|

市場調查報告書

商品編碼

1808959

近眼顯示市場趨勢與技術分析(2025年)2025 Near-Eye Display Market Trend and Technology Analysis |

|||||||

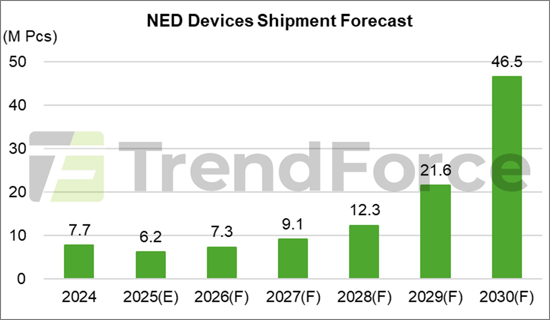

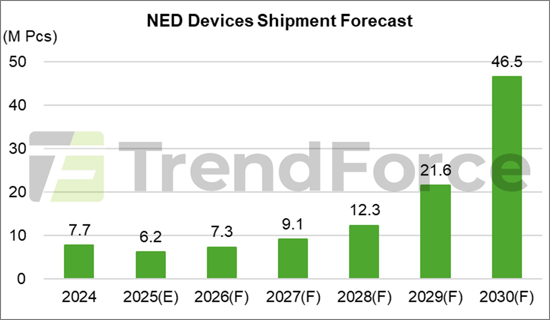

在 "近眼顯示市場趨勢與技術分析(2025)" 中,預計近眼顯示設備市場短期內將保持低迷,2025年全球出貨量預測為620萬台。 Meta的Quest 3s表現低於預期,預計2025年出貨量將降至560萬台。相比之下,AR設備短期內表現出強勁勢頭。在新型AI+AR產品的推動下,以及OLEDoS成本下降,預計2025年出貨量將達到60萬台。從中長期來看,Meta和蘋果等主要公司對VR/MR產品的開發預計將增強生態系統。同時,基於通知功能的AR設備的強勁需求以及高端全彩AR產品的興起將推動長期增長,預計到2030年,全球NED設備出貨量將激增至4650萬台。

AR顯示技術展望

AR顯示技術的選擇反映了品牌策略和市場趨勢。 TrendForce指出,OLEDoS面臨來自其他顯示技術的日益激烈的競爭。目前,其成本優勢預計將在中國保持主導地位。由於Meta的採用,LCoS預計將推動市場成長,而採用單色LEDoS的通知功能AR眼鏡的成長也推動了LEDoS的普及。

長遠來看,AR 設備將需要更高的運算能力、更長的電池續航時間和更強大的顯示效能。全球品牌正傾向高規格、全彩的 LEDoS 技術。隨著成本下降和效能提升,TrendForce 預測,到 2030 年,配備全彩 LED 的 Surface AR 設備出貨量將達到 2,090 萬台,佔總市場滲透率的 65%。

波導製程與 SiC 聯盟分析

波導技術仍是 AR 光學引擎的關鍵差異化因素。衍射波導目前是主流,但仍需提高效率。

波導製造主要由兩種製程技術主導:

- 奈米壓印光刻 (NIL) - 低模具成本和對複雜奈米結構設計的適應性使其適合早期小批量開發。

- 光刻 (PL) - 高產量、長光罩壽命以及高折射率 SiC 材料的直接加工使其適合大規模生產。

TrendForce 觀察到,中國 SiC 供應商與波導製造商的合作正在增加。 SiC 的高折射率使其成為一種極具前景的材料。目前,中國的 SiC 基板主要以 4 英吋和 6 英吋為主,但成本效益正在推動其朝向更大尺寸轉變。到 2030 年,8 吋 SiC 晶圓的出貨量預計將超過 20%,12 吋也有望發展。這將進一步加速 PL 技術的普及。

AR 品牌策略與規格趨勢

隨著 AR 光學引擎模組尺寸的縮小,規格趨於趨同,從而限制了差異化。 CMOS 基板尺寸和設計正趨向標準化以控製成本。目前,大多數 LEDoS 和 LCoS 面板尺寸為 0.13-0.18 英寸,像素密度超過 5,500 PPI。 LEDoS 的解析度通常在 640x480 到 720x720 之間,而 LCoS 面板的解析度通常為 720x720。這促使各品牌追求不同的策略方向。

Xreal 專注於擴大視野角 (FOV) 和提升運算效能的顯示技術和演算法。 RayNeo 正在推廣全彩 LEDoS+波導 AR 眼鏡,同時強化其用於媒體消費的 OLEDoS+Birdbath 解決方案。同時,INMO 優先考慮一體化 AI 驅動的 AR 設備。 Meta 計劃打造完整的產品線,並大力投資 AI 功能,以應對蘋果未來的市場進入。

