|

市場調查報告書

商品編碼

1666640

乳製品原料市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Dairy Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

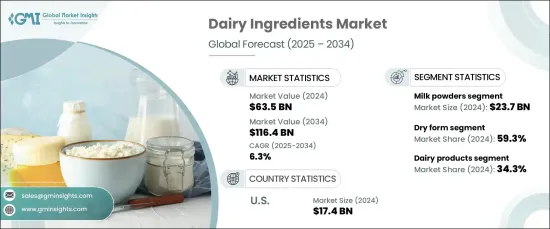

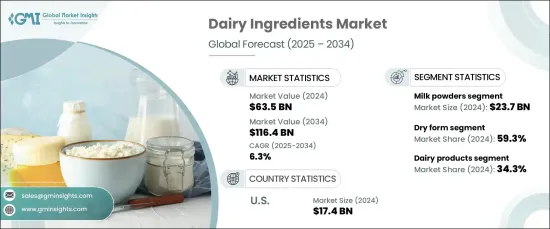

2024 年全球乳製品原料市場價值為 635 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 6.3%。這項擴張的關鍵促進因素是人們越來越意識到乳製品的營養價值。消費者越來越意識到這些成分在維持健康飲食方面的作用,從而促進了食品和飲料行業對這些成分的採用。乳製品原料因其多功能性而聞名,使其成為從加工食品和烘焙食品到糖果和飲料等各種食品的主要成分。它們的受歡迎程度進一步受到對清潔標籤產品和強化營養產品日益成長的需求的推動,這與優先考慮透明度和健康意識選擇的飲食偏好的轉變相一致。

市場受益於多種消費者驅動的趨勢,包括對高蛋白飲食和功能性營養的偏好日益成長。人們擴大尋求能夠提供額外健康益處的產品,例如改善消化、控制體重和增強運動表現。因此,運動營養和功能性食品等行業對乳製品成分(特別是乳清蛋白和酪蛋白)的需求正在穩步成長。此外,人們對天然、低加工食品的興趣日益濃厚,促使製造商不斷創新,提供滿足注重健康的人群需求的清潔標籤乳製品成分解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 635億美元 |

| 預測值 | 1164億美元 |

| 複合年成長率 | 6.3% |

根據產品類型細分,市場包括酪蛋白和酪蛋白酸鹽、乳清成分、乳糖和衍生物、奶粉和其他相關產品。 2024年,奶粉佔據了市場主導地位,佔有相當大的佔有率。由於它們的保存期限長、運輸方便、能夠融入各種食品中,所以它們成為了製造商必不可少的原料。隨著全球食品產量不斷擴大,奶粉因其成本效益和延長儲存時間仍然是首選。

市場還根據形式細分為乾奶和液態奶,其中乾奶在 2024 年佔據 59.3% 的市場佔有率。這些特性使得乾乳製品特別適合用於烘焙食品、飲料混合物和糖果產品。加工食品消費量的不斷成長,以及對快速簡便的膳食解決方案的需求不斷增加,進一步推動了對乾乳製品成分的需求。

在美國,受高蛋白功能性食品和營養補充劑強勁需求的推動,乳製品原料市場在 2024 年的收入將達到 174 億美元。市場的成長得益於人們對運動營養、嬰兒配方奶粉和清潔標籤產品的日益重視。隨著乳製品加工技術的進步,製造商現在能夠生產更多客製化解決方案來滿足多樣化的消費者需求,推動創新並提高產品品質。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 食品飲料業的擴張

