|

市場調查報告書

商品編碼

1776873

醫療保健大數據市場:產業趨勢及全球預測-按組件、硬體類型、軟體類型、服務類型、部署選項、應用領域、醫療保健產業、最終用戶、經濟狀況、地區和主要參與者劃分Big Data in Healthcare Market: Industry Trends and Global Forecasts - Distribution by Component, Hardware, Software, Service, Deployment Option, Application Area, Healthcare Vertical, End User, Economic Status, Geography and Leading Players |

||||||

預計到 2035 年,全球醫療保健大數據市場規模將從目前的 780 億美元成長至 5,400 億美元,預測期內複合年增長率為 19.20%。

市場區隔根據以下參數劃分市場規模與機會:

零組件

- 硬體設備

- 軟體

- 服務

硬體設備類型

- 儲存·設備

- 網路·基礎設施

- 伺服器

軟體類型

- 電子健康記錄

- 診療管理軟體

- 收益循環管理軟體

- 勞動力管理軟體

服務類型

- 說明的分析

- 診斷分析

- 預測分析

- 指示性分析

展開選擇

- 雲端基礎

- 內部部署

應用領域

- 臨床資料管理

- 財務管理

- 運用管理

- 族群健康管理

醫療保健各領域

- 醫療保健服務

- 醫療設備

- 醫藥品

- 其他

終端用戶

- 診所

- 醫療保險代理店

- 醫院

- 其他

經濟狀況

- 高所得國

- 高中所得國

- 低中所得國

主要地區

- 北美

- 歐洲

- 亞洲

- 南美

- 中東·北非

- 其他地區

全球醫療保健大數據市場:成長與趨勢

醫療保健大數據是指持續成長且無法使用傳統工具有效儲存和處理的大量資料。由於醫療保健產業產生的大量數據,尤其是近年來,大數據以及大數據分析工具和技術的普及度呈指數級增長。醫療保健大數據利用大量現有數據,將為患者提供個人化照護的課題轉化為機會。此外,大數據可用於醫療保健產業的各個領域,包括人口健康管理、電子健康記錄 (EHR) 管理、藥物研究以及遠距醫療和遠距保健。

大數據在醫療保健領域的日益普及,對醫療保健大數據市場的規模產生了重大影響。大數據分析不僅應用於醫療保健市場,也應用於各個領域,利用機器學習和人工智慧來推動組織發展並預測未來趨勢。大數據也對金融業產生了重大影響。醫療保健領域的大數據具有許多優勢,將預測分析和機器學習演算法與大數據結合,可實現早期疾病檢測、個人化治療方案和精準醫療。

全球醫療保健大數據市場:關鍵洞察

本報告深入探討了全球醫療保健大數據市場的現狀,並識別了行業內的潛在成長機會。主要發現包括:

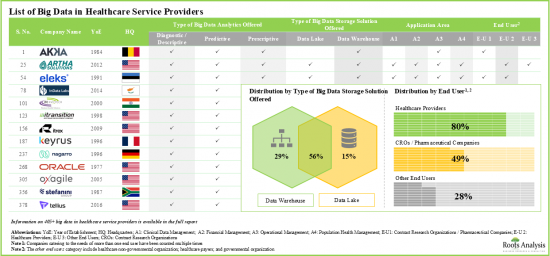

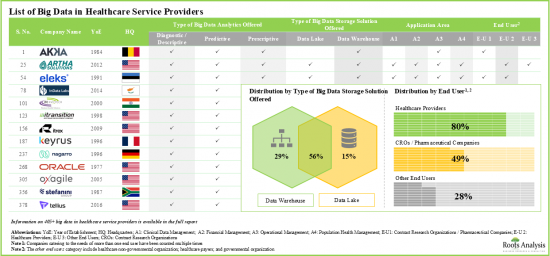

- 超過 405 家公司提供客製化解決方案和服務,以支援醫療保健領域的大數據應用,其中約 55% 的公司提供用於資料管理和分析的資料倉儲和資料湖。

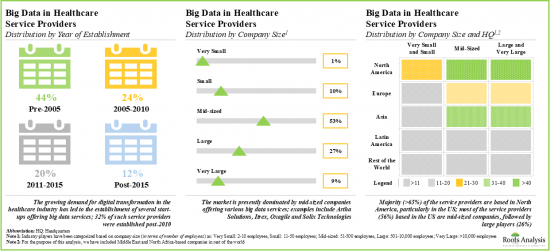

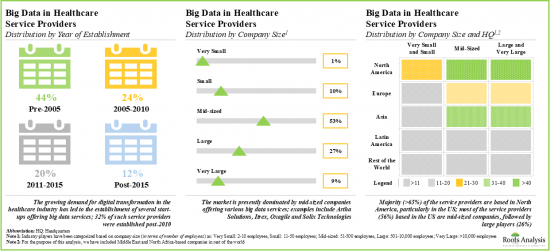

- 大多數服務提供者(超過 65%)位於北美,尤其是美國。大多數美國服務供應商(56%)是中型公司,其次是大型公司(26%)。

- 市場格局高度分散,既有新進者,也有位於不同地區的老牌公司。其中近 55% 的公司是中型公司。

- 各種分析模型從臨床、營運和財務數據中獲取洞察。 23% 的參與者提供全面的大數據分析軟體套件,包括預測性分析、規範分析和描述性分析。

- 為了獲得競爭優勢,企業正在積極升級現有功能並添加新功能,以增強其產品組合和合作夥伴的大數據產品。

- 分析影響醫療保健市場大數據發展的關鍵驅動因素和障礙,為深入了解該領域當前和未來的商業機會提供了寶貴的見解。

- 受雲端解決方案和服務日益普及的推動,醫療保健領域的大數據市場在未來 12 年內的複合年增長率預計將達到 19.06%。

- 預計市場機會將涵蓋大數據的各個組成部分,包括各種類型的硬體、服務和軟體。

- 高收入國家正優先採用大數據解決方案來優化營運管理,從而提高醫療保健營運的效率和效益,並推動市場收入成長。

- 隨著遠距醫療服務和個人化醫療需求的不斷增長,醫療保健大數據市場為不同地區的參與者提供了豐厚的機會。

全球醫療保健大數據市場:主要細分市場

依組成部分劃分,市場分為大數據硬體、大數據軟體及大數據服務。目前,硬體市場在全球醫療保健大數據市場中佔據最大佔有率(超過 40%)。此外,由於先進技術的日益普及以及對技術創新的持續投入,硬體領域的成長速度可能高於其他領域。