這一趨勢凸顯了 AR 市場正從單純的硬體競爭轉向更整合的軟硬體生態系統。

目錄

第1章 近眼顯示設備市場分析

- NED設備出貨分析,2025年~2030年

- VR/MR出貨分析,2025年~2030年

- 全球VR/MR設備市場佔有率(各技術),2025年~2030年

- VR/MR設備市場規模分析:LCD/OLEDoS,2025年~2030年

- AR出貨分析,2025年~2030年

- AR設備市場佔有率(各地區)

- 全球AR設備市場佔有率(各技術),2025年~2030年

- AR設備市場規模分析:LCD/OLEDoS,2025年~2030年

第2章 近眼顯示技術的開發趨勢分析

- 2.1.VR/MR顯示器技術與市場趨勢分析

- VST 的固有問題:幾何失真

- 注視點技術可減少資料傳輸和功耗

- 亮度感知也聚焦在註視點 - 暈影

- 利用偏光和餅狀技術實現注視點 VR 顯示屏

- 降低 LCD 功耗的解決方案

- Mini-LED 背光餅狀補償的損耗

- 直射光會降低 Mini-LED 背光的對比增益

- RGB Mini-LED 背光拓展 LCD VR 的潛力

- 我們會從藍光 Mini-LED 升級到 RGB Mini-LED 嗎?

- 定向背光是LCD VR的理想目標

- 12吋OLEDoS廠商產能分析

- 全彩OLEDoS技術橫向比較

- 採用三噴嘴蒸鍍系統PPI上限的改良型OLEDoS

- VR/MR發展

- 2.2.AR顯示器技術與市場趨勢分析

- 光源規格與價格最佳點分析

- 多區域Micro/Mini LED背光增強LCoS對比度並降低功耗

- LCoS的進一步小型化:平面光技術的持續研究

- LCoS技術發展趨勢

- LEDoS從X-Cube向單晶片全彩演進過程中所面臨的課題

- 推動從X-Cube轉向單晶片全彩解決方案的因素LEDoS 技術

- 全彩 LEDoS 技術橫向比較

- 全彩 LEDoS 技術縱向堆疊橫向比較

- 垂直堆疊 LEDoS 關鍵技術分析:首爾偉傲世/JBD

- 全彩 LEDoS 技巧 - InGaN 橫向比較

- CMOS 驅動微型顯示器背板尺寸擴展至 12 吋

- 從背板設計到系統整合,LEDoS CMOS 技術面臨的技術課題

- 晶片鍵合製程分析

- 晶圓鍵合製程分析

- 索尼半導體也提出 LEDoS 的 D2W2W 技術

- LEDoS 參與者產能分析

- LCoS 和 LEDoS

- DoS 和 LCoS 功耗比較

- LEDoS 和 LCoS 顯示器規格分析

- LEDoS 和 LCoS 規格分析全彩光引擎

- 2.3. AR光學技術及市場趨勢分析

- 幾何波導

- 繞射波導

- 繞射波導三大關鍵參數的折衷

- 衍射波導的效率課題

- 奈米壓印微影 (NIL) 與光刻 (PL)

- 熱NIL和紫外線NIL

- 熱NIL的課題

- 幾何光學波導的Rain技術

- 偏振系統

- Ant Reality Optics - 混合波導

- 合束器技術的優缺點

- 元波導專利策略

- 友達光電和京東方參與SRG波導

- 2.4.SiC 光波導技術及市場趨勢分析

- Meta Orion AR:SiC 光波導+雙面光柵

- SiC 波導應用的可行性與局限性

- 各 SiC 晶圓尺寸 AR 玻璃產量

- SiC 晶圓市場分析

- SiC 產業鏈廠商

- 2.5.AR 系統技術及市場趨勢分析

- 新興技術:近眼顯示中的眼動追踪

- AR/VR - 眼動追蹤優勢分析

- 眼動追蹤 - PCCR 與 AI 影像分析

- 眼動追蹤 - 品牌策略及價值鏈分析

- SoC

第3章 全球AR產品開發趨勢分析

- 3.1.中國的AR產品開發趨勢分析

- AR的開發

- 中國AR品牌-Xreal

- 中國AR品牌-RayNeo

- 中國AR品牌-INMO

- 中國AR品牌-Rokid/MEIZU

- 中國AR眼鏡的比較:重量/顯示器技術

- 中國AR眼鏡的比較:價格/顯示器技術

- 3.2.AR產品開發趨勢分析- 中國以外

- AI/AR眼鏡發展路線圖

- 海外AI/AR眼鏡對比

- 2014年至2024年AR眼鏡發展趨勢

- 海外AR眼鏡全彩顯示技術

第4章 參與企業的動態更新

- VR/MR Supply Chain

- Seeya

- Sidtek

- BOE Achieved Milestone of Double 5K for 0.9-inch OLEDoS

- AR Supply Chain

- EV Group

- Porotech

- Polar Light Technologies AB (PLT)