- 消費者對功能性食品的需求不斷增加

- 產業陷阱與挑戰

- 來自植物替代品的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:依形式,2021-2034 年

- 主要趨勢

- 乾燥

- 液體

第 6 章:市場規模與預測:依產品類型,2021-2034 年

- 主要趨勢

- 奶粉

- 乳清成分

- 乳糖及其衍生物

- 酪蛋白和酪蛋白酸鹽

- 其他

第 7 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 麵包和糖果

- 乳製品

- 嬰兒配方奶粉

- 運動與臨床營養

- 其他

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Amco Proteins

- Arla Foods

- Dairy Farmers of America

- EPI Ingredients

- Fonterra

- FrieslandCampina

- Glanbia

- Ingredia

- Kerry Group

- Lactalis Group

- Saputo

- Sodiaal co-operative group

- Volac International

The Global Dairy Ingredients Market, valued at USD 63.5 billion in 2024, is poised for significant growth with a projected CAGR of 6.3% from 2025 to 2034. The market includes a broad array of milk-derived products such as milk powders, whey proteins, lactose, casein, and other derivatives. A key driver of this expansion is the increasing awareness of the nutritional benefits offered by dairy ingredients. Consumers are becoming more conscious of the role these ingredients play in maintaining a healthy diet, contributing to the rising adoption across the food and beverage sector. Dairy ingredients are celebrated for their versatility, making them a staple in everything from processed foods and bakery items to confectioneries and beverages. Their popularity is further fueled by the growing demand for clean-label products and fortified nutrition, which align with shifting dietary preferences that prioritize transparency and health-conscious choices.

The market is benefiting from several consumer-driven trends, including the rising preference for high-protein diets and functional nutrition. People are increasingly seeking products that provide additional health benefits, such as improved digestion, weight management, and enhanced athletic performance. As a result, the demand for dairy ingredients, particularly whey proteins and casein, is seeing a steady rise in industries like sports nutrition and functional food products. Moreover, the growing interest in natural, minimally processed foods has pushed manufacturers to innovate and offer clean-label dairy ingredient solutions that cater to a health-focused demographic.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.5 Billion |

| Forecast Value | $116.4 Billion |

| CAGR | 6.3% |

Segmented by product type, the market includes casein and caseinates, whey ingredients, lactose and derivatives, milk powders, and other related products. In 2024, milk powders dominated the market, capturing a significant share. Their long shelf life, ease of transport, and ability to be incorporated into various food products have made them an essential ingredient for manufacturers. As food production continues to expand globally, milk powders remain a top choice due to their cost-effectiveness and extended storage capabilities.

The market is also segmented by form into dry and liquid variants, with the dry segment accounting for 59.3% of the market share in 2024. Dry dairy ingredients, including powdered milk, whey, and casein, are preferred for their convenience, stability, and extended shelf life. These characteristics make dry dairy ingredients particularly well-suited for use in bakery goods, beverage mixes, and confectionery products. The growing consumption of processed foods, along with the increasing demand for quick and easy meal solutions, is further propelling the demand for dry dairy ingredients.

In the United States, the dairy ingredients market generated USD 17.4 billion in 2024, driven by strong demand for high-protein functional foods and nutritional supplements. The market's growth is supported by the increasing emphasis on sports nutrition, infant formula, and clean-label products. With advances in dairy processing technologies, manufacturers are now able to produce more customized solutions to cater to diverse consumer needs, driving innovation and enhancing product quality.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Expansion of the food and beverage industry

- 3.6.1.2 Increasing consumer demand for functional foods

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Competition from plant-based alternatives

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Dry

- 5.3 Liquid

Chapter 6 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Milk powders

- 6.3 Whey ingredients

- 6.4 Lactose and derivatives

- 6.5 Casein and caseinates

- 6.6 Other

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.3 Dairy products

- 7.4 Infant milk formula

- 7.5 Sports and clinical nutrition

- 7.6 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amco Proteins

- 9.2 Arla Foods

- 9.3 Dairy Farmers of America

- 9.4 EPI Ingredients

- 9.5 Fonterra

- 9.6 FrieslandCampina

- 9.7 Glanbia

- 9.8 Ingredia

- 9.9 Kerry Group

- 9.10 Lactalis Group

- 9.11 Saputo

- 9.12 Sodiaal co-operative group

- 9.13 Volac International