|

市場調查報告書

商品編碼

1667050

牛奶蛋白水解物市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Milk Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

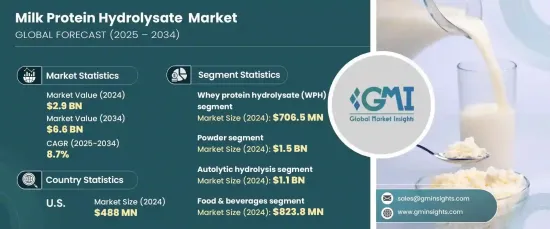

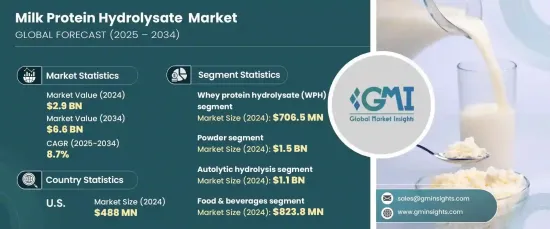

2024 年全球牛奶蛋白水解物市場價值為 29 億美元,預計在 2025 年至 2034 年期間將以 8.7% 的強勁複合年成長率成長。將它們納入低過敏性配方和功能性食品中,凸顯了它們在促進肌肉恢復、增強免疫系統和支持整體健康方面的作用。

這一成長的推動因素包括健康意識的增強、高蛋白飲食需求的增加以及專業營養產品市場的不斷擴大。酶水解技術的進步和從牛奶蛋白中提取的生物活性肽的研究進一步加速了市場的發展,特別是在運動營養和嬰兒配方奶粉領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 8.7% |

市場對無過敏原且易於消化的蛋白質來源的需求巨大,重點是嬰兒和運動營養。隨著消費者的健康意識不斷增強,他們開始轉向那些能夠提供超越基本營養價值的功能性食品。水解過程的創新正在改進生物活性胜肽的生產,使其能夠融入小眾飲食應用中。

人口老化和慢性病發病率上升推動了對醫療營養解決方案的需求不斷成長,這也推動了市場的發展。這些因素加上產品開發的進步,預計將維持市場的上升趨勢。

乳清蛋白水解物 (WPH) 佔據市場主導地位,2024 年價值為 7.065 億美元,預計到 2034 年複合年成長率為 8.9%。它的低過敏性和低乳糖含量使其成為嬰兒配方奶粉和醫療營養的理想選擇。

奶粉蛋白水解物因其便利性、保存期限長和成本效益而引領市場,到 2024 年價值將達到 15 億美元。粉末形式因其與一系列產品相容而受到青睞,包括運動補充劑、嬰兒配方奶粉和功能性食品。

在美國,牛奶蛋白水解物市場規模在 2024 年達到 4.88 億美元,預計到 2034 年的複合年成長率為 8%。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 嬰兒營養產品需求不斷成長

- 健康意識增強和高蛋白飲食

- 水解技術進展

- 產業陷阱與挑戰

- 生產成本高

- 標籤和健康聲明的監管挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021-2034 年

- 主要趨勢

- 乳清蛋白水解物(WPH)

- 酪蛋白水解物 (CPH)

- 總乳蛋白水解物

- 乳鐵蛋白水解物

- 免疫球蛋白水解物

- α-乳清蛋白水解物

- BETA-乳球蛋白水解物

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 貼上

第 7 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 酸水解

- 酵素水解

- 微生物發酵

- 自溶水解

- 超音波水解

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 嬰兒營養

- 運動營養

- 烘焙及食品配料

- 飲料

- 其他

- 動物飼料

- 家禽

- 肉雞

- 圖層

- 豬

- 牛

- 水產養殖

- 鮭魚

- 鱒魚

- 蝦

- 其他

- 馬

- 寵物

- 家禽

- 製藥

- 藥物製劑

- 臨床營養

- 其他

- 化妝品和個人護理

- 保養

- 護髮

- 其他

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Arla Foods Ingredients Group

- AMCO Proteins

- A. Costantino & C.

