|

市場調查報告書

商品編碼

1664898

公用事業併網光伏逆變器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Utility On Grid PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

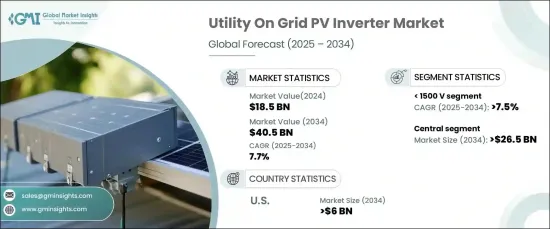

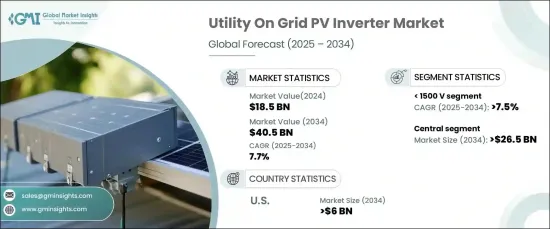

全球公用事業併網光伏逆變器市場預計將經歷顯著成長,到 2024 年達到 185 億美元的價值,預計 2025 年至 2034 年的複合年成長率為 7.7%。這些逆變器旨在處理從數百千瓦到幾兆瓦的高功率輸出,提供效率、可靠性和無縫電網合規性。

市場按產品類型細分,其中中央逆變器佔據領先地位。預計到 2034 年,中央逆變器將產生 265 億美元的收入,它因能夠管理高功率需求而特別受歡迎,使其成為公用事業規模太陽能專案的理想選擇。這些逆變器以其成本效益和易於維護而聞名,這對於大規模安裝至關重要。此外,中央逆變器配備了無功功率控制、電壓調節和頻率響應等先進功能,所有這些功能都確保符合電網標準並有助於整體電網穩定性。這些功能使中央逆變器成為市場成長的主要驅動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 185億美元 |

| 預測值 | 405億美元 |

| 複合年成長率 | 7.7% |

就標稱輸出電壓而言,到 2034 年,輸出低於 1500V 的逆變器預計以 7.5% 的複合年成長率成長。對於能夠支援更高功率輸出的逆變器的需求不斷增加,特別是在大型公用事業規模的應用中,將進一步加速其採用。此外,各個地區不斷升級電網基礎設施以支援更高電壓的太陽能連接,這將推動對這些逆變器的需求。

預計到 2034 年,美國公用事業併網光伏逆變器市場將創收 60 億美元。這些政策正在刺激對太陽能技術的投資並推動公用事業併網光伏逆變器的採用。此外,美國正在向更加分散和有彈性的能源電網轉變,同時太陽能技術成本下降,這進一步支持了該市場的成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 細繩

- 中央

第 6 章:市場規模及預測:依標稱輸出電壓,2021 – 2034 年

- 主要趨勢

- < 1500 伏

- ≥1500V

第 7 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 波蘭

- 荷蘭

- 奧地利

- 英國

- 法國

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第8章:公司簡介

- Canadian Solar

- Delta Electronics

- Eaton

- Enphase Energy

- Fimer Group

- GoodWe

- Schneider Electric

- SMA Solar Technology

- Sungrow Power Supply

- Solis Inverters

- SolarEdge Technologies

- V-Guard Industries

The Global Utility On Grid PV Inverter Market is expected to experience significant growth, reaching a value of USD 18.5 billion in 2024 and a projected CAGR of 7.7% from 2025 to 2034. PV inverters play a crucial role in large-scale solar energy systems by converting direct current (DC) from photovoltaic (PV) panels into alternating current (AC), which is synchronized with the utility grid. These inverters are built to handle high power outputs, ranging from hundreds of kilowatts to several megawatts, offering efficiency, reliability, and seamless grid compliance.

The market is segmented by product type, with central inverters leading the way. Expected to generate USD 26.5 billion by 2034, central inverters are particularly sought after for their ability to manage high power demands, making them ideal for utility-scale solar projects. These inverters are known for their cost-efficiency and easy maintenance, which are essential for large-scale installations. Furthermore, central inverters come equipped with advanced features like reactive power control, voltage regulation, and frequency response, all of which ensure compliance with grid standards and contribute to overall grid stability. These capabilities have made central inverters a key driver of growth in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.5 Billion |

| Forecast Value | $40.5 Billion |

| CAGR | 7.7% |

In terms of nominal output voltage, inverters with outputs below 1500V are expected to grow at a CAGR of 7.5% through 2034. This growth is fueled by the demand for greater efficiency and the need to reduce electrical losses during long-distance power transmission. The increasing requirement for inverters capable of supporting higher power outputs, especially in large utility-scale applications, will further accelerate adoption. Additionally, the ongoing upgrade of grid infrastructure in various regions to support higher-voltage solar connections will drive demand for these inverters.

The U.S. utility on-grid PV inverter market is projected to generate USD 6 billion by 2034. The market's growth is primarily driven by robust government support for renewable energy, with initiatives like the Investment Tax Credit (ITC) and renewable energy standards. These policies are stimulating investment in solar technology and boosting the adoption of utility on-grid PV inverters. Additionally, the U.S. is experiencing a shift toward a more decentralized and resilient energy grid, alongside falling costs for solar technology, which further supports the growth of this market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Central

Chapter 6 Market Size and Forecast, By Nominal Output Voltage, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 < 1500 V

- 6.3 ≥ 1500 V

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Canadian Solar

- 8.2 Delta Electronics

- 8.3 Eaton

- 8.4 Enphase Energy

- 8.5 Fimer Group

- 8.6 GoodWe

- 8.7 Schneider Electric

- 8.8 SMA Solar Technology

- 8.9 Sungrow Power Supply

- 8.10 Solis Inverters

- 8.11 SolarEdge Technologies

- 8.12 V-Guard Industries