|

市場調查報告書

商品編碼

1895183

全球工程木材市場(至 2035 年):按產品類型、黏合劑類型、應用、最終用戶、地區、產業趨勢和預測Engineered Wood Market, Till 2035: Distribution by Type of Product, Type of Bonding Material, Area of Application, End User, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

工程木材市場展望

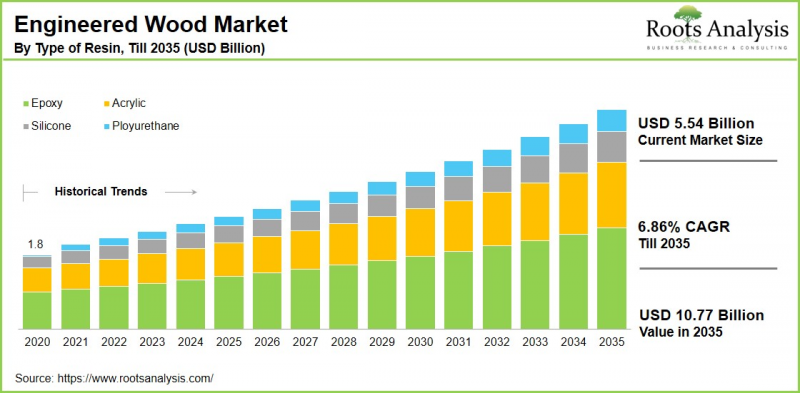

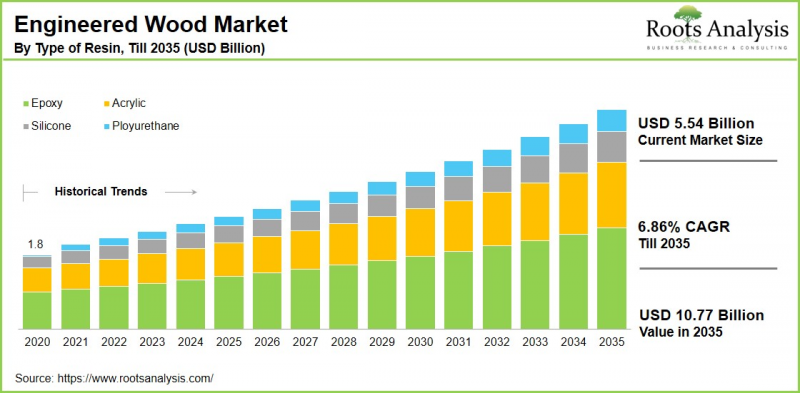

全球工程木材市場預計將從目前的 3,060 億美元成長到 2035 年的 5,690 億美元,預測期內複合年增長率 (CAGR) 為 6.37%。

實木在家具和建築領域的使用是造成森林砍伐的重要原因,而且實木容易受潮,從而導致結構損壞。為了解決這些環境和安全問題,工程木材這種木材生物製品正變得越來越受歡迎。工程木材是通過將木纖維和顆粒與粘合劑粘合在一起而製成的,從而形成堅固的結構。這些產品具有優異的防潮性能,並在生產過程中利用了木材廢料。

建築技術的進步,例如輕質建築材料的開發,正在顯著推動市場成長。 此外,預製建築材料(例如LVL和工字鋼)的出現正在重塑市場格局。特別是膠合板和定向刨花板(OSB)的生產,由於其可塑性和可變形性,正在加速工程木材在住宅和商業建築中的應用。此外,工程木材的成本效益和易於加工性也推動了其在家俱生產中的應用成長。

由於對永續建築材料的需求不斷增長,預計全球工程木材市場在預測期內將顯著增長。此外,由於木樑和木柱技術的進步,工程木材在結構應用中的廣泛使用預計也將顯著促進市場擴張。此外,這些材料的高耐久性和強度在影響木結構建築設計趨勢方面發揮關鍵作用。

