|

市場調查報告書

商品編碼

1808077

嵌入式和邊緣 AI 硬體:邁向量產Embedded & Edge AI Hardware: The Rubber Meets the Road for Production Scale |

||||||

本報告的內容

嵌入式和邊緣 AI 市場正在快速發展,這得益於處理技術、軟體工具、模型可用性和開源計劃的廣泛進步。邊緣 AI 機會涵蓋整個嵌入式硬體領域,從超低功耗感測器到高性能近邊緣基礎設施,核心技術供應商不斷尋求將其定位為新收入來源的核心,而這些創新也使其受益匪淺。目標邊緣系統類型、覆蓋範圍、部署參數和最終用戶產業的碎片化,使得任何一家公司都無法完全主導龐大的邊緣 AI 運算市場。市場不斷發展,新的解決方案和參與者不斷湧入,從小型新創公司到已經在嵌入式領域深耕數十億美元的大型企業,不一而足。

本報告探討了商用嵌入式 AI 硬體市場中最具影響力的廠商和關鍵參與者,這些硬體產品銷往第三方/外部 OEM 和 ODM、系統整合商、服務供應商以及企業/工業終端用戶。市場正在不斷擴張,邊緣 AI 解決方案已部署到各個領域,包括航空航太和國防、汽車、通訊和網路、消費性電子、數位安全和監控、能源和電力、工業自動化和控制、醫療設備和醫療保健、零售自動化和數位看板、機器人以及運輸和物流。本報告也詳細分析了各種形態的商用嵌入式和邊緣 AI 硬體解決方案的競爭格局。

本報告也研究了嵌入式和邊緣 AI 硬體的總面積市場 (TAM),提供了獨立處理器、運算模組、主機板、單板電腦、整合系統和伺服器的市場規模估算和趨勢分析。該報告還深入探討了嵌入式 AI 硬體領域的關鍵應用驅動因素、生產規模擴大和轉型。

本報告探討的問題:

- 全球嵌入式與邊緣 AI 硬體市場規模?哪些因素推動了其成長?

- 哪些產業在邊緣 AI 的全面量產部署方面處於領先地位?

- 哪些區域因素和法規將影響邊緣 AI 解決方案的發展?

- 嵌入式和邊緣 AI 處理器、模組、主機板、單板電腦 (SBC)、整合系統/伺服器及其所包含的硬體加速器的領先供應商有哪些?

- 哪些形態的 AI 硬體加速器將達到最快的成長?

- 在您目前的工程專案中,哪些嵌入式堆疊組件和特性/功能與邊緣 AI 的協同作用最強?

- 邊緣系統現在和三年後需要多少邊緣 AI 效能?

本報告中涉及的技術提供者

|

|

|

主要發現:

- 預計全球嵌入式和邊緣 AI 硬體市場規模將從 2024 年的約 178 億美元增長到 2029 年的 464 億美元以上,複合年增長率為 21.1%。

- 在嵌入式分立 MPU、MCU 和 SoC 中,整合 NPU 是整個預測期內成長最快的 AI 加速器類型。

- 在嵌入式運算模組市場(CoM 和 SoM),整合 GPU 加速將佔邊緣 AI 出貨量收入的近一半,當用作主機板、SBC 和整合系統/伺服器上的附加加速器時,採用率甚至更高。

- 嵌入式和邊緣 AI 硬體的最大終端用戶產業包括汽車、通訊和網路、消費性電子、工業自動化和控制、零售自動化和數位看板,醫療保健和機器人技術也在迅速崛起。

- 美洲地區在嵌入式/OEM AI 系統和伺服器市場中佔有最大份額,而亞太地區由於其製造基地的集中,在組件處理器和計算模組方面處於領先地位。

- VDC Research 的 "工程師之聲" 調查數據顯示,嵌入式 AI 專案/產品與行動或電池供電的外形尺寸、增強的安全性(硬體和軟體)、遠端應用程式部署和管理以及機器視覺/物體檢測等功能之間存在很強的相關性。

