|

市場調查報告書

商品編碼

1771298

生物製藥賦形劑市場:產業趨勢及全球預測-依生物製劑類型、賦形劑類型、公司規模、業務規模及主要地區Biopharmaceutical Excipients Market: Industry Trends and Global Forecasts - Distribution by Type of Biologics, Type of Excipient, Company Size, Scale of Operation and Key Geographies |

||||||

全球生物製藥賦形劑市場:概覽

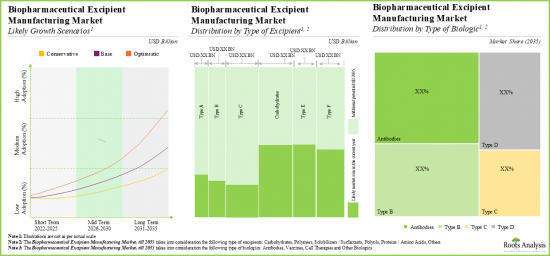

預計2035年,生物製藥賦形劑市場規模將從目前的27.3億美元成長至45.8億美元,預測期內年複合成長率為4.8%。

市場區隔包括以下參數的市場規模與機會分析:

生物製劑類型

- 抗體

- 疫苗

- 細胞療法

- 其他

賦形劑類型

- 碳水化合物

- 聚合物

- 增溶劑/界面活性劑

- 多元醇

- 蛋白質/胺基酸

- 其他

公司規模

- 小型

- 中型

- 大型和超大型

業務規模

- 臨床前

- 臨床試驗

- 商業化

主要地區

- 北美

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和北非

- 世界其他地區

全球生物製藥賦形劑市場:成長與趨勢

由於生物製藥賦形劑在生物製劑開發中發揮著非常重要的作用,其需求在過去幾年中顯著成長。這些生物製藥賦形劑透過控制活性藥物成分(API)的pH 值和滲透壓來提高生物製劑的溶解度和生物利用度。然而,生物製藥賦形劑的生產流程高度複雜且資金密集,因此許多現代生物製劑開發商更傾向於依賴 CMO 來供應 GMP 級賦形劑。此外,為了滿足臨床和商業規模對生物製藥賦形劑日益成長的需求,預計擁有該領域專業知識的CMO將在未來幾年擴大其產能和現有產能。

在研究過程中,發現多家公司提供生物製藥賦形劑生產服務,包括脂質、海藻糖、乳糖、甘露醇、琥珀酸鹽、吐溫20和苯甲醇。這些公司致力於開發協同工程的多功能生物製藥賦形劑,以提高創新生物製藥藥物的穩定性和療效。事實上,在過去的三十年中,生物製藥製造商已經開發出多種優質賦形劑,聲稱可以將生物製藥製劑的保存期限延長三倍。

全球生物製藥賦形劑市場:關鍵洞察

本報告分析了全球生物製藥賦形劑市場的現狀,並指出了潛在的成長機會。主要調查結果包括:

