|

市場調查報告書

商品編碼

1766306

商業及工業光電逆變器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial and Industrial PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

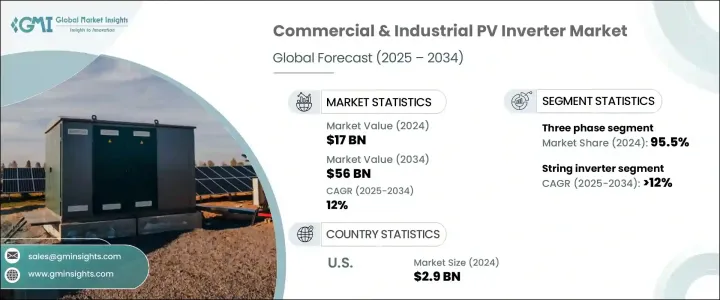

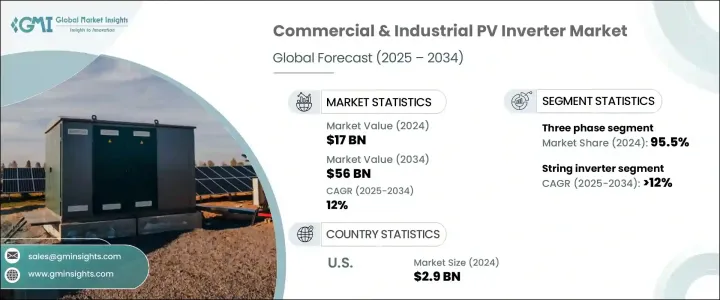

2024年,全球商業和工業光伏逆變器市場規模達170億美元,預計到2034年將以12%的複合年成長率成長,達到560億美元。推動這一成長的主要因素是電價不穩定性的加劇,促使企業尋求更可預測、更永續的能源。商業和工業設施正擴大轉向太陽能光電系統,而逆變器在確保太陽能有效轉換和融入日常營運方面發揮著至關重要的作用。這種轉變的主要目的是降低營運成本、提高能源效率並滿足日益嚴格的永續性標準。

隨著商業建築和製造部門的電力需求持續激增,太陽能逆變器已成為幫助企業最佳化能源消耗、管理尖峰負載和實現碳減排目標的重要工具。它們與建築能源管理系統的整合正變得越來越普遍,這反映出對更智慧能源解決方案的需求日益成長。企業不僅受到節省成本的驅動,也面臨越來越大的減少環境影響的壓力,這進一步增強了對太陽能技術的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 170億美元 |

| 預測值 | 560億美元 |

| 複合年成長率 | 12% |

全球各國政府和私營機構正在製定更積極的再生能源應用目標,進一步刺雷射電逆變器的需求。這些目標得到了旨在加速向太陽能轉型的有利法規和激勵計劃的支持。淨計量和再生能源信用等政策持續為採用太陽能解決方案創造積極的商業案例,尤其是在商業和工業應用中。隨著人們對氣候變遷和能源安全的認知不斷提高,越來越多的企業將能源獨立放在首位,而逆變器正成為該策略的重要組成部分。此外,緊湊型、高效、低壓逆變器系統的日益普及,使太陽能技術在更廣泛的應用中更具可行性,幫助企業克服空間和基礎設施的限制。這對於在城市地區營運的公司尤其重要,因為這些地區的房地產和安裝空間都非常寶貴。

然而,貿易相關的挑戰,尤其是對進口太陽能組件徵收的關稅,預計將對市場發展勢頭造成一些限制。太陽能設備採購成本的上升可能會推遲專案進度,並導致商業和工業開發商的預算超支。這些障礙也可能給供應鏈帶來壓力,尤其是在價格具有競爭力的高性能逆變器供應已經有限的情況下。儘管面臨這些不利因素,但由於持續的創新和對工業級逆變器技術的投入,市場的整體前景仍然強勁。

根據產品類型,市場分為組串式逆變器、微型逆變器和集中式逆變器。預計到2034年,組串式逆變器市場的複合年成長率將超過12%。此類別的需求主要源於設計、效率和系統可擴展性的改進,使其成為商業屋頂和中型工業設施的首選。隨著太陽能專案開發商尋求更靈活、更模組化的選擇,組串式逆變器在各種部署規模中都越來越受歡迎。

就相位配置而言,商業和工業光伏逆變器市場分為單相和三相系統。 2024年,三相逆變器佔據了全球95.5%的市場佔有率,這得益於其在工廠綜合體、倉庫和多租戶商業建築等大型應用中的日益普及。三相逆變器在處理高功率負載方面效率更高,並且更適合與電網系統整合,這使其成為大規模安裝的理想選擇。

從區域來看,美國已成為關鍵市場,其商業和工業光伏逆變器產業規模將在2024年達到29億美元,高於2023年的25億美元和2022年的22億美元。北美在2024年佔據全球市場的17.3%,預計到預測期末這一比例將會上升。強大的國內製造基礎和更快的交付速度,有助於加速逆變器在美國商業和工業設施中的應用。政府支持的推廣清潔能源和獎勵使用國產零件的措施也促進了市場的成長。