報告摘錄

目錄

該報告的內容

摘要整理

- 主要調查結果

全球市場:概要

- AI 功能的全系統堆疊考量

- 支援硬體所需的 AI 軟體

- 整合與附加加速技術

- 最近的M&A,策略性聯盟

各地區的趨勢·預測

各終端用戶產業趨勢·預測

- 汽車

- 通訊·網路

- 工業自動化·控制

- 機器人技術

- 新興市場

AI加速器趨勢·預測

- NPU

- 圖形處理器

- 其他

終端用戶的洞察

- 邊緣 AI 與其他嵌入式功能和特性緊密相關。

- 嵌入式 AI 專案容易出現技術障礙和整合問題。

- 邊緣 AI 需要一個全面的技術平台和強大的軟體支援。

- AI 工作負載和加速器需求正在不斷發展。

競爭情形

- 競爭情形概要

- 供應商洞察

- 新興企業

調查範圍·調查手法

- AI,機器學習,神經網

關於作者

關於VDC Research

Inside this Report

The embedded and edge AI marketplace is rapidly evolving behind widespread advances in processing technology, software tooling, model availability, and open source initiatives. The market opportunity for edge AI spans the gamut of embedded hardware footprints from ultra-low-power sensors to high-performance near edge infrastructure, which all stand to benefit from the continuous innovation of core technology providers trying to center themselves within this new revenue stream. As with such fragmentation in target edge system types, footprints, deployment parameters, and vertical end users, no single company can completely take over the expansive edge AI computing market. It is under near-constant change with new solutions and players entering the market, including small upstarts as well as multi-billion-dollar organizations that are firmly entrenched in the embedded sector already.

Within this report is VDC's research-driven commentary about the largest influences and players in the burgeoning commercial market for embedded AI hardware sold to third-party/external OEMs/ODMs, system integrators, service providers, and enterprise/industrial end users. The market is increasingly broad with varying regional adoption and real-world deployments of edge AI solutions into domains such as aerospace and defense, automotive, communications and networking, consumer electronics, digital security and surveillance, energy and power, industrial automation and control, medical devices and healthcare, retail automation and digital signage, robotics, transportation and logistics, and other verticals. This research also includes an in-depth analysis of the competitive landscape for commercial embedded and edge AI hardware solutions of various form factors.

This market research report investigates the global merchant TAM for embedded and edge AI hardware, including dedicated sizing and trends analysis across the markets for discrete processors, computing modules, motherboards, single-board computers, and integrated systems and servers. It features a deep investigation into the key drivers for adoption, production scale up, and transformation in the embedded AI hardware space supported by highly granular market sizing, research interviews and ongoing conversations/projects with several dozen key ecosystem members and leading device suppliers, as well as interviews with and large-scale surveys of decision makers at product development organizations.

What Questions are Addressed?

- How large is the global market for embedded and edge AI hardware, and what is driving its growth?

- Which vertical markets are leading the charge for full-scale production rollouts of edge AI?

- What regional factors and regulations will impact the development of edge AI solutions?

- Who are the leading providers of embedded and edge AI processors, modules, boards, SBCs, and integrated systems/servers and the hardware acceleration within their offerings?

- Which types of AI hardware accelerators are expected to grow the fastest for different form factors?

- Which embedded stack components and capabilities/features have the most synergy with edge AI in engineering projects today?

- How much edge AI performance is needed in today's edge systems and three years from now?

Who Should Read this Report?

This report was written for those making critical decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing, or are a part of the ecosystem of, IoT, embedded, and/or edge AI computing solutions, including:

|

|

Technology Providers in this Report:

|

|

|

Demand-side Research Overview

VDC launches numerous surveys of the IoT and embedded engineering ecosystem every year using an online survey platform. To support this research, VDC leverages its in-house panel of more than 30,000 individuals from various roles and industries across the world. Our global Voice of the Engineer survey recently captured insights from a total of 600 qualified respondents. This survey was used to inform our insight into key trends, preferences, and predictions within the engineering community.