依硬體類型,市場細分為儲存設備、網路基礎架構和伺服器。目前,儲存設備領域佔據醫療大數據市場的最大佔有率(約 60%)。此外,該領域很可能以相對較高的複合年增長率成長。

依軟體類型,市場細分為電子病歷、實務管理軟體、收入週期管理軟體和勞動力管理軟體。目前,電子病歷領域佔據醫療大數據市場的最大佔有率(超過 45%)。此外,勞動力管理軟體領域很可能以相對較高的複合年增長率成長。

依服務類型,市場細分為描述性分析、診斷性分析、預測性分析及規範性分析。目前,診斷分析領域佔據醫療大數據市場的最大佔有率(超過 30%)。此外,值得注意的是,醫療大數據市場中的規範分析領域很可能以相對較高的複合年增長率成長。

根據部署方式,市場分為雲端部署和本地部署。由於雲端部署具有可擴展性、靈活性、成本效益、易於部署和維護以及資料存取等諸多優勢,雲端部署目前佔據醫療大數據市場的最大佔有率(約 60%)。預計未來這一趨勢將持續下去。

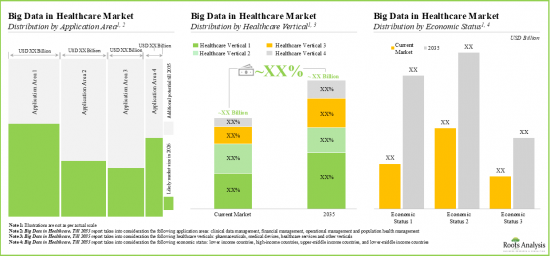

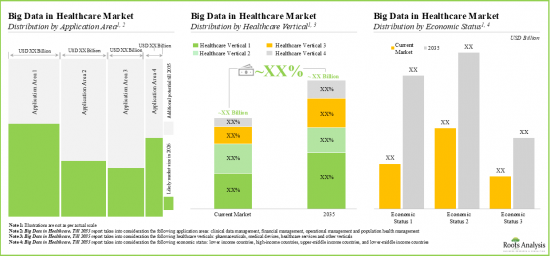

根據應用,市場分為臨床資料管理、財務管理、營運管理和人口健康管理。目前,營運管理領域佔據醫療大數據市場的最大佔有率(超過 30%)。此外,預計在預測期內,人口健康管理領域的複合年增長率將高於其他領域,展現出最高的成長潛力。

依醫療保健領域劃分,市場分為醫療服務、醫療器材、藥品及其他領域。雖然醫療服務領域預計將成為整體市場的主要驅動力,但值得注意的是,醫療器材領域的全球醫療大數據市場複合年增長率可能超過20%。

依最終用戶劃分,全球市場分為診所、醫療保險機構、醫院和其他領域。目前,醫院領域佔最大市場佔有率(超過40%)。然而,預計未來幾年診所領域的醫療大數據市場將顯著成長。

依經濟狀況劃分,市場分為高收入國家、中上收入國家及中下收入國家。目前,高收入國家在醫療大數據市場中佔比最高(約 85%)。此外,值得注意的是,中上收入國家的醫療大數據市場可望維持相對較高的複合年增長率。

依主要地區劃分,市場分為北美、歐洲、亞洲、中東及非洲、拉丁美洲等地區。目前,北美(約 60%)在醫療大數據市場中佔據主導地位,佔據最大的收入佔有率。然而,預計亞太地區的市場將以更高的複合年增長率成長。

醫療保健的巨量資料市場參與企業案例

- Accenture

- Akka Technologies

- Altamira.ai

- Amazon Web Services

- Athena Global Technologies

- atom Consultancy Services(ACS)

- Avenga

- Happiest Minds

- InData Labs

- Itransition

- Kellton

- Keyrus

- Lutech

- Microsoft

- Nagarro

- Nous Infosystems

- NTT data

- Oracle

- Orange Mantra

- Oxagile

- Scalefocus

- Softweb Solutions

- Solix Technologies

- Spindox

- Tata Elxsi

- Teradata

- Trianz(formerly CBIG Consulting)

- Trigyn Technologies

- XenonStack

按按本報告提供全球醫療保健的巨量資料市場相關調查,市場概要,以及各零件,硬體設備類別,軟體類別,各服務形式,展開選擇,應用各領域,醫療保健各領域,各終端用戶,經濟狀況,各地區的趨勢,及的加入此市場的主要企業的簡介等。

目錄

第1章 序文

第2章 調查手法

- 章概要

- 調查的前提

- 計劃調查手法

- 預測調查手法

- 堅牢的品管

- 重要的考慮事項

- 主要的市場區隔

第3章 經濟以及其他的計劃特有的考慮事項

- 章概要

- 市場動態

第4章 摘要整理

第5章 簡介

- 章概要

- 巨量資料概要

- 巨量資料分析

- 醫療保健的巨量資料的應用

- 未來展望

第6章 市場形勢

第7章 重要的洞察

- 章概要

- 醫療保健服務供應商的巨量資料:重要的洞察

第8章 企業競爭力分析

- 章概要

- 前提主要的參數

- 調查手法

- 醫療保健服務供應商的巨量資料:企業競爭力分析

第9章 企業簡介北美的醫療保健服務供應商的巨量資料

- 章概要

- 北美的主要加入企業的詳細內容簡介

- Amazon Web Services

- Microsoft

- Oracle

- Teradata

- 北美的其他的參與企業的簡介

- Itransition

- Nous Infosystems

- Oxagile

- Softweb Solutions

- Solix Technologies

- Trianz(formerly CBIG Consulting)

