|

市場調查報告書

商品編碼

1708881

LNG 船用燃料市場(按船舶類型和地區分類)Lng as a Bunker Fuel Market, By Vessel Type (Offshore Tugs & Service, Ferries, Oil & Chemical Tankers, Container Ships, Gas Carriers, Cargo, Others), By Geography (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) |

||||||

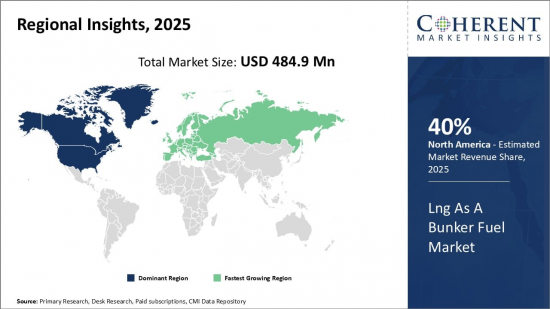

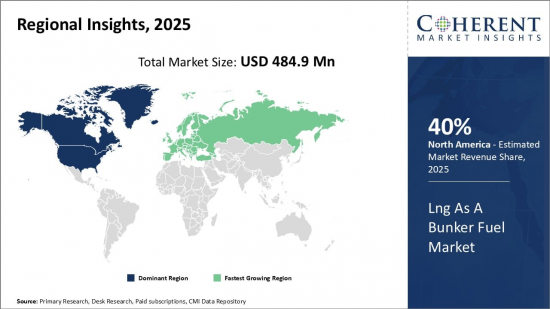

預計 2025 年全球液化天然氣船用燃料市場規模將達到 4.849 億美元,到 2032 年將達到 16.485 億美元,2025 年至 2032 年的複合年成長率為年複合成長率%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025年的市場規模 | 4.849億美元 |

| 效能數據 | 從2020年到2024年 | 預測期 | 2025年至2032年 |

| 預測期:2025-2032年複合年成長率: | 19.10% | 2032年價值預測 | 16.485億美元 |

液化天然氣(LNG)作為船用燃料是指利用LNG作為船舶的動力來源。 LNG 是經過冷卻並變成液體的天然氣,因此可以輕鬆安全地在非加壓狀態下儲存和運輸。作為船用燃料,液化天然氣比重質燃料油等傳統船用燃料有許多優點。由於硫和顆粒物排放較低,它提供了一種更清潔的替代燃料,改善了港口城市的空氣品質。液化天然氣的碳排放比重質燃料油低,符合正在採取的嚴格的氣候變遷目標。從經濟角度來看,液化天然氣價格與石油相關船用燃料相比具有競爭力,並且長期保持穩定。隨著世界各地液化天然氣燃料庫基礎設施的不斷發展,航運業擴大採用液化天然氣作為燃料。

市場動態:

國際海事組織 (IMO) 要求減少船舶硫排放,並對顆粒物和氮氧化物排放實施更嚴格的限制,推動了全球液化天然氣市場作為船用燃料的發展。 2020 年 1 月生效的 IMO 2020 指令正在加速對包括液化天然氣在內的更清潔船用燃料的需求。主要港口和地區擁有液化天然氣燃料庫基礎設施,也為液化天然氣作為船用燃料的廣泛應用提供了機會。然而,將船舶改裝為使用液化天然氣以及建造液化燃料庫網路所需的高昂資本成本仍然是限制大規模採用的主要挑戰。過度依賴特定地區的液化天然氣供應所帶來的地緣政治風險也是一個限制。儘管如此,航運公司的環保意識和永續性目標的提高預計將推動液化天然氣燃料庫的未來機會。

本研究的主要特點

- 本報告對作為船用燃料的液化天然氣市場進行了詳細分析,並以 2024 年為基準年,展示了預測期(2025-2032 年)的市場規模和復合年成長率。

- 它還強調了各個領域的潛在收益成長機會,並說明了該市場的引人注目的投資提案矩陣。

- 它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景和主要企業採用的競爭策略的主要考察。

- 它根據公司亮點、產品系列、關鍵亮點、財務業績和策略等參數列出了液化天然氣作為船用燃料市場的主要企業。

- 本報告的見解將使負責人和企業經營團隊能夠就未來的產品發布、新興趨勢、市場擴張和行銷策略做出明智的決策。

- LNG 作為船用燃料市場報告針對該行業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進入者和金融分析師。

- 透過用於分析液化天然氣作為船用燃料市場的各種策略矩陣,相關人員將能夠更輕鬆地做出決策。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章市場動態、法規與趨勢分析

- 市場動態

- 液化天然氣與傳統燃料相比具有成本競爭力

- 液化天然氣儲存挑戰與安全問題

- 增加液化天然氣產量

- 主要亮點

- 監管情景

- 近期動態

- 產品發布/核准

- PEST分析

- 波特分析

- 合併、收購和合作

4. 液化天然氣市場作為船用燃料-新冠病毒 (COVID-19) 疫情的影響

- COVID-19流行病學

- 供需側分析

- 經濟影響

5. 2020-2032年LNG船用燃料市場(依船舶類型)