工程木材市場:主要結論

競爭格局:工程木材市場中的企業

工程木材市場的競爭格局由大型跨國公司和專業化的本地企業組成,使得該行業既保持了適度的集中度,又展現出多樣性。主要市場領導者包括博伊西凱斯卡德公司 (Boise Cascade)、喬治亞-太平洋公司 (Georgia-Pacific)、路易斯安那-太平洋公司 (Louisiana-Pacific Corporation)、威好公司 (Weyerhaeuser Company)、西弗雷澤木材公司 (West Fraser Timber Co.) 和斯道拉恩索公司 (Stora髮領公司 (Stora),它們對發展的先進業務發展、發展和業務對市場的先進發展。

另一方面,中小型工程木材公司不斷改進產品,透過了解消費者偏好或提供專業服務來滿足特定細分市場的需求。這些產業參與者專注於實施競爭策略,例如開發創新解決方案、擴展產品組合以及透過策略聯盟和合作夥伴關係進行國際擴張。此外,他們還投資於最新技術進步和新產品發布,以改進工程木材產品。

工程木材市場:主要成長驅動因素

工程木材市場的主要驅動因素是全球對環保建築材料日益增長的需求,而這種需求又受到環境和森林砍伐問題的驅動。快速的城市化和基礎設施建設,尤其是在發展中國家,正在推動住宅和商業項目中對工程木材的需求。 CLT、LVL 和高性能黏合劑等技術創新提高了產品的強度、耐久性和多功能性,從而擴大了其應用範圍。 工程木材因其價格更實惠、安裝更便捷,而備受建築商和建築師的青睞。此外,家俱生產的擴張和預製/模組化建築的興起也是推動市場發展的關鍵因素。

美國關稅的影響:成本上升與策略轉變重塑產業格局

美國對木製品(包括工程木材和層壓木材)徵收的關稅,透過提高進口關稅,顯著擾亂了該行業,導致成本上升和供應鏈不確定性增加。這些旨在保護國內製造業的關稅,增加了依賴進口的美國產業的成本,擠壓了建築商的利潤空間,並對房地產市場造成了衝擊。主要出口國的市場佔有率和收入均有所下降,受到不利影響;而由於關稅增加和供應鏈轉移,美國和全球消費者的價格也隨之上漲。 此外,貿易夥伴的報復性措施和持續的政策轉變威脅著長期的貿易穩定,導致一些外國供應商將出口轉向其他市場或調整其供應鏈以減輕關稅的影響。

