱電動雪地摩托車,以滿足注重環保的旅客的需求。政府透過清潔能源激勵措施和在偏遠地區擴大電動車基礎設施建設等方式提供支持,加速了市場對電動雪地摩托車的接受度。與傳統車型相比,電動雪地摩托車的維護需求較低,營運效率更高,也促進了電動轉型,使其成為冬季休閒活動的未來選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 817萬美元 |

| 預測值 | 1690萬美元 |

| 複合年成長率 | 9.4% |

2024年,鋰離子電池市場佔78%的市場佔有率,預計2025-2034年期間的複合年成長率將達到9.5%。這類電池具有許多優勢,例如更高的能源效率、更輕的重量以及在嚴寒環境下可靠運作的能力。此外,它們還能提供更快的充電時間和更長的續航里程,這對於在雪地環境下的戶外行駛至關重要。隨著技術的進步,電池壽命和熱穩定性的提高也進一步推動了鋰離子動力汽車的普及。

從應用角度來看,休閒娛樂用途在2024年佔據了66%的市場佔有率,預計將以9.7%的複合年成長率持續成長。電動雪地摩托車的吸引力在於安靜的運作和零排放,使其成為尋求自然友善戶外活動人士的理想之選。租賃業者和休閒度假村擴大將這些機器添加到他們的車隊中,以吸引具有環保意識的客戶,而基礎設施升級和激勵計劃則有助於擴大電動雪地摩托車的普及範圍。

2024年,美國電動雪地摩托車市場規模達245萬美元,約佔62%的市佔率。受環保意識增強的推動,氣候較冷的州走在電動雪地摩托車普及的前列,而各州的激勵措施也減少了休閒車輛的碳排放。隨著永續性成為戶外運動愛好者關注的關鍵因素,電動雪地摩托車正日益成為比燃氣雪地摩托車更乾淨、更安靜的替代品。

Taiga Motors、Arctic Cat、BRP Inc.、Yamaha Motor、MoonBikes、eSled、Polaris、Vidde Snow Mobility、Snowbike 和 Alpina Snowmobiles 等公司正在投資研發,以提升電池效能和雪地摩托車的續航力。與旅遊公司和戶外裝備經銷商建立的策略夥伴關係,正在幫助這些品牌觸及新的消費群體。許多企業進入租賃市場,以提高知名度和測試採用率。產品多元化、經銷商擴張和智慧連網功能是他們為增強品牌影響力和滿足不斷變化的客戶需求所採取的額外策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 電動雪地摩托車原始設備製造商

- 分銷及零售網路

- 最終用途

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 增強環保意識和永續關注

- 生態旅遊與永續休閒趨勢日益興起

- 電池和馬達系統的技術進步

- 政府激勵和補貼

- 對安靜、低影響休閒活動的需求日益成長

- 產業陷阱與挑戰

- 前期成本高

- 續航里程有限且電池技術有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 鋰離子電池

- 鉛酸電池

- 固態電池

- 其他

第6章:市場估計與預測:依範圍,2021 - 2034 年

- 主要趨勢

- 最遠 50 英里

- 51–100英里

- 100英里以上

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 休閒娛樂

- 旅遊

- 公用事業

- 賽車/體育

第8章:市場估計與預測:依座位容量,2021 年至 2034 年

- 主要趨勢

- 單座賽車

- 雙座

- 多座位

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM (直銷)

- 售後市場/經銷商

- 網上銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Alpina Snowmobiles

- Arctic Cat

- BRP Inc

- eSled

- MoonBikes

- Polaris

- Snowbike

- SnowMoto

- Taiga Motors

- Vidde Snow Mobility

- Yamaha Motor

The Global Electric Snowmobile Market was valued at USD 8.17 million in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 16.9 million by 2034, driven by the sustainability and purchasing decisions in the recreational vehicle sector. Growing awareness around environmental issues encourages consumers to opt for cleaner, quieter, and emission-free alternatives to conventional fossil-fueled snowmobiles. With increasing restrictions on noise and emissions in natural reserves and trails, electric variants are emerging as a compelling solution. These vehicles offer both environmental benefits and a smoother, more peaceful riding experience, making them attractive to individual consumers and commercial operators.