第10章 企業簡介:歐洲的醫療保健服務供應商的巨量資料

- 章概要

- 歐洲的主要加入企業的詳細內容簡介

- Accenture

- Keyrus

- 歐洲的其他的參與企業的簡介

- Akka Technologies

- Altamira.ai

- atom Consultancy Services(ACS)

- Avenga

- Lutech

- Nagarro

- Scalefocus

- Spindox

第11章 企業簡介:亞洲及全球其他地區的醫療保健服務供應商的巨量資料

- 章概要

- 亞洲及其他各國的主要加入企業的詳細內容簡介

- Tata Elxsi

- Kellton

- 亞洲及其他各國的其他的參與企業的簡介

- Athena Global Technologies

- Happiest Minds

- InData Labs

- NTT data

- OrangeMantra

- Trigyn Technologies

- XenonStack

第12章 市場影響分析:促進因素,阻礙因素,機會,課題

第13章 醫療保健市場上世界巨量資料

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上全球巨量資料,歷史的趨勢(2018年以後)與預測(到2035年)

- 主要的市場區隔

第14章 醫療保健市場上巨量資料(各零件)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:各零件

- 與資料的三角測量檢驗

第15章 醫療保健市場上巨量資料(各硬體設備)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:硬體設備類別

- 與資料的三角測量檢驗

第16章 醫療保健市場上巨量資料(軟體類別)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:軟體類別

- 與資料的三角測量檢驗

第17章 醫療保健市場上巨量資料(各類服務)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:各服務形式

- 與資料的三角測量檢驗

第18章 醫療保健市場上巨量資料(展開選擇)

- 章概要

- 與主要的前提調查手法

- 按醫療保健市場上巨量資料:展開選擇

- 與資料的三角測量檢驗

第19章 醫療保健市場上巨量資料(應用各領域)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:應用各領域

- 與資料的三角測量檢驗

第20章 醫療保健市場上巨量資料(醫療保健各領域)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:醫療保健各領域

- 與資料的三角測量檢驗

第21章 醫療保健市場上巨量資料(各終端用戶)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:各終端用戶

- 與資料的三角測量檢驗

第22章 按醫療保健市場上巨量資料(經濟狀況)

- 章概要

- 與主要的前提調查手法

- 按醫療保健市場上巨量資料:經濟狀況

- 與資料的三角測量檢驗

第23章 醫療保健市場上巨量資料(各地區)

- 章概要

- 與主要的前提調查手法

- 醫療保健市場上巨量資料:各地區分佈

- 與資料的三角測量檢驗

第24章 醫療保健市場上巨量資料,主要企業的收益預測

- 章概要

- 與主要的前提調查手法

- Microsoft

- Optum

- IBM

- Oracle

- Allscripts

第25章 結論

第26章 執行洞察

第27章 附錄I:表格形式資料

第28章 附錄II:企業及組織的一覽

GLOBAL BIG DATA IN HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the big data in healthcare market is estimated to grow from USD 78 billion in the current year to USD 540 billion by 2035, at a CAGR of 19.20% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Component

- Hardware

- Software

- Services

Type of Hardware

- Storage Devices

- Networking Infrastructure

- Servers

Type of Software

- Electronic Health Record

- Practice Management Software

- Revenue Cycle Management Software

- Workforce Management Software

Type of Service

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

Deployment Option

- Cloud-based

- On-premises

Application Area

- Clinical Data Management

- Financial Management

- Operational Management

- Population Health Management

Healthcare Vertical

- Healthcare Services

- Medical Devices

- Pharmaceuticals

- Other Verticals

End User

- Clinics

- Health Insurance Agencies

- Hospitals

- Other End Users

Economic Status

- High Income Countries

- Upper-Middle Income Countries

- Lower-Middle Income Countries

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

GLOBAL BIG DATA IN HEALTHCARE MARKET: GROWTH AND TRENDS

Big Data in healthcare refers to the vast amount of data that is continuously expanding and cannot be efficiently stored or processed using traditional tools. Notably, over the past few years, the popularity of big data / big data analytics tools and technologies has increased exponentially in healthcare due to the large volumes of data being generated in this domain. Big data in healthcare turns the challenges into opportunities to provide personalized care to the patients by using huge amounts of existing data. Further, big data can be used across different verticals of healthcare industry, such as in population health management, Electronic Health Record (EHR) management, pharmaceutical research, and telemedicine and telehealth.

Owing to the increasing popularity of big data in healthcare domain, there is a huge impact of big data in healthcare market size. Big data analysis is used not only in healthcare market but also used in different sectors for the growth of the organization and to forecast future trends using machine learning and artificial intelligence. Moreover, big data has also had a considerable impact on the financial sector. Big data in the healthcare domain has several advantages and the integration of predictive analytics and machine learning algorithms with big data can enable early detection of diseases, personalized treatment plans, and precision medicine.

GLOBAL BIG DATA IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of global big data in healthcare market and identifies potential growth opportunities within industry. Some key findings from the report include:

- More than 405 players claim to offer customized solutions and services to support big data in healthcare initiatives, with around 55% offering data warehouses and data lakes for data management and analytics.

- Majority (>65%) of the service providers are based in North America, particularly in the US; most of the service providers (56%) based in the US are mid-sized companies, followed by large players (26%).

- The market landscape is highly fragmented, featuring the presence of both new entrants and established players based across different geographical regions; close to 55% of such players are mid-sized companies.

- Various analytical models derive insights from clinical, operational and financial data; 23% of the players offer a comprehensive software suite of big data analytics including predictive, prescriptive, and descriptive analytics.

- In pursuit of building a competitive edge, players are actively upgrading their existing capabilities and adding new competencies in order to augment their respective portfolios and affiliated big data offerings.

- By analyzing the key drivers and barriers affecting the evolution of big data in healthcare market, valuable insights can be generated leading to a deeper understanding of the current and future opportunities within this domain.

- Driven by the increasing adoption of cloud-based solutions and services, the big data in healthcare market is likely to grow at a CAGR of 19.06% over the next 12 years.

- The projected market opportunity is anticipated to be well distributed across different components of big data, including various types of hardware, services and software.

