|

市場調查報告書

商品編碼

1762542

抗體合約製造市場:產業趨勢和全球預測 - 依生產的抗體類型、使用的表達系統類型、業務規模和地區劃分Antibody Contract Manufacturing Market : Industry Trends and Global Forecasts - Distribution by Type of Antibody Manufactured, Type of Expression System Used, Scale of Operation, and Geographical Regions |

||||||

抗體合約製造市場:概覽

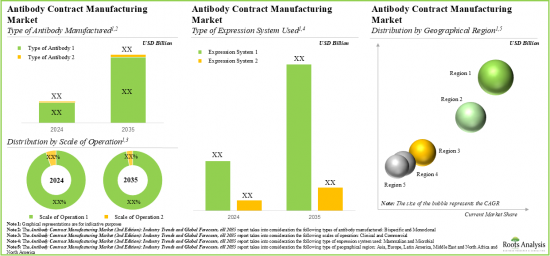

預計2035年,全球抗體合約製造市場規模將從目前的166億美元成長至470億美元,預測期間的年複合成長率為10%。

市場區隔根據以下參數劃分市場規模與機會分析:

生產的抗體類型

- 單株抗體

- 雙特異性抗體

使用的表達系統類型

- 哺乳動物抗體

- 微生物抗體

業務規模

- 臨床

- 商業化

地區

- 北美

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和北非

抗體藥物合約製造市場:成長與趨勢

近年來,合約製造商已成為整個生物製藥市場不可或缺的一部分。這一趨勢在抗體製造市場也日益盛行,開發商日益將其抗體製造需求外包給合約服務提供者。這可能是因為聘請此類第三方服務提供者俱有許多優勢,包括降低整體製造成本以及獲得合約製造商的專業知識。事實上,該領域的抗體製造公司積極與其他公司合作,以擴展其現有產能,以滿足對治療性抗體的整體需求。

自1986年Orthoclone OKT3®得到認可以來,單株抗體已成為現代醫療保健的重要組成部分。事實上,一些專家認為單株抗體是生物製藥產業的支柱。由於其高特異性和良好的安全性,基於抗體的干預措施目前構成了生物製劑合約製造市場中最大的類別。隨著雙特異性抗體和基於抗體片段的產品等高級抗體變體逐漸普及,這種趨勢在短期內不太可能改變。此外,由於生物製劑開發和生產面臨的挑戰(例如先進的供應鏈要求),抗體生產業務的外包預計將顯著成長。

抗體合約製造市場:關鍵洞察

本報告分析了抗體合約製造市場的現狀,並揭示了潛在的成長機會。主要調查結果包括:

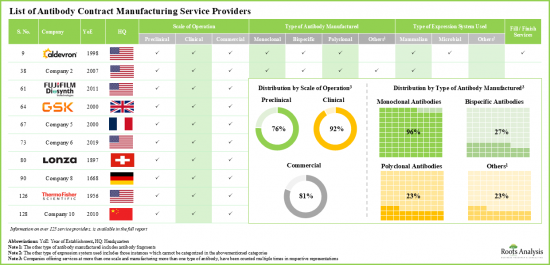

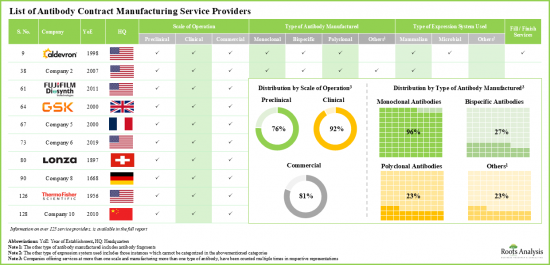

- 目前,全球有超過 125 家合約製造商聲稱提供抗體製造服務,其中 74%的服務提供者已實現商業規模生產單株抗體。

- 目前的市場格局較為分散,既有大型企業,也有新進業者。其中大多數是位於北美的中型企業(43%)。

- 為了在該領域獲得競爭優勢,各利益相關者積極升級現有能力,並增加新的能力以增強各自的產品組合。

- 持續改善能力和升級設施的努力,已建立了行業基準,新產品開發計劃可以此為依據。

- 從合作活動的增加可以看出,利害關係人對該領域的興趣日益濃厚,其中大多數簽署的合作協議都集中在抗體生產領域。

- 為了增強在本研究領域的核心競爭力,CMO 積極投資升級現有基礎設施並擴大各自的生產能力。

- 儘管全球抗體合約生產能力分佈在不同地區,但超過 55%位於北美生產基地。

- 隨著多種以抗體為基礎的藥物和治療候選藥物處於不同的開發階段,預計未來十年對此類產品的需求將大幅成長。

- 到2035年,抗體生產市場預計年複合成長率將達到10%。目前,北美佔據大部分市場佔有率,其次是歐洲。

抗體合約生產市場:主要細分市場

根據生產的抗體類型,市場分為單株抗體和雙特異性抗體。目前,單株抗體在全球抗體合約生產市場中佔有最大佔有率。然而,越來越多的公司開始致力於開髮用於治療用途的雙特異性抗體。

根據所使用的表達系統類型,市場分為哺乳動物表達系統和微生物表達系統。目前,由於抗體在哺乳動物表達系統中表現出更高的生物活性和結合親和力,哺乳動物表達系統佔據全球抗體合約生產市場的最大佔有率。

依業務規模劃分,市場分為臨床規模及商業規模。目前,由於抗體商業化生產需求的不斷成長,商業規模在全球抗體合約生產市場中佔據最大佔有率。

依主要地區劃分,市場分為北美、歐洲、亞洲、拉丁美洲以及中東和北非。目前,北美在抗體合約生產市場中佔據主導地位,佔據最大的收入佔有率。此外,未來亞洲市場可望以更高的年複合成長率成長。

抗體合約生產市場參與者範例

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

目錄

第1章 簡介

第2章 研究方法

第3章 經濟及其他專案特定注意事項

第4章 執行摘要

第5章 導論

- 章節概述

- 抗體概念

- 抗體結構

- 抗體亞型

- 抗體作用機制

- 抗體類型

- 合約生產概述

- 生物製藥產業外包的必要性

- 外包生產服務的優勢

第6章 市場格局

- 章節概述

- 抗體合約生產企業:市場格局

第7章 公司競爭力分析

- 章節概述

- 假設與關鍵輸入參數

- 研究方法論

- 競爭分析:北美抗體合約製造商

- 競爭分析:歐洲抗體合約製造商

- 競爭分析:亞太地區抗體合約製造商

第8章 公司詳細簡介

- 章節概述

- AGC Biologics

- Aldeveron

- Emergent Biosolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung Biologics

- Synthon

- Thermo Fisher Scientific

第9章 公司簡介

- 章節概述

- ABL

- Abzena

- Allele Biotechnology &Pharmaceuticals

- Alvotech

- Antibody Production Services

- Arabio

- Bharat Serums and Vaccines

- Boehringer Ingelheim

- Glenmark Pharmaceuticals

- MilliporeSigma

- Siam Bioscience

第10章 案例研究:小分子與大分子的比較(生物製劑)藥物/療法

- 章節概述

- 小分子和生物製劑

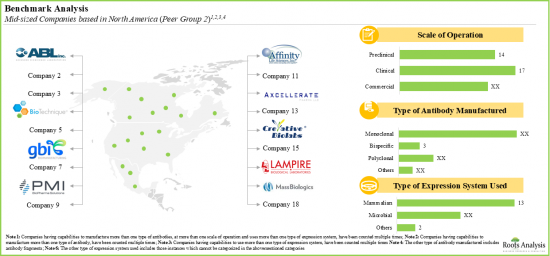

第11章 基準分析

- 章節概述

- 研究方法

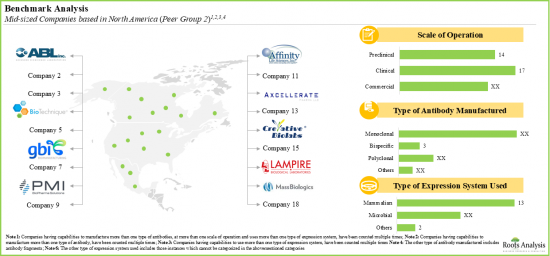

- 抗體合約製造商:基準分析

- 結論

第12章 合作夥伴關係與合作

- 章節概述

- 合作模式

- 抗體合約製造:合作夥伴名單

第13章 近期擴張

- 章節概述

- 抗體合約製造商:擴張名單

第14章 產能分析

- 章節概述

- 假設與研究方法

- 抗體合約製造:全球裝置容量

- 結論

第15章 需求分析

- 章節概述

- 假設與研究方法

- 抗體合約製造市場:年度總需求

第16章 市場影響分析:驅動因素、限制因素、機會與挑戰

第17章 全球抗體合約製造市場

- 章節概述

- 關鍵假設與研究方法

- 全球抗體合約製造市場,歷史趨勢(2019年至今)及預測(至2035年)

