|

市場調查報告書

商品編碼

1630232

塔燈(泛光燈):市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Light Tower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

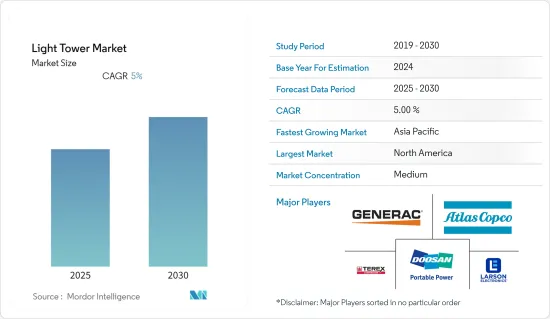

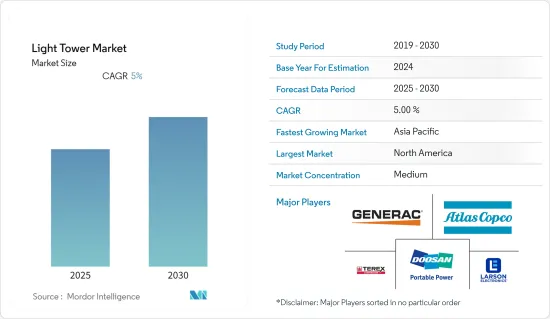

塔燈市場預計在預測期內複合年成長率為 5%。

主要亮點

- 塔燈(泛光燈)市場見證了全球各行業的需求不斷成長,導致該市場上的各個供應商快速進行產品創新。此外,由於建築、工業和採礦業的高需求,大多數塔燈由柴油運作。

- 滿足工業需求的關鍵因素包括更好的流明覆蓋、更高的耐用性和充足的電力供應。 LED 可以滿足這些基本要求。它比其他現有技術更受青睞,因為它具有燃油效率高、照明範圍廣(超過 100,000 流明),並且擁有和維護成本相對較低。

- 此外,採礦和建築等行業對更堅固、更耐用的塔燈(泛光燈)的需求不斷增加,因此許多製造商正在推出更新的重型版本,以適應更苛刻的部署。例如,2020年3月,Lind Equipment推出了一體化Beacon LED塔。該公司專注於北美市場,Lind Equipment 近 90% 的銷售額來自租賃活動。

- 移動塔燈(泛光燈)也越來越受歡迎,因為它們具有多種優點。行動塔燈(泛光燈)是由拖車、升降桅杆、電源、照明設備等組成的系統。拖車可以是由車輛牽引的獨立車身,也可以由各種現有卡車改裝而成。起重桅杆、照明設備等設備合理安裝在拖車上,組合成完整的移動照明系統。

- 另外,移動照明塔適用於軍隊、公路、鐵路、電力、公共安全等企事業單位、各種大型施工作業、礦山作業、維護保養、事故處理、救災等。

- 然而,著眼於工作場所和獨特的活動照明解決方案等應用,Allmand Brothers 於 2020 年 2 月推出了 Nightlight GR 系列塔燈系列。它具有緊湊的結構和靈活的動力傳動系統選項,包括風冷柴油機、汽油機和拖鏈裝置。

塔燈(泛光燈)市場趨勢

LED塔燈(泛光燈)佔據最大市場佔有率

- LED 塔燈(泛光燈)採用LED燈來照亮各個位置。此類照明設備依賴固態設計,即使在惡劣的工作條件下也能確保穩健性。由於 LED 不使用反射器來儲存光,因此它們可以使用與金屬鹵化物塔相同類型的設置,並且需要更少的瓦特來產生相同的流明。

- 此外,近年來,LED 塔燈(泛光燈)越來越受到金屬鹵化物塔的青睞,並正在取代長期使用的金屬鹵化物塔,目前是全球使用最廣泛的塔。這是因為它與金屬鹵化物塔相比具有許多優點。