本報告分析了全球工程木材市場,並提供了市場規模估算、機會分析、競爭格局和公司概況等資訊。

目錄

第一章:引言

第二章:研究方法

第三章:市場動態

第四章:宏觀經濟指標

第五章:摘要整理

第六章:引言

第七章:監理環境

第八章:主要公司綜合資料庫

第九章:競爭格局

第十章:市場空白分析

第十一章:公司競爭力分析

第 12 章:創業生態系

第 13 章:公司簡介

- 章節概述

- TESA 行動

- 博伊西級聯

- Celulosa Arauco Y Constitucion

- 埃格

- Huber 工程木材

- 卡爾斯

- 克諾斯邦

- 路易斯安那-太平洋地區

- 北歐風

- 羅斯堡林業產品

- 深圳瑞斯威爾

- 瑞士克朗

- 通用林產品

- 西弗雷澤木材

- 威好公司

第十四章:大趨勢分析

第十五章:未滿足需求分析

第十六章:專利分析

第十七章:最新發展

第十八章:全球工程木材市場

第十九章:依產品類型劃分的市場機會

第二十章:依黏合劑類型劃分的市場機會

第二十一章:依應用領域劃分的市場機會

第二十二章:依最終用戶劃分的市場機會

第二十三章:北美工程木材市場機會

第24章:歐洲工程木材市場機會

第25章:亞洲工程木材市場機會

第26章:中東和北非(MENA)工程木材市場機會

第27章:拉丁美洲工程木材市場機會

第28章:其他地區工程木材市場機會

第29章:主要參與者的市場集中度分析

第30章:鄰近市場分析

第31章:關鍵制勝策略

第32章:波特五力模型分析

第33章:SWOT分析

第34章:價值鏈分析

第35章:Roots的策略建議

第36章:初步研究結果

第37章:報告結論

第38章:表格資料

第39章:公司與組織清單

第40章:客製化機會

第41章:Roots訂閱服務

第42章:作者資訊

Engineered Wood Market Outlook

As per Roots Analysis, the global engineered wood market size is estimated to grow from USD 306 billion in the current year to USD 569 billion by 2035, at a CAGR of 6.37% during the forecast period, till 2035. The new study provides a comprehensive global engineered wood industry analysis, detailed market forecast analysis, and providing actionable strategic recommendations.

The use of solid wood in furniture and construction significantly contributes to deforestation, and these woods are also susceptible to moisture problems that can lead to structural failure. To address these environmental and safety issues, engineered wood, a form of wood bio-products, is gaining popularity. Engineered wood is produced by binding wood fibers or particles with adhesives for secure assembly. These products offer excellent moisture resistance and utilize wood waste in their production.

Advancements in construction techniques, such as the creation of lightweight materials for weight reduction, have significantly influenced the market's growth. Additionally, the emergence of prefabricated building materials like laminated veneer lumber (LVL) and wood I-joists has shaped the market. Notably, the production of plywood and oriented strand board (OSB), which allows for moldability and shape transformation, has accelerated the use of engineered wood in both residential and commercial construction. Furthermore, due to their cost-effectiveness and ease of handling, the manufacturing of furniture using engineered wood is increasing.

The global engineered wood market is projected to experience substantial growth during the forecast period, driven by the rising demand for sustainable construction materials. Moreover, the increasing use of engineered wood in structural applications due to advancements in wooden beams and columns will significantly contribute to market expansion. Additionally, the high durability and strength of these materials are playing a crucial role in influencing architectural design trends in wood construction.

Engineered Wood Market: Key Takeaways

Competitive Landscape: Companies Involved in Engineered Wood Market

The competitive landscape of the engineered wood market is characterized by a mix of large multinational corporations and specialized regional players, making the industry moderately consolidated but diverse. Key market leaders include companies like Boise Cascade, Georgia-Pacific, Louisiana-Pacific Corporation, Weyerhaeuser Company, West Fraser Timber Co., and Stora Enso, which dominate through integrated operations, advanced manufacturing technologies, and sustainability initiatives.

Meanwhile, smaller engineered wood companies are consistently refining their products to address specific niche markets by understanding consumer preferences, or they are providing specialized services. These industry participants are concentrating on implementing competitive strategies, such as creating innovative solution techniques, establishing strategic alliances and partnerships to broaden their portfolios and international reach. Additionally, they are investing in recent advancements and new product launches to improve their engineered wood offerings.

Engineered Wood Market: Key Drivers Propelling Growth

The primary factors propelling the engineered wood market include a rising global demand for eco-friendly construction materials stemming from environmental concerns and awareness of deforestation. The swift pace of urbanization and infrastructure growth, particularly in developing nations, is driving the need for engineered wood in both residential and commercial projects. Innovations in technology such as cross-laminated timber (CLT), laminated veneer lumber (LVL), and superior adhesives improve product strength, durability, and versatility, expanding their range of applications. The affordability and ease of installation in comparison to traditional wood make engineered wood a favored choice among builders and architects. Further, the expansion of furniture production and the rise of prefabricated / modular construction are significant sectors advancing the market.

Impact of US Tariffs: Rising Costs and Strategic Shifts Redefine Industry Dynamics

US tariffs on wood products, which include engineered wood and laminates, have greatly disrupted the industry by elevating import duties, leading to increased expenses and uncertainties in the supply chain. These tariffs, claimed to be protective measures for domestic manufacturing, have resulted in higher costs for import-dependent sectors in the US, pressuring builders' profit margins and affecting the housing market. Key exporting countries are negatively impacted, facing declines in market share and revenue, while consumer prices in the US and around the world are climbing due to elevated tariffs and shifted supply routes. Additionally, retaliatory measures by trade partners and ongoing policy shifts threaten long-term trade stability, with some foreign suppliers redirecting exports to alternative markets or adjusting supply chains to mitigate tariff impacts.