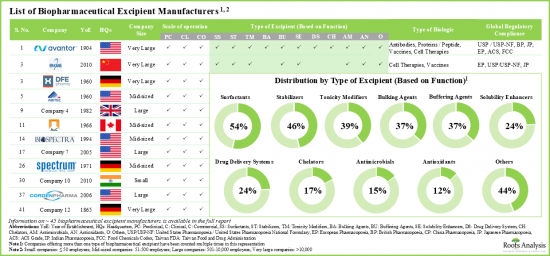

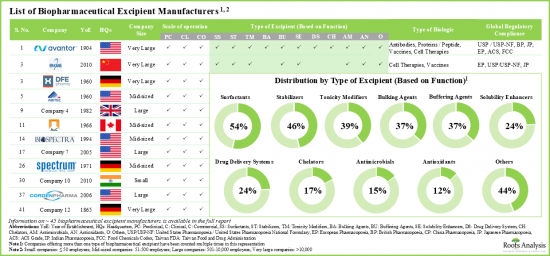

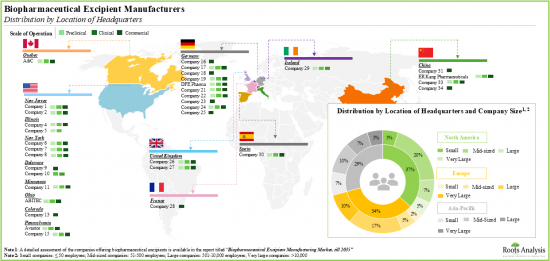

- 目前,約有45家公司聲稱向生物製劑開發商提供各種類型的生物製藥賦形劑,這些公司的營運均符合全球監管標準。

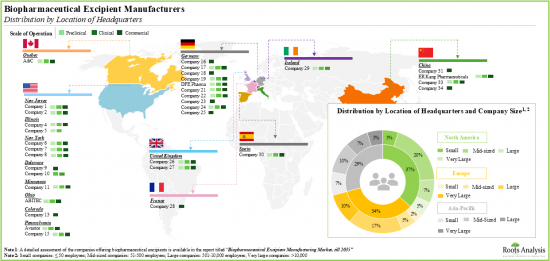

- 為了滿足申辦者不斷變化的需求,提供生物製藥賦形劑的公司已在各個地區建立了業務。

- 市場格局較為分散,現有企業和新進業者均參與各類生物製藥賦形劑的生產。

- 近90%的公司聲稱擁有提供各種規模液體製劑賦形劑所需的能力和專業知識。

- 大多數製造商(約75%)位於已開發地區,而許多新進業者最近出現在印度和中國等亞洲國家。

- 近60%的製造商聲稱提供用於疫苗和蛋白質/勝肽類治療的生物製藥賦形劑。

- 各公司正穩步拓展現有能力,以增強各自的產品組合,並推動其符合不斷變化的行業基準。

- 致力於生物製藥賦形劑的合作夥伴關係的增加,證明了利益相關者對該領域的興趣日益濃厚,此類交易數量在過去三年中達到最高水準。

- 自2020年以來,該領域的合作活動一直穩定成長。值得注意的是,大多數交易是在過去兩年內達成的。

- 過去五年,該領域已簽署了40多項協議,其中32%為分銷協議。該領域參與者採用的其他常見合作模式包括收購(23%)和供應協議(13%)。

- 現有企業已簽署多項生物製藥賦形劑協議,其中大多數致力於銷售其自有生物製藥賦形劑。

- 在北美擁有多項協議的公司包括 ABITEC、Aceto、Evonik、Merck 和 Roquette(依字母順序排列)。

- 為了滿足日益成長的生物製藥賦形劑需求,製造商近期實施了許多擴張計劃。

- 超過 45%的擴張計畫致力於擴大其生產設施的產能,其次是擴大現有設施(43%)。值得注意的是,大多數擴張計畫(78%)都在歐洲和北美實施。

- 該市場的供應方由中型和大型生物製藥賦形劑製造商驅動。有趣的是,目前有近 40%的可用生產能力位於歐洲的生產工廠。

- 有趣的是,目前有近 40%的可用生產能力位於歐洲的生產工廠。其餘 5%則專用於生物製藥賦形劑的臨床前/臨床規模生產。此外,目前全球超過50%的生物製藥賦形劑生產能力位於歐洲。

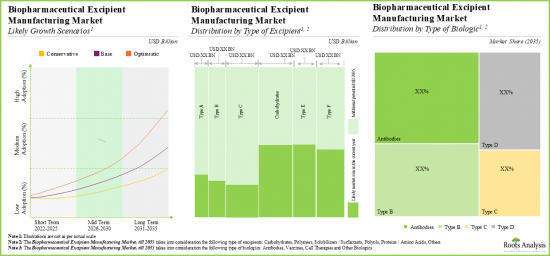

- 隨著對基於生物製劑的治療干預措施的日益關注,預計未來十年生物製藥賦形劑市場將保持穩步成長。

- 預計該市場機會將根據不同的生物製劑、業務規模和主要地域進行細分。

- 預計到2035年,北美和歐洲將佔據70%以上的市場。此外,預計亞太地區市場長期成長速度相對較快(6.4%)。此外,預計到2035年,抗體生物製藥賦形劑製造市場將佔據整個市場的大部分佔有率(約 52%)。

