|

市場調查報告書

商品編碼

1895181

全球情感辨識人工智慧市場(至 2035 年):按組件、情緒識別人工智慧類型、技術類型、應用類型、地區、產業趨勢和預測Electronic Adhesives Market: Distribution by Type of Electronic Adhesives, Type of Resin, Type of Form, Application Area, Type of Enterprise, End-Use Industry, and Geographical Regions: Industry Trends and Global Forecasts, Till 2035 |

||||||

情感辨識人工智慧市場展望

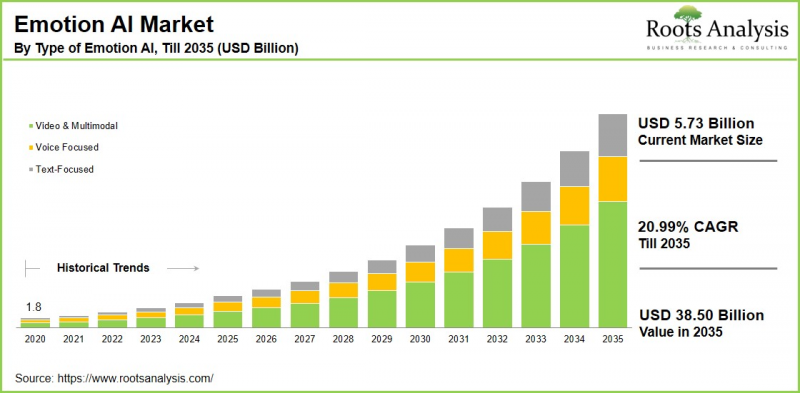

預計到 2035 年,全球情緒辨識人工智慧市場規模將達到 385 億美元,高於目前的 57 億美元,預測期內複合年增長率 (CAGR) 為 20.9%。人工智慧的快速發展正推動情感識別人工智慧市場邁向新的高度,並重塑機器與人類的互動方式。情緒辨識人工智慧利用機器學習、電腦視覺、自然語言處理 (NLP) 和生物辨識感測器等技術,使系統能夠檢測、解讀和回應人類的情緒。這些工具分析臉部表情、語調、文字情緒和生理訊號,從而推斷情緒狀態。

這項技術使企業能夠了解客戶的情緒狀態,從而提供可顯著影響行銷策略和產品創新的洞察。 這使企業不僅能夠滿足客戶期望,還能超越客戶期望,最終提高客戶滿意度和客戶留存率。

情感識別人工智慧市場:重點

競爭格局:情感辨識人工智慧市場的主要參與者

目前,包括微軟、IBM、Google、蘋果、Cogito 和 Realeyes 在內的多家大型科技公司,以及許多專業新創公司和本地企業,都活躍於該市場,推動了行業的競爭格局。這些企業透過利用人工智慧生態系統、雲端服務以及廣泛的研發投入,引領市場發展。產業參與者專注於合作、併購,並致力於打造創新且客製化的解決方案,以滿足各行業的獨特需求。

情緒辨識人工智慧市場:關鍵成長驅動因素

情緒識別人工智慧市場的關鍵驅動因素包括:對客製化和積極客戶體驗日益增長的需求,以及其在心理健康監測和診斷領域日益廣泛的應用。企業正在利用人工智慧即時評估情緒,從而增強客戶互動。他們也根據情緒回饋優化廣告、產品和服務,進一步拓展了市場的潛力。

此外,醫療保健領域的情緒識別人工智慧解決方案使穿戴式裝置能夠監測情緒狀態,追蹤憂鬱、焦慮和壓力,從而提供個人化的健康洞察。

情緒辨識人工智慧的演進:產業新興趨勢

機器學習、自然語言處理和電腦視覺的快速發展正在推動情緒辨識人工智慧市場的成長。現在,可以透過臉部表情、語音、文字和生理訊號更準確地檢測情緒。 此外,對個人化客戶體驗和心理健康應用日益增長的需求正在推動醫療保健和零售等行業的採用。

情感感知人工智慧也越來越多地與對話式人工智慧和虛擬助理融合,從而促進具備情感智慧的人機介面發展,以支援同理心對話和決策。

區塊鏈技術也正在整合,以安全透明地管理敏感的情緒資料。最後,開源情感感知人工智慧框架和平台的開發正在普及尖端工具的使用,加速各行各業的創新和應用。這些技術的進步共同提升了情感感知人工智慧在實際應用中的反應速度、安全性和情境感知能力。

