|

年間契約型資訊服務

商品編碼

1456206

無線基礎設施訂閱:全球產業分析Wireless Infrastructure Subscription: Global Industry Analysis Subscription |

|||||||

無線基礎架構訂閱:

|

|

|

除報告外,訂閱者還可獲得以下額外資料:

- 重點介紹報告研究結果的現場網路研討會簡報,

- 與分析師進行免費討論

- 免費點閱Stephane Teral 的觀點(超過 8 份出版品)

報告內容

- 市場分析報告(紙本)

- 包含銷售數據和圖表的 Excel 電子表格

- 目標地區:北美、歐洲、中東和非洲、亞太地區、加勒比海地區和拉丁美洲

- 歷史市場數據

- 五年市場預測

- 各供應商的市佔率

2026 年研究議程:

| 報告 | 研究內容 | 月份 |

|---|---|---|

| NEW TES 資料庫 | 綠色排名、基準和市場範圍的能源數據 | 十二月 |

| AI 驅動的 RAN | RAN 中 AI 應用的現狀,包括歷史和生態系統分析,AI RAN 支出及各區域 5 年預測 | 一月 |

| 無線基礎設施:2025 年第四季/2025 財政年度 | 4G/5G RAN、5G 核心網及 EPC 市場分析、市場規模、供應商市佔率及各地區 5 年預測 | 二月 |

| Open vRAN:第一版 | Open RAN RU、vDU、vCU、5G 和 2G/3G/4G 市場規模、生態系統分析、供應商市場佔有率及各區域 5 年預測 | 三月 |

| 日本無線基礎設施 | Open RAN 市場分析、市場規模、供應商市佔率及 5 年預測。通訊服務提供者 (CSP) 用戶數、資本支出、基地台收發器 (BTS) 等。 | 四月 |

| 無線基礎設施:2026 年第一季 | 4G/5G RAN、5G 核心網及 EPC 市場分析、市場規模、供應商市場佔有率及各地區 5 年預測 | 五月 |

| 5G SA 核心網、SDM 與政策 | 生態系分析、市場規模、供應商市場佔有率及各網路功能 5 年預測 | 六月 |

| 中國無線基礎設施 | 七月 | |

| 印度無線基礎設施。 | B經濟與地緣政治分析、RAN 市場規模、供應商市佔率及 5 年預測。通訊服務提供者 (CSP) 用戶數、資本支出、基地台收發器 (BTS) | 七月 |

| 無線基礎設施 | 4G/5G RAN 及核心網市場規模、供應商市佔率及各地區 5 年預測 | 八月 |

| Open vRAN:第二版 | Open RAN RU、vDU、vCU、5G 和 2G/3G/4G 市場規模、生態系統分析、供應商市場佔有率及各地區 5 年預測 | 九月 |

| NEW 國防與軍事應用的 5G 用例 | 5G RAN/O-RAN 及核心網市場分析、市場規模、供應商市佔率及 5 年預測 | 九月 |

| RAN 自動化:SON、AI、RIC 和 SMO | 生態系分析、市場規模、供應商市佔率及各地區 5 年預測 | 十月 |

| 無線基礎設施:3Q26 | 4G/5G RAN 及核心網路市場規模、供應商市佔率及各地區 5 年預測 | 十一月 |

| 6G 基礎設施展望 | 6G 技術、經濟、地緣政治及生態系發展現況、6G 研發支出及 5 年預測地區 | 十二月 |

| NEWTES 電信業者及供應商概況 | 供應商/營運商永續發展記分卡(目標、績效、評估、機會) | 持續更新 |

| Stephane Teral 的觀點 | 基於事實的分析師觀點和洞察,涵蓋產業重大變化和事件 | 持續更新 |

國防與軍事領域的 5G 使用案例(新!)

為何啟動這項新研究?

- 5G 在國防和軍事領域變得至關重要,美國國防部和許多其他國家在軍事基地部署專用 5G 網路以啟用行動作戰中心、連接自主無人機和車輛並支援即時資料處理的策略就證明了這一點。

Teral Research 的目標

- 分析每個國家/地區和/或 CSP 針對國防和軍事用例(包括生態系統)的私有 5G 網路計劃。

- 收集相關投資和支出數據。

- 評估並預測針對國防和軍事用例的 RAN/O-RAN 和核心網路的私有 5G 網路市場規模。

- 了解供應商的市場佔有率。

TES(電信能源與永續性)模組(新!)

