|

市場調查報告書

商品編碼

1869564

液位感測器的全球市場(~2035年):各技術,感測器連接性別,感測器各材料,監測各類型,應用各領域,不同企業規模,不同商業模式,各終端用戶,各地區,產業趨勢,未來的預測Level Sensors Market, Till 2035, Distribution by Technology, Sensor Connectivity, Sensor Material, Monitoring Type, Application Area, Company Size, Business Model, End User, and Geographical Region: Industry Trend and Future Forecast |

||||||

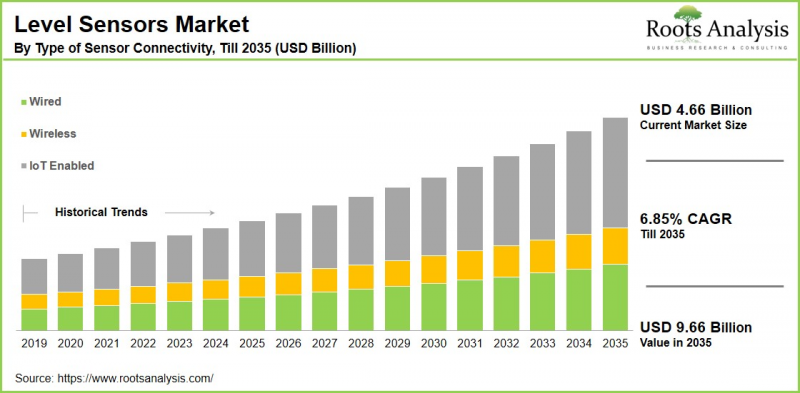

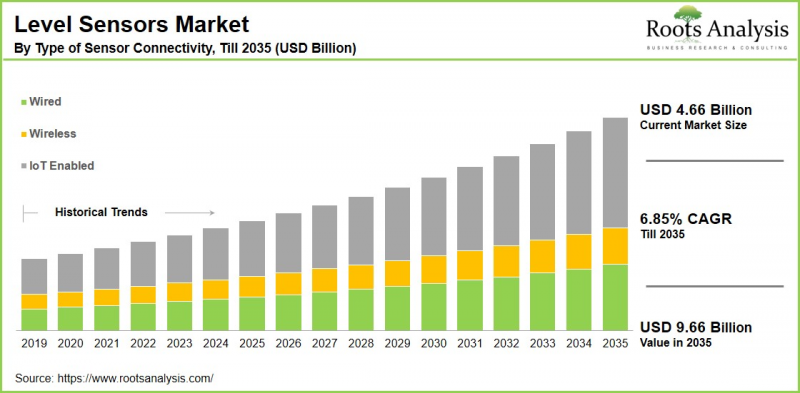

全球液位感測器的市場規模,被預測從目前46億6,000萬美元到2035年達到96億6,000萬美元,2035年為止的預測期間年複合成長率6.85%的成長被預料。

液位感測器市場:成長和趨勢

工業自動化技術寬廣地持續被採用中,智慧感應器作為被控制了的製造流程能放的重要的結構要素抬頭著。基於感測器的這些的技術,為產品製造的最佳化,廢棄物的削減,品管的強化很大地貢獻著。在產業環境中,感測器為基礎的技術促進自動化做提供,以及製造上的缺陷,層級的變化,對產品開發必要的理想的條件相關即時資訊。

為了現在,溫度感測器,雷射感測器,視覺感測器,液位感測器,壓力感應器等的各種的感測器,確保產品的最適合的製造條件由於複數的產業被利用。特別液位感測器適合液面檢測用產業部門越發普及著。醫藥品,食品·飲料,污水處理,為了海事等的部門,防禦貪污和溢出,維持恰當的液面的事不可缺少。

被預測現在,把這些的產業上生產條件的最佳化作為目的數位液體感測器的需求高漲著,促進今後數年的市場成長。譬如製藥部門,被有損傷金屬容器的可能性的壓力容器內的腐蝕性液體的層級檢測這些的液體感測器活用。對同樣,在天然氣部門和石油部門中,液面感測器對油數量的正確的檢測也不可缺少,根據這個為石油供給的計劃調整,過剩供給的迴避,不足的防止貢獻著。被預測踏各種各樣的產業部門的液位感測器的使用的擴大的話,今後數年這些的感測器的市場踏實增長。