- 主要市場細分

第18章 全球抗體合約製造市場(依製造的抗體類型)

- 章節概述

- 關鍵假設與研究方法

- 抗體合約生產市場:依抗體類型

- 資料三角測量與驗證

第19章 依企業規模劃分的全球抗體合約生產市場

- 章節概述

- 關鍵假設與研究方法

- 依企業規模劃分的抗體合約生產市場

- 資料三角測量與驗證

第20章 依所用表現系統類型劃分的全球抗體合約生產市場

- 章節概述

- 關鍵假設與研究方法

- 依所用表現系統類型劃分的抗體合約生產市場

- 資料三角測量與驗證

第21章 依主要地區劃分的全球抗體合約生產市場

- 章節概述

- 關鍵假設與研究方法

- 依主要地區劃分的抗體合約生產市場

- 資料三角測量與驗證

第22章 SWOT分析

第23章 抗體CMO市場的未來

- 章節概述

- 外包活動日益增多

- 從一次性合約轉向策略夥伴關係

- 引進新的創新技術

- 生物相似藥市場的成長促進了合約服務領域的成長

- 擴展CMO能力與專業知識,打造一站式服務平台

- 進行離岸外包活動,以實現利潤最大化並擴展現有能力

- 申辦單位和服務提供者面臨的挑戰

- 影響抗體合約製造市場未來的因素

- 結論

第24章 高層洞察

第25 附錄2:表格資料

第26章 附錄3:公司與組織清單

ANTIBODY CONTRACT MANUFACTURING MARKET: OVERVIEW

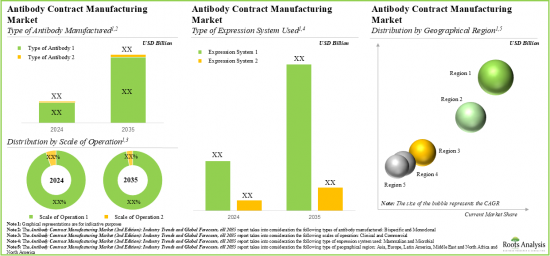

As per Roots Analysis, the global antibody contract manufacturing market is estimated to grow from USD 16.6 billion in the current year to USD 47 billion by 2035, at a CAGR of 10% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Antibody Manufactured

- Monoclonal

- Bispecific

Type of Expression System Used

- Mammalian

- Microbial

Scale of Operation

- Clinical

- Commercial

Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

ANTIBODY CONTRACT MANUFACTURING MARKET: GROWTH AND TRENDS

In recent years, contract manufacturers have become an integral part of the overall biopharmaceutical market. This trend is also gaining popularity within the antibody manufacturing market, as developers are increasingly outsourcing their antibody manufacturing requirements to contract service providers. This can be attributed to the fact that employing such third-party service providers offers various advantages, such as a reduction in overall production cost and access to the specialized expertise of these contract manufacturers. In fact, antibody manufacturing companies engaged in this domain are actively collaborating with other players and expanding their existing capabilities and capacities in order to cater to the overall demand for therapeutic antibodies.

Since the approval of Orthoclone OKT3(R) in 1986, monoclonal antibodies have become an important part of modern healthcare practices. In fact, several experts consider monoclonal antibodies to be the backbone of the biopharmaceutical industry. Owing to their high specificity and the favorable safety profile, antibody-based interventions presently constitute the largest class of biologics contract manufacturing market. This trend is likely to remain the same in the near future as advanced variants of antibodies, such as bispecific antibodies and antibody fragments-based products, are steadily gaining traction. Further, owing to challenges associated with the development and production of biologics, such as advanced supply chain requirements, outsourcing antibody production operation is expected to witness significant growth.

ANTIBODY CONTRACT MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the antibody contract manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 125 contract manufacturers claim to offer services for antibody manufacturing across the globe; 74% of the service providers manufacture monoclonal antibodies at commercial scale.

- The current market landscape is fragmented, featuring the presence of both large players and new entrants; most of these are mid-sized players (43%) based in North America.

- In pursuit of gaining a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective portfolios.