領先的製造商正在大力投資產能擴張、研發以及推出專為高性能應用而設計的先進逆變器。這些公司還透過策略合作夥伴關係和分銷網路拓展其全球影響力,從而實現更快的回應時間和更優質的本地服務。與工程、採購和施工公司以及太陽能開發商的合作已變得十分普遍,尤其是在獲得大型商業和工業專案方面。在具有高成長潛力的市場中,本地製造和支援服務仍然是關鍵的差異化因素。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 細繩

- 微

- 中央

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依連結性,2021 - 2034

- 主要趨勢

- 獨立

- 在電網上

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 波蘭

- 荷蘭

- 奧地利

- 英國

- 法國

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第9章:公司簡介

- Canadian Solar

- Delta Electronics

- Darfon Electronics

- Eaton

- Fimer Group

- Ginlong Technologies

- GoodWe

- Growatt New Energy

- Huawei Technologies

- Schneider Electric

- SMA Solar Technology

- Sungrow

- SolarEdge Technologies

- Sineng Electric

- Tabuchi Electric

The Global Commercial and Industrial PV Inverter Market was valued at USD 17 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 56 billion by 2034. A major factor driving this growth is the rising instability in electricity prices, prompting businesses to seek more predictable and sustainable energy sources. Commercial and industrial facilities are increasingly turning to solar photovoltaic systems, with inverters playing a crucial role in ensuring the effective conversion and integration of solar energy into everyday operations. This shift is primarily aimed at reducing operational costs, improving energy efficiency, and meeting rising sustainability standards.

As power demands continue to surge across commercial buildings and manufacturing units, solar inverters have emerged as vital tools to help companies optimize their energy consumption, manage peak loads, and meet carbon reduction goals. Their integration with building energy management systems is becoming more common, reflecting the rising need for smarter energy solutions. Companies are not only driven by cost-saving motives but also by mounting pressure to reduce their environmental impact, which is reinforcing the demand for solar-based technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17 Billion |

| Forecast Value | $56 Billion |

| CAGR | 12% |

Governments and private organizations worldwide are setting more aggressive targets for renewable energy adoption, further fueling demand for PV inverters. These goals are supported by favorable regulations and incentive programs aimed at accelerating the shift to solar energy. Policies such as net metering and renewable energy credits continue to create a positive business case for adopting solar energy solutions, especially in commercial and industrial applications. As awareness of climate change and energy security rises, more enterprises are prioritizing energy independence, and inverters are becoming an essential part of that strategy. In addition, the growing availability of compact, high-efficiency, low-voltage inverter systems is making solar technology more viable for a wider range of applications, helping businesses overcome space and infrastructure limitations. This is particularly important for companies operating in urban areas where real estate and installation space come at a premium.

However, trade-related challenges, particularly tariffs imposed on imported solar components, are expected to pose some limitations on the market's momentum. Increased procurement costs for solar equipment can delay project timelines and result in budget overruns for commercial and industrial developers. These barriers could also strain the supply chain, especially when the availability of competitively priced high-performance inverters is already limited. Despite these headwinds, the overall outlook for the market remains strong due to consistent innovation and investments in inverter technology tailored for industrial-grade installations.

Based on product type, the market is divided into string, micro, and central inverters. The string inverter segment is projected to expand at a CAGR exceeding 12% through 2034. Demand for this category is primarily fueled by improvements in design, efficiency, and system scalability, making it a preferred choice for commercial rooftops and mid-sized industrial installations. As solar project developers seek more flexible and modular options, string inverters are becoming increasingly popular across various deployment scales.

In terms of phase configuration, the commercial and industrial PV inverter market is segmented into single phase and three phase systems. The three phase segment accounted for 95.5% of the global market share in 2024, supported by its growing use in large-scale applications such as factory complexes, warehouses, and multi-tenant commercial buildings. Three phase inverters are more efficient for handling high power loads and are better suited for integration with grid systems, which makes them ideal for large-scale installations.

Regionally, the United States has emerged as a key market, with its commercial and industrial PV inverter industry reaching USD 2.9 billion in 2024, up from USD 2.5 billion in 2023 and USD 2.2 billion in 2022. North America held a 17.3% share of the global market in 2024, and this is expected to increase by the end of the forecast period. A robust domestic manufacturing base and faster delivery timelines are helping to accelerate inverter adoption across commercial and industrial installations in the U.S. Market growth is also being reinforced by government-backed initiatives that promote clean energy and reward the use of domestically produced components.

Leading manufacturers are investing heavily in capacity expansion, research and development, and the launch of advanced inverters designed for high-performance applications. These companies are also extending their global reach through strategic partnerships and distribution networks that enable quicker response times and better local service. Collaborations with engineering, procurement, and construction firms, as well as solar developers, have become common, especially for securing large-scale commercial and industrial projects. Local manufacturing and support services continue to be key differentiators in markets with high growth potential.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Standalone

- 7.3 On grid

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Poland

- 8.3.4 Netherlands

- 8.3.5 Austria

- 8.3.6 UK

- 8.3.7 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Canadian Solar

- 9.2 Delta Electronics

- 9.3 Darfon Electronics

- 9.4 Eaton

- 9.5 Fimer Group

- 9.6 Ginlong Technologies

- 9.7 GoodWe

- 9.8 Growatt New Energy

- 9.9 Huawei Technologies

- 9.10 Schneider Electric

- 9.11 SMA Solar Technology

- 9.12 Sungrow

- 9.13 SolarEdge Technologies

- 9.14 Sineng Electric

- 9.15 Tabuchi Electric