|

市場調查報告書

商品編碼

1666668

手動升降燈塔市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Manual Lifting Light Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

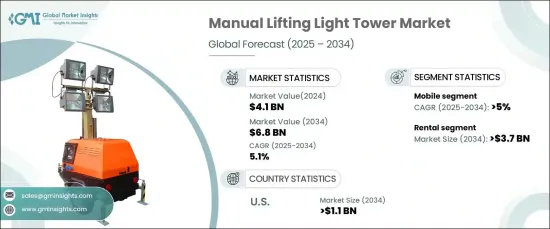

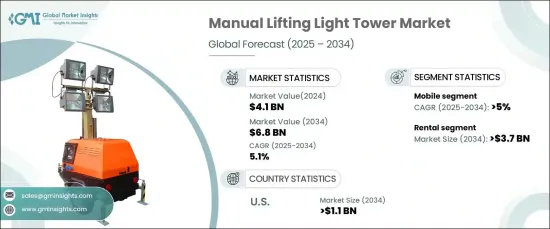

2024 年全球手動升降燈塔市場價值為 41 億美元,預計 2025 年至 2034 年的複合年成長率為 5.1%。

這些塔提供了簡單且易於在偏遠地區部署的功能。基礎建設推動市場成長,美國交通部將在2023年為基礎建設項目撥款1850億美元。 LED 照明整合、耐用性和燃油效率的提高增加了全球手動升降燈塔的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 68億美元 |

| 複合年成長率 | 5.1% |

由於各行各業對靈活且經濟高效的照明解決方案的需求不斷增加,租賃行業的規模預計到 2034 年將超過 37 億美元。租賃燈塔適用於短期項目,例如建築、採礦和戶外活動,這些項目需要臨時照明而不需要長期投資。基礎設施項目數量的不斷增加(特別是在新興經濟體)刺激了對租賃設備的需求。此外,救災和緊急應變行動對攜帶式照明的需求進一步促進了市場的成長。由於維護成本較低且部署速度較快,設備租賃服務日益流行,這是推動租賃市場擴張的另一個關鍵因素。

到 2034 年,行動手動升降燈塔的複合年成長率預計將超過 5%。移動式燈塔具有增強的靈活性、便攜性和易於運輸的特點,使其成為偏遠或具有挑戰性的環境中專案的理想選擇。緊急應變、救災和大型戶外活動臨時照明的興起趨勢進一步刺激了需求。此外,燃油效率、LED 照明技術和耐用性的進步也促進了移動式手動升降燈塔的普及。

隨著各行業對攜帶式高效照明解決方案的需求不斷增加,美國手動升降燈塔市場規模預計到 2034 年將超過 11 億美元。不斷成長的基礎設施開發、建設和戶外活動是推動這一市場擴張的關鍵因素。手動升降燈塔因其價格便宜、使用方便、可在電力有限的地區快速部署而受到青睞。此外,緊急狀況和自然災害發生的頻率不斷增加,也導致臨時照明的需求不斷增加。節能 LED 照明技術的進步以及燃油效率和耐用性的提高進一步支持了美國市場對手動升降燈塔的採用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:按通路,2021 – 2034 年

