|

市場調查報告書

商品編碼

1690197

工程木材:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Engineered Wood - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

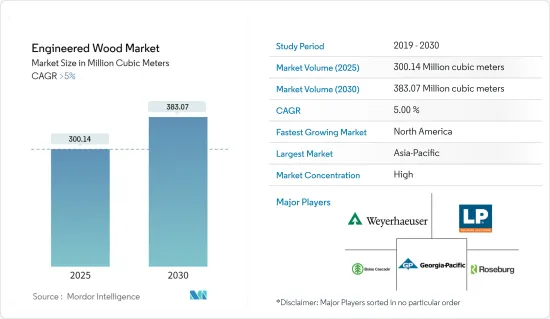

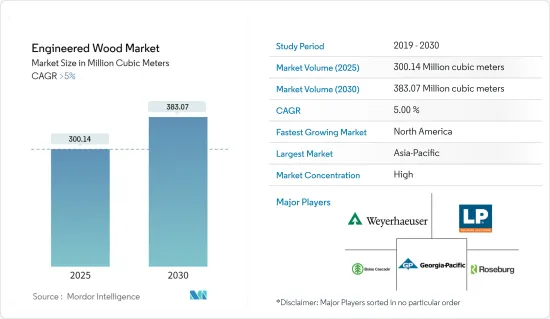

預計 2025 年工程木材市場規模為 3.0014 億立方米,到 2030 年將達到 3.8307 億立方米,預測期內(2025-2030 年)的複合年成長率將超過 5%。

COVID-19疫情對市場產生了負面影響。然而,由於疫情後建築和裝修活動的增加,工程木材市場目前預計將達到疫情前的水平。

主要亮點

- 從中期來看,非住宅領域的需求不斷成長以及 CLT(交叉層壓木材)作為建築材料的使用不斷增加可能會在預測期內推動市場發展。

- 另一方面,對甲醛排放的嚴格環境問題可能會阻礙市場成長。

- 預計印度和中國住宅的興起將在預測期內帶來機會。

- 亞太地區可能主導全球市場,而北美預計在預測期內工程木材的消費速度最快。

工程木材市場趨勢

住宅領域佔據市場主導地位

- 工程木材用途廣泛,包括家具、牆壁、地板、門、屋頂、櫥櫃、柱子、橫樑和樓梯。

- 複合板的用途正在迅速擴大。對於低層建築,CLT 牆板的承重能力增強,比傳統的框架牆具有更大的優勢。

- CLT 已成為歐洲和北美中層住宅領域的成熟體系。此外,交叉層壓木材在建造150公尺以上的高層建築時也得到越來越多的應用。

- 預計 OSB 在牆壁、地板和屋頂等各種住宅應用中的使用日益增加將推動市場的發展。

- 各種工程木材被廣泛應用於住宅領域,用於各種用途。歐洲有 73% 的人口居住在都市區,預計到 2050 年都市區將達到 80% 以上。

- 歐洲家具公司非常成功且富有創新精神。德國、義大利和斯堪的納維亞的家具公司是奢華設計領域的標竿。

- 根據美國人口普查局公佈的資料,2023年美國私人建築年度總價值與前一年同期比較成長4.7%。

- 2023年的總建築預算為19,787億美元,比2022年的總建築預算高出7%。

- 2023 年 12 月,建築支出預計為 2.096 兆美元,而 2022 年為 1.8409 兆美元,成長 13.9%。

- 因此,由於上述方面,預計住宅領域將在預測期內推動市場發展。

亞太地區佔市場主導地位

- 亞太地區包括中國、印度、東協、日本等主要國家。

- 中國經濟成長的動力主要來自發達的住宅和商業建築業。在中國,香港住宅委員會已推出多項舉措,推動經濟適用住宅建設。當局的目標是到 2030 年提供 301,000 套公共住宅。

- 此外,預計到 2025 年將建成 7,000 多個購物中心。

- 在印度,預計2024年經濟適用住宅將增加約70%。據Invest India稱,到2025年,印度建築業規模預計將達到1.4兆美元。

- 此外,預計到 2030 年,印度將有超過 30% 的人口居住在都市區,這將帶來對額外 2,500 萬套中檔和經濟適用住宅的需求,從而在預測期內推動對工程木製品的需求。

- 在亞太地區,日本和中國佔了OSB市場的很大佔有率。 Norbond 在日本銷售 OSB 板已有 20 多年,並在廣大最終用戶的建築項目中取得了優異的成績。

- 因此,預計亞太地區將主導全球市場。

工程木材產業概況

工程木材市場部分整合,大多數公司佔有較小的市場佔有率。市場的主要企業(不分先後順序)包括 Weyerhaeuser Company、Boise 連鎖、 喬治亞-Pacific、Roseburg Forest Products 和 Louisiana-Pacific Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 非住宅領域的需求不斷增加

- 擴大使用複合板(CLT)作為建築材料

- 其他機會

- 限制因素

- 甲醛排放引發的嚴重環境問題

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 合板

- 定向纖維板(OSB)

- 古拉姆

- 交叉層壓木材(CLT)

- 層壓單板木材(LVL)

- 塑合板

- 其他(纖維板、平行股線等)

- 應用

- 非住宅

- 住宅

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Binderholz GmbH

- Boise Cascade

- Georgia-Pacific(Georgia-Pacific Wood Products LLC)

- HASSLACHER Holding GmbH

- Havwoods India Pvt. Ltd

- Huber Engineered Woods LLC

- KLH Massivholz Wiesenau GmbH

- Kronoplus Limited

- Louisiana-Pacific Corporation

- Mayr-Melnhof Holz Holding AG

- Nordic Structures

- Pacific Woodtech Corporation

- Resolute Forest Products

- Roseburg

- Stora Enso

- West Fraser

- Weyerhaeuser Company

第7章 市場機會與未來趨勢

- 印度和中國的住宅建設成長

- 其他機會

The Engineered Wood Market size is estimated at 300.14 million cubic meters in 2025, and is expected to reach 383.07 million cubic meters by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market. However, the market for engineered wood has now been close to reaching pre-pandemic levels because of increasing construction and restoration activities in the post-pandemic period.