Executive Summary

Edge AI is sweeping the embedded hardware market faster and with more impact than any individual technology revolution before - whether multicore processing, hardware-based security, M2M communications, IoT connectivity platforms, or local intelligent analytics. The edge AI revolution has transformed decision-making in product development and reshaped the very core of hardware architecture choice and design. It is a blanket trend that is driving rapid advances in many established and new embedded/OEM use cases, both to internal systems and services optimization as well as for external/customer applications. Edge AI is creating a rare inflection point in the embedded sector, driving transformation in a market long characterized by slow adoption and resistance to major architectural change due to entrenched design dependencies, stringent cost constraints, regulatory compliance demands, security requirements, and other barriers.

Mounting data volumes in the field, despite great advances in connectivity and embedded storage technologies through the past several years, continues to challenge data utilization strategies. The only way to achieve maximum autonomy and extract the maximum value from far edge/endpoint and operational data is to employ edge AI at several levels of end-to-end IoT and industrial solutions. However, each edge AI deployment, even within the same industries or environments, has its own unique considerations for power availability, network access, connected devices (i.e., cameras, sensors) and infrastructure, data types, etc. As a result, a wide variety of AI hardware solutions and integrated or attached workload acceleration technologies are in high demand within the IoT, embedded, and edge computing market to cater to the vast needs of manufacturers, integrators, and end users.

Key Findings:

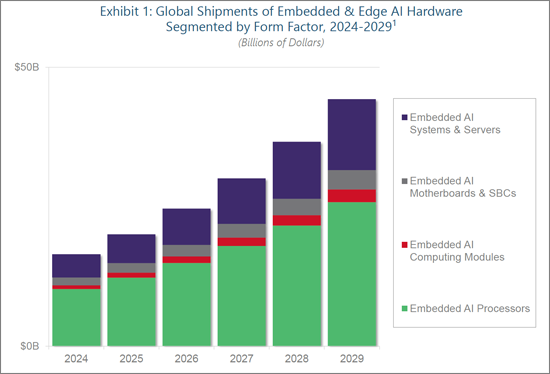

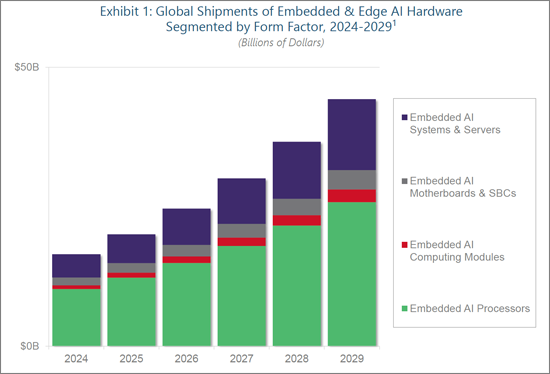

- The global embedded and edge AI hardware market is projected to grow from ~$17.8B in 2024 to over $46.4B by 2029, reflecting a CAGR of 21.1%.

- Integrated NPUs are the fastest-growing AI accelerator type throughout the forecast period for discrete embedded MPUs, MCUs, and SoCs.

- In the embedded computing modules market (CoMs and SoMs), integrated GPU-driven acceleration accounts for nearly half of edge AI revenue shipments, with adoption rates even higher when used as attached accelerators for motherboards, SBCs, and integrated systems/servers.

- The largest vertical markets for embedded and edge AI hardware are automotive, communications and networking, consumer electronics, industrial automation and control, and retail automation and digital signage, with other segments such as medical/healthcare and robotics rapidly emerging.

- The Americas holds the largest share of the embedded/OEM AI systems and servers market, while Asia-Pacific's manufacturing concentration makes it the leading region for component processors and computing modules.

- VDC Research's Voice of the Engineer survey data shows a strong correlation between embedded AI projects/products and features such as mobile or battery-powered form factors, security enhancements (hardware and software), remote application deployment and management, and machine vision/object detection.

Report Excerpt

The embedded and edge AI hardware market is expanding rapidly, increasing its share within the broader markets for embedded processors, computing modules, motherboards, single-board computers, and integrated systems/servers. Through its implementation in both general-purpose hardware as well as via the growing portfolios of dedicated product families, embedded and edge AI capabilities are becoming table stakes for engineering organizations and end users worldwide and across industries. AI and machine learning technologies are unlocking significant value in the field, enabling the next data revolution with advancements in vision and imaging systems, sensor platforms, power and connectivity infrastructure, user interaction, and other domains.