- Q Pixel

- Micledi Microdisplays

- VueReal

- JBD

- Hongshi

- Raysolve

- Giga-Image

- GIS/JorJin

- Himax

- Meta

- Snap

TrendForce, "2025 Near-Eye Display Market Trend and Technology Analysis" observes that the near-eye display device market is expected to remain subdued in the short term, with global shipments protected at 6.2 million units in 2025. Meta's Quest 3s has underperformed expectations, with shipments forecast to decline to 5.6 million units in 2025. In contrast, AR devices are showing stronger short-term momentum. Driven by new AI+AR products and falling OLEDoS costs, shipments are expected to reach 600,000 units in 2025. Over the medium to long term, ongoing VR/MR product development by major players such as Meta and Apple will help strengthen the ecosystem. On the other hand, strong demand in notification-type AR devices and the rise of high-end full-color AR products are set to fuel long-term growth, with global NED devices shipment forecast to surge to 46.5 million units by 2030.

Outlook on AR Display Technology

Choices regarding AR display technology reflect brand strategies and market trends. In the near term, OLEDoS will remain dominant in China due to cost advantages, though TrendForce notes it faces rising competition from other display technologies. LCoS is expected to gain market traction with adoption by Meta, while growth in notification-type AR glasses using single-color LEDoS is also driving LEDoS penetration.

Over the long term, AR devices will increasingly demand higher computing power, longer battery life, and enhanced display performance-particularly with the integration of AI. Global brands are leaning toward high-spec full-color LEDoS technology. As costs decline and performance improves, TrendForce forecasts shipments of AR devices equipped with full-color LEDoS to reach 20.9 million units by 2030, accounting for 65% penetration.

Waveguide Process and SiC Alliance Analysis

In AR optical engines, waveguide technology remains a critical differentiator. While diffractive waveguides are the current mainstream, efficiency improvements are still needed.

Two primary process technologies dominate waveguide manufacturing:

- Nanoimprint lithography (NIL): Suited for early-stage small-batch development due to lower mother mold costs and adaptability to complex nanostructure design.

- Photolithography (PL): Better for mass production, with higher throughput, longer mask lifetimes, and direct processing capability for high-refractive-index SiC materials.

TrendForce observes a growing number of Chinese SiC suppliers forming alliances with waveguide makers. SiC's high refractive index makes it a highly promising material. Currently, Chinese SiC substrates are mainly 4- and 6-inch, but cost efficiency is driving a shift to larger sizes. By 2030, shipments of 8-inch SiC wafers are expected to exceed 20%, with 12-inch development on the horizon. This will further accelerate the adoption of PL technology.

AR Brand Strategies and Specification Trends

As AR optical engine modules shrink, specifications are converging and limiting differentiation. CMOS substrate sizes and designs are trending toward standardization to manage costs. Currently, most LEDoS and LCoS panels range from 0.13-0.18 inches, with pixel densities exceeding 5,500 PPI. LEDoS resolutions typically range 640x480 to 720x720, while LCoS panels generally sit at 720x720. This has pushed brands to pursue distinct strategic directions.

Xreal is focused on display technology and algorithms to expand FOV and enhance computing performance, and RayNeo is strengthening its OLEDoS + Birdbath solution for media consumption while advancing full-color LEDoS + waveguide AR glasses. Meanwhile, INMO is prioritizing all-in-one AI-driven AR terminals and Meta plans to build a full product lineup and invest heavily in AI capabilities to counter Apple's future market entry.

This trend highlights a shift in the AR market from hardware-only competition to a more integrated hardware-software ecosystem.

Table of Contents

Chapter 1. Near-Eye Display Devices Market Analysis

- 2025-2030 NED Device Shipment Analysis

- 2025-2030 VR/MR Shipment Analysis

- 2025-2030 Global VR/MR Devices Market Share by Technology

- 2025-2030 VR/MR Devices Market Size Analysis: LCD/OLEDoS

- 2025-2030 AR Shipment Analysis

- AR Devices Market Share by Region

- 2025-2030 Global AR Devices Market Share by Technology

- 2025-2030 AR Devices Market Size Analysis: LCD/OLEDoS

Chapter 2. Near-Eye Display Technology Development Trend Analysis

- 2.1. VR/MR Display Technology and Market Trend Analysis

- Native Issue of VST : Geometric Distortion

- Foveation Reduces Data Transmission and Power Consumption

- Brightness Perception Also Focuses on Fovea - Peripheral Dimming

- Foveated VR Display Achieved through Polarization + Pancake

- Solutions in Reducing Power Consumption for LCD

- Losses Generated from Compensation on Pancake by Mini LED Backlight

- Straight Light Lowers Contrast Gain of Mini LED Backlight

- RGB Mini LED Backlight Enter Possible Realm of LCD VR

- Upgrading from Blue Light Mini LED to RGB Mini LED?

