|

市場調查報告書

商品編碼

1822547

Wi-Fi 模組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wi-Fi Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

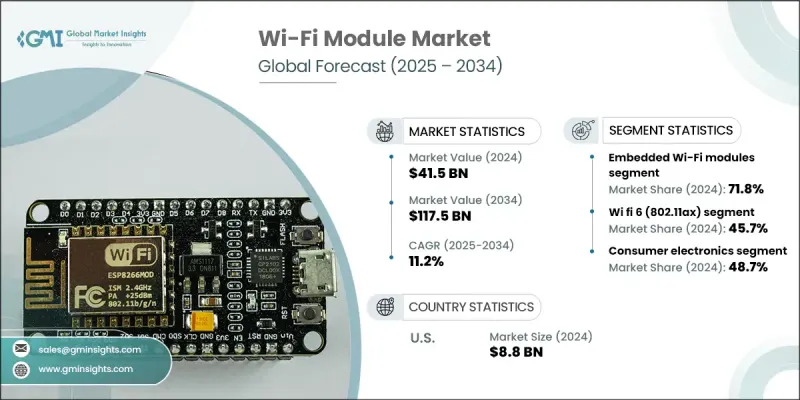

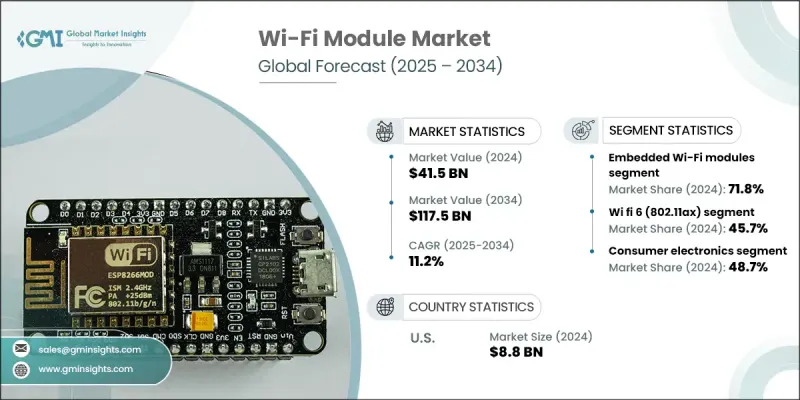

2024 年全球 Wi-Fi 模組市場價值 415 億美元,預計到 2034 年將以 11.2% 的複合年成長率成長至 1175 億美元。

這一成長主要得益於智慧家庭和智慧基礎設施日益普及,這些領域依賴無縫無線連接來實現能源效率、安防系統、娛樂和自動化。汽車產業也做出了巨大貢獻,因為如今整合的Wi-Fi模組已支援連網功能、診斷和軟體更新。邊緣運算、人工智慧和高速資料環境的創新正在推動對先進Wi-Fi技術的需求。低功耗穿戴式裝置在高密度網路環境中的興起以及對增強網路安全的需求也在重塑產品開發策略。隨著Wi-Fi 6、6E和新興Wi-Fi 7技術的日益普及,市場正在快速發展,以支援沉浸式遊戲、4K視訊、AR/VR和即時資料處理等應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 415億美元 |

| 預測值 | 1175億美元 |

| 複合年成長率 | 11.2% |

2024年,嵌入式Wi-Fi模組市場佔71.8%的市場佔有率,達到297億美元。智慧型設備和物聯網設備的快速成長,以及全球無線通訊技術的持續進步,推動了該領域市場的快速發展。製造商應注重緊湊的模組設計、高能源效率以及與多種協議的兼容性,以支援智慧家庭、醫療保健系統和工業自動化平台等應用。

Wi-Fi 6 (802.11ax) 市場在 2024 年佔據了 45.7% 的佔有率,這得益於其處理高網路流量、低延遲和增強吞吐量的能力。此版本尤其適用於高密度連接設備的環境,並提供物聯網應用所需的可靠性。展望未來,建議企業改善 Wi-Fi 6 模組效能,提高節能效果,並增強對更高速度和更廣泛覆蓋範圍的支援。

2024年,美國Wi-Fi模組市場規模達88億美元。遠距辦公的普及、智慧城市基礎設施的不斷部署以及向Wi-Fi 6和Wi-Fi 7技術的早期過渡等趨勢推動了這一成長。為了維持市場領先地位,美國製造商正專注於打造高性能、安全且節能的模組,以滿足互聯家居、汽車系統和數位學習平台的需求。