Key Highlights

- Over the medium term, growing demand from the non-residential sector and increasing use of cross-laminated timber (CLT) as a construction material are likely to drive the market during the forecast period.

- On the flip side, stringent environmental concerns related to formaldehyde emissions are likely to hinder market growth.

- The growing residential construction in India and China is expected to act as an opportunity in the forecast period.

- Asia-Pacific is likely to dominate the global market, while North America is expected to witness the fastest consumption of engineered wood during the forecast period.

Engineered Wood Market Trends

The Residential Segment to Dominate the Market

- Engineered wood is used for a wide range of applications, including furniture, walls, flooring, doors, roofs, cabinets, columns, beams, and staircases.

- The application of cross-laminated wood has been increasing rapidly. For low-rise construction, the increased loadbearing capacity of CLT wall panels adds further benefits over conventional stud-framed walls.

- Cross-laminated timber is now an established system in the mid-rise residential sector in Europe and North America. In addition, there are increasing examples of cross-laminated timber being used to construct skyscrapers for buildings over 150 meters tall.

- The growing application of OSB in various residential applications, such as walls, flooring, and roofs, is estimated to drive the market.

- All types of engineered woods are significantly used in various applications in the residential sector. With 73% of its population living in urban areas, Europe is expected to be over 80% urban by 2050.

- European furniture companies are very successful and innovative. The German, Italian, and Nordic furniture companies act as benchmarks in the field of high-class design.

- According to the data released by the United States Census Bureau, the total annual value of private construction in the country increased by 4.7% in 2023 compared to the previous year.

- The total value of construction in 2023 was USD 1,978.7 billion, which was 7% above the total value of construction in 2022.

- In December 2023, a total of USD 2,096 billion was spent compared to USD 1,840.9 billion in 2022, registering a 13.9% rise in construction spending.

- Thus, based on the aforementioned aspects, the residential segment is expected to drive the market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific has several major countries, such as China, India, ASEAN, and Japan.

- China has been majorly driven by ample developments in the residential and commercial construction sectors and is supported by a growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- China is also likely to witness the construction of 7,000 more shopping centers, which are estimated to start functioning by 2025.

- In India, the availability of affordable housing is expected to rise by around 70% by 2024. By 2025, India's construction industry is expected to reach USD 1.4 trillion, as per Invest India.

- Also, by 2030, more than 30% of the population is expected to live in urban India, creating a demand for 25 million additional mid-end and affordable units, thus bolstering the demand for engineered wood products during the forecast period.

- In Asia-Pacific, Japan and China have a considerable share of the OSB market. Norbond has been marketing its OSB panels in Japan for over 20 years, and it has established a track record of high performance in a variety of end-user construction.

- Hence, Asia-Pacific is expected to dominate the global market.

Engineered Wood Industry Overview

The engineered wood market is partially consolidated, with most players accounting for a marginal market share. Major companies in the market (in no particular order) include Weyerhaeuser Company, Boise Cascade, Georgia-Pacific, Roseburg Forest Products, and Louisiana-Pacific Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Non-residential Sector

- 4.1.2 Increasing Use of Cross-laminated Timber (CLT) as Construction Materials

- 4.1.3 Other Opportunities

- 4.2 Restraints

- 4.2.1 Stringent Environmental Concerns Related to Formaldehyde Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Plywood

- 5.1.2 Oriented Strand Board (OSB)

- 5.1.3 Glulam

- 5.1.4 Cross-laminated Timber (CLT)

- 5.1.5 Laminated Veneer Lumber (LVL)

- 5.1.6 Particleboard

- 5.1.7 Other Types (Fiber Board, Parallel Strand, Others)

- 5.2 Application

- 5.2.1 Non-residential

- 5.2.2 Residential

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Binderholz GmbH

- 6.4.2 Boise Cascade

- 6.4.3 Georgia-Pacific (Georgia-Pacific Wood Products LLC)

- 6.4.4 HASSLACHER Holding GmbH

- 6.4.5 Havwoods India Pvt. Ltd

- 6.4.6 Huber Engineered Woods LLC

- 6.4.7 KLH Massivholz Wiesenau GmbH

- 6.4.8 Kronoplus Limited

- 6.4.9 Louisiana-Pacific Corporation

- 6.4.10 Mayr-Melnhof Holz Holding AG

- 6.4.11 Nordic Structures

- 6.4.12 Pacific Woodtech Corporation

- 6.4.13 Resolute Forest Products

- 6.4.14 Roseburg

- 6.4.15 Stora Enso

- 6.4.16 West Fraser

- 6.4.17 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Residential Construction in India and China

- 7.2 Other Opportunities