- Armor Proteines

- Agropur Cooperative

- Ba'emek Advanced Technologies

- FrieslandCampina DMV

- Glanbia Nutritionals

- Hilmar Ingredients

- Havero Hoogwegt

- Kerry Ingredients

- Lactalis Group

- Milk Specialties Global

- Tatua Co-operative Dairy Company

The Global Milk Protein Hydrolysate Market, valued at USD 2.9 billion in 2024, is poised to grow at a robust CAGR of 8.7% from 2025 to 2034. These hydrolysates are becoming increasingly popular in applications such as infant nutrition, sports supplements, and medical nutrition due to their enhanced digestibility and superior bioavailability. Their inclusion in hypoallergenic formulas and functional foods highlights their role in promoting muscle recovery, strengthening the immune system, and supporting overall wellness.

This growth is driven by rising health awareness, increasing demand for high-protein diets, and the expanding market for specialized nutrition products. Advances in enzymatic hydrolysis techniques and research into bioactive peptides derived from milk proteins are further accelerating market development, particularly in sports nutrition and infant formulas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 8.7% |

The market is witnessing substantial demand for allergen-free and easily digestible protein sources, with a strong focus on infant and sports nutrition. As consumers become more health-conscious, there is a shift toward functional foods that offer benefits beyond basic nutrition. Innovations in hydrolysis processes are refining the production of bioactive peptides, enabling their integration into niche dietary applications.

The growing need for medical nutrition solutions, driven by an aging population and the increasing prevalence of chronic diseases, is also boosting the market. These factors, combined with advancements in product development, are expected to sustain the market's upward trajectory.

The whey protein hydrolysate (WPH) segment dominates the market, valued at USD 706.5 million in 2024, with a projected CAGR of 8.9% through 2034. Known for its rapid absorption, high digestibility, and rich amino acid profile, WPH is widely used in sports nutrition to enhance muscle recovery and performance. Its hypoallergenic properties and low lactose content make it an ideal choice for infant formulas and medical nutrition.

Powdered milk protein hydrolysates, valued at USD 1.5 billion in 2024, lead the market due to their convenience, long shelf life, and cost-effectiveness. The powder format is favored for its compatibility with a range of products, including sports supplements, infant formulas, and functional foods.

In the U.S., the milk protein hydrolysate market reached USD 488 million in 2024, with an anticipated CAGR of 8% through 2034. The region benefits from advanced healthcare infrastructure, high consumer awareness, and significant demand for specialized nutritional products, solidifying its leadership in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for infant nutrition products

- 3.6.1.2 Rising health consciousness and protein-rich diets

- 3.6.1.3 Advances in hydrolysis technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.2.2 Regulatory challenges regarding labeling and health claims

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Whey protein hydrolysate (WPH)

- 5.3 Casein hydrolysate (CPH)

- 5.4 Total milk protein hydrolysate

- 5.5 Lactoferrin hydrolysate

- 5.6 Immunoglobulin hydrolysate

- 5.7 Alpha-lactalbumin hydrolysate

- 5.8 Beta-lactoglobulin hydrolysate

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Paste

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Acid hydrolysis

- 7.3 Enzymatic hydrolysis

- 7.4 Microbial fermentation

- 7.5 Autolytic hydrolysis

- 7.6 Ultrasonic hydrolysis

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Infant nutrition

- 8.2.2 Sports nutrition

- 8.2.3 Bakery & food ingredients

- 8.2.4 Beverages

- 8.2.5 Others

- 8.3 Animal feed

- 8.3.1 Poultry

- 8.3.1.1 Broilers

- 8.3.1.2 Layers

- 8.3.2 Swine

- 8.3.3 Cattle

- 8.3.4 Aquaculture

- 8.3.4.1 Salmon

- 8.3.4.2 Trouts

- 8.3.4.3 Shrimps

- 8.3.4.4 Others

- 8.3.5 Equine

- 8.3.6 Pet

- 8.3.1 Poultry

- 8.4 Pharmaceutical

- 8.4.1 Pharmaceutical formulations

- 8.4.2 Clinical nutrition

- 8.4.3 Others

- 8.5 Cosmetics & Personal Care

- 8.5.1 Skincare

- 8.5.2 Haircare

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arla Foods Ingredients Group

- 10.2 AMCO Proteins

- 10.3 A. Costantino & C.

- 10.4 Armor Proteines

- 10.5 Agropur Cooperative

- 10.6 Ba’emek Advanced Technologies

- 10.7 FrieslandCampina DMV

- 10.8 Glanbia Nutritionals

- 10.9 Hilmar Ingredients

- 10.10 Havero Hoogwegt

- 10.11 Kerry Ingredients

- 10.12 Lactalis Group

- 10.13 Milk Specialties Global

- 10.14 Tatua Co-operative Dairy Company