影響全球 Wi-Fi 模組市場的關鍵公司包括博通公司 (Broadcom Inc.)、高通公司 (Qualcomm Incorporated)、聯發科技公司 (MediaTek Inc.)、德州儀器公司 (Texas Instruments Inc.) 和村田製作所 (Murata Manufacturing Co., Ltd.)。為了在競爭激烈的 Wi-Fi 模組領域中佔據更有利的地位,各大公司正在加大研發投入,以突破無線速度、安全性和能源效率的極限。關鍵策略包括開發新一代 Wi-Fi 6E 和 Wi-Fi 7 模組,這些模組專為汽車互聯、AR/VR 和密集智慧家庭網路等新興應用量身定做。與物聯網設備製造商和原始設備製造商 (OEM) 的策略合作有助於增強整合度和覆蓋範圍。各公司也專注於可擴展的模組設計,該設計支援多頻段、雙頻性能,以滿足不斷變化的消費者和工業需求,同時確保全球部署的向後相容性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 物聯網設備需求不斷成長

- 智慧家庭和智慧建築的普及率不斷提高

- 連網消費性電子產品的成長

- Wi-Fi 技術的改進 - Wi-Fi 6 和 6E

- 工業自動化擴展/智慧製造興起

- 產業陷阱與挑戰

- 資料外洩和設備駭客攻擊的風險。

- 訊號中斷導致網路效能不可靠。

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續發展計劃

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 嵌入式Wi-Fi模組

- Router-Scheme wifi模組

第6章:市場估計與預測:按 Wi-Fi 技術,2021 - 2034 年

- 主要趨勢

- Wi-Fi 4 (802.11n)

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6(802.11ax)

- Wi-Fi 6E(802.11ax,6 GHz)

- Wi-Fi 7 (802.11be)

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 消費性電子產品

- 智慧型手機和平板電腦

- 筆記型電腦和個人電腦

- 穿戴式裝置

- 其他

- 智慧家庭和家電

- 智慧電視和串流媒體設備

- 聯網照明

- 安全系統

- 其他

- 工業的

- 遠端監控系統

- 預測性維護

- 機器人技術

- 其他

- 汽車和運輸

- 車載資訊娛樂

- 電動車充電與遠端資訊處理

- 其他

- 醫療保健和醫療器械

- 遠端病人監控

- 無線診斷設備

- 其他

- 農業和環境監測

- 智慧灌溉控制器

- 牲畜追蹤設備

- 天氣和土壤監測

- 其他

- 建築和基礎設施

- 現場監控設備

- 無線感測器網路

- 互聯機械

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球關鍵參與者

- Qualcomm Incorporated

- Broadcom Inc.

- MediaTek Inc.

- Intel Corporation

- Texas Instruments Inc.

- 區域關鍵參與者

- 北美洲

- Microchip Technology Inc.

- Marvell Technology, Inc.

- 亞太地區

- u-blox Holding AG

- Nordic Semiconductor ASA

- Laird Connectivity

- 歐洲

- Quectel Wireless Solutions Co., Ltd.

- Espressif Systems (Shanghai) Co., Ltd.

- Murata Manufacturing Co., Ltd.

- AzureWave Technologies, Inc.

- Realtek Semiconductor Corp.

- 北美洲

- 利基市場參與者/分銷商

- Telit Cinterion

- NXP Semiconductors NV

- Redpine Signals, Inc.

- Advantech Co., Ltd.

- Silicon Laboratories Inc.

The Global Wi-Fi Module Market was valued at USD 41.5 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 117.5 billion by 2034.

This growth is largely driven by the increasing penetration of smart homes and intelligent infrastructure, which rely on seamless wireless connectivity for energy efficiency, security systems, entertainment, and automation. The automotive industry is also contributing significantly, as Wi-Fi modules are now integrated to support connected features, diagnostics, and software updates. Innovations in edge computing, AI, and high-speed data environments are fueling the demand for advanced Wi-Fi technologies. The rise of low-power devices for wearable tech and the need for enhanced cybersecurity in dense network setups are also reshaping product development strategies. With increasing adoption of Wi-Fi 6, 6E, and emerging Wi-Fi 7 technologies, the market is rapidly evolving to support applications like immersive gaming, 4K video, AR/VR, and real-time data processing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.5 Billion |

| Forecast Value | $117.5 Billion |

| CAGR | 11.2% |

The embedded Wi-Fi modules segment held 71.8% share in 2024, reaching USD 29.7 billion. The surge in this segment is backed by the rapid growth of intelligent and IoT-enabled devices, along with ongoing advancements in global wireless communication technologies. Manufacturers are urged to focus on compact module design, power efficiency, and compatibility with multiple protocols to support applications across smart homes, healthcare systems, and industrial automation platforms.

The Wi-Fi 6 (802.11ax) segment held a 45.7% share in 2024, fueled by its capability to handle high network traffic, low latency, and enhanced throughput. This version is especially suited for environments with a high density of connected devices and delivers the reliability needed for IoT applications. Moving forward, companies are advised to refine Wi-Fi 6 module performance, boost energy savings, and increase support for higher speeds and broader coverage.