主要市場挑戰:決策者如何降低風險

情感感知人工智慧市場面臨決策者必須採取策略性因應措施的幾個關鍵挑戰。 這項技術依賴敏感的生物辨識訊息,例如臉部表情、語音模式和心率,這引發了關於監控和知情同意的質疑,使得隱私和倫理考量成為首要關注的問題。此外,在招聘和執法等關鍵領域過度依賴情緒識別人工智慧,可能會用帶有偏見的演算法取代細緻入微的人類判斷。

因此,解決這些障礙至關重要。如果沒有強而有力的保障措施,這些問題可能會削弱公眾信任,阻礙技術普及,最終影響市場成長。

本報告分析了全球情緒辨識人工智慧市場,並提供了市場規模估算、機會分析、競爭格局和公司概況。

目錄

第一部分:報告概述

第一章:引言

第二章:研究方法

第三章:市場動態

第四章:宏觀經濟指標

第二部分:質性研究結果

第五章:摘要整理

第六章:引言

第七章:監理環境

第三部分:市場概覽

第八章:關鍵指標綜合資料庫

第九章:競爭格局

第十章:空白市場分析

第十一章:競爭分析

第十二章:情感辨識人工智慧市場的創業生態系統

第四部分:公司簡介

第十三章:公司簡介

- 章節概述

- AUDEERING

- AWS

- Behavioral Signals

- CIPIA Vision

- Cogito

- Entropik Tech

- Hume人工智慧

- IBM

- 微軟

- MorphCast

- 諾杜斯

- 觀點

- Realeyes

- 錫耶納人工智慧

- 超越

- 賽曼托

- Uniphore

- VIER

- 聲感

第 5 部分:市場趨勢

第 14 章:大趨勢分析

第 15 章:未滿足的需求分析

第 16 章:專利分析

第 17 章:最新進展

第 6 節:市場機會分析

第18章:全球情感辨識AI市場

第19章:依組件類型劃分的市場機會

第20章:依情感辨識AI類型劃分的市場機會

第21章:依技術類型劃分的市場機會

第22章:按應用類型劃分的市場機會

第23章:北美情感辨識AI市場機會

第24章:歐洲情感辨識AI市場機會

第25章:亞洲情感辨識AI市場機會

第26章:中東東非與北非(MENA)情感辨識人工智慧市場機會

第27章:鄰近市場分析

第7節:策略工具

第28章:關鍵制勝策略

第29章:波特五力分析

第30章:SWOT分析

第31章:價值鏈分析

第32章:Roots的策略建議

第8節:其他獨家發現

第33章:一手調查結果

第34章:報告結論

第九節:附錄

Electronic Adhesives Market Outlook

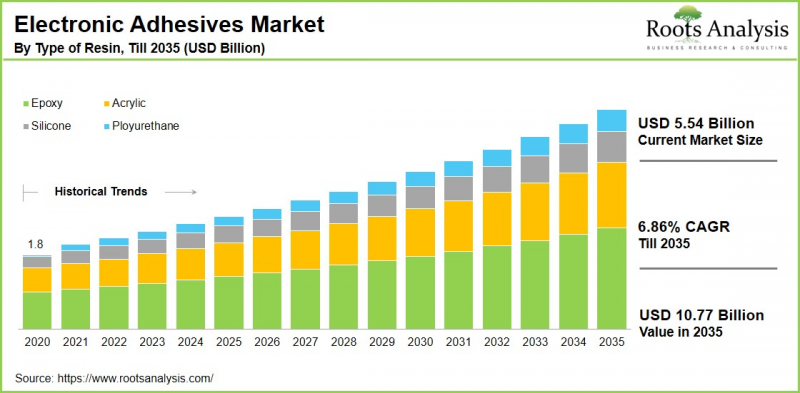

As per Roots Analysis, the global electronic adhesives market size is estimated to grow from USD 5.54 billion in 2025 to USD 10.77 billion by 2035, at a CAGR of 6.86% during the forecast period, from 2025 to 2025. The new study provides a comprehensive global electronic adhesive industry analysis, mega trends, patent analysis, porter's five forces, SWOT analysis, value chain analysis and other strategic frameworks.