進入生物製藥賦形劑市場的公司範例

- ABITEC

- Avantor

- BASF

- Corden Pharma

- DFE Pharma

- Evonik

- Kirsch Pharma

- Merck KGaA

- Pfanstiehl

- Roquette

- Spectrum Chemical Manufacturing

- SPI製藥

本報告調查全球生物製藥賦形劑市場,提供市場概述,以及依生物製劑類型、賦形劑類型、公司規模、業務規模劃分的趨勢、區域趨勢以及參與市場的公司簡介。

目錄

第1章 前言

第2章 執行摘要

第3章 導論

- 章節概述

- 生物製藥賦形劑

- 理想的賦形劑特性

- 生物製藥賦形劑的分類

- 生物製藥賦形劑的應用

- 監理情勢

- 結論

第4章 市場格局

- 章節概述

- 生物製藥賦形劑市場格局

第5章 競爭格局分析

- 章節概述

- 假設和關鍵參數

- 研究方法

- 生物製藥賦形劑市場格局分析

第6章 公司簡介:生物製藥賦形劑製造商

- 章節概述

- ABITEC

- Avantor

- BASF Pharma

- Corden Pharma

- DFE Pharma

- Evonik

- Kirsch Pharma

- Merck KGaA

- Pfanstiehl

- Roquette

- Spectrum Chemical Manufacturing

- SPI Pharma

第7章 合作夥伴和合作

- 章節概述

- 合作模式

- 生物製藥賦形劑製造市場:合作夥伴關係與合作

第8章 近期擴張

第9章 產能分析

- 章節概述

- 關鍵假設與研究方法

- 生物製藥賦形劑製造:全球已安裝產能

- 結論

第10章 市場預測與機會分析

- 章節概述

- 預測研究方法與關鍵假設

- 2035年全球生物製藥賦形劑製造市場

- 生物製藥賦形劑製造市場:依生物製劑類型

- 生物製藥賦形劑製造市場:依賦形劑類型

- 生物製藥賦形劑製造市場:依公司規模

- 生物製藥賦形劑製造市場:依企業規模

- 生物製藥賦形劑製造市場:依地區

第11章 結論

第12章 高層洞察

第13章 附錄1:表格資料

第14章 附錄2:公司與組織清單

GLOBAL BIOPHARMACEUTICAL EXCIPIENTS MARKET: OVERVIEW

As per Roots Analysis, the biopharmaceutical excipients market is estimated to grow from USD 2.73 billion in the current year to USD 4.58 billion by 2035, at a CAGR of 4.8% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Biologics

- Antibodies

- Vaccines

- Cell Therapies

- Other Biologics

Type of Excipient

- Carbohydrates

- Polymers

- Solubilizers / Surfactants

- Polyols

- Proteins / Amino Acids

- Others

Company Size

- Small

- Mid-sized

- Large / Very Large

Scale of Operation

- Preclinical

- Clinical

- Commercial

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

GLOBAL BIOPHARMACEUTICAL EXCIPIENTS MARKET: GROWTH AND TRENDS

The demand for biopharmaceutical excipients has grown considerably in the past few years as they play a critical role in development of biologics. These biopharmaceutical excipients enhance solubility and bioavailability of biologics, by controlling pH and tonicity of the active pharmaceutical ingredients (APIs). However, due to the highly complex and capital-intensive manufacturing processes of biopharmaceutical excipients, many contemporary biologic developers prefer to rely on CMOs for the supply of GMP grade excipients. Further, in order to cater to the growing demand for biopharmaceutical excipients across both clinical and commercial scales, CMOs with expertise in this field are expected to expand their capabilities and existing capacities in the coming years.

During our research, we identified various players that offer manufacturing services of biopharmaceutical excipients, including lipids, trehalose, lactose, mannitol, succinate, Tween 20 and benzyl alcohol. These companies are placing greater emphasis on developing co-processed multifunctional biopharmaceutical excipients to enhance the stability and efficacy of innovative biotherapeutics. In fact, over the past three decades biopharmaceutical manufacturers have developed some exceptional excipients which claim to increase the biopharmaceutical formulation shelf life by three times.

GLOBAL BIOPHARMACEUTICAL EXCIPIENTS MARKET: KEY INSIGHTS

The report delves into the current state of the global biopharmaceutical excipients market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, around 45 players claim to provide various types of biopharmaceutical excipients to biologic developers; these companies operate in compliance to global regulatory standards.

- In order to cater to the evolving needs of sponsors, companies offering biopharmaceutical excipients have established their presence in various geographical regions.

- The market landscape is fragmented, featuring the presence of both established players and new entrants involved in the manufacturing of excipients for different types of biologics.

- Close to 90% of companies claim to have the required capabilities and expertise to offer excipients for liquid drug formulations at all scales of operations.

- Although majority (~75%) of the manufacturers are based in developed regions, many players have recently emerged in some Asian countries, such as India and China.

- Nearly 60% of the manufacturers claim to provide biopharmaceutical excipients for vaccines and protein / peptide-based therapeutics.

- Companies are steadily expanding their existing capabilities in order to enhance their respective portfolios and drive compliance to evolving industry benchmarks.

- A rise in partnerships, focused on biopharmaceutical excipients, validates the growing interest of stakeholders in this domain; maximum number of such deals were signed in the last three years.

- Since 2020, the partnership activity has increased at a steady pace in this domain. It is worth mentioning that majority of the deals were established in the last two years.

- Over 40 agreements have been inked in the last 5 years in this domain; 32% of which were distribution agreements. Other popular types of partnership models adopted by players engaged in this domain include acquisitions (23%) and supply agreements (13%).

- Established players have forged multiple deals for biopharma excipients; most of these were focused on distribution of proprietary biopharmaceutical excipients.

- Examples of firms that have signed multiple deals within North America include (in alphabetical order) ABITEC, Aceto, Evonik, Merck and Roquette.

- To keep pace with the growing demand for biopharmaceutical excipients, manufacturers have undertaken many expansion initiatives in the recent past; ~80% of such instances involved facilities based in Europe.

- More than 45% of expansion initiatives were focused on capacity expansion of manufacturing facilities, followed by those undertaken for expanding existing facilities (43%). It is worth mentioning that most of the expansion initiatives (78%) were carried out in Europe and North America.