- The ongoing efforts to improve capabilities and upgrade facilities have led to the establishment of industry benchmarks, which serve as a standard for new product development initiatives.

- The growing interest of stakeholders in this domain is evident from the rise in partnership activity; most of the partnerships signed were focused on antibody manufacturing.

- In order to enhance core competencies related to this field of research, CMOs are actively investing in upgrading existing infrastructure and expanding their respective manufacturing capacities.

- The global installed antibody contract manufacturing capacity is spread across various regions; over 55% of this capacity is available in manufacturing facilities based in North America.

- Given that there are several antibody-based drug / therapy candidates being evaluated across various stages of development, the demand for such products is anticipated to rise significantly over the next decade.

- The antibody manufacturing market is likely to grow at a CAGR of 10%, till 2035; presently, majority of the market share is occupied by North America, followed by Europe.

ANTIBODY CONTRACT MANUFACTURING MARKET: KEY SEGMENTS

Monoclonal Antibodies Occupy the Largest Share of the Global Antibody Contract Manufacturing Market

Based on the type of antibody manufactured, the market is segmented into monoclonal and bispecific antibody. At present, the monoclonal antibody segment holds the maximum share of the global antibody contract manufacturing market. However, players are now increasingly focusing on the development of bispecific antibodies for therapeutic use.

By Type of Expression System Used, Microbial Expression System is the Fastest Growing Segment of the Global Antibody Contract Manufacturing Market

Based on the type of expression system used, the market is segmented into mammalian and microbial expression systems. Currently, the mammalian expression system segment captures the highest proportion of the global antibody contract manufacturing market owing to the fact that mammalian expression systems allow antibodies to produce higher biological activity and binding affinity.

By Scale of Operation, Commercial Scale Segment Occupies the Largest Share of the Global Antibody Contract Manufacturing Market

Based on the scale of operation, the market is segmented into clinical and commercial scale. At present, the commercial segment holds the maximum share of the global antibody contract manufacturing market owing to the increasing demand for commercial production of antibodies.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America and Middle East and North Africa. Currently, North America dominates the antibody contract manufacturing market and accounts for the largest revenue share. Additionally, the market in Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Antibody Contract Manufacturing Market

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

ANTIBODY CONTRACT MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global antibody contract manufacturing market, focusing on key market segments, including [A] type of antibody manufactured, [B] type of expression system used, [C] scale of operation and [D] geographical regions.

- Market Landscape: A comprehensive evaluation of the companies engaged in antibody contract manufacturing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facilities, [E] scale of operation, [F] type of antibody, [G] type of expression systems used, [H] fill / finish operations and [I] affiliations to regulatory agencies.

- Company Competitiveness Analysis: A comprehensive competitive analysis of antibody contract manufacturers, examining factors, such as [A] company strength and [B] portfolio strength and [C] portfolio diversity.

- Company Profiles: In-depth profiles of key service providers engaged in the antibody contract manufacturing market, focusing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and an informed future outlook.

- Case Study: A detailed comparison of the key characteristics of large and small molecule drugs, along with information on the steps and challenges involved in their respective manufacturing processes.

- Benchmark Analysis: A detailed analysis of the key focus areas of small, mid-sized, large and very large companies by comparing their existing capabilities within and beyond their respective peer groups.

- Capacity Analysis: An insightful analysis of the overall, installed capacity for manufacturing antibodies, based on various parameters, such as [A] company size and [B] key geographical regions.

- Demand Analysis: An in-depth analysis of the annual commercial and clinical demand for antibodies, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of antibody contract manufacturing market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risks

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Concept of an Antibody

- 5.3. Structure of an Antibody

- 5.4. Antibody Isotypes

- 5.5. Mechanism of Action of Antibodies

- 5.6. Types of Antibodies

- 5.6.1. Monoclonal Antibodies

- 5.6.2. Bispecific Antibodies

- 5.6.3. Polyclonal Antibodies

- 5.7. Overview of Contract Manufacturing

- 5.8. Need for Outsourcing in the Biopharmaceutical Industry

- 5.9. Advantages of Outsourcing Manufacturing Services

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Antibody Contract Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Location of Antibody Manufacturing Facilities

- 6.2.5. Analysis by Scale of Operation

- 6.2.6. Analysis by Type of Antibody Manufactured

- 6.2.7. Analysis by Expression System Used

- 6.2.8. Analysis by Fill / Finish Services Offered

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Input Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: Antibody Contract Manufacturers in North America