Electronic adhesives are specialized bonding materials engineered to assemble, safeguard, and improve the functionality of electronic components and devices. They play a vital role in manufacturing electronics by offering mechanical support, electrical conductivity / insulation, and protection against environmental stressors. The ways these adhesives bond materials include mechanical interlocking, interdiffusion, surface adsorption and reaction, and even electrostatic attraction, enabling them to meet the varied needs of contemporary electronic assemblies.

As the electronics sector advances, the expectations for adhesives have grown increasingly intricate. The emergence of compact, high-density devices (such as smartphones, wearable technology, and medical sensors) necessitates smaller electronic adhesives. These adhesives provide outstanding performance in confined spaces while enduring thermal fluctuations, vibrations, and exposure to environmental factors. Considering the above mentioned factors, the global electronic adhesives market is expected to grow at a significant pace during the forecast period.

Strategic Insights for Senior Leaders

Competitive Landscape: Companies Involved in Electronic Adhesives Market

Currently, a variety of major technology companies, specialized startups, and local businesses, such as 3M Company, Arkema., BASF, Dow, Henkel among others, are active in the market, enhancing the competitive dynamics of the industry. These firms actively allocate significant resources to research and development (R&D), focusing on creating innovative high-performance adhesives designed for new applications (including compact electronics, flexible gadgets, and automotive electrification).

Electronic Adhesives Market: Key Drivers Propelling Growth

The electronic adhesives market is driven by the rise in production and usage of electronic devices across various sectors, such as telecommunications, consumer electronics, and automotive. The trend towards smaller electronic components and the increasing need for compact, high-performance devices drive the demand for cutting-edge adhesives that provide robust bonding and durability. The boom in electric vehicle production and the growth of semiconductor packaging capabilities further enhance this demand. Moreover, environmental regulations and the transition towards sustainable adhesive formulations are influencing market growth.

Impact of US Tariffs: Rising Costs and Strategic Shifts Redefine Industry Dynamics

The impact of US tariffs on the electronic adhesives market has been significant, primarily leading to heightened production expenses for manufacturers who depend on imported raw materials, such as epoxy and silicone adhesives from nations like South Korea and Taiwan. These tariffs raise prices in the US market, affecting semiconductors and PCB assembly industry, and squeeze profit margins due to escalated raw material costs. Additionally, reciprocal tariffs and global trade tensions have introduced supply chain disruptions and increased uncertainty, which delays investment and product rollouts. In response, companies are diversifying suppliers, localizing production, and increasing R&D spending on bio-based and high-performance adhesives to mitigate these challenges.

Electronic Adhesives Evolution: Emerging Trends in the Industry

This market is rapidly evolving with important trends including miniaturization, flexible electronics, and an increasing demand for sustainable materials. Innovative adhesives that utilize nanotechnology and low-temperature curing are improving bonding effectiveness while enabling quicker assembly processes. Additionally, adhesives that are electrically and thermally conductive are becoming essential for automotive electronics, 5G, and IoT devices, enhancing thermal management and resilience.

Further, the growth of electric vehicles and smart wearables is driving substantial demand within the automotive industry. Manufacturers are prioritizing the creation of sustainable, lead-free, and low-VOC (volatile organic compounds) adhesives to comply with global environmental standards. These trends highlight industry's transition towards high-performance and eco-friendly solutions that align with the manufacturing needs of next-generation electronics.

Electronic Adhesives Market: Key Market Segmentation

Type of Electronic Adhesive

- Electrically Conductive

- Thermally Conductive

- UV Curing

- Other Adhesives

Type of Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

Type of Form

- Liquid

- Paste

- Solid

Application Area

- Conformal Coatings

- Encapsulation

- Integrated Circuit

- Printed Circuit Boards

- Semiconductor

- Surface Mounting

- Wire Tracking

- Other Applications

Type of Enterprise

- Large Enterprises

- Small and Medium Enterprises

End-Use Industry

- Automotive

- Commercial Aviation

- Communications

- Computers & Servers

- Consumer Electronics

- Industrial

- Medical

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Electronic Adhesives Market: Key Market Insights

Which Type of Electronic Adhesive Will Dominate the Market?

Based on the type of electronic adhesive, the global market is segmented into electrically conductive, thermally conductive, UV curing and other adhesives. According to our estimates, currently, electrically conductive adhesives capture majority market share. This growth is due to the rapid growth of sectors, such as consumer electronics, electric vehicles, and renewable energy, where these adhesives are utilized for applications including battery connections, heat sinks, and flexible electronics.