- The supply-side of this market is driven by mid-sized and large biopharmaceutical excipient manufacturers; interestingly, close to 40% of the currently available capacity is installed in production plants located in Europe.

- Approximately 95% of the total installed capacity is dedicated to commercial scale manufacturing. The remaining 5% of the installed capacity is focused on preclinical / clinical scale manufacturing of biopharmaceutical excipients. In addition, over 50% of the total current global, installed biopharmaceutical excipient manufacturing capacity is installed in Europe.

- With the growing focus on biologics based therapeutic interventions, the biopharmaceutical excipients market is likely to grow at a steady pace over the next decade.

- The opportunity is expected to be segregated across a variety of biologics, scales of operation and key geographical regions.

- North America and Europe are anticipated to capture over 70% of the market share by 2035. In addition, the market in Asia Pacific is likely to grow at a relatively faster pace (6.4%) in the long term. Further, in 2035, biopharmaceutical excipient manufacturing market for antibodies is expected to capture the majority share (~52%) of the total market.

Example Players in the Biopharmaceutical Excipients Market

- ABITEC

- Avantor

- BASF

- Corden Pharma

- DFE Pharma

- Evonik

- Kirsch Pharma

- Merck KGaA

- Pfanstiehl

- Roquette

- Spectrum Chemical Manufacturing

- SPI Pharma

GLOBAL BIOPHARMACEUTICAL EXCIPIENTS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global biopharmaceutical excipients market, focusing on key market segments, including [A] type of biologics, [B] type of excipient, [C] company size, [D] scale of operation and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of the current biopharmaceutical excipients, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facilities, [E] type of excipient, [F] scale of operation, [G] type of formulation, [H] type of biologic and [I] global regulatory compliance.

- Company Competitiveness Analysis: A comprehensive competitive analysis of biopharmaceutical excipient manufacturers, examining factors, such as [A] supplier power and [B] company competitiveness.

- Company Profiles: In-depth profiles of companies engaged in this domain, focused on [A] company overview, [B] financial information (if available), [C] biopharmaceutical excipients portfolio, [D] manufacturing facilities and [E] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the biopharmaceutical excipient market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of excipient, [D] type of drug molecule, [E] most active players (in terms of the number of partnerships signed) and [F] geography.

- Recent Expansions: In-depth analysis of recent expansions undertaken by various biopharmaceutical excipient manufacturers, focused on [A] year of expansion, [B] type of expansion, [C] company size, [D] location of headquarters, [E] location of expanded facility, [F] type of excipient, [G] type of drug molecule, [H] most active players and [I] geographical distribution.

- Capacity Analysis: A detailed analysis of the global installed capacity for biopharmaceutical excipients considering the capacities of various biopharmaceutical excipient manufacturers, based on several relevant parameters, such as [A] company size, [B] scale of operation and [C] key geographical regions.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Biopharmaceutical Excipients

- 3.3. Properties of Ideal Excipients

- 3.4. Classification of Biopharmaceutical Excipients

- 3.4.1. Classification based on Route of Administration

- 3.4.2. Classification of Excipients based on Structure

- 3.4.3. Classification of Excipients based on Function

- 3.4.4. Classification based on Ability to Interfere with Metabolization and Efflux Mechanisms

- 3.5. Applications of Biopharmaceutical Excipients

- 3.6. Regulatory Scenario

- 3.7. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Biopharmaceutical Excipient Manufacturers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Location of Biopharmaceutical Excipient Manufacturing Facilities

- 4.2.5. Analysis by Type of Excipient based on Chemical Composition

- 4.2.6. Analysis by Type of Excipient based on Function

- 4.2.7. Analysis by Type of Excipient based on Chemical Structure

- 4.2.8. Analysis by Scale of Operation

- 4.2.9. Analysis by Type of Formulation

- 4.2.10. Analysis by Type of Biologic

- 4.2.11. Analysis by Global Regulatory Compliance

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. Biopharmaceutical Excipient Manufacturers: Company Competitiveness Analysis

- 5.4.1. Company Competitiveness Analysis: Small Companies

- 5.4.2. Company Competitiveness Analysis: Mid-Sized Companies

- 5.4.3. Company Competitiveness Analysis: Large Companies

- 5.4.4. Company Competitiveness Analysis: Very Large Companies

6. COMPANY PROFILES: BIOPHARMACEUTICAL EXCIPIENT MANUFACTURERS

- 6.1. Chapter Overview

- 6.2. ABITEC

- 6.2.1. Company Overview

- 6.2.2. Biopharmaceutical Excipient Offerings

- 6.2.3. Manufacturing Facilities

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Avantor

- 6.3.1. Company Overview

- 6.3.2. Financial Information

- 6.3.3. Biopharmaceutical Excipient Offerings

- 6.3.4. Manufacturing Facilities

- 6.3.5. Recent Developments and Future Outlook

- 6.4. BASF Pharma

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Biopharmaceutical Excipient Offerings