- High-income countries are driving market revenues by prioritizing the deployment of big data solutions to optimize operational management, leading to enhanced efficiency and effectiveness in healthcare operations.

- With the rise in demand for telehealth services and personalized medicine, the big data in healthcare market presents lucrative opportunities for players based across various geographies.

GLOBAL BIG DATA IN HEALTHCARE MARKET: KEY SEGMENTS

Hardware Segment Occupies the Largest Share of the Big Data in Healthcare Market

Based on the component, the market is segmented into big data hardware, big data software and big data services. At present, hardware segment holds the maximum (>40%) share of the global big data in healthcare market. Additionally, due to the rising adoption of advanced technologies, and ongoing investments in innovation, the hardware segment is likely to grow at a faster pace compared to the other segments.

By Type of Hardware, Storage Devices Segment is the Fastest Growing Segment of the Global Big Data in Healthcare Market

Based on the type of hardware, the market is segmented into storage devices, networking infrastructure and servers. Currently, storage devices segment captures the highest proportion (~60%) of the big data in healthcare market. Further, this segment is likely to grow at a relatively higher CAGR.

Electronic Health Record Segment Occupy the Largest Share of the Big Data in Healthcare Market

Based on the type of software, the market is segmented into electronic health record, practice management software, revenue cycle management software, and workforce management software. At present, the electronic health record segment holds the maximum share (>45%) of the big data in healthcare market. In addition, workforce management software segment is likely to grow at a relatively higher CAGR.

By Type of Service, the Diagnostic Analytics Segment is the Fastest Growing Segment of the Big Data in Healthcare Market During the Forecast Period

Based on the type of service, the market is segmented into descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. Currently, the diagnostic analytics segment captures the highest proportion (>30%) of the big data in healthcare market. Further, it is worth highlighting that the big data in healthcare market for prescriptive analytics segment is likely to grow at a relatively higher CAGR.

Cloud-based Segment Account for the Largest Share of the Global Big Data in Healthcare Market

Based on the deployment option, the market is segmented into cloud-based deployment and on-premises deployment. Currently, cloud-based segment holds the maximum share (~60%) of the big data in healthcare market owing to the various benefits offered by cloud-based deployment, such as scalability, flexibility, cost-effectiveness, ease of implementation and maintenance, and data accessibility. This trend is likely to remain the same in the coming years.

By Application Area, Operational Management Segment is Likely to Dominate the Big Data in Healthcare Market

Based on the application area, the market is segmented into clinical data management, financial management, operational management, and population health management. At present, the operational management segment holds the maximum share (>30%) of the big data in healthcare market. Additionally, the population health management segment is expected to show the highest growth potential during the forecast period, growing at a higher CAGR, compared to the other segments.

The Healthcare Services Segment in Healthcare Vertical Occupy the Largest Share of the Big Data in Healthcare Market

Based on the healthcare vertical, the market is segmented into healthcare services, medical devices, pharmaceuticals, and other verticals. While healthcare services segment is expected to be the primary driver of the overall market, it is worth highlighting that the global big data in healthcare market for medical devices segment is likely to grow at a relatively higher CAGR of more than 20%.

Currently, Hospitals Segment Holds the Largest Share of the Big Data in Healthcare Market

Based on end users, the global market is segmented into clinics, health insurance agencies, hospitals, and other end users. Currently, the hospitals segment holds the largest market share (>40%). However, the big data in healthcare market for clinics segment is expected to witness substantial growth in the coming years.

By Economic Status, the Upper-Middle Income Countries Segment is the Fastest Growing Segment of the Big Data in Healthcare Market During the Forecast Period

Based on the economic status, the market is segmented into high income countries, upper-middle income countries, and lower-middle income countries. Currently, the high-income countries segment captures the highest proportion (~85%) of the big data in healthcare market. Further, it is worth highlighting that the big data in healthcare market for upper-middle income countries segment is likely to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Middle East and North Africa, Latin America and Rest of the World. Currently, North America (~60%) dominates the big data in healthcare market and accounts for the largest revenue share. However, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Big Data in Healthcare Market

- Accenture

- Akka Technologies

- Altamira.ai

- Amazon Web Services

- Athena Global Technologies

- atom Consultancy Services (ACS)

- Avenga

- Happiest Minds

- InData Labs

- Itransition

- Kellton

- Keyrus

- Lutech

- Microsoft

- Nagarro

- Nous Infosystems

- NTT data

- Oracle

- Orange Mantra

- Oxagile

- Scalefocus

- Softweb Solutions

- Solix Technologies

- Spindox

- Tata Elxsi

- Teradata

- Trianz (formerly CBIG Consulting)

- Trigyn Technologies

- XenonStack

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Chief Executive Officer and Founder, Company A

- Chief Executive Officer and Co-Founder, Company B

- Chief People Officer and Co-Founder, Company C

- Vice President, Company D

- Vice President, Company E

- Business Head, Company F

- Senior IT Inside Sales Lead, Company G

- Senior Manager, Company H

- Delivery Manager, Company I

- Strategy, Research and Analyst Relations Manager, Company J

- Business Development Manager, Company K

- Business Development Associate, Company L

- Business Development Specialist Advisor, Company M

- Business Development Executive, Company N

GLOBAL BIG DATA IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global big data in healthcare market, focusing on key market segments, including [A] component, [B] type of hardware, [C] type of software, [D] type of service, [E] deployment option, [F] application area, [G] healthcare vertical, [H] end user, [I] economic status and [J] key geographical regions.

- Market Landscape: A comprehensive evaluation of big data in healthcare service providers, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] business model, [E] type of offering, [F] type of big data analytics offered, [G] type of big data storage solution offered, [H] deployment option, [I] application area and [J] end user.

- Company Competitiveness Analysis: A comprehensive competitive analysis of big data in healthcare service providers, examining factors, such as [A] supplier strength and [B] portfolio strength.