Although AI and machine learning are not new to the embedded market, the surrounding ecosystem of hardware accelerators, software development platforms, open-source models, and AI frameworks has radically expanded their potential, from MCU-based sensors to many-core systems and servers. At the same time, the market opportunity for embedded and edge AI isn't confined to only greenfield deployments or new infrastructure rollouts. Given the long deployment lifetimes typical in many of the leading embedded hardware markets, there is strong demand for computing solutions to augment existing deployments or designs with attached or in-line edge AI capabilities - transforming "dumb" sensors, cameras, client devices, machinery, and other operational systems into intelligent platforms to achieve new efficiencies, controls, or levels of automation.

1 Note: Exhibit has been modified for the Executive Brief. Granular market forecast data is available within the report.

Scope & Methodology

AI, Machine Learning & Neural Networks

For the purposes of this report, VDC defines artificial intelligence as the ability of machines to mimic the cognitive functions of humans and carry out complex tasks in an autonomous or semi-autonomous fashion.

Machine learning (ML) is an application of AI that allows a system to improve its operation through the analysis and reimplementation of collected data without the need for explicit reprogramming. Production ML systems generally consist of a large bundle of code and tools surrounding the core ML decision-making code. Data collection, feature extraction, process management tools, data verification, machine resource management, configuration, analysis tools, monitoring, and server infrastructure are all vital components for production ML systems. The objective of ML is to build a tool and compute-based framework that allows machines to combine inputs to produce useful predictions on never-before-seen data. Machine learning models can be static or dynamic. A static model is trained offline, exactly once, then run on this system for a period of time before being updated. A dynamic model is trained on an ongoing basis, with data continuously entering the system and training the model as it operates.

A neural network (NN) further optimizes an ML system by adding layers of nodes to a model. A node consists of one or more weighted input connections, a transfer function that combines the inputs, and an output connection to the larger model. These layers of nodes transform the data in useful ways before it is passed to the final output node of the ML algorithm to use in its decision or classification. NNs allow for much more complex actions to be performed on incoming data and are useful for nonlinear systems where an ML algorithm must distinguish between many different possibilities (e.g., "Is this image an apple, a bear, an egg, or a duck?") rather than binary yes or no decisions. NNs are classified as deep learning methods or algorithms that attempt to learn broader data representations and patterns, as opposed to inflexible, task-specific algorithms.

Methodology

VDC produces its forecasts from a combination of primary and secondary data, including its own surveys and in- depth interviews with OEMs and industry executives; internal historical data sets and market models; public and privately disclosed numbers from vendors and customers, industry organizations, trade publications, and conferences; and our analysts' extensive base of industry experience and knowledge.

In this report, we size the market for merchant embedded and edge hardware supporting AI applications that are built for, and deployed on, OEM and embedded systems. It does not include the captive portion of the market, which includes hardware designed and built internally at OEMs solely for internal use or integration into their own larger systems or end products.

The embedded and edge AI hardware market sizing estimates and forecasts are based on a combination of:

- (1) VDC's longstanding expertise and ongoing coverage of the total market opportunity for merchant processors, boards, modules, and integrated systems;

- (2) frequently updated engineering survey data from product development organizations designing, building, deploying, and managing edge AI solutions;

- (3) in-depth interviews with decision-makers at OEMs and other embedded technology customers; and

- (4) regular discussions with embedded and edge technology providers and broader ecosystem participants.

Table of Contents

Inside this Report

Executive Summary

- Key Findings

Global Market Overview

- Full System Stack Considerations for AI Capabilities

- AI Software Needed for Hardware Enablement

- Integrated & Attached Acceleration Technology

- Recent Acquisitions, Mergers & Strategic Partnerships

Regional Trends & Forecast

Vertical Market Trends & Forecast

- Automotive

- Communications & Networking

- Industrial Automation & Control

- Robotics

- Emerging Markets

AI Accelerator Trends & Forecast

- NPU

- GPU

- Others

End-user Insights

- Edge AI has Strong Connections with other Embedded Capabilities/Features

- Embedded AI Projects are Prone to Technical Obstacles & Integration Issues

- Edge AI Demands a Comprehensive Technology Platform Including Rich Software Support