How is the Epoxy Resin Segment Leading the Market?

Based on the type of resin, the global market is segmented into acrylic, epoxy, polyurethane and silicone. According to our estimates, currently, epoxy resins capture majority market share. This growth can be attributed to their remarkable thermal stability, superior cohesive strength, and exceptional electrical insulation, making them the preferred option for a wide array of electronic applications.

Regional Analysis: Asia to hold the Largest Share in the Market

Based on our estimates, Asia holds the largest share of the electronic adhesives market, leading the way with advancements in electronic adhesives technologies. This growth can be linked to various factors, such as the region's vast and swiftly expanding electronics sector, which encompasses producers of consumer electronics, automotive electronics, and industrial electronics. Notably, China stands out as a key market for electronic adhesives, driven by its extensive electronics manufacturing landscape.

Example Players in Electronic Adhesives Market

- 3M Company

- Arkema

- Ashland Global Holdings

- DELO Adhesives

- Dow Inc.

- H.B. Fuller Company

- Henkel

- Huntsman International

- Pidilite Industries

- Sika AG

Electronic Adhesives Market: Report Coverage

The report on the electronic adhesives market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the electronic adhesives market, focusing on key market segments, including [A] type of electronic adhesives, [B] type of resin, [C] type of form, [D] application area, [E] type of enterprise, [F] end-use industry, and [G] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the electronic adhesives market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the electronic adhesives market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the electronic adhesives industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the electronic adhesives domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the electronic adhesives market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the electronic adhesives market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the electronic adhesives market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2035?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Electronic Adhesives Market

- 6.2.1. Type of Electronic Adhesives

- 6.2.2. Type of Resin

- 6.2.3. Type of Form

- 6.2.4. Application Area

- 6.2.5. Type of Enterprises

- 6.2.6. End-Use Industries

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Electronic Adhesives Market: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of Electronic adhesives Solution Provider

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE ELECTRONIC ADHESIVES MARKET

- 12.1. Electronic Adhesives Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. 3M*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Alent

- 13.4. Arkema

- 13.5. Atom Adhesives

- 13.6. Avery Dennison

- 13.7. BASF SE

- 13.8. Bondline Electronic Adhesives

- 13.9. Boyd Corporation

- 13.10. Covestro

- 13.11. Cytec Industries

- 13.12. Delo

- 13.13. Dow

- 13.14. Dymax Corporation

- 13.15. Ellsworth Adhesives

- 13.16. Element Solutions

- 13.17. Evonik Industries

- 13.18. Henkel

- 13.19. Hitachi Chemical

- 13.20. Huntsman International

- 13.21. Indium Corporation

- 13.22. Jowat

- 13.23. LG Chemical

- 13.24. Loctite

- 13.25. Master Bond

- 13.26. Mitsui Chemicals

- 13.27. Nagase

- 13.28. Panasonic

- 13.29. Parker Hannifin

- 13.30. Permabond

- 13.31. Pidilite

- 13.32. Rogers

- 13.33. Sika

- 13.34. Shin-Etsu Chemical

- 13.35. Synthomer

- 13.36. ThreeBond

- 13.37. Toyo Polymer

- 13.38. Wacker Chemie

- 13.39. Xiamen Weldbond New Material

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL ELECTRONIC ADHESIVES MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Electronic Adhesives Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF ELECTRONIC ADHESIVE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Electronic Adhesives Market for Electrically Conductive: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Electronic Adhesives Market for Thermally Conductive: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Electronic Adhesives Market for UV Curing: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.9. Electronic Adhesives Market for Other Adhesives: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

- 19.10.1. Secondary Sources

- 19.10.2. Primary Sources

- 19.10.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF RESIN

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Electronic Adhesives Market for Acrylic: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Electronic Adhesives Market for Epoxy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Electronic Adhesives Market for Polyurethane: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.9. Electronic Adhesives Market for Silicon: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.10. Data Triangulation and Validation

- 20.10.1. Secondary Sources

- 20.10.2. Primary Sources

- 20.10.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF FORM

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Electronic Adhesives Market for Liquid: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Electronic Adhesives Market for Paste: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.8. Electronic Adhesives Market for Solid: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