- 近海拖船和服務

- 渡輪

- 石油和化學品運輸船

- 貨櫃船

- 氣體裝運船隻

- 貨物

- 其他

6. 2020-2032年液化天然氣(LNG)船用燃料市場(按地區)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭態勢

- 公司簡介

- BP PLC

- Conocophillips Corporation

- Chevron Corporation

- China National Petroleum Corporation

- ENI SPA

- Equinor ASA

- Exxon Mobil Corporation

- PJSC GAZPROM

- Petronas

- Rosneft Oil Company

- Royal Dutch Shell PLC

- Total SA

第 8 章 章節

- 參考

- 調查方法

- 關於出版商

Global Lng As A Bunker Fuel Market is estimated to be valued at USD 484.9 Mn in 2025 and is expected to reach USD 1,648.5 Mn by 2032, growing at a compound annual growth rate (CAGR) of 19.1% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 484.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 19.10% | 2032 Value Projection: | USD 1,648.5 Mn |

Liquefied natural gas (LNG) as a bunker fuel refers to the use of LNG to power ships. LNG is a natural gas that has been cooled to liquid form for ease and safety in non-pressurized storage or transport. As a bunker fuel, LNG offers various benefits compared to conventional bunker fuels such as heavy fuel oil. It is a cleaner alternative as it emits less sulfur and particulate emissions, which improves local air quality in port cities. LNG produces less carbon emissions compared to heavy fuel oil and meets the stringent climate targets adopted. From an economic standpoint, the price of LNG is competitive and more stable over the long term compared to oil-linked bunker fuels. With the growing availability of infrastructure for LNG bunkering worldwide, the maritime industry is progressively adopting LNG as a fuel.

Market Dynamics:

The global LNG as a bunker fuel market is driven by the International Maritime Organization's (IMO) regulations to reduce maritime sulfur emissions and tighten restrictions on particulate matter and nitrogen oxide emissions from ships. The IMO 2020 mandate, which came into effect in January 2020, has accelerated the demand for cleaner marine fuels, including LNG. The availability of LNG bunkering infrastructure in key ports and regions also provides opportunities for wider adoption of LNG as a ship fuel. However, the high capital costs associated with retrofitting ships to use LNG and establishing networks for LNG bunkering remain a key challenge restricting large scale adoption. Geopolitical risks associated with heavy reliance on certain regions for LNG supply are another restraint. Nevertheless, the growing environmental awareness and sustainability targets of shipping companies are expected to drive future opportunities for LNG bunkering.

Key features of the study:

- This report provides an in-depth analysis of the LNG as a bunker fuel market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025 -2032), considering 2024 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the LNG as a bunker fuel market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include a BP P.L.C., Conocophillips Corporation, Chevron Corporation, China National Petroleum Corporation, ENI S.P.A., Equinor ASA, Exxon Mobil Corporation, PJSC GAZPROM, Petronas, Rosneft Oil Company, Royal Dutch Shell PLC, and Total S.A.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The LNG as a bunker fuel market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the LNG as a bunker fuel market

Detailed Segmentation:

- LNG as a Bunker Fuel Market, By Vessel Type

- Offshore Tugs & Service

- Ferries

- Oil & Chemical Tankers

- Container Ships

- Gas Carriers

- Cargo

- Others

- LNG as a Bunker Fuel Market, By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East

- Africa

- Company Profiles

- BP P.L.C.

- Conocophillips Corporation

- Chevron Corporation

- China National Petroleum Corporation

- ENI S.P.A.

- Equinor ASA

- Exxon Mobil Corporation

- PJSC GAZPROM

- Petronas

- Rosneft Oil Company

- Royal Dutch Shell PLC

- Total S.A.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- LNG as a Bunker Fuel Market, By Vessel Type

- LNG as a Bunker Fuel Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Driver

- Cost competitiveness of LNG compared to conventional fuels

- Restraints

- Storage challenges and safety issues of LNG

- Opportunities

- Increasing LNG production

- Key Highlights

- Regulatory Scenario

- Recent Trends

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Mergers, Acquisitions, and Collaborations

4. LNG as a Bunker Fuel Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. LNG as a Bunker Fuel Market, By Vessel Type , 2020-2032 , (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Offshore Tugs & Service

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Ferries

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Oil & Chemical Tankers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Container Ships

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Gas Carriers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Cargo

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

6. LNG as a Bunker Fuel Market, By Region, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- GCC Countries

- Israel

- South Africa

- Central Africa

- North Africa

- Rest of Middle East

7. Competitive Landscape

- Company Profile

- BP P.L.C.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Conocophillips Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Chevron Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- China National Petroleum Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- ENI S.P.A.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Equinor ASA

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Exxon Mobil Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- PJSC GAZPROM

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Petronas

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Rosneft Oil Company

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Royal Dutch Shell PLC

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Total S.A.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Analyst Views

8. Section

- References

- Research Methodology

- About us