- AI Workloads & Accelerator Needs are Evolving

Competitive Landscape

- Competitive Landscape Overview

- Vendor Insights

- Emerging Players

Scope & Methodology

- AI, Machine Learning & Neural Networks

About the Authors

About VDC Research

List of Report Exhibits

- Exhibit 1: Global Shipments of Embedded & Edge AI Hardware Segmented by Form Factor, 2024-2029

- Exhibit 2: Typical AI Accelerator Performance vs. Thermal Design Power Segmented by Accelerator Type

- Exhibit 3: Typical Performance Needs for Common Edge AI Workloads

- Exhibit 4: Level of AI/ML Performance Expected for Target Systems to Run Typical End User/Customer Workloads

- Exhibit 5: Notable Acquisitions by Embedded & Edge AI Hardware Leaders Since Mid-2023

- Exhibit 6: Global Shipments of Embedded & Edge AI Hardware Segmented by Region

- Exhibit 7: Global Shipments of Embedded & Edge AI Processors Segmented by Vertical Market

- Exhibit 8: Global Shipments of Embedded & Edge AI Computing Modules Segmented by Vertical Market

- Exhibit 9: Global Shipments of Embedded & Edge AI Motherboards & SBCs Segmented by Vertical Market

- Exhibit 10 Global Shipments of Embedded & Edge AI Systems & Servers Segmented by Vertical Market

- Exhibit 11 Leading Embedded & Edge AI Applications Segmented by Vertical Market

- Exhibit 12 Global Shipments of Embedded & Edge AI Processors Segmented by AI Accelerator Type

- Exhibit 13 Global Shipments of Embedded & Edge AI Boards, Modules & Systems Segmented by AI Accelerator Type

- Exhibit 14 Capabilities/Features in Current IoT, Embedded & Edge AI and Non-AI Projects

- Exhibit 15 Leading Causes for Project Delays in Edge AI Engineering Projects

- Exhibit 16 Embedded Software Stack Components Required in Current IoT, Embedded & Edge AI and Non-AI Projects

- Exhibit 17 Types of Artificial Intelligence Workloads Used in Current Projects & Expected Three Years From Now

- Exhibit 18 Leading Embedded AI Processors & Motherboards Vendor Shares Segmented by Form Factor, 2024

- Exhibit 19 Leading Embedded AI SBCs, Integrated Systems & Servers Vendor Shares Segmented by Form Factor, 2024

List of Market Data Exhibits

Embedded AI Processors

- Exhibit 1: Embedded AI Processors, Discrete Processor Type, Dollar Volume Shipments, 2024-2029

- Exhibit 2: Embedded AI Processors, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 3: Embedded AI Processors, Region, Dollar Volume Shipments, 2024-2029

- Exhibit 4: Embedded AI Processors, Customer Class, Dollar Volume Shipments, 2024-2029

- Exhibit 5: Embedded AI MPU Processors, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 6: Embedded AI MCU Processors, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 7: Embedded AI SoC Processors, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 8: Embedded AI MPU Processors, Integrated AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 9: Embedded AI MCU Processors, Integrated AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 10: Embedded AI SoC Processors, Integrated AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 11: Embedded AI MPU Processors, Integrated AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 12: Embedded AI MCU Processors, Integrated AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 13: Embedded AI SoC Processors, Integrated AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 14: Embedded AI Processors, Global Supplier Shares, Dollar Volume Shipments, 2024

Embedded AI Computing Modules

- Exhibit 1: Embedded AI Computing Modules, Form Factor, Dollar Volume Shipments, 2024-2029

- Exhibit 2: Embedded AI Computing Modules, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 3: Embedded AI Computing Modules, Region, Dollar Volume Shipments, 2024-2029

- Exhibit 4: Embedded AI Computing Modules, Customer Class, Dollar Volume Shipments, 2024-2029

- Exhibit 5: Embedded AI Computing Modules, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 6: Embedded AI Computing Modules, Integrated AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 7: Embedded AI Computing Modules, Integrated AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 8: Embedded AI Computer-on-Modules, Global Supplier Shares, Dollar Volume Shipments, 2024