- 6.4.4. Manufacturing Facilities

- 6.4.5. Recent Developments and Future Outlook

- 6.5. Corden Pharma

- 6.5.1. Company Overview

- 6.5.2. Biopharmaceutical Excipient Service Offerings

- 6.5.3. Manufacturing Facilities

- 6.5.4. Recent Developments and Future Outlook

- 6.6. DFE Pharma

- 6.6.1. Company Overview

- 6.6.2. Biopharmaceutical Excipient Offerings

- 6.6.3. Manufacturing Facilities

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Evonik

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. Biopharmaceutical Excipient Offerings

- 6.7.4. Manufacturing Facilities

- 6.7.5. Recent Developments and Future Outlook

- 6.8. Kirsch Pharma

- 6.8.1. Company Overview

- 6.8.2. Biopharmaceutical Excipient Offerings

- 6.8.3. Manufacturing Facilities

- 6.8.4. Recent Developments and Future Outlook

- 6.9. Merck KGaA

- 6.9.1. Company Overview

- 6.9.2. Financial Information

- 6.9.3. Biopharmaceutical Excipient Offerings

- 6.9.4. Manufacturing Facilities

- 6.9.5. Recent Developments and Future Outlook

- 6.10. Pfanstiehl

- 6.10.1. Company Overview

- 6.10.2. Biopharmaceutical Excipient Offerings

- 6.10.3. Manufacturing Facilities

- 6.10.4. Recent Developments and Future Outlook

- 6.11. Roquette

- 6.11.1. Company Overview

- 6.11.2. Biopharmaceutical Excipient Offerings

- 6.11.3. Manufacturing Facilities

- 6.11.4. Recent Developments and Future Outlook

- 6.12. Spectrum Chemical Manufacturing

- 6.12.1. Company Overview

- 6.12.2. Biopharmaceutical Excipient Offerings

- 6.12.3. Manufacturing Facilities

- 6.12.4. Recent Developments and Future Outlook

- 6.13. SPI Pharma

- 6.13.1. Company Overview

- 6.13.2. Biopharmaceutical Excipient Offerings

- 6.13.3. Manufacturing Facilities

- 6.13.4. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Chapter Overview

- 7.2. Partnership Models

- 7.3. Biopharmaceutical Excipients Manufacturing Market: Partnerships and Collaborations

- 7.3.1. Analysis by Year of Partnership

- 7.3.2. Analysis by Type of Partnership

- 7.3.3. Analysis by Year and Type of Partnership

- 7.3.4. Analysis by Type of Excipient

- 7.3.5. Analysis by Type of Drug Molecule

- 7.3.6. Most Active Players: Analysis by Number of Partnerships

- 7.3.7. Analysis by Geography

- 7.3.7.1. Intercontinental and Intracontinental Deals

- 7.3.7.2. International and Local Deals

8. RECENT EXPANSIONS

- 8.1. Chapter Overview

- 8.2. Biopharmaceutical Excipient Manufacturing Market: Recent Expansions

- 8.2.1. Analysis by Year of Expansion

- 8.2.2. Analysis by Type of Expansion

- 8.2.3. Analysis by Company Size and Location of Headquarters

- 8.2.4. Analysis by Location of Expanded Facility

- 8.2.5. Analysis by Type of Excipient

- 8.2.6. Analysis by Type of Drug Molecule

- 8.2.7. Most Active Players: Analysis by Number of Recent Expansions

- 8.2.8. Geographical Analysis

- 8.2.8.1. Region-wise Distribution

- 8.2.8.2. Country-wise Distribution

9. CAPACITY ANALYSIS

- 9.1. Chapter Overview

- 9.2. Key Assumptions and Methodology

- 9.3. Biopharmaceutical Excipient Manufacturing: Installed Global Capacity

- 9.3.1. Analysis by Company Size

- 9.3.2. Analysis by Scale of Operation

- 9.3.3. Analysis by Location of Manufacturing Facility

- 9.4. Concluding Remarks

10. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 10.1. Chapter Overview

- 10.2. Forecast Methodology and Key Assumptions

- 10.3. Global Biopharmaceutical Excipient Manufacturing Market, Till 2035

- 10.4. Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Biologic

- 10.5. Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Excipient

- 10.6. Biopharmaceutical Excipient Manufacturing Market: Distribution by Company Size

- 10.7. Biopharmaceutical Excipient Manufacturing Market: Distribution by Scale of Operation

- 10.8. Biopharmaceutical Excipient Manufacturing Market: Distribution by Region

- 10.8.1. Biopharmaceutical Excipient Manufacturing Market in North America, Till 2035

- 10.8.2. Biopharmaceutical Excipient Manufacturing Market in Europe, Till 2035

- 10.8.3. Biopharmaceutical Excipient Manufacturing Market in Asia Pacific, Till 2035