- 7.5. Company Competitiveness Analysis: Antibody Contract Manufacturers in Europe

- 7.6. Company Competitiveness Analysis: Antibody Contract Manufacturers in Asia-Pacific

8. DETAILED COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. AGC Biologics

- 8.2.1. Company Overview

- 8.2.2. Antibody Contract Manufacturing Service Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Aldeveron

- 8.3.1. Company Overview

- 8.3.2. Antibody Contract Manufacturing Service Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Emergent Biosolutions

- 8.4.1. Company Overview

- 8.4.2. Antibody Contract Manufacturing Service Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Eurofins CDMO

- 8.5.1. Company Overview

- 8.5.2. Antibody Contract Manufacturing Service Portfolio

- 8.5.3. Future Outlook

- 8.6. FUJIFILM Diosynth Biotechnologies

- 8.6.1. Company Overview

- 8.6.2. Antibody Contract Manufacturing Service Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. KBI Biopharma

- 8.7.1. Company Overview

- 8.7.2. Antibody Contract Manufacturing Service Portfolio

- 8.7.3. Recent Developments and Future Outlook

- 8.8. Lonza

- 8.8.1. Company Overview

- 8.8.2. Antibody Contract Manufacturing Service Portfolio

- 8.8.3. Recent Developments and Future Outlook

- 8.9. Nitto Avecia Pharma Services

- 8.9.1. Company Overview

- 8.9.2. Antibody Contract Manufacturing Service Portfolio

- 8.9.3. Recent Developments and Future Outlook

- 8.10. Novasep

- 8.10.1. Company Overview

- 8.10.2. Antibody Contract Manufacturing Service Portfolio

- 8.10.3. Future Outlook

- 8.11. Pierre Fabre

- 8.11.1. Company Overview

- 8.11.2. Antibody Contract Manufacturing Service Portfolio

- 8.11.3. Recent Developments and Future Outlook

- 8.12. Samsung Biologics

- 8.12.1. Company Overview

- 8.12.2. Antibody Contract Manufacturing Service Portfolio

- 8.12.3. Recent Developments and Future Outlook

- 8.13. Synthon

- 8.13.1. Company Overview

- 8.13.2. Antibody Contract Manufacturing Service Portfolio

- 8.13.3. Recent Developments and Future Outlook

- 8.14. Thermo Fisher Scientific

- 8.14.1. Company Overview

- 8.14.2. Antibody Contract Manufacturing Service Portfolio

- 8.14.3. Recent Developments and Future Outlook

9. TABULATED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. ABL

- 9.2.1. Company Overview

- 9.2.2. Antibody Contract Manufacturing Service Portfolio

- 9.3. Abzena

- 9.3.1. Company Overview

- 9.3.2. Antibody Contract Manufacturing Service Portfolio

- 9.4. Allele Biotechnology & Pharmaceuticals

- 9.4.1. Company Overview

- 9.4.2. Antibody Contract Manufacturing Service Portfolio

- 9.5. Alvotech

- 9.5.1. Company Overview

- 9.5.2. Antibody Contract Manufacturing Service Portfolio

- 9.6. Antibody Production Services

- 9.6.1. Company Overview

- 9.6.2. Antibody Contract Manufacturing Service Portfolio

- 9.7. Arabio

- 9.7.1. Company Overview

- 9.7.2. Antibody Contract Manufacturing Service Portfolio

- 9.8. Bharat Serums and Vaccines

- 9.8.1. Company Overview

- 9.8.2. Antibody Contract Manufacturing Service Portfolio

- 9.9. Boehringer Ingelheim

- 9.9.1. Company Overview

- 9.9.2. Antibody Contract Manufacturing Service Portfolio

- 9.10. Glenmark Pharmaceuticals

- 9.10.1. Company Overview

- 9.10.2. Antibody Contract Manufacturing Service Portfolio

- 9.11. MilliporeSigma

- 9.11.1. Company Overview

- 9.11.2. Antibody Contract Manufacturing Service Portfolio

- 9.12. Siam Bioscience

- 9.12.1. Company Overview

- 9.12.2. Antibody Contract Manufacturing Service Portfolio

10. CASE STUDY: COMPARISON OF SMALL AND LARGE MOLECULES (BIOLOGICS) DRUGS / THERAPIES

- 10.1. Chapter Overview

- 10.2. Small Molecules and Biologics

- 10.2.1. Comparison of Strengths and Weakness of Small Molecules and Biologics

- 10.2.2. Comparison of Key Characteristics

- 10.2.3. Comparison of Manufacturing Processes

- 10.2.4. Comparison of Key Manufacturing related Challenges

11. BENCHMARK ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology

- 11.3. Antibody Contract Manufacturers: Benchmarking Analysis

- 11.3.1. Benchmark Analysis of Small Players Based in North America (Peer Group I)