- Company Profiles: In-depth profiles of companies engaged in offering big data analytics solutions across various geographies, focusing on [A] company overviews, [B] financial information (if available), [C] big data analytics offerings and capabilities and [D] recent developments and an informed future outlook.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2.RESEARCH METHODOLOGY

- 2.1.Chapter Overview

- 2.2.Research Assumptions

- 2.3.Project Methodology

- 2.4.Forecast Methodology

- 2.5.Robust Quality Control

- 2.6.Key Considerations

- 2.6.1.Demographics

- 2.6.2.Economic Factors

- 2.6.3.Government Regulations

- 2.6.4. Supply Chain

- 2.6.5.COVID Impact / Related Factors

- 2.6.6. Market Access

- 2.6.7. Healthcare Policies

- 2.6.8. Industry Consolidation

- 2.7. Key Market Segmentations

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1. Chapter Overview

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Big Data

- 5.2.1. Types of Big Data

- 5.2.1.1. Structured Data

- 5.2.1.2. Unstructured Data

- 5.2.1.3. Semi-Structured Data

- 5.2.2. Management and Storage of Big Data

- 5.2.1. Types of Big Data

- 5.3. Big Data Analytics

- 5.3.1. Types of Big Data Analytics

- 5.3.1.1. Descriptive Analytics

- 5.3.1.2. Diagnostic Analytics

- 5.3.1.3. Predictive Analytics

- 5.3.1.4. Prescriptive Analytics

- 5.3.1. Types of Big Data Analytics

- 5.4. Applications of Big Data in Healthcare

- 5.5. Future Perspective

6. OVERALL MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Big Data in Healthcare Service Providers: Overall Market Landscape

- 6.3. Analysis by Year of Establishment

- 6.4. Analysis by Company Size

- 6.5. Analysis by Location of Headquarters

- 6.6. Analysis by Type of Business Model

- 6.7. Analysis by Type of Offering

- 6.8. Analysis by Type of Big Data Analytics Offered

- 6.9. Analysis by Type of Big Data Storage Solution Offered

- 6.10. Analysis by Deployment Option

- 6.11. Analysis by Application Area

- 6.12. Analysis by End User

7. KEY INSIGHTS

- 7.1. Chapter Overview

- 7.2. Big Data in Healthcare Service Providers: Key Insights

- 7.2.1. Analysis by Year of Establishment and Company Size

- 7.2.2. Analysis by Company Size and Location of Headquarters

- 7.2.3. Analysis by Type of Offering and Company Size

- 7.2.4. Analysis by Type of Big Data Analytics Offered and Application Area

- 7.2.5. Analysis by Company Size, Application Area and End User

8. COMPANY COMPETITIVENSS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Big Data in Healthcare Service Providers: Company Competitiveness Analysis

- 8.4.1. Big Data in Healthcare Service Providers based in North America

- 8.4.1.1. Small Service Providers based in North America

- 8.4.1.2. Mid-sized Service Providers based in North America

- 8.4.1.3. Large Service Providers based in North America

- 8.4.1.4. Very LargeService Providers based in North America

- 8.4.2. Big Data in Healthcare Service Providers based in Europe

- 8.4.2.1. Small Service Providers based in Europe

- 8.4.2.2. Mid-sized Service Providers based in Europe

- 8.4.2.3. Large and Very Large Service Providers based in Europe

- 8.4.3. Big Data in Healthcare Service Providers based in Asia and Rest of the World

- 8.4.3.1. Small Service Providers based in Asia and Rest of the World

- 8.4.3.2. Mid-sized Service Providers based in Asia and Rest of the World

- 8.4.3.3. Large Service Providers based in Asia and Rest of the World

- 8.4.3.4. Very Large Service Providers based in Asia and Rest of the World

- 8.4.1. Big Data in Healthcare Service Providers based in North America

9. COMPANY PROFILES: BIG DATA IN HEALTHCARE SERVICE PROVIDERS IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2. Detailed Company Profiles of Leading Players in North America

- 9.2.1. Amazon Web Services

- 9.2.1.1. Company Overview

- 9.2.1.2. Financial Information

- 9.2.1.3. Big Data Offerings and Capabilities

- 9.2.1.4. Recent Developments and Future Outlook

- 9.2.2. Microsoft

- 9.2.2.1. Company Overview

- 9.2.2.2. Financial Information

- 9.2.2.3. Big Data Offerings and Capabilities

- 9.2.2.4. Recent Developments and Future Outlook

- 9.2.3. Oracle

- 9.2.3.1. Company Overview

- 9.2.3.2. Financial Information

- 9.2.3.3. Big Data Offerings and Capabilities

- 9.2.3.4. Recent Developments and Future Outlook

- 9.2.4. Teradata

- 9.2.4.1. Company Overview

- 9.2.4.2. Financial Information

- 9.2.4.3. Big Data Offerings and Capabilities

- 9.2.4.4. Recent Developments and Future Outlook

- 9.2.1. Amazon Web Services

- 9.3. Short Company Profiles of Other Prominent Players in North America

- 9.3.1. Itransition

- 9.3.1.1. Company Overview

- 9.3.1.2. Big Data Offerings and Capabilities

- 9.3.2 Nous Infosystems

- 9.3.2.1. Company Overview

- 9.3.2.2. Big Data Offerings and Capabilities

- 9.3.3 Oxagile

- 9.3.3.1. Company Overview

- 9.3.3.2. Big Data Offerings and Capabilities

- 9.3.4 Softweb Solutions

- 9.3.4.1. Company Overview

- 9.3.4.2. Big Data Offerings and Capabilities

- 9.3.5 Solix Technologies

- 9.3.5.1. Company Overview

- 9.3.5.2. Big Data Offerings and Capabilities

- 9.3.6 Trianz (formerly CBIG Consulting)