本報告提供全球液位感測器市場相關調查,與市場規模的估計機會分析,競爭情形,企業簡介等資訊提供做著。

目錄

第1章 序文

第2章 調查手法

第3章 經濟考慮事項,其他的計劃特有的考慮事項

第4章 宏觀經濟指標

第5章 摘要整理

第6章 簡介

第7章 競爭情形

第8章 企業簡介

- 章概要

- ABB

- AMETEK

- Garner Industries

- Indicator

- Emerson Electric

- Electro-Sensors

- Endress+Hauser

- Fortive

- Gems Sensors

- Honeywell International

- Magnetrol International

- OMEGA Engineering

- MTS System Corporation

- Pepperl+Fuchs

- Senix Corporation

- Texas Instruments

- TE Connectivity

第9章 液位感測器市場上Start-Ups生態系統

第10章 價值鏈的分析

第11章 SWOT的分析

第12章 全球液位感測器市場

第13章 市場機會:各技術類型

第14章 市場機會:感測器連接性各類型

第15章 市場機會:感測器各材料

第16章 市場機會:監測各類型

第17章 市場機會:應用各領域

第18章 市場機會:各終端用戶

第19章 市場機會:不同企業規模

第20章 市場機會:不同商業模式

第21章 北美的液位感測器市場機會

第22章 歐洲的液位感測器市場機會

第23章 亞洲的液位感測器市場機會

第24章 中東·北非(MENA)的液位感測器市場機會

第25章 南美的液位感測器市場機會

第26章 其他地區的液位感測器市場機會

第27章 表格形式資料

第28章 企業·團體的清單

第29章 客制化的機會

第30章 Roots的訂閱服務

第31章 著者詳細內容

Level Sensors Market Overview

As per Roots Analysis, the global level sensors market size is estimated to grow from USD 4.66 billion in the current year USD 9.66 billion by 2035, at a CAGR of 6.85% during the forecast period, till 2035.

The opportunity for level sensors market has been distributed across the following segments:

Type of Technology

- Contact

- Non-Contact

Type of Sensor Connectivity

- Wired

- Wireless

- IoT Enabled

Sensor Material

- Ceramic

- Plastic

- Stainless Steel

- Other

Monitoring Type

- Point Level Sensors

- Mechanical and Magnetic Float Level Sensors

- Capacitance Level Sensors

- Vibratory Probe Level Sensors

- Conductivity Level Sensors

- Other Point Level Sensors

- Continuous Level Sensors

- Laser Level Sensor

- Ultrasonic Level Sensors

- Magnetostrictive Level Sensors

- Radar Level Sensors

- Other Continuous Level Sensors

Application Area

- Power Generation

- Oil and Gas

- Mining and Metal Processing

- Food and Beverage

- Chemical

- Water and Wastewater

Company Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Business Model

- B2B

- B2C

- B2B2C

End User

- Manufacturing

- Energy & Utilities

- Automotive

- Aerospace

- Food and Beverages

- Pharmaceuticals

- Healthcare

- Other End users

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Level Sensors Market: Growth and Trends

As industrial automation technologies continue to be widely adopted, smart sensors have emerged as a crucial component in controlled manufacturing processes. These technologies, based on sensors, are significantly contributing to the optimization of product manufacturing, reduction of waste, and enhancement of quality control. In the industrial landscape, sensor-based technologies facilitate automation and deliver real-time information regarding manufacturing defects, level changes, and the ideal conditions necessary for product development.

At present, various types of sensors, including temperature sensors, laser sensors, vision sensors, level sensors, and pressure sensors, are being utilized across multiple industries to ensure optimal manufacturing conditions for products. Notably, level sensors are becoming increasingly popular in industries for liquid level detection. In sectors like pharmaceuticals, food and beverage, sewage treatment, and marine, maintaining the correct liquid levels is essential to prevent spoilage and overflow.

Currently, there is a high demand for digital liquid sensors aimed at optimizing production conditions in these industries, which is projected to fuel market growth in the years ahead. For example, in the pharmaceutical sector, these liquid sensors are utilized for level detection of corrosive liquids within pressure vessels that could potentially harm metallic containers. Similarly, in the natural gas or petroleum sector, liquid level sensors are crucial for providing accurate measurements of oil levels, which assist in scheduling oil deliveries, avoiding excess supply, and preventing shortages. Given the increasing use of level sensors across various industrial sectors, it is anticipated that the market for these sensors will experience steady growth in the coming years.

Level Sensors Market: Key Segments

Market Share by Type of Technology

Based on type of technology, the global level sensors market is segmented into contact and non-contact sensors. According to our estimates, currently, the non-contact sensor technology segment captures the majority of the market share. This dominance is driven by its ability of employing electromagnetic waves for liquid level measurement. Technologies such as photoelectric and ultrasonic sensors function more rapidly and offer the ability to handle various level measurement tasks with greater accuracy across multiple industries.