- 10.8.4. Biopharmaceutical Excipient Manufacturing Market in Latin America, Till 2035

- 10.8.5. Biopharmaceutical Excipient Manufacturing Market in MENA, Till 2035

- 10.8.6. Biopharmaceutical Excipient Manufacturing Market in Rest of the World, Till 2035

11. CONCLUDING REMARKS

12. EXECUTIVE INSIGHTS

- 12.1. Chapter Overview

- 12.2. Company A

- 12.2.1. Company Snapshot

- 12.2.2. Interview Transcript: Biopharma Sales Director

13. APPENDIX 1: TABULATED DATA

14. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 Classification of Biopharmaceutical Excipients based on Function

- Table 4.1 Biopharmaceutical Excipient Manufacturers: List of Companies

- Table 4.2 Biopharmaceutical Excipient Manufacturers: Information on Type of Excipient based on Chemical Composition and Function

- Table 4.3 Biopharmaceutical Excipient Manufacturers: Information on Scale of Operation, Type of Formulation, Type of Excipient (based on Chemical Structure), Type of Biologic and Global Regulatory Compliance

- Table 6.1 Leading Biopharmaceutical Excipient Manufacturers

- Table 6.2 ABITEC: Company Snapshot

- Table 6.3 ABITEC: Biopharmaceutical Excipient Offerings

- Table 6.4 ABITEC: Information on Manufacturing Facilities

- Table 6.5 ABITEC: Recent Developments and Future Outlook

- Table 6.6 Avantor: Company Snapshot

- Table 6.7 Avantor: Biopharmaceutical Excipient Offerings

- Table 6.8 Avantor: Information on Manufacturing Facilities

- Table 6.9 Avantor: Recent Developments and Future Outlook

- Table 6.10 BASF: Company Snapshot

- Table 6.11 BASF: Biopharmaceutical Excipient Offerings

- Table 6.12 BASF: Information on Manufacturing Facilities

- Table 6.13 BASF: Recent Developments and Future Outlook

- Table 6.14 Corden Pharma: Company Snapshot

- Table 6.15 Corden Pharma: Biopharmaceutical Excipient Offerings

- Table 6.16 Corden Pharma: Information on Manufacturing Facilities

- Table 6.17 Corden Pharma: Recent Developments and Future Outlook

- Table 6.18 DFE Pharma: Company Snapshot

- Table 6.19 DFE Pharma: Biopharmaceutical Excipient Offerings

- Table 6.20 DFE Pharma: Information on Manufacturing Facilities

- Table 6.21 DFE Pharma: Recent Developments and Future Outlook

- Table 6.22 Evonik: Company Snapshot

- Table 6.23 Evonik: Biopharmaceutical Excipient Offerings

- Table 6.24 Evonik: Information on Manufacturing Facilities

- Table 6.25 Evonik: Recent Developments and Future Outlook

- Table 6.26 Kirsch Pharma: Company Snapshot

- Table 6.27 Kirsch Pharma: Biopharmaceutical Excipient Offerings

- Table 6.28 Kirsch Pharma: Information on Manufacturing Facilities

- Table 6.29 Kirsch Pharma: Recent Developments and Future Outlook

- Table 6.30 Merck KGaA: Company Snapshot

- Table 6.31 Merck KGaA: Biopharmaceutical Excipient Offerings

- Table 6.32 Merck KGaA: Information on Manufacturing Facilities

- Table 6.33 Merck KGaA: Recent Developments and Future Outlook

- Table 6.34 Pfanstiehl: Company Snapshot

- Table 6.35 Pfanstiehl: Biopharmaceutical Excipient Offerings

- Table 6.36 Pfanstiehl: Information on Manufacturing Facilities

- Table 6.37 Pfanstiehl: Recent Developments and Future Outlook

- Table 6.38 Roquette: Company Snapshot

- Table 6.39 Roquette: Biopharmaceutical Excipient Offerings

- Table 6.40 Roquette: Information on Manufacturing Facilities

- Table 6.41 Roquette: Recent Developments and Future Outlook

- Table 6.42 Spectrum Chemical Manufacturing: Company Snapshot

- Table 6.43 Spectrum Chemical Manufacturing: Biopharmaceutical Excipient Offerings

- Table 6.44 Spectrum Chemical Manufacturing: Information on Manufacturing Facilities

- Table 6.45 SPI Pharma: Company Snapshot

- Table 6.46 SPI Pharma: Biopharmaceutical Excipient Offerings

- Table 6.47 SPI Pharma: Information on Manufacturing Facilities

- Table 6.48 SPI Pharma: Recent Developments and Future Outlook

- Table 7.1 Biopharmaceutical Excipient Manufacturers: List of Partnerships and Collaborations, Since 2016

- Table 8.1 Biopharmaceutical Excipient Manufacturers: Recent Expansions, Since 2016