- LED 塔燈(泛光燈)的最大優勢之一是與金屬鹵化物燈塔相比,其燃油效率更高。與傳統照明相比,LED 可以節省高達 40% 的能源。在最佳條件下,此類燈的效率可達80%,平均為60-70%。相較之下,金屬鹵素燈將電能轉換為光時,平均能源效率約為50%。

- 與金屬鹵素燈不同,LED 照明可以即時切換。開機時沒有等待時間,工人在工作時可以隨時開關燈。這為工作現場提供了更大的靈活性,使工人能夠調整該區域的照明條件,而不會造成明顯的延誤。此外,幾乎可以立即實現全功率。

- 此外,LED 還可以降低能源成本,為企業帶來環保效益。 LED 照明燈具不使用汞或鉛等有害化學物質。因此,它很容易回收,並且在處置時不需要精細處理。因此,現場使用安全,工作期間發生事故的健康風險顯著降低。

北美佔最大市場佔有率

- 供應商不斷擴大他們的產品線。 2020 年 1 月,Wanco Inc. 發布了其「下一代」緊湊型塔燈。一輛卡車上最多可安裝 18 台 WALi Compact,從而節省堆場或現場空間。

- 新功能包括巨大的燃料箱、最高的塔和從地面進行最安全的燈光調節。 Wanco 緊湊型塔燈採用耐用組件設計,包括全焊接結構鋼框架、同類中唯一的鋼製櫃體,以及安全雙滑輪系統,可從下方提升每個塔架部分,使其更加可靠的重量平衡負載並提高安全性。此外,同類產品中最亮的 LED 燈具、眾多寒冷天氣套件、低分貝等級、多種引擎選項以及自動黃昏到黎明功能,讓您無需操作員即可打開和關閉塔燈。 。

- 2020 年 2 月,Briggs & Stratton 公司的子公司、高效能可攜式現場設備製造商 Allmand Brothers 在 2020 年 ARA 展會上推出了全新 Nightlight GR 系列塔燈系列,推出了 Maxi Heat 1M BTU 牽引式加熱器。

- 此外,根據美國人口普查局的數據,預計 2022 年美國建築業價值將達到約 1,350 億美元。美國政府預計該國的土木建築支出將持續成長。到 2022 年,美國的土木建築支出可能達到 3,716 億美元。此外,根據美國建築師協會的最新預測,2020 年美國住宅建築市場預計將年增與前一年同期比較%。

- 總部位於美國的特雷克斯公司提供重型塔燈,幾乎可以滿足從建築工地和體育賽事到採礦和油田應用的任何照明需求。特雷克斯塔燈包括多種功能和選項,可提高每個單位的生產力,以滿足特定工作現場的需求。

塔燈(泛光燈)產業概況

塔燈市場競爭適度,由幾個主要企業組成。目前,少數大公司在市場佔有率方面佔據主導地位,並繼續保持整體市場的顯著佔有率,特別是在北美和歐洲等已開發經濟體地區。在印度和中國等新興經濟體,市場基本上是無組織的,並且由區域和本地供應商主導。意識到巨大的成長機會,國際參與者透過併購、收購和建立供應網路逐漸進入這些無組織的市場。

- 2021 年 6 月 - Generac Mobile 開發了一款「一體式」行動照明塔,集柴油、電池、混合動力、主電源和太陽能選項於一身。

- 2021 年 1 月 - 阿特拉斯·科普柯推出適用於都市區和住宅的超靜音柴油驅動 LED 燈塔。更新版本的 HiLight B5+ 塔燈具有 55dBA 的低運行噪音水平,非常適合活動照明、臨時公共照明以及提高住宅附近建築工地的能見度。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對工業生態系的影響

第5章市場動態

- 市場促進因素

- 石油天然氣、採礦業和建築業投資快速成長

- 重點減少塔燈(泛光燈)排放

- 市場挑戰

- 太陽能和 LED 塔燈(泛光燈)高成本,租賃業不斷發展

第6章 市場細分

- 按類型

- LED塔燈(泛光燈)

- 金鹵燈塔燈(泛光燈)

- 按電源類型

- 太陽能供電

- 柴油引擎

- 氫燃料

- 直接供電

- 按最終用戶產業

- 建造

- 石油和天然氣

- 礦業

- 工業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Atlas Copco AB

- Terex Corporation

- Generac Power Systems Inc.