- 9.3.6.1. Company Overview

- 9.3.6.2. Big Data Offerings and Capabilities

- 9.3.1. Itransition

10. COMPANY PROFILES: BIG DATA IN HEALTHCARE SERVICE PROVIDERS IN EUROPE

- 10.1. Chapter Overview

- 10.2. Detailed Company Profiles of Leading Players in Europe

- 10.2.1. Accenture

- 10.2.1.1. Company Overview

- 10.2.1.2. Financial Information

- 10.2.1.3. Big Data Offerings and Capabilities

- 10.2.1.4. Recent Developments and Future Outlook

- 10.2.2. Keyrus

- 10.2.2.1. Company Overview

- 10.2.2.2. Financial Information

- 10.2.2.3. Big Data Offerings and Capabilities

- 10.2.2.4. Recent Developments and Future Outlook

- 10.2.1. Accenture

- 10.3. Short Company Profiles of Other Prominent Players in Europe

- 10.3.1. Akka Technologies

- 10.3.1.1. Company Overview

- 10.3.1.2. Big Data Offerings and Capabilities

- 10.3.2 Altamira.ai

- 10.3.2.1. Company Overview

- 10.3.2.2. Big Data Offerings and Capabilities

- 10.3.3 atom Consultancy Services (ACS)

- 10.3.3.1. Company Overview

- 10.3.3.2. Big Data Offerings and Capabilities

- 10.3.4 Avenga

- 10.3.4.1. Company Overview

- 10.3.4.2. Big Data Offerings and Capabilities

- 10.3.5 Lutech

- 10.3.5.1. Company Overview

- 10.3.5.2. Big Data Offerings and Capabilities

- 10.3.6 Nagarro

- 10.3.6.1. Company Overview

- 10.3.6.2. Big Data Offerings and Capabilities

- 10.3.7 Scalefocus

- 10.3.7.1. Company Overview

- 10.3.7.2. Big Data Offerings and Capabilities

- 10.3.8 Spindox

- 10.3.8.1. Company Overview

- 10.3.8.2. Big Data Offerings and Capabilities

- 10.3.1. Akka Technologies

11. COMPANY PROFILES: BIG DATA IN HEALTHCARE SERVICE PROVIDERS IN ASIA AND REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Detailed Company Profiles of Leading Players in Asia and Rest of the World

- 11.2.1. Tata Elxsi

- 11.2.1.1. Company Overview

- 11.2.1.2. Big Data Offerings and Capabilities

- 11.2.1.3. Recent Developments and Future Outlook

- 11.2.2. Kellton

- 11.2.2.1. Company Overview

- 11.2.2.2. Financial Information

- 11.2.2.3. Big Data Offerings and Capabilities

- 11.2.2.4. Recent Developments and Future Outlook

- 11.2.1. Tata Elxsi

- 11.3. Short Company Profiles of Other Prominent Players in Asia and Rest of the World

- 11.3.1. Athena Global Technologies

- 11.3.1.1. Company Overview

- 11.3.1.2. Big Data Offerings and Capabilities

- 11.3.2 Happiest Minds

- 11.3.2.1. Company Overview

- 11.3.2.2. Big Data Offerings and Capabilities

- 11.3.3 InData Labs

- 11.3.3.1. Company Overview

- 11.3.3.2. Big Data Offerings and Capabilities

- 11.3.4 NTT data

- 11.3.4.1. Company Overview

- 11.3.4.2. Big Data Offerings and Capabilities

- 11.3.5 OrangeMantra

- 11.3.5.1. Company Overview

- 11.3.5.2. Big Data Offerings and Capabilities

- 11.3.6 Trigyn Technologies

- 11.3.6.1. Company Overview

- 11.3.6.2. Big Data Offerings and Capabilities

- 11.3.7 XenonStack

- 11.3.7.1. Company Overview

- 11.3.7.2. Big Data Offerings and Capabilities

- 11.3.1. Athena Global Technologies

12. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. GLOBAL BIG DATA IN HEALTHCARE MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Big Data in Healthcare Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.3.1. Scenario Analysis

- 13.3.1.1. Conservative Scenario

- 13.3.1.2. Optimistic Scenario

- 13.3.1. Scenario Analysis

- 13.4. Key Market Segmentations

14. BIG DATA IN HEALTHCARE MARKET, BY COMPONENT

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Big Data in Healthcare Market: Distribution by Component

- 14.3.1. Big Data Hardware: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.3.2. Big Data Software: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.3.3. Big Data Services: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4. Data Triangulation and Validation

15. BIG DATA IN HEALTHCARE MARKET, BY TYPE OF HARDWARE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Big Data in Healthcare Market: Distribution by Type of Hardware

- 15.3.1. Storage Devices: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.3.2. Servers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.3.3. Networking Infrastructure: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.4. Data Triangulation and Validation

16. BIG DATA IN HEALTHCARE MARKET, BY TYPE OF SOFTWARE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Big Data in Healthcare Market: Distribution by Type of Software

- 16.3.1. Electronic Health Record: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3.2. Revenue Cycle Management Software: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3.3. Practice Management Software: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3.4. Workforce Management Software: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.4. Data Triangulation and Validation

17. BIG DATA IN HEALTHCARE MARKET, BY TYPE OF SERVICE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Big Data in Healthcare Market: Distribution by Type of Services

- 17.3.1. Diagnostic Analytics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.2. Descriptive Analytics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.3. Predictive Analytics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.4. Prescriptive Analytics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.4. Data Triangulation and Validation

18. BIG DATA IN HEALTHCARE MARKET, BY DEPLOYMENT OPTION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Big Data in Healthcare Market: Distribution by Deployment Option

- 18.3.1. Cloud-based Deployment: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.2. On-premises Deployment: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. BIG DATA IN HEALTHCARE MARKET, BY APPLICATION AREA

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Big Data in Healthcare Market: Distribution by Application Area

- 19.3.1. Operational Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.2. Clinical Data Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.3. Financial Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.4. Population Health Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. BIG DATA IN HEALTHCARE MARKET, BY HEALTHCARE VERTICAL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Big Data in Healthcare Market: Distribution by Healthcare Vertical

- 20.3.1. Healthcare Services: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.2. Pharmaceuticals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.3. Medical Devices: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.4. Other Verticals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. BIG DATA IN HEALTHCARE MARKET, BY END USER

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Big Data in Healthcare Market: Distribution by End User

- 21.3.1. Hospitals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.2. Health Insurance Agencies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.3. Clinics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.4. Other End Users: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. BIG DATA IN HEALTHCARE MARKET, BY ECONOMIC STATUS