Engineered Wood Evolution: Emerging Trends in the Industry

The engineered wood sector is experiencing remarkable developments and expansion due to the increasing need for eco-friendly and high-performance construction materials. A prominent trend is the growing use of cross-laminated timber (CLT) and glued laminated timber (glulam) in multi-story residential and commercial buildings, attributed to their superior strength, fire resistance, and moisture protection. Additionally, there is a significant movement towards environmentally friendly adhesives and binders that minimize formaldehyde emissions, in line with stricter environmental standards.

Innovations in technology, including the incorporation of AI in design and production, enhanced bonding methods, and modular construction techniques, are boosting product longevity and construction efficiency. Moreover, market growth is further supported by government incentives promoting sustainable building practices and the increasing urbanization around the globe.

Engineered Wood Market: Key Market Segmentation

Type of Product

- Glulam

- I-beams and Cross Laminated

- Laminated Veneer Lumber (LVL)

- Plywood

- Timber (CLT)

Type of Bonding Material

- Adhesives / Resin

- Wood Fibers / Particles

Area of Application

- Construction

- Flooring

- Furniture

- Packaging

- Transport

- Other Applications

End User

- Commercial

- Residential

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Engineered wood Market: Key Market Insights

Which Type of Product Will Dominate the Market?

Based on the type of product, the global market is segmented into glulam, I-beams and cross laminated, laminated veneer lumber (LVL), plywood and timber (CLT). According to our estimates, currently, plywood segment captures majority share of the market. This growth is due to its lower manufacturing costs and shorter production time compared to solid wood. Plywood's properties, such as being waterproof, fire-resistant, and termite-proof, make it suitable for multiple applications, including building construction and furniture making.

Which Bonding Material Will Grow at a Higher CAGR?

Based on the type of bonding material, the global market is segmented into adhesives / resins and wood fibers / particles. According to our estimates, currently, wood fibers / particles capture majority share of the market. However, the adhesives / resins are expected to grow at a higher CAGR during the forecast period. This is due to the robust and lasting bond of adhesives and sealants, which can easily endure high stress and different weather conditions.

Regional Analysis: Asia to hold the Largest Share in the Market

Asia currently captures a significant share of the engineered wood market. This can be linked to various factors, including rapid urbanization and increasing demand for affordable housing in emerging economies such as China, India, South Korea, and Japan. This demand necessitates quick and cost-effective construction solutions, which are provided by engineered wood. Additionally, the growing use of engineered wood in structural applications due to its high durability and strength has contributed to this dominance.

It is important to note that the strong emphasis on sustainability and environmental issues is likely to support the growth of the engineered wood market. The presence of major companies, including Action TESA and Shenzhen Risewell, is also driving market expansion through innovation and swift advancements. As a result, significant investments in research and development have been crucial in maintaining this dominance.

Example Players in Engineered Wood Market

- Action TESA

- Boise Cascade

- Celulosa Arauco Y Constitucion

- Egger

- Huber Engineered Wood

- Kahrs

- Kronospan

- Louisiana-Pacific

- Nordic

- Roseburg Forest Products

- Shenzhen Risewell

- Swiss Krono

- Universal Forest Products

- West Fraser Timber

Engineered Wood Market: Report Coverage

The report on the engineered wood market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the engineered wood market, focusing on key market segments, including [A] type of product, [B] type of bonding material, [C] area of application, [D] end user, and [E] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the engineered wood market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the engineered wood market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the engineered wood industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the engineered wood domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the engineered wood market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the engineered wood market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the engineered wood market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2035?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Engineered Wood Market

- 6.2.1. Type of Product

- 6.2.2. Type of Bonding Material

- 6.2.3. Area of Application

- 6.2.4. End-User

- 6.3. Future Perspective

7. REGULATORY SCENARIO

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Engineered Wood: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM

- 12.1. Engineered Wood Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Action TESA*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Boise Cascade

- 13.4. Celulosa Arauco Y Constitucion

- 13.5. Egger

- 13.6. Huber Engineered Wood

- 13.7. Kahrs

- 13.8. Kronospan

- 13.9. Louisiana-Pacific

- 13.10. Nordic

- 13.11. Roseburg Forest Products

- 13.12. Shenzhen Risewell

- 13.13. Swiss Krono

- 13.14. Universal Forest Products

- 13.15. West Fraser Timber

- 13.16. WeyerHaeuser

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

18. GLOBAL ENGINEERED WOOD MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Engineered Wood Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Engineered Wood Market for Glulam: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Engineered Wood Market for I-beams and Cross Laminated: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Engineered Wood Market for Laminated Veneer Lumber (LVL): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.9. Engineered Wood Market for Plywood: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.10. Engineered Wood Market for Timber: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.11. Data Triangulation and Validation

- 19.11.1. Secondary Sources

- 19.11.2. Primary Sources

- 19.11.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF BONDING MATERIAL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Engineered Wood Market for Adhesives / Resins: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Engineered Wood Market for Wood Fibers / Particles: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

- 20.8.1. Secondary Sources

- 20.8.2. Primary Sources

- 20.8.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON AREA OF APPLICATION

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Engineered Wood Market for Construction: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Engineered Wood Market for Flooring: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.8. Engineered Wood Market for Furniture: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.9. Engineered Wood Market for Packaging: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.10. Engineered Wood Market for Transport: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.11. Engineered Wood Market for Other Applications: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.12. Data Triangulation and Validation

- 21.12.1. Secondary Sources

- 21.12.2. Primary Sources

- 21.12.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON END-USER

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Engineered Wood Market for Commercial: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Engineered Wood Market for Residential: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Engineered Wood Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.1. Engineered Wood Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.2. Engineered Wood Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.3. Engineered Wood Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.4. Engineered Wood Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Engineered Wood Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.1. Engineered Wood Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.2. Engineered Wood Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.3. Engineered Wood Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.4. Engineered Wood Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.5. Engineered Wood Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.6. Engineered Wood Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.7. Engineered Wood Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.8. Engineered Wood Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.9. Engineered Wood Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.10. Engineered Wood Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.11. Engineered Wood Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.12. Engineered Wood Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.13. Engineered Wood Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.14. Engineered Wood Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.15. Engineered Wood Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Engineered Wood Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.1. Engineered Wood Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.2. Engineered Wood Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.3. Engineered Wood Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.4. Engineered Wood Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.5. Engineered Wood Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.6. Engineered Wood Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Engineered Wood Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.1. Engineered Wood Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 26.6.2. Engineered Wood Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.3. Engineered Wood Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.4. Engineered Wood Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.5. Engineered Wood Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.6. Engineered Wood Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.7. Engineered Wood Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.8. Engineered Wood Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Engineered Wood Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.1. Engineered Wood Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.2. Engineered Wood Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.3. Engineered Wood Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.4. Engineered Wood Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.5. Engineered Wood Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.6. Engineered Wood Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR ENGINEERED WOOD IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Engineered Wood Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.1. Engineered Wood Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.2. Engineered Wood Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.3. Engineered Wood Market in Other Countries

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

- 29.7. Leading Player 7

- 29.8. Leading Player 8

30. ADJACENT MARKET ANALYSIS

31. KEY WINNING STRATEGIES

32. PORTER'S FIVE FORCES ANALYSIS

33. SWOT ANALYSIS

34. VALUE CHAIN ANALYSIS

35. ROOTS STRATEGIC RECOMMENDATIONS

- 35.1. Chapter Overview

- 35.2. Key Business-related Strategies

- 35.2.1. Research & Development

- 35.2.2. Product Manufacturing

- 35.2.3. Commercialization / Go-to-Market

- 35.2.4. Sales and Marketing

- 35.3. Key Operations-related Strategies

- 35.3.1. Risk Management

- 35.3.2. Workforce

- 35.3.3. Finance

- 35.3.4. Others