- Larson Electronics LLC

- Doosan Portable Power

- Colorado Standby

- Westquip Diesel Sales

- Wacker Neuson Group

- Youngman Richardson & Co. Ltd

- Inmesol Gensets SL

- JC Bamford Excavators Ltd

- Xylem Inc.

- Wanco Inc.

- BMI Group

- The Will-Burt Company

第8章投資分析

第9章市場展望

The Light Tower Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- The light tower market is witnessing increased demand from various industries worldwide and has led to rapid product innovations from different vendors operating in this market. Additionally, most light towers run on diesel due to their high demand across construction, industrial, and mining activities.

- Some of the significant factors essential to industrial requirements are more excellent light coverage in terms of the lumen, increased durability, and the right power source. The LED has been able to address those essential requirements. It has been preferred over other existing technologies, as it has higher fuel savings, broader coverage of light with more than 100,000 lumens, and is comparatively cheaper to own and maintain.

- Further, the increased demand for more rugged and durable light towers from industries like mining and construction has led to significant manufacturers launching newer heavy-duty versions of tower lights for harsher deployments. For instance, in March 2020, Lind Equipment launched All-in-One Beacon LED Tower. The company focused on the North American market, and nearly 90% of Lind Equipment's sales come from rental activities.

- Additionally, mobile light towers are gaining popularity owing to several benefits it offers. A mobile light tower is a system composed of the trailer, lifting mast, power supply, and lighting equipment, among others. The trailer can be an independent body towed by a vehicle or modified from existing and various trucks. The lifting mast, lighting equipment, and other equipment are reasonably installed on the trailer and combined to form a complete movable lighting system.

- Furthermore, the mobile light tower is suitable for large-area, high-brightness lighting needs for large-scale, high-brightness lighting in military, highway, railway, electric power, public security, and other enterprises and institutions, and various large-scale construction operations, mine operations, maintenance, and repair, accident handling, and disaster relief.

- However, looking at applications, such as job sites and unique event lighting solutions, Allmand Bros. Inc., in February 2020, launched a Night-Lite GR-Series light tower line. It features a compact structure with flexible powertrain options, such as air-cooled diesel, gasoline, or a towable chain unit.

Light Towers Market Trends

LED Light Tower Accounts For the Largest Market Share

- LED light towers incorporate LED lamps to illuminate various locations. Such lighting equipment relies on a solid-state design that ensures its sturdiness under extreme working conditions. LEDs use no reflectors for saving light, and this offers the use of the same type of setup and lesser wattage requirements to produce the same amount of lumens as the Metal Halide Towers.

- Moreover, LED light towers are increasingly favored over metal halide towers over the past few years and are replacing the longstanding metal halide towers and are now the most used towers globally. This is due to their numerous advantages over the metal halide towers.

- One of the most significant advantages of LED light towers is the fuel efficiency it offers compared to the metal halide towers. LEDs can save up to 40% of energy compared to traditional lighting options. Under optimal conditions, such lamps reach up to 80% efficiency with an average of 60-70%. By comparison, metal halide units average roughly 50% energy efficiency during electrical power conversion to light.

- Unlike metal halide lamps, LED lights can be toggled instantly. There is no waiting period during start-up, and operators can toggle the lights any time while working. This offers greater flexibility on the Jobsite, allowing workers to make adjustments to the lighting conditions of the area without significant delays. Furthermore, total power is achieved almost immediately.

- Additionally, LEDs possess several eco-friendly benefits for businesses due to their ability to cut down energy costs. The fixtures do not use toxic chemicals, such as mercury and lead to produce light. As a result, the units are easily recyclable and do not require sensitive handling during disposal. This also makes the lights safer to use on the Jobsite and considerably lowers health-related risks during accidents in the workplace.