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Big Data in Healthcare Market: Distribution by Economic Status

- 22.3.1. High Income Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.1. US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.2. Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.3. Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.4. UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.5. UAE: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.6. South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.7. France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.8. Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.9. New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.10. Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.11. Saudi Arabia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.12. Nordic Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2. Upper-Middle Income Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2.1. China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2.2. Russia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2.3. Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2.4. Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2.5. South Africa: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.3. Lower-Middle Income Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.3.1. India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1. High Income Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4. Data Triangulation and Validation

23. BIG DATA IN HEALTHCARE MARKET, BY GEOGRAPHY

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Big Data in Healthcare Market: Distribution by Geography

- 23.3.1. North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.2. Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.3. Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.4. Middle East and North Africa: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.5. Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.6. Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4. Data Triangulation and Validation

24. BIG DATA IN HEALTHCARE MARKET, REVENUE FORECAST OF LEADING PLAYERS

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Microsoft: Revenue Generated from Big Data in Healthcare Offerings Since FY 2018

- 24.4. Optum: Revenue Generated from Big Data in Healthcare Offerings Since FY 2018

- 24.5. IBM: Revenue Generated from Big Data in Healthcare Offerings Since FY 2018

- 24.6. Oracle: Revenue Generated from Big Data in Healthcare Offerings Since FY 2018

- 24.7. Allscripts: Revenue Generated from Big Data in Healthcare Offerings Since FY 2018

25. CONCLUSION

- 25.1. Chapter Overview

26. EXECUTIVE INSIGHTS

- 26.1. Chapter Overview

- 26.2. Company A

- 26.2.1. Company Snapshot

- 26.2.2. Interview Transcript

- 26.3. Company B

- 26.3.1. Company Snapshot

- 26.3.2. Interview Transcript

- 26.4. Company C

- 26.4.1. Company Snapshot

- 26.4.2. Interview Transcript

- 26.5. Company D

- 26.5.1. Company Snapshot

- 26.5.2. Interview Transcrip

- 26.6. Company E

- 26.6.1. Company Snapshot

- 26.6.2. Interview Transcript

- 26.7. Company F

- 26.7.1. Company Snapshot

- 26.7.2. Interview Transcript

- 26.8. Company G

- 26.8.1. Company Snapshot

- 26.8.2. Interview Transcript

- 26.9. Company H

- 26.9.1. Company Snapshot

- 26.9.2. Interview Transcript

- 26.10. Company I

- 26.10.1. Company Snapshot

- 26.10.2. Interview Transcript

- 26.11. Company J

- 26.11.1. Company Snapshot

- 26.11.2. Interview Transcript

- 26.12. Company K

- 26.12.1. Company Snapshot

- 26.12.2. Interview Transcript

- 26.13. Company L

- 26.13.1. Company Snapshot

- 26.13.2. Interview Transcript

- 26.14. Company M

- 26.14.1. Company Snapshot

- 26.14.2. Interview Transcript

- 26.15. Company N

- 26.15.1. Company Snapshot

- 26.15.2. Interview Transcript

27. APPENDIX I: TABULATED DATA

28. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentation

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Overall Market Landscape

- Figure 4.2 Executive Summary: Global Market for Big Data in Healthcare by Component, Type of Hardware, Type of Software, Type of Service, and Deployment Option

- Figure 4.3 Executive Summary: Global Market for Big Data in Healthcare by Application Area, Healthcare Vertical, End User, Economic Status, Geography and Leading Players

- Figure 5.1 Types of Big Data Analytics

- Figure 5.2 Applications of Big Data in Healthcare

- Figure 6.1 Big Data in Healthcare Service Providers: Distribution by Year of Establishment

- Figure 6.2 Big Data in Healthcare Service Providers: Distribution by Company Size

- Figure 6.3 Big Data in Healthcare Service Providers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Big Data in Healthcare Service Providers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Big Data in Healthcare Service Providers: Distribution by Type of Business Model

- Figure 6.6 Big Data in Healthcare Service Providers: Distribution by Type of Offering

- Figure 6.7 Big Data in Healthcare Service Providers: Type of Big Data Analytics Offered

- Figure 6.8 Big Data in Healthcare Service Providers: Type of Big Data Storage Solution Offered

- Figure 6.9 Big Data in Healthcare Service Providers: Distribution by Deployment Option

- Figure 6.10 Big Data in Healthcare Service Providers: Distribution by Application Area

- Figure 6.11 Big Data in Healthcare Service Providers: Distribution by End User

- Figure 7.1 Big Data in Healthcare Service Providers: Distribution by Year of Establishment and Company Size

- Figure 7.2 Big Data in Healthcare Service Providers: Distribution by Company Size and Location of Headquarters

- Figure 7.3 Big Data in Healthcare Service Providers: Distribution by Type of Offering and Company Size

- Figure 7.4 Big Data in Healthcare Service Providers: Distribution by Type of Big Data Analytics Offered and Application Area

- Figure 7.5 Big Data in Healthcare Service Providers: Distribution by Company Size, Application Area and End User

- Figure 8.1 Company Competitiveness Analysis: Small Service Providers based in North America

- Figure 8.2 Company Competitiveness Analysis: Mid-sized Service Providers based in North America (I/II)

- Figure 8.3 Company Competitiveness Analysis: Mid-sized Service Providers based in North America (II/II)

- Figure 8.4 Company Competitiveness Analysis: Large Service Providers based in North America (I/II)

- Figure 8.5 Company Competitiveness Analysis: Large Service Providers based in North America (II/II)

- Figure 8.6 Company Competitiveness Analysis: Very Large Service Providers based in North America

- Figure 8.7 Company Competitiveness Analysis: Small Service Providers based in Europe

- Figure 8.8 Company Competitiveness Analysis: Mid-sized Service Providers based in Europe

- Figure 8.9 Company Competitiveness Analysis: Large and Very Large Big Service Providers based in Europe

- Figure 8.10 Company Competitiveness Analysis: Small Service Providers based in Asia and Rest of the World