該服務為供應商和營運商提供了對績效進行基準測試、增強 ESG 敘事以及確定通往綠色網路的途徑所需的工具。

我們提供的服務

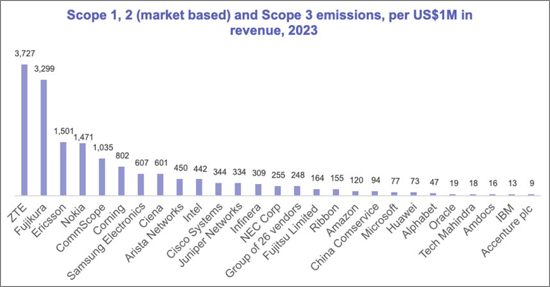

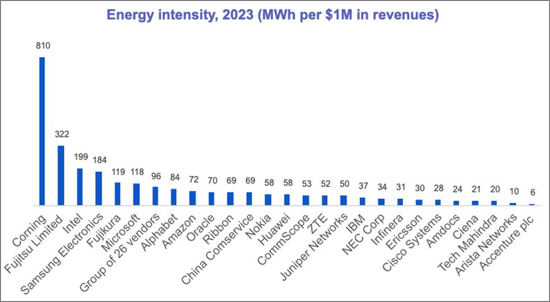

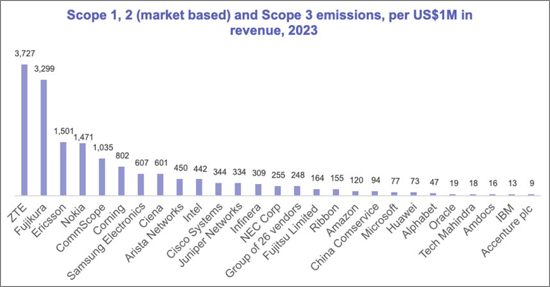

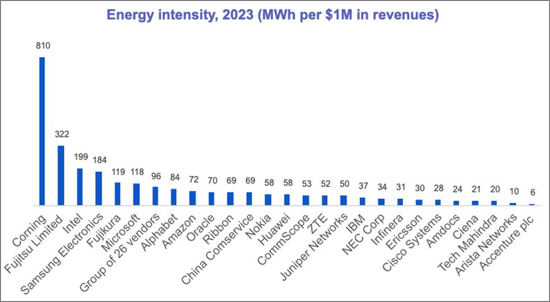

- 年度 Excel 追蹤:綠色排名、基準與市場能源數據

- 簡介:供應商/營運商永續發展記分卡(目標、績效、評估和機會)

附加服務

- 贊助白皮書:深入探討永續發展主題的品牌論文

- 諮詢服務:客製化分析與建議,提升您的永續發展定位

電信網路佔全球電力消耗的2%以上,隨著人工智慧和5G的普及,需求也不斷成長。

同時,在能源成本上升、電網不穩定以及解決ESG問題的壓力日益增大的背景下,實現淨零排放的進展仍然緩慢且難以衡量。

為什麼這很重要?

- 可與同行和業界平均值進行對比

- 可強化 ESG 報告與行銷敘述

- 可識別效率與創新機會

- 可滿足合規性和投資者期望

Stephane Teral 的觀點為何?

- 這十年始於 5G 的快速發展。這場革命有望改變我們生活的各個層面,您不可錯過這個趨勢。

- 電信專家透過及時、引人入勝、富有洞察力且通常充滿趣味的文章,對值得關注的事件和新聞進行批判性分析。

- 透過簡短、切中要點的研究筆記,以誠實、大膽和新穎的視角傳遞訊息,為讀者提供資訊並激發靈感。

我們提供適合您需求的訂閱計劃,從單份報告到完整版報告,應有盡有。我們隨時可為您提供協助,請立即聯絡我們,洽談價格。

"Wireless Infrastructure Subscription" includes the following publications during the calendar year:

|

|

|

In addition to the reports, our subscribers receive the following bonus materials during the calendar year:

- Live webinar presentation highlighting findings from a report

- Free discussion time with the analyst

- Free access to Stephane Teral's Perspectives (8+ publications)

What our reports looks like:

- Written analysis of the market

- Excel spreadsheet with sales data and charts

- Regions: North America, Europe Middle East Africa, Asia Pacific, and Caribbean Latin America

