|

市場調查報告書

商品編碼

1666946

金屬鹵化物燈塔市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Metal Halide Light Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

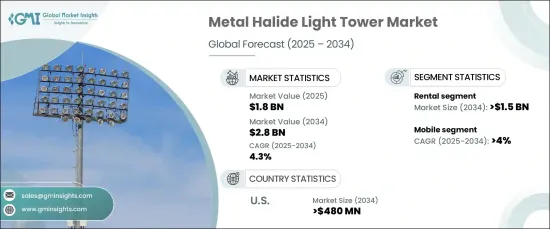

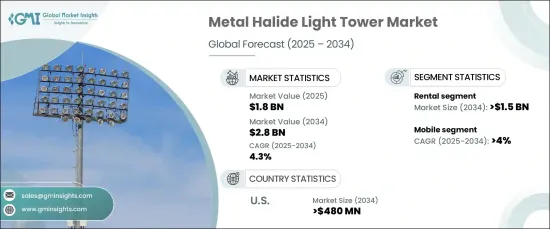

2024 年全球金屬鹵化物燈塔市場價值為 18 億美元,預計 2025 年至 2034 年的複合年成長率為 4.3%。然而,在需要高強度照明的行業中,尤其是在大型專案和夜間作業中,金屬鹵化物塔仍然佔據主導地位。新興市場對基礎設施和建築項目的需求不斷成長,推動了對這些燈塔的需求,它們在確保具有挑戰性的環境中持續照明方面發揮關鍵作用。

智慧技術,包括遠端控制、監控和自動燈光調節等功能,正擴大融入金屬鹵化物燈塔中。這些創新有助於最佳化能源消耗,美國能源部報告稱,智慧系統可減少高達 50% 的能源使用。此外,製造商正在提高燈塔的便攜性,提供緊湊、輕巧的型號,以便更輕鬆地運送到各個工作地點。這一趨勢在建築和戶外活動領域尤其重要,攜帶式照明解決方案對於維持安全性和生產力至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 4.3% |

金屬鹵化物燈塔市場主要分為兩個管道:租賃和銷售。租賃業預計將大幅成長,到 2034 年將達到 15 億美元以上。租賃設備的靈活性確保企業能夠快速獲得必要的照明,而無需長期投資。

金屬鹵化物燈塔也分為固定式和移動式。行動市場預計將保持強勁成長,到 2034 年複合年成長率將超過 4%。這些塔具有便攜性和可靠性,確保有效滿足離網地點的照明需求。

在美國,金屬鹵化物燈塔的市場規模預計到 2034 年將超過 4.8 億美元。建築業和採礦業尤其依賴這些高強度照明解決方案來滿足嚴格的安全標準並確保在具有挑戰性的工作現場環境中的可見性。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:按通路,2021 – 2034 年

- 主要趨勢

- 銷售量

- 租賃

第 6 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 固定式

- 移動的

第 7 章:市場規模及預測:依電源分類,2021 年至 2034 年

- 主要趨勢

- 柴油引擎

- 太陽的

- 直接的

- 其他

第 8 章:市場規模與預測:依技術,2021 – 2034 年

- 主要趨勢

- 手動升降

- 油壓升降

第 9 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 建造

- 基礎建設發展

- 石油和天然氣

- 礦業

- 軍事與國防

- 緊急及災難救援

- 其他

第 10 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司簡介

- Allmand Bros

- Aska Equipments

- Atlas Copco

- Caterpillar

- Chicago Pneumatic

- Colorado Standby

- DMI

- Doosan Portable Power

- Generac Power Systems

- Himoinsa

- Inmesol Gensets

- JC Bamford Excavators

- Larson Electronics

- Light Boy

- LTA Projects

- Multiquip

- Olikara Lighting Towers

- Progress Solar Solutions

- The Will Burt Company

- Trime

- United Rentals

- Wacker Neuson

- Youngman Richardson

The Global Metal Halide Light Tower Market was valued at USD 1.8 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Metal halide light towers face strong competition from LED lighting, which provides superior energy efficiency, longer lifespan, and lower maintenance costs. However, metal halide towers remain dominant in industries requiring high-intensity lighting, especially in large-scale projects and nighttime operations. The increasing demand for infrastructure and construction projects in emerging markets is driving the need for these light towers, which play a critical role in ensuring consistent illumination in challenging environments.

Smart technologies, including features like remote control, monitoring, and automated light adjustments, are increasingly being integrated into metal halide light towers. These innovations are helping optimize energy consumption, with the U.S. Department of Energy reporting that smart systems can reduce energy use by up to 50%. Furthermore, manufacturers are enhancing the portability of light towers, offering compact, lightweight models for easier transport to various job sites. This trend is particularly relevant in the construction and outdoor event sectors, where portable lighting solutions are vital for maintaining safety and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 4.3% |

The market for metal halide light towers is divided into two main channels: rental and sales. The rental segment is expected to grow significantly, reaching over USD 1.5 billion by 2034. Renting light towers allows businesses to avoid the heavy upfront costs associated with purchasing equipment, which is particularly appealing for companies engaged in short-term projects like construction or events. The flexibility of renting equipment ensures that companies can quickly access the necessary lighting without the need for long-term investments.

Metal halide light towers are also categorized into stationary and mobile types. The mobile segment is projected to grow at a robust pace, with a CAGR exceeding 4% through 2034. Mobile towers provide essential lighting solutions for temporary or seasonal projects, allowing industries such as mining and oil and gas to operate in remote areas lacking infrastructure. These towers offer portability and reliability, ensuring that lighting requirements are met efficiently in off-grid locations.

In the United States, the market for metal halide light towers is expected to surpass USD 480 million by 2034. The demand for these towers is driven by advancements in engine technology and fuel efficiency, reducing operational costs while extending the duration of lighting during night shifts. The construction and mining industries, in particular, are relying on these high-intensity lighting solutions to meet stringent safety standards and ensure visibility in challenging worksite environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sales

- 5.3 Rental

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Solar

- 7.4 Direct

- 7.5 Others

Chapter 8 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Manual lifting

- 8.3 Hydraulic lifting

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Infrastructure development

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Military & defense

- 9.7 Emergency & disaster relief

- 9.8 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million and ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Allmand Bros

- 11.2 Aska Equipments

- 11.3 Atlas Copco

- 11.4 Caterpillar

- 11.5 Chicago Pneumatic

- 11.6 Colorado Standby

- 11.7 DMI

- 11.8 Doosan Portable Power

- 11.9 Generac Power Systems

- 11.10 Himoinsa

- 11.11 Inmesol Gensets

- 11.12 JC Bamford Excavators

- 11.13 Larson Electronics

- 11.14 Light Boy

- 11.15 LTA Projects

- 11.16 Multiquip

- 11.17 Olikara Lighting Towers

- 11.18 Progress Solar Solutions

- 11.19 The Will Burt Company

- 11.20 Trime

- 11.21 United Rentals

- 11.22 Wacker Neuson

- 11.23 Youngman Richardson