Tourism and outdoor recreation industries are showing a notable shift toward sustainable transport, boosting demand for electric snowmobiles across snow-rich destinations. As battery technology becomes more reliable and cold-weather performance improves, resorts and guided tour operators are embracing electric snowmobiles to meet the preferences of eco-conscious travelers. Government support through clean energy incentives and expanding electric vehicle infrastructure in remote areas accelerates market adoption. The transition to electric is also aided by low maintenance needs and improved operational efficiency compared to traditional models, positioning electric snowmobiles as a future-forward choice for winter recreation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.17 Million |

| Forecast Value | $16.9 Million |

| CAGR | 9.4% |

The lithium-ion battery segment held a 78% share in 2024 and is projected to grow at a CAGR of 9.5% during 2025-2034. These batteries offer advantages such as better energy efficiency, lighter weight, and the ability to function reliably in frigid temperatures. They also provide faster charging times and longer operational ranges, critical for outdoor performance in snowy terrains. As technology advances, improvements in battery longevity and thermal stability are further encouraging the shift toward lithium-ion-powered vehicles.

Based on application, recreational use commanded a 66% share in 2024 and is expected to continue expanding at a CAGR of 9.7%. The appeal lies in quiet operation and zero emissions, making electric snowmobiles ideal for individuals seeking nature-friendly outdoor activities. Rental operators and leisure resorts are increasingly adding these machines to their fleets to appeal to environmentally aware customers, while infrastructure upgrades and incentive programs support broader accessibility.

United States Electric Snowmobile Market generated USD 2.45 million in 2024, capturing approximately 62% share. States with colder climates are at the forefront of adoption, driven by growing environmental consciousness, and state-level incentives reduce carbon emissions from recreational vehicles. As sustainability becomes a key consideration among outdoor enthusiasts, electric snowmobiles are increasingly cleaner, quieter alternatives to their gas-powered counterparts.

Companies like Taiga Motors, Arctic Cat, BRP Inc., Yamaha Motor, MoonBikes, eSled, Polaris, Vidde Snow Mobility, Snowbike, and Alpina Snowmobiles are investing in R&D to enhance battery performance and snowmobile range. Strategic partnerships with tourism firms and outdoor equipment distributors are helping these brands reach new consumer segments. Many players enter the rental and leasing markets to increase visibility and test adoption. Product diversification, dealer expansion, and smart connectivity features are additional tactics being deployed to strengthen brand presence and capture evolving customer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Electric snowmobile OEMs

- 3.2.4 Distribution and retail networks

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing environmental awareness and sustainability concerns

- 3.11.1.2 Rising eco-tourism and sustainable recreation trends

- 3.11.1.3 Technological advancements in battery and motor systems

- 3.11.1.4 Government incentives and subsidies

- 3.11.1.5 Growing demand for quiet and low-impact recreation

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High upfront cost

- 3.11.2.2 Limited range and battery technology limitations

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid battery

- 5.4 Solid-state battery

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Up to 50 miles

- 6.3 51–100 miles

- 6.4 Above 100 miles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Recreational

- 7.3 Tourism

- 7.4 Utility

- 7.5 Racing/Sports

Chapter 8 Market Estimates & Forecast, By Seating Capacity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Single-seater

- 8.3 Two-seater

- 8.4 Multi-seater

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM (Direct Sales)

- 9.3 Aftermarket/dealers

- 9.4 Online sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alpina Snowmobiles

- 11.2 Arctic Cat

- 11.3 BRP Inc

- 11.4 eSled

- 11.5 MoonBikes

- 11.6 Polaris

- 11.7 Snowbike

- 11.8 SnowMoto

- 11.9 Taiga Motors

- 11.10 Vidde Snow Mobility

- 11.11 Yamaha Motor