United States Wi-Fi Module Market was valued at USD 8.8 billion in 2024. This growth was supported by trends such as widespread remote work, increasing implementation of smart city infrastructure, and early transitions to Wi-Fi 6 and Wi-Fi 7 technologies. To maintain leadership in this market, U.S. manufacturers are focusing on building high-performance, secure, and energy-efficient modules that align with the needs across connected homes, automotive systems, and digital learning platforms.

Key companies shaping the Global Wi-Fi Module Market include Broadcom Inc., Qualcomm Incorporated, MediaTek Inc., Texas Instruments Inc., and Murata Manufacturing Co., Ltd. To establish a stronger position in the competitive Wi-Fi module landscape, top players are investing in R&D to push the limits of wireless speed, security, and energy efficiency. Key strategies include the development of next-generation Wi-Fi 6E and Wi-Fi 7 modules tailored for emerging applications such as automotive connectivity, AR/VR, and dense smart home networks. Strategic collaborations with IoT device manufacturers and OEMs help enhance integration and reach. Companies are also focusing on scalable module design that supports multi-band, dual-frequency performance to meet evolving consumer and industrial demands, while ensuring backward compatibility for global deployments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Wi-Fi technology trends

- 2.2.3 End use trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for IoT Devices

- 3.2.1.2 Increase in Adoption of Smart Home and Smart Buildings

- 3.2.1.3 Growth of Connected Consumer Electronics

- 3.2.1.4 Improvements in Wi-Fi technology - Wi-Fi 6 and 6E

- 3.2.1.5 Expanded Industrial Automation/Rise in Smart Manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of Data Breaches and Device Hacking.

- 3.2.2.2 Signal Disruption Results in Unreliable Network Performance.

- 3.2.3. Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability Initiatives

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Embedded wi-fi modules

- 5.3 Router-Scheme wi-fi modules

Chapter 6 Market Estimates and Forecast, By Wi-Fi Technology, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Wi-Fi 4 (802.11n)

- 6.3 Wi-Fi 5 (802.11ac)

- 6.4 Wi-Fi 6 (802.11ax)

- 6.5 Wi-Fi 6E (802.11ax at 6 GHz)

- 6.6 Wi-Fi 7 (802.11be)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.2.1 Smartphones and tablets

- 7.2.2 Laptops and personal computers

- 7.2.3 Wearables

- 7.2.4 Others

- 7.3 Smart home and appliances

- 7.3.1 Smart TVs and streaming devices

- 7.3.2 Connected lighting

- 7.3.3 Security systems

- 7.3.4 Others

- 7.4 Industrial

- 7.4.1 Remote monitoring systems

- 7.4.2 Predictive Maintenance

- 7.4.3 Robotics

- 7.4.4 Others

- 7.5 Automotive and transportation

- 7.5.1 In-vehicle infotainment

- 7.5.2 EV charging and telematics

- 7.5.3 Others

- 7.6 Healthcare and medical devices

- 7.6.1 Remote patient monitoring

- 7.6.2 Wireless diagnostic equipment

- 7.6.3 Others

- 7.7 Agriculture and environmental monitoring

- 7.7.1 Smart irrigation controllers

- 7.7.2 Livestock tracking devices

- 7.7.3 Weather and soil monitoring

- 7.7.4 Others

- 7.8 Construction and infrastructure

- 7.8.1 Site surveillance equipment

- 7.8.2 Wireless sensor networks

- 7.8.3 Connected machinery

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Qualcomm Incorporated

- 9.1.2 Broadcom Inc.

- 9.1.3 MediaTek Inc.

- 9.1.4 Intel Corporation

- 9.1.5 Texas Instruments Inc.

- 9.2 Regional key players

- 9.2.1 North America

- 9.2.1.1 Microchip Technology Inc.

- 9.2.1.2 Marvell Technology, Inc.

- 9.2.2 Asia Pacific

- 9.2.2.1 u-blox Holding AG

- 9.2.2.2 Nordic Semiconductor ASA

- 9.2.2.3 Laird Connectivity

- 9.2.3 Europe

- 9.2.3.1 Quectel Wireless Solutions Co., Ltd.

- 9.2.3.2 Espressif Systems (Shanghai) Co., Ltd.

- 9.2.3.3 Murata Manufacturing Co., Ltd.

- 9.2.3.4 AzureWave Technologies, Inc.

- 9.2.3.5 Realtek Semiconductor Corp.

- 9.2.1 North America

- 9.3 Niche Players/Distributors

- 9.3.1 Telit Cinterion

- 9.3.2 NXP Semiconductors N.V.

- 9.3.3 Redpine Signals, Inc.

- 9.3.4 Advantech Co., Ltd.

- 9.3.5 Silicon Laboratories Inc.