- Exhibit 9: Embedded AI System-on-Modules, Global Supplier Shares, Dollar Volume Shipments, 2024

Embedded AI Motherboards & SBCs

- Exhibit 1: Embedded AI Motherboards & Single-board Computers, Form Factor, Dollar Volume Shipments, 2024-2029

- Exhibit 2: Embedded AI Motherboards & Single-board Computers, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 3: Embedded AI Motherboards & Single-board Computers, Region, Dollar Volume Shipments, 2024-2029

- Exhibit 4: Embedded AI Motherboards & Single-board Computers, Customer Class, Dollar Volume Shipments, 2024-2029

- Exhibit 5: Embedded AI Motherboards & Single-board Computers, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 6: Embedded AI Motherboards & Single-board Computers, Integrated/Attached AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 7: Embedded AI Motherboards & Single-board Computers, Integrated/Attached AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 8: Embedded AI Motherboards, Global Supplier Shares, Dollar Volume Shipments, 2024

- Exhibit 9: Embedded AI Single-board Computers, Global Supplier Shares, Dollar Volume Shipments, 2024

Embedded AI Systems & Servers

- Exhibit 1: Embedded AI Systems & Servers, Form Factor, Dollar Volume Shipments, 2024-2029

- Exhibit 2: Embedded AI Systems & Servers, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 3: Embedded AI Box PCs & Other Active Backplane Systems, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 4: Embedded AI Rackmount & Blade Servers, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 5: Embedded AI Standalone Systems & Mobile Platforms, Vertical Market, Dollar Volume Shipments, 2024-2029

- Exhibit 6: Embedded AI Systems & Servers, Region, Dollar Volume Shipments, 2024-2029

- Exhibit 7: Embedded AI Systems & Servers, Customer Class, Dollar Volume Shipments, 2024-2029

- Exhibit 8: Embedded AI Systems & Servers, CPU Architecture, Dollar Volume Shipments, 2024-2029

- Exhibit 9: Embedded AI Systems & Servers, Integrated/Attached AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 10: Embedded AI Box PCs & Other Active Backplane Systems, Integrated/Attached AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 11: Embedded AI Rackmount & Blade Servers, Integrated/Attached AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 12: Embedded AI Standalone Systems & Mobile Platforms, Integrated/Attached AI Accelerator Type, Dollar Volume Shipments, 2024-2029

- Exhibit 13: Embedded AI Systems & Servers, Integrated/Attached AI Accelerator Provider, Dollar Volume Shipments, 2024- 2029

- Exhibit 14: Embedded AI Box PCs & Other Active Backplane Systems, Integrated/Attached AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 15: Embedded AI Rackmount & Blade Servers, Integrated/Attached AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 16: Embedded AI Standalone Systems & Mobile Platforms, Integrated/Attached AI Accelerator Provider, Dollar Volume Shipments, 2024-2029

- Exhibit 17: Embedded AI Systems & Servers, Global Supplier Shares, Dollar Volume Shipments, 2024

- Exhibit 18: Embedded AI Box PCs & Other Active Backplane Systems, Global Supplier Shares, Dollar Volume Shipments, 2024

- Exhibit 19: Embedded AI Rackmount & Blade Servers, Global Supplier Shares, Dollar Volume Shipments, 2024

- Exhibit 20: Embedded AI Standalone & Mobile Platforms, Global Supplier Shares, Dollar Volume Shipments, 2024

IoT & Embedded Engineering Survey (Partial)

- Exhibit 30: Capabilities/Features of Current Project

- Exhibit 60: Primary Method for Updating Devices Once Deployed in Field

- Exhibit 70: Discrete/Standalone Processing Unit(s) Used on Current Project

- Exhibit 140: Types of Artificial Intelligence Workloads Used in Current Projects

- Exhibit 142: Types of Machine Learning Used for AI in Current Projects

- Exhibit 147: Target Architecture(s) Used for Inferencing In Current Project

- Exhibit 151: Current Level of AI/ML Performance Expected for Target Systems to Run Typical End User/Customer Workloads