- Table 9.1 Capacity Analysis: Information on Company Size of Biopharmaceutical Excipient Manufacturers

- Table 9.2 Capacity Analysis: Information on Average Capacity by Company Size

- Table 9.3 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Total Capacity by Company Size

- Table 12.1 DFE Pharma: Company Snapshot

- Table 13.1 Biopharmaceutical Excipient Manufacturers: Distribution by Year of Establishment

- Table 13.2 Biopharmaceutical Excipient Manufacturers: Distribution by Company Size

- Table 13.3 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Table 13.4 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Table 13.5 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters and Company Size

- Table 13.6 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Biopharmaceutical Excipient Manufacturing Facilities (Region-wise)

- Table 13.7 Biopharmaceutical Excipients Manufacturers: Distribution by Location of Biopharmaceutical Excipient Manufacturing Facilities (Country-wise)

- Table 13.8 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Composition

- Table 13.9 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Function

- Table 13.10 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Structure

- Table 13.11 Biopharmaceutical Excipient Manufacturers: Distribution by Scale of Operation

- Table 13.12 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Formulation

- Table 13.13 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Biologic

- Table 13.14 Biopharmaceutical Excipient Manufacturers: Distribution by Global Regulatory Compliance

- Table 13.15 BASF Pharma: Annual Revenues, Since 2016 (EUR Million)

- Table 13.16 Evonik: Annual Revenues, Since 2016 (EUR Million)

- Table 13.17 Merck KGaA: Annual Revenues, Since 2016 (EUR Million)

- Table 13.18 Partnerships and Collaborations: Cumulative Year-Wise Trend, Since 2016

- Table 13.19 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 13.20 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Table 13.21 Partnerships and Collaborations: Distribution by Type of Excipient

- Table 13.22 Partnerships and Collaborations: Distribution by Type of Drug Molecule

- Table 13.23 Partnerships and Collaborations: Year-Wise Trend of Partnerships by Type of Drug Molecule, Since 2016

- Table 13.24 Most Active Players: Distribution by Number of Partnerships

- Table 13.25 Partnerships and Collaborations: Distribution by Intercontinental and Intracontinental Deals

- Table 13.26 Partnerships and Collaborations: Distribution by International and Local Deals

- Table 13.27 Recent Expansions: Cumulative Year-wise Trend, Since 2016

- Table 13.28 Recent Expansions: Distribution by Type of Expansion

- Table 13.29 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Table 13.30 Recent Expansions: Distribution by Location of Expanded Facility

- Table 13.31 Recent Expansions: Distribution by Location of Facility Expanded and Type of Expansion

- Table 13.32 Recent Expansions: Distribution by Type of Excipient

- Table 13.33 Recent Expansions: Distribution by Type of Drug Molecule

- Table 13.34 Most Active Players: Distribution by Number of Recent Expansions

- Table 13.35 Recent Expansions: Year-wise Distribution by Geography

- Table 13.36 Recent Expansions: Country-wise Distribution

- Table 13.37 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Range of Installed Capacity

- Table 13.38 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Company Size

- Table 13.39 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Scale of Operation

- Table 13.40 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Continent-wise)

- Table 13.41 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Country-wise)

- Table 13.42 Global Biopharmaceutical Excipient Manufacturing Market, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.43 Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Biologic (USD Billion)

- Table 13.44 Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Excipient (USD Billion)

- Table 13.45 Biopharmaceutical Excipient Manufacturing Market: Distribution by Company Size (USD Billion)

- Table 13.46 Biopharmaceutical Excipient Manufacturing Market: Distribution by Scale of Operation (USD Billion)

- Table 13.47 Biopharmaceutical Excipient Manufacturing Market: Distribution by Region, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 13.48 Biopharmaceutical Excipient Manufacturing Market in North America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.49 Biopharmaceutical Excipient Manufacturing Market in Europe, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.50 Biopharmaceutical Excipient Manufacturing Market in Asia Pacific, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.51 Biopharmaceutical Excipient Manufacturing Market in Latin America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.52 Biopharmaceutical Excipient Manufacturing Market in MENA, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.53 Biopharmaceutical Excipient Manufacturing Market in Rest of the World, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Executive Summary: Market Forecast

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Recent Expansions

- Figure 2.4 Executive Summary: Capacity Analysis

- Figure 2.5 Executive Summary: Market Forecast

- Figure 3.1 Properties of an Ideal Excipient

- Figure 3.2 Classification of Biopharmaceutical Excipients based on Ability to Interfere with Metabolization and Efflux Mechanisms

- Figure 3.3 Applications of Biopharmaceutical Excipients

- Figure 4.1 Biopharmaceutical Excipient Manufacturers: Distribution by Year of Establishment

- Figure 4.2 Biopharmaceutical Excipient Manufacturers: Distribution by Company Size