- 21.9.1. Secondary Sources

- 21.9.2. Primary Sources

- 21.9.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON APPLICATION AREA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Electronic Adhesives Market for Conformal Coatings: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Electronic Adhesives Market for Encapsulation: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.8. Electronic Adhesives Market for Integrated Circuit: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.9. Electronic Adhesives Market for Printed Circuit Boards: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.10. Electronic Adhesives Market for Semiconductor: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.11. Electronic Adhesives Market for Surface Mounting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.12. Electronic Adhesives Market for Wire Tracking: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.13. Electronic Adhesives Market for Other Applications: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.14. Data Triangulation and Validation

- 22.14.1. Secondary Sources

- 22.14.2. Primary Sources

- 22.14.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Podcasting Market for Large Enterprises: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Podcasting Market for Small and Medium Enterprises (SMEs): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.8. Data Triangulation and Validation

- 23.8.1. Secondary Sources

- 23.8.2. Primary Sources

- 23.8.3. Statistical Modeling

24. MARKET OPPORTUNITIES BASED ON END-USER INDUSTRIES

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Electronic Adhesives Market for Automotive: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Electronic Adhesives Market for Commercial Aviation: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.8. Electronic Adhesives Market for Communications: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.9. Electronic Adhesives Market for Computers & Servers: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.10. Electronic Adhesives Market for Consumer Electronics: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.11. Electronic Adhesives Market for Industrial: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.12. Electronic Adhesives Market for Medical: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.13. Data Triangulation and Validation

- 24.13.1. Secondary Sources

- 24.13.2. Primary Sources

- 24.13.3. Statistical Modeling

25. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN NORTH AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Electronic Adhesives Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.1. Electronic Adhesives Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.2. Electronic Adhesives Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.3. Electronic Adhesives Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.4. Electronic Adhesives Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN EUROPE

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Electronic Adhesives Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.1. Electronic Adhesives Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.2. Electronic Adhesives Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.3. Electronic Adhesives Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.4. Electronic Adhesives Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.5. Electronic Adhesives Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.6. Electronic Adhesives Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.7. Electronic Adhesives Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.8. Electronic Adhesives Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.9. Electronic Adhesives Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.10. Electronic Adhesives Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.11. Electronic Adhesives Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.12. Electronic Adhesives Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.13. Electronic Adhesives Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.14. Electronic Adhesives Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.15. Electronic Adhesives Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN ASIA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Electronic Adhesives Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.1. Electronic Adhesives Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.2. Electronic Adhesives Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.3. Electronic Adhesives Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.4. Electronic Adhesives Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.5. Electronic Adhesives Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.6. Electronic Adhesives Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Electronic Adhesives Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.1. Electronic Adhesives Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 28.6.2. Electronic Adhesives Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.3. Electronic Adhesives Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.4. Electronic Adhesives Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.5. Electronic Adhesives Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.6. Electronic Adhesives Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.7. Electronic Adhesives Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.8. Electronic Adhesives Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN LATIN AMERICA

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Electronic Adhesives Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.1. Electronic Adhesives Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.2. Electronic Adhesives Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.3. Electronic Adhesives Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.4. Electronic Adhesives Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.5. Electronic Adhesives Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.6. Electronic Adhesives Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.7. Data Triangulation and Validation

30. MARKET OPPORTUNITIES FOR ELECTRONIC ADHESIVES IN REST OF THE WORLD

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Revenue Shift Analysis

- 30.4. Market Movement Analysis

- 30.5. Penetration-Growth (P-G) Matrix

- 30.6. Electronic Adhesives Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.1. Electronic Adhesives Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.2. Electronic Adhesives Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.3. Electronic Adhesives Market in Other Countries

- 30.7. Data Triangulation and Validation

31. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 31.1. Leading Player 1

- 31.2. Leading Player 2

- 31.3. Leading Player 3

- 31.4. Leading Player 4

- 31.5. Leading Player 5

- 31.6. Leading Player 6

- 31.7. Leading Player 7

- 31.8. Leading Player 8

32. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

33. KEY WINNING STRATEGIES

34. PORTER'S FIVE FORCES ANALYSIS

35. SWOT ANALYSIS

36. VALUE CHAIN ANALYSIS

37. ROOTS STRATEGIC RECOMMENDATIONS

- 37.1. Chapter Overview

- 37.2. Key Business-related Strategies

- 37.2.1. Research & Development

- 37.2.2. Product Manufacturing

- 37.2.3. Commercialization / Go-to-Market

- 37.2.4. Sales and Marketing

- 37.3. Key Operations-related Strategies

- 37.3.1. Risk Management

- 37.3.2. Workforce

- 37.3.3. Finance

- 37.3.4. Others