Market Share by Type of Sensor Connectivity

Based on type of sensor connectivity, the global level sensors market is segmented into wired, wireless and IoT enabled types. According to our estimates, currently, the IoT enabled sensor captures the majority of the market share. This growth is driven by an increasing need for sophisticated sensors that offer real-time monitoring features.

Such IoT-enabled sensors are crucial for sectors such as oil & gas, pharmaceuticals, and wastewater management. It is important to mention that this growth trend is expected to persist throughout the forecast period, with IoT-enabled sensors anticipated to experience a higher CAGR during this time.

Market Share by Sensor Material

Based on sensor material, the global level sensors market is segmented into ceramic, plastic, stainless steel and others. According to our estimates, currently, the ceramic material segment captures the majority of the market share. This is due to the durability and corrosion resistance of ceramic that makes it well-suited to withstand harsh environments and chemicals.

However, the plastic sensor segment is expected to grow at a higher CAGR during the forecast period, due to its cost-effectiveness and continuous advancements enhancing its ability to endure environmental conditions.

Market Share by Monitoring Type

Based on monitoring type, the global level sensors market is segmented into point-level sensors and continuous-level sensors. According to our estimates, currently, the continuous monitoring segment captures the majority of the market share. This growth is due to the enhanced accuracy and flexibility provided by continuous monitoring technology. Radar and ultrasonic level sensors are the most commonly utilized continuous-level sensors, capable of measuring the levels of liquids and fluidized solids.

Market Share by Application Area

Based on application area, the global level sensors market is segmented into liquid measuring & monitoring, and fluidized measuring & monitoring. According to our estimates, currently, the liquid measuring & monitoring segment captures the majority of the market share, due to the increasing adoption of level sensors for liquid measurement and monitoring across various industries such as food & beverages, automotive, chemical, and oil & gas.

In both the chemical and oil & gas sectors, there is a substantial demand for liquid level sensors, as these industries must comply with regulatory standards related to the storage of liquid petroleum and gas. Therefore, these sectors require dependable liquid-level measuring sensors to meet regulatory requirements, which is expected to be the primary reason for the largest market share.

Market Share by Company Size

Based on company size, the global level sensors market is segmented into large enterprises and small and medium-sized enterprises. According to our estimates, currently, the large enterprises captures the majority of the market share. This can be attributed to the wide range of sensor products offered by these larger companies and their substantial investments in this expanding market.

Notably, these firms are intensifying their research and development efforts to create advanced sensor technologies. Larger enterprises are also utilizing acquisitions and partnerships to enhance their product offerings and address the increasing demand for liquid-level sensors.

Market Share by End User

Based on end user, the global level sensors market is segmented into manufacturing, food & beverage, chemical, water and wastewater, industrial manufacturing, energy & utilities, pharmaceuticals, automotive, aerospace, healthcare, and others. According to our estimates, currently, the oil, gas and chemical segment captures the majority of the market share.

This can be attributed to the increasing use of sensors for monitoring and managing liquid levels in storage tanks, processing vessels, and pipelines. Importantly, oil and gas operations are intricate, and there exists a significant risk of fire incidents due to the volatility of these substances. Therefore, oil and gas companies employ sophisticated liquid sensor technologies to maintain safety and operational efficiency.

Market Share by Geographical Regions

Based on geographical regions, the level sensors market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently North America captures the majority share of the market, driven by the rising implementation of level sensors in high-tech vehicles within the region. Additionally, a mandate from the US government, known as the TEREAD Act, requires that pressure and level sensors be installed to indicate underinflated tires, further boosting the demand for these sensors in North America.

In addition, the market in Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) during the forecast period, due to growing concerns regarding water management and environmental pollution.

Example Players in Level Sensors Market

- ABB

- AMETEK

- Garner Industries

- Indicator

- Emerson Electric

- Electro-Sensors

- Endress+Hauser

- Fortive

- Gems Sensors

- Honeywell International

- Magnetrol International

- OMEGA Engineering

- MTS System Corporation

- Pepperl+Fuchs

- Senix Corporation

- Texas Instruments

- TE Connectivity

Level Sensors Market: Research Coverage

The report on the level sensors market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the level sensors market, focusing on key market segments, including [A] type of technology, [B] type of sensor connectivity, [C] sensor material, [D] monitoring type, [E] application area, [F] company size, business model, [G] end user, and [H] geographical region.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the level sensors market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the level sensors market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] level sensors portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the level sensors industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the level sensors domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the level sensors market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the level sensors market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the level sensors market.