- Figure 4.3 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Figure 4.4 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Figure 4.5 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters and Company Size

- Figure 4.6 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Biopharmaceutical Excipient Manufacturing Facilities (Region-wise)

- Figure 4.7 Biopharmaceutical Excipients Manufacturers: Distribution by Location of Biopharmaceutical Excipient Manufacturing Facilities (Country-wise)

- Figure 4.8 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Composition

- Figure 4.9 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Function

- Figure 4.10 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Structure

- Figure 4.11 Biopharmaceutical Excipient Manufacturers: Distribution by Scale of Operation

- Figure 4.12 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Formulation

- Figure 4.13 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Biologic

- Figure 4.14 Biopharmaceutical Excipient Manufacturers: Distribution by Global Regulatory Compliance

- Figure 5.1 Company Competitiveness Analysis: Small Companies

- Figure 5.2 Company Competitiveness Analysis: Mid-sized Companies

- Figure 5.3 Company Competitiveness Analysis: Large Companies

- Figure 5.4 Company Competitiveness Analysis: Very Large Companies

- Figure 6.1 BASF Pharma: Annual Revenues, Since 2016 (EUR Million)

- Figure 6.2 Evonik: Annual Revenues, Since 2016 (EUR Million)

- Figure 6.3 Merck KGaA: Annual Revenues, Since 2016 (EUR Million)

- Figure 7.1 Partnerships and Collaborations: Cumulative Year-Wise Trend, Since 2016

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Figure 7.4 Partnerships and Collaborations: Distribution by Type of Excipient

- Figure 7.5 Partnerships and Collaborations: Distribution by Type of Drug Molecule

- Figure 7.6 Partnerships and Collaborations: Year-Wise Trend of Partnerships by Type of Drug Molecule, Since 2016

- Figure 7.7 Most Active Players: Distribution by Number of Partnerships

- Figure 7.8 Partnerships and Collaborations: Intercontinental and Intracontinental Distribution

- Figure 7.9 Partnerships and Collaborations: International and Local Distribution

- Figure 8.1 Recent Expansions: Cumulative Year-wise Trend, Since 2016

- Figure 8.2 Recent Expansions: Distribution by Type of Expansion

- Figure 8.3 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Figure 8.4 Recent Expansions: Distribution by Location of Expanded Facility

- Figure 8.5 Recent Expansions: Distribution by Location of Facility Expanded and Type of Expansion

- Figure 8.6 Recent Expansions: Distribution by Type of Excipient

- Figure 8.7 Recent Expansions: Distribution by Type of Drug Molecule

- Figure 8.8 Most Active Players: Distribution by Number of Recent Expansions

- Figure 8.9 Recent Expansions: Year-wise Distribution by Geography

- Figure 8.10 Recent Expansions: Country-wise Distribution

- Figure 9.1 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Range of Installed Capacity

- Figure 9.2 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Company Size

- Figure 9.3 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Scale of Operation

- Figure 9.4 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Continent-wise)

- Figure 9.5 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Country-wise)

- Figure 10.1 Global Biopharmaceutical Excipient Manufacturing Market, Till 2035 (USD Billion)

- Figure 10.2 Biopharmaceutical Excipient Manufacturing Market: Likely Growth Scenarios

- Figure 10.3 Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Biologic (USD Billion)

- Figure 10.4 Biopharmaceutical Excipient Manufacturing Market: Distribution by Type of Excipient (USD Billion)

- Figure 10.5 Biopharmaceutical Excipient Manufacturing Market: Distribution by Company Size (USD Billion)

- Figure 10.6 Biopharmaceutical Excipient Manufacturing Market: Distribution by Scale of Operation (USD Billion)

- Figure 10.7 Biopharmaceutical Excipient Manufacturing Market: Distribution by Region (USD Billion)

- Figure 10.8 Biopharmaceutical Excipient Manufacturing Market in North America, Till 2035 (USD Billion)

- Figure 10.9 Biopharmaceutical Excipient Manufacturing Market in Europe, Till 2035 (USD Billion)

- Figure 10.10 Biopharmaceutical Excipient Manufacturing Market in Asia Pacific, Till 2035 (USD Billion)

- Figure 10.11 Biopharmaceutical Excipient Manufacturing Market in Latin America, Till 2035 (USD Billion)

- Figure 10.12 Biopharmaceutical Excipient Manufacturing Market in MENA, Till 2035 (USD Billion)

- Figure 10.13 Biopharmaceutical Excipient Manufacturing Market in Rest of the World, Till 2035 (USD Billion)

- Figure 11.1 Concluding Remarks: Overall Market Landscape

- Figure 11.2 Concluding Remarks: Partnerships and Collaborations

- Figure 11.3 Concluding Remarks: Recent Expansions

- Figure 11.4 Concluding Remarks: Capacity Analysis

- Figure 11.5 Concluding Remarks: Market Forecast