- Directional Backlight an Ideal Target of LCD VR

- 12-inch OLEDoS Player Capacity Analysis

- Lateral Comparison of Full-Color OLEDoS Technology

- OLEDoS PPI Cap Elevated by Triple-Nozzle Evaporation System

- Development of VR/MR

- 2.2. AR Display Technology and Market Trend Analysis

- Light Source Specification and Pricing Sweet Spot Analysis

- Multi-Zone Micro/Mini LED Backlight Increases Contrast and Reduces Power Consumption for LCoS

- LCoS Further Shrinking: Planar Optical Technology Ongoing Exploration

- Summarized Development Trends of LCoS Technology

- Challenges in Advancing from X-Cube to Single-Chip Full-Color for LEDoS

- Drivers Behind Transition from X-Cube to Single-Chip Full-Color Solution for LEDoS

- Lateral Comparison of Full-Color LEDoS Technology

- Lateral Comparison of Full-Color LEDoS Technology-Vertical Stacking

- Vertical Stacking LEDoS Key Technology Analysis- Seoul Viosys / JBD

- Lateral Comparison of Full-Color LEDoS Technology-InGaN

- CMOS Driving Backplanes of Microdisplays Marching to 12-inch

- Technical Challenges on CMOS for LEDoS from Backplane Designs to System Integration

- Chip Bonding Process Analysis

- Wafer Bonding Process Analysis

- Sony Semiconductor Also Proposed D2W2W for LEDoS

- LEDoS Player Capacity Analysis

- LCoS vs LEDoS

- Power consumption comparison between LEDoS and LCoS

- Analysis on Specifications of LEDoS and LCoS Displays

- Analysis on Specifications of LEDoS and LCoS Full-Color Light Engines

- 2.3. AR Optical Technology and Market Trend Analysis

- Geometric Waveguide

- Diffractive Waveguide

- Compromises of Diffraction Waveguides in the Three Major Specifications

- The Efficiency Challenges of Diffractive Waveguides

- Nano Imprint Lithography (NIL) vs. Photolithography (PL)

- Thermal NIL vs. UV NIL

- Thermal NIL Challenges

- Rain Technology Adopted with Geometric Optical Waveguide of

- the Polarization System

- Ant Reality Optics - Mixed Waveguide

- Pros and Cons of Combiner Technology

- Meta waveguide patent strategy

- AUO and BOE Both Involved in SRG Waveguide

- 2.4. SiC Optical Wavegudie Technology and Market Trend Analysis

- Meta Orion AR:SiC Optical Wavegudie + Dual-sided Grating

- Feasibility and limitation of SiC waveguide applications

- AR Glasses Output by SiC Wafer Size

- SiC Wafer Market Analysis

- SiC Industry Chain Manufacturers

- 2.5. AR System Technology and Market Trend Analysis

- Emerging Technology: Eye Tracking in Near-Eye Displays

- AR/VR - Analysis on Advantages of Eye Tracking

- Eye Tracking - PCCR vs. Al Image Analysis

- Eye Tracking - Analysis on Brand Strategies and Value Chain

- SoC

Chapter 3. Global AR Product Development Trend Analysis

- 3.1. AR Product Development Trend Analysis in China

- Development of AR

- China AR Brand-Xreal

- China AR Brand-RayNeo

- China AR Brand-INMO

- China AR Brand- Rokid / MEIZU

- China AR Glasses Comparison: Weight/Display Technology

- China AR Glasses Comparison: Price/Display Technology

- 3.2. AR Product Development Trend Analysis - Non China

- AI/AR Glasses Roadmap

- Non China AI/AR Glasses Comparison

- Development of AR glasses from 2014 to 2024

- Non China AR glasses Full-color Display Technology

Chapter 4. Player Dynamic Updates

- VR/MR Supply Chain

- Seeya

- Sidtek

- BOE Achieved Milestone of Double 5K for 0.9-inch OLEDoS

- AR Supply Chain

- EV Group

- Porotech

- Polar Light Technologies AB (PLT)

- Q Pixel

- Micledi Microdisplays

- VueReal

- JBD

- Hongshi

- Raysolve

- Giga-Image

- GIS /JorJin

- Himax

- Meta

- Snap