- Figure 8.11 Company Competitiveness Analysis: Mid-sized Service Providers based in Asia and Rest of the World (I/II)

- Figure 8.12 Company Competitiveness Analysis: Mid-sized Service Providers based in Asia and Rest of the World (II/II)

- Figure 8.13 Company Competitiveness Analysis: Large Big Service Providers based in Asia and Rest of the World

- Figure 8.14 Company Competitiveness Analysis: Very Large Service Providers based in Asia and Rest of the World

- Figure 9.1 Amazon Web Services: Annual Revenues (USD Billion)

- Figure 9.2 Microsoft: Annual Revenues (USD Billion)

- Figure 9.3 Oracle: Annual Revenues (USD Billion)

- Figure 9.4 Teradata: Annual Revenues (USD Billion)

- Figure 10.1 Accenture: Annual Revenues (USD Billion)

- Figure 10.2 Keyrus: Annual Revenues (USD Million)

- Figure 11.1 Tata Elxsi: Annual Revenues (INR Billion)

- Figure 11.2 Kellton: Annual Revenues (INR Billion)

- Figure 12.1 Big Data in Healthcare Market Drivers

- Figure 12.2 Big Data in Healthcare Market Restraints

- Figure 12.3 Big Data in Healthcare Market Opportunities

- Figure 12.4 Big Data in Healthcare Market Challenges

- Figure 13.1 Global Market for Big Data in Healthcare, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 13.2 Global Market for Big Data in Healthcare, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 13.3 Global Market for Big Data in Healthcare, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 14.1 Big Data in Healthcare Market: Distribution by Component (USD Billion)

- Figure 14.2 Big Data in Healthcare Market for Hardware, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.3 Big Data in Healthcare Market for Software, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 14.4 Big Data in Healthcare Market for Services, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.1 Big Data in Healthcare Market: Distribution by Type of Hardware (USD Billion)

- Figure 15.2 Big Data in Healthcare Market for Storage Devices, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.3 Big Data in Healthcare Market for Servers, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.4 Big Data in Healthcare Market for Networking Infrastructure, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.1 Big Data in Healthcare Market: Distribution by Type of Software (USD Billion)

- Figure 16.2 Big Data in Healthcare Market for Electronic Health Records, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.3 Big Data in Healthcare Market for Revenue Cycle Management Software, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.4 Big Data in Healthcare Market for Practice Management Software, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.5 Big Data in Healthcare Market for Workforce Management Software, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.1 Big Data in Healthcare Market: Distribution by Type of Service (USD Billion)

- Figure 17.2 Big Data in Healthcare Market for Diagnostic Analytics, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.3 Big Data in Healthcare Market for Descriptive Analytics, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.4 Big Data in Healthcare Market for Predictive Analytics, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.5 Big Data in Healthcare Market for Prescriptive Analytics, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.1 Big Data in Healthcare Market: Distribution by Deployment Option (USD Billion)

- Figure 18.2 Big Data in Healthcare Market for Cloud-based Deployment, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Big Data in Healthcare Market for On-premises Deployment, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Big Data in Healthcare Market: Distribution by Application Area

- Figure 19.2 Big Data in Healthcare Market for Operational Management, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Big Data in Healthcare Market for Clinical Data Management, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Big Data in Healthcare Market for Financial Management, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Big Data in Healthcare Market for Population Health Management, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Big Data in Healthcare Market: Distribution by Healthcare Vertical

- Figure 20.2 Big Data in Healthcare Market for Healthcare Services, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Big Data in Healthcare Market for Pharmaceuticals, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.4 Big Data in Healthcare Market for Medical Devices, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.5 Big Data in Healthcare Market for Other Verticals, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Big Data in Healthcare Market: Distribution by End User (USD Billion)

- Figure 21.2 Big Data in Healthcare Market for Hospitals, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Big Data in Healthcare Market for Health Insurance Agencies, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.4 Big Data in Healthcare Market for Clinics, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.5 Big Data in Healthcare Market for Other End Users, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.1 Big Data in Healthcare Market: Distribution by Economic Status

- Figure 22.2 Big Data in Healthcare Market in High Income Countries, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.3 Big Data in Healthcare Market in the US, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.4 Big Data in Healthcare Market in Canada, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.5 Big Data in Healthcare Market in Germany, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.6 Big Data in Healthcare Market in the UK, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.7 Big Data in Healthcare Market in the UAE, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.8 Big Data in Healthcare Market in South Korea, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.9 Big Data in Healthcare Market in France, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.10 Big Data in Healthcare Market in Australia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.11 Big Data in Healthcare Market in New Zealand, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.12 Big Data in Healthcare Market in Italy, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.13 Big Data in Healthcare Market in Saudi Arabia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.14 Big Data in Healthcare Market in Nordic Countries, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.15 Big Data in Healthcare Market in Upper-Middle Income Countries, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.16 Big Data in Healthcare Market in China, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.17 Big Data in Healthcare Market in Russia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.18 Big Data in Healthcare Market in Brazil, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.19 Big Data in Healthcare Market in Japan, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.20 Big Data in Healthcare Market in South Africa, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.21 Big Data in Healthcare Market in India, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.1 Big Data in Healthcare Market: Distribution by Geography (USD Billion)

- Figure 23.2 Big Data in Healthcare Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.3 Big Data in Healthcare Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.4 Big Data in Healthcare Market in Asia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.5 Big Data in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.6 Big Data in Healthcare Market in Latin America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.7 Big Data in Healthcare Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 24.1 Microsoft: Revenue Generated from Big Data in Healthcare Offerings, Since FY 2018 (USD Billion)

- Figure 24.2 Optum: Revenue Generated from Big Data in Healthcare Offerings, Since FY 2018 (USD Billion)

- Figure 24.3 IBM: Revenue Generated from Big Data in Healthcare Offerings, Since FY 2018 (USD Billion)

- Figure 24.4 Oracle: Revenue Generated from Big Data in Healthcare Offerings, Since FY 2018 USD Billion)

- Figure 24.5 Allscripts: Revenue Generated from Big Data in Healthcare Offerings, Since FY 2018 (USD Billion)