Key Questions Answered in this Report

- How many companies are currently engaged in level sensors market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.15. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.15. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Level Sensors Market

- 6.2.1. Key Characteristics of Level Sensors Market

- 6.2.2. Type of Technology

- 6.2.3. Type of Monitoring Type

- 6.2.4. Type of Application

- 6.2.5. Company Size

- 6.2.6. Type of Business Model

- 6.2.7. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Level Sensors: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. ABB

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. AMETEK

- 8.4. Garner Industries

- 8.5. Indicator

- 8.6. Emerson Electric

- 8.7. Electro-Sensors

- 8.8. Endress+Hauser

- 8.9. Fortive

- 8.10. Gems Sensors

- 8.11. Honeywell International

- 8.12. Magnetrol International

- 8.13. OMEGA Engineering

- 8.14. MTS System Corporation

- 8.15. Pepperl+Fuchs

- 8.16. Senix Corporation

- 8.17. Texas Instruments

- 8.18. TE Connectivity

9. STARTUP ECOSYSTEM IN THE LEVEL SENSORS MARKET

- 9.1. Level Sensors Market: Market Landscape of Startups

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Company Size and Year of Establishment

- 9.1.4. Analysis by Location of Headquarters

- 9.1.5. Analysis by Company Size and Location of Headquarters

- 9.1.6. Analysis by Ownership Structure

- 9.2. Key Findings

10. VALUE CHAIN ANALYSIS

11. SWOT ANALYSIS

12. GLOBAL LEVEL SENSROS MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Trends Disruption Impacting Market

- 12.4. Global Level Sensors Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.5. Multivariate Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Level Sensors Market for Contact Technology: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Level Sensors Market for Non-Contact Technology: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF SENSOR CONNECTIVITY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Level Sensors Market for Wired: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Level Sensors Market for Wireless: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Level Sensors Market for IoT Enabled: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON SENSOR MATERIAL

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Level Sensors Market for Ceramic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Level Sensors Market for Plastic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Level Sensors Market for Stainless Steel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Level Sensors Market for Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON MONITORING TYPE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Level Sensors Market for Point Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.1. Level Sensors Market for Mechanical and Magnetic Float Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.2. Level Sensors Market for Capacitance Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.3. Level Sensors Market for Vibratory Probe Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6. 4. Level Sensors Market for Conductivity Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6. 5. Level Sensors Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Level Sensors Market for Continuous Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7.1. Level Sensors Market for Laser Level Sensor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7.2. Level Sensors Market for Ultrasonic Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7.3. Level Sensors Market for Magnetostrictive Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7.4. Level Sensors Market for Radar Level Sensors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7.5. Level Sensors Market for Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON APPLICATION AREA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Level Sensors Market for Power Generation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Level Sensors Market for Oil and Gas: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Level Sensors Market for Mining and Metal Processing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Level Sensors Market for Food and Beverage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Level Sensors Market for Chemical: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.11. Level Sensors Market for Water and Wastewater: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.12. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON END USER

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Level Sensors Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Level Sensors Market for Energy & Utilities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Level Sensors Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Level Sensors Market for Aerospace: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Level Sensors Market for Food & Beverages: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.11. Level Sensors Market for Pharmaceuticals: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.12. Level Sensors Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.13. Level Sensors Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.14. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 19.6. Level Sensors Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Level Sensors Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Level Sensors Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Level Sensors Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Level Sensors Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN NORTH AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Level Sensors Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Level Sensors Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Level Sensors Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Level Sensors Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Level Sensors Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN EUROPE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Level Sensors Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Level Sensors Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Level Sensors Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Level Sensors Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Level Sensors Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Level Sensors Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Level Sensors Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.7. Level Sensors Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.8. Level Sensors Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.9. Level Sensors Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.10. Level Sensors Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

22..6.11. Level Sensors Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.12. Level Sensors Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.13. Level Sensors Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.15. Level Sensors Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.15. Level Sensors Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN ASIA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Level Sensors Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Level Sensors Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Level Sensors Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Level Sensors Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Level Sensors Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Level Sensors Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Level Sensors Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Level Sensors Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Level Sensors Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 24.6.2. Level Sensors Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Level Sensors Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Level Sensors Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Level Sensors Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Level Sensors Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Level Sensors Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Level Sensors Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN LATIN AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Level Sensors Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Level Sensors Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Level Sensors Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Level Sensors Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Level Sensors Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Level Sensors Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Level Sensors Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR LEVEL SENSORS IN REST OF THE WORLD

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Level Sensors Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Level Sensors Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Level Sensors Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Level Sensors Market in Other Countries

- 26.7. Data Triangulation and Validation