- 主要趨勢

- 銷售量

- 租賃

第 6 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 固定式

- 移動的

第 7 章:市場規模及預測:依明,2021 – 2034 年

- 主要趨勢

- 金屬鹵化物

- 引領

- 電的

- 其他

第 8 章:市場規模及預測:依電源分類,2021 年至 2034 年

- 主要趨勢

- 柴油引擎

- 太陽的

- 直接的

- 其他

第 9 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 建造

- 基礎建設發展

- 石油和天然氣

- 礦業

- 軍事與國防

- 緊急及災難救援

- 其他

第 10 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司簡介

- Allmand Bros

- Aska Equipments

- Atlas Copco

- Caterpillar

- Chicago Pneumatic

- Colorado Standby

- DMI

- Doosan Portable Power

- Generac Power Systems

- HIMOINSA

- Inmesol gensets

- JC Bamford Excavators

- LARSON Electronics

- Light Boy

- LTA Projects

- Multiquip

- Olikara Lighting Towers

- Progress Solar Solutions

- The Will Burt Company

- Trime

- United Rentals

- Wacker Neuson

- Youngman Richardson

The Global Manual Lifting Light Tower Market was valued at USD 4.1 billion in 2024 and is expected to witness a CAGR of 5.1% from 2025 to 2034. The industry is expanding as construction, mining, and emergency response operations demand portable, cost-effective lighting solutions.

These towers provide simplicity and easy deployment in remote locations. Infrastructure development drives market growth, as evidenced by the U.S. Department of Transportation's allocation of USD 185 billion for infrastructure projects in 2023. The need for temporary lighting in disaster relief operations and outdoor events further propels market demand. LED lighting integration, improved durability, and enhanced fuel efficiency increase the adoption of manual lifting light towers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 5.1% |

The rental segment is expected to surpass USD 3.7 billion by 2034, driven by increasing demand for flexible and cost-effective lighting solutions across various industries. Rental light towers are favored for short-term projects, such as construction, mining, and outdoor events, where temporary lighting is required without long-term investment. The rising number of infrastructure projects, particularly in emerging economies, fuels the demand for rental equipment. Additionally, the need for portable lighting in disaster relief and emergency response operations further contributes to market growth. The growing trend of equipment rental services, supported by lower maintenance costs and quick deployment, is another key factor driving the expansion of the rental market.

The mobile manual lifting light towers are expected to grow at a CAGR of over 5% through 2034. This growth is driven by the increasing demand for versatile and easily deployable lighting solutions in various industries, including construction, mining, and outdoor events. Mobile light towers offer enhanced flexibility, portability, and ease of transport, making them ideal for projects in remote or challenging environments. The rising trend of temporary lighting for emergency response, disaster relief, and large-scale outdoor events further fuels demand. Additionally, advancements in fuel efficiency, LED lighting technology, and durability contribute to the growing adoption of mobile manual lifting light towers.

The U.S. manual lifting light tower market is expected to surpass USD 1.1 billion by 2034, driven by increasing demand for portable and efficient lighting solutions across various sectors. Growing infrastructure development, construction, and outdoor events are key factors fueling this market expansion. Manual lifting light towers are favored for their affordability, ease of use, and quick deployment in areas with limited access to power. Additionally, the rising frequency of emergency response situations and natural disasters contributes to the growing demand for temporary lighting. Technological advancements in energy-efficient LED lighting, along with improvements in fuel efficiency and durability, further support the adoption of manual lifting light towers across the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sales

- 5.3 Rental

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Size and Forecast, By Lighting, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Metal halide

- 7.3 LED

- 7.4 Electric

- 7.5 Others

Chapter 8 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Solar

- 8.4 Direct

- 8.5 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Infrastructure development

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Military & defense

- 9.7 Emergency & disaster relief

- 9.8 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million and ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Allmand Bros

- 11.2 Aska Equipments

- 11.3 Atlas Copco

- 11.4 Caterpillar

- 11.5 Chicago Pneumatic

- 11.6 Colorado Standby

- 11.7 DMI

- 11.8 Doosan Portable Power

- 11.9 Generac Power Systems

- 11.10 HIMOINSA

- 11.11 Inmesol gensets

- 11.12 J C Bamford Excavators

- 11.13 LARSON Electronics

- 11.14 Light Boy

- 11.15 LTA Projects

- 11.16 Multiquip

- 11.17 Olikara Lighting Towers

- 11.18 Progress Solar Solutions

- 11.19 The Will Burt Company

- 11.20 Trime

- 11.21 United Rentals

- 11.22 Wacker Neuson

- 11.23 Youngman Richardson