- Market historical data

- Market forecast for next 5 years

- Vendor market shares

Here is our 2026 Research Agenda:

| Report | Description | Month |

|---|---|---|

| NEW->TES Database | Green ranking, benchmarks, and market-wide energy data | December |

| AI-driven RAN | State of AI penetration in RAN, including history and ecosystem analysis, AI RAN spend size and regional 5-year forecasts | January |

| Wireless Infrastructure 4Q25/FY25 | 4G/5G RAN, 5G core and EPC market analysis, size, vendor market shares, regional 5-year forecasts | February |

| Open vRAN 1st Edition | Open RAN RU, vDU, vCU, 5G vs 2G/3G/4G market size, ecosystem analysis, vendor market shares, regional 5-year forecasts | March |

| Japan Wireless Infrastructure | Open RAN market analysis and size, vendor market shares, 5-year forecasts. Includes CSP subscribers, Capex and BTS. | April |

| Wireless Infrastructure 1Q26 | 4G/5G RAN, 5G core and EPC, market analysis, size, vendor market shares, regional 5-year forecasts | May |

| 5G SA Core, SDM and Policy | Ecosystem analysis, market size, vendor market shares, 5-year forecasts by network function | June |

| China Wireless Infrastructure | Economic and geopolitical analysis, RAN market size, vendor market shares, 5-year forecasts. Includes CSP subscribers, Capex and BTS. | July |

| India Wireless Infrastructure | Economic and geopolitical analysis, RAN market size, vendor market shares, 5-year forecasts. Includes CSP subscribers, Capex and BTS. | July |

| Wireless Infrastructure 2Q26 | 4G/5G RAN and core market size, vendor market shares, regional 5-year forecasts | August |

| Open vRAN 2nd Edition | Open RAN RU, vDU, vCU, 5G vs 2G/3G/4G market size, ecosystem analysis, vendor market shares, regional 5-year forecasts | September |

| NEW->5G for Defense & Military Use Cases | 5G RAN/O-RAN & Core market analysis, size, vendor market shares, 5-year forecasts | September |

| RAN Automation: SON, AI, RIC, and SMO | Ecosystem analysis, market size, vendor market shares, regional 5-year forecasts | October |

| Wireless Infrastructure 3Q26 | 4G/5G RAN and core market size, vendor market shares, regional 5-year forecasts | November |

| 6G Infrastructure Outlook | State of 6G developments regarding technology, economics, geopolitics, and ecosystem; 6G R&D spend size and regional 5-year forecast | December |

| NEW->TES Telcos & Vendor Profiles | Vendor/operator sustainability scorecards (targets, performance, recognition, opportunities) | Ongoing |

| Stephane Teral's Perspectives | Fact-based analyst opinions and insights about key industry shifts and events | Ongoing |

5G for Defense & Military Use Cases (New!)

Why we are launching this new research:

- As evidenced by the U.S. Department of Defense's and many countries' strategy for deploying private 5G networks at military bases to enable mobile operations centers, connect autonomous drones and vehicles, and support real-time data processing for intelligence , surveillance, and reconnaissance, 5G is increasingly used and vital for defense and military use cases.

- As a result, a portion of what we track quarterly already fits in this category.

What we plan to achieve:

- Analyze countries' and/or CSPs' private 5G network plans for defense and military use cases, including the ecosystem

- Collect related investments and spendings

- Size and forecast the private 5G network market, both RAN/O-RAN and Core, for defense and military use cases

- Determine vendor market shares

TES (Telecom Energy & Sustainability) Module (New!)

This service equips vendors and operators with the tools they need to benchmark performance, enhance ESG narratives, and identify pathways toward greener networks.

What We Offer:

- Annual Excel Tracker -> Green rankings, benchmarks, and market-wide energy data

- Mini Profiles -> Vendor/operator sustainability scorecards (targets, performance, recognition, opportunities)

Additional Services:

- Sponsored White Papers -> Branded deep dives into sustainability themes, distributed globally

- Consulting Services -> Tailored analysis & recommendations to improve sustainability positioning

Telecom networks consume over 2% of global electricity, and demand is rising with AI and 5G.

Energy costs, grid instability, and ESG pressures are intensifying, while progress toward net-zero remains slow and hard to measure.

Why It Matters:

- Benchmark against peers & industry averages

- Strengthen ESG reporting & marketing narratives

- Identify opportunities for efficiency & innovation

- Support compliance and investor expectations

What is Stephane Teral's Perspective:

- As this decade started in a fast-growing 5G world, you cannot afford to miss a piece of this revolution that is expected to change many aspects of our lives.

- Stay on top of everything with timely eye-catching insightful entertaining opinion pieces of critical analysis on the events and news that telecom professionals should be aware of and pay attention to.

- In the form of short yet straight to the point research notes, we unabatedly inform, inspire and provoke while being honest, fearless and startlingly original.

Choose the subscription package that fits your needs - from single reports to full access. Our packages are ready to go, simply reach out to request pricing.