North America Accounts For the Largest Market Share

- Vendors are continuously expanding their product lines. In January 2020, Wanco Inc. announced its "next-generation" compact light tower, with features designed specifically for safety and better-operating costs. With the WALi Compact, one can fit up to 18 units on a single truck, taking up less room around the yard or job site.

- The new features include the giant fuel tank, tallest tower available, and safest light adjustment from the ground. The Wanco Compact Light Tower is engineered to last, with durable components that incorporate an all-welded structural steel frame, the only steel cabinet in its class, and a safety dual-pulley system that lifts each tower section from the bottom, creating a more reliable weight-balanced load, that improves safety. Additional options include the brightest LED fixtures in its class, numerous cold-weather packages, low dB levels, multiple engine options, and an automated dusk-to-dawn control system that allows the light tower to turn itself on and off without an operator.

- In February 2020, Allmand Bros. Inc., a subsidiary of Briggs & Stratton Corporation and a high-performance portable job site equipment manufacturer announced its new Night-Lite GR-Series light tower line Maxi-Heat 1M BTU towable heater at the 2020 ARA Show.

- Further, according to the US Census Bureau, the value of construction in the United States is estimated to reach some USD 135 billion in 2022. The US government expects civil engineering construction expenditures in the country to grow consistently. Civil engineering construction spending will likely come to about USD 371.6 billion by 2022 in the United States. Additionally, according to a new forecast from the American Institute of Architects, the US non-residential construction market is anticipated to grow to 2.4% in 2020 compared to the previous year.

- US-based Terex Corporation provides a heavy-duty light tower to fit virtually any lighting need, from construction sites and sporting events to mining and oil field applications. Terex light towers include various features and options to help enhance the productivity of each unit for specific Jobsite needs.

Light Towers Industry Overview

The light towers market is moderately competitive and consists of several major players. A few of the major players currently dominate the market in terms of market share, which continues to hold a considerable share in the overall market, especially across developed economies in regions such as North America and Europe. In developing economies such as India and China, the market is mainly unorganized, featuring the dominance of regional or local vendors. Realizing the vast growth opportunities, international players slowly enter these unorganized markets through mergers, acquisitions, and establishing supply networks.

- June 2021 - Generac Mobile has developed an 'all-in-one' mobile lighting tower offering a single machine with diesel, battery, hybrid, mains power, and solar options.

- January 2021 - Atlas Copco has introduced a new ultra-quiet, diesel-driven LED light tower in urban and residential areas. Delivering operating noise levels as low as 55 dBA, the renewed version of the HiLight B5+ light tower is ideally suited to provide illumination at events, temporary public lighting, or enhanced visibility at construction sites near residential areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Investments and Rapid Growth in the Oil and Gas, Mining and Construction Sectors

- 5.1.2 Focus on Reducing Light Tower Emissions

- 5.2 Market Challenges

- 5.2.1 High Cost of Solar Light Towers and LED Lights and Increasing Growth of the Rental Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LED Light Tower

- 6.1.2 Metal Halid Light Tower

- 6.2 By Type of Power Source

- 6.2.1 Solar Powered

- 6.2.2 Diesel Powered

- 6.2.3 Hydrogen Fuel Powered

- 6.2.4 Directly Powered

- 6.3 By End-user Industry

- 6.3.1 Construction

- 6.3.2 Oil & Gas

- 6.3.3 Mining

- 6.3.4 Industrial

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco AB

- 7.1.2 Terex Corporation

- 7.1.3 Generac Power Systems Inc.

- 7.1.4 Larson Electronics LLC

- 7.1.5 Doosan Portable Power

- 7.1.6 Colorado Standby

- 7.1.7 Westquip Diesel Sales

- 7.1.8 Wacker Neuson Group

- 7.1.9 Youngman Richardson & Co. Ltd

- 7.1.10 Inmesol Gensets SL

- 7.1.11 J C Bamford Excavators Ltd

- 7.1.12 Xylem Inc.

- 7.1.13 Wanco Inc.

- 7.1.14 BMI Group

- 7.1.15 The Will-Burt Company