- 11.3.2. Benchmark Analysis of Mid-Sized Players Based in North America (Peer Group II)

- 11.3.3. Benchmark Analysis of Large Players Based in North America (Peer Group III)

- 11.3.4. Benchmark Analysis of Very Large Players Based in North America (Peer Group IV)

- 11.3.5. Benchmark Analysis of Small Players Based in Europe (Peer Group V)

- 11.3.6. Benchmark Analysis of Mid-Sized Players Based in Europe (Peer Group VI)

- 11.3.7. Benchmark Analysis of Large Players Based in Europe (Peer Group VII)

- 11.3.8. Benchmark Analysis of Very Large Players Based in Europe (Peer Group VIII)

- 11.3.9. Benchmark Analysis of Small Players Based in Asia-Pacific (Peer Group IX)

- 11.3.10. Benchmark Analysis of Mid-Sized Players Based in Asia-Pacific (Peer Group X)

- 11.3.11. Benchmark Analysis of Large Players Based in Asia-Pacific (Peer Group XI)

- 11.3.12. Benchmark Analysis of Very Large Players Based in Asia-Pacific (Peer Group XII)

- 11.4. Concluding Remarks

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnerships Models

- 12.3. Antibody Contract Manufacturing: List of Partnerships

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Antibody Manufactured

- 12.3.5. Analysis by Project Scale

- 12.3.6. Analysis by Focus Therapeutic Area

- 12.3.7. Most Active Players: Analysis by Number of Partnerships and Type of Partnership

- 12.3.8. Geographical Analysis

- 12.3.8.1. Continent-wise Distribution

- 12.3.8.2. Country-wise Distribution

13. RECENT EXPANSIONS

- 13.1. Chapter Overview

- 13.2. Antibody Contract Manufacturers: List of Expansions

- 13.2.1. Analysis by Year of Expansion

- 13.2.2. Analysis by Type of Expansion

- 13.2.3. Analysis by Type of Antibody Manufactured

- 13.2.4. Analysis by Location of Manufacturing Facility

- 13.2.5. Analysis by Location of Manufacturing Facility and Type of Expansion

- 13.2.6. Analysis of Most Active Players by Number of Expansions

- 13.2.7. Geographical Analysis

- 13.2.7.1. Country-wise Distribution

14. CAPACITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Assumptions and Methodology

- 14.3. Antibody Contract Manufacturing: Installed Global Capacity

- 14.3.1. Analysis by Scale of Operation

- 14.3.3. Analysis by Type of Expression System Used

- 14.3.4. Analysis by Location of Manufacturing Facility

- 14.4. Concluding Remarks

15. DEMAND ANALYSIS

- 15.1 Chapter Overview

- 15.2 Assumptions and Methodology

- 15.3 Antibody Contract Manufacturing Market: Overall Annual Demand

- 15.3.1. Analysis by Scale of Operation

- 15.3.2. Analysis by Geography

16 MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17 GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.1 Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1 Scenario Analysis

- 17.4. Key Market Segmentations

18. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF ANTIBODY MANUFCATURED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- 18.3.1. Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.2. Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- 19.3.1. Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2. Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF EXPRESSION SYSTEM USED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- 20.3.1. Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.2. Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY KEY GEOGRAPHICAL REGIONS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Antibody Contract Manufacturing Market: Distribution by Key Geographical Regions

- 21.3.1. Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. SWOT ANALYSIS

- 22.1. Chapter Overview

- 22.2. Strengths

- 22.3. Weaknesses

- 22.4. Opportunities

- 22.5. Threats

- 22.6. Comparison of SWOT Factors

- 22.7. Concluding Remarks

23 FUTURE OF THE ANTIBODY CMO MARKET

- 23.1. Chapter Overview

- 23.2. Rise in Outsourcing Activity

- 23.3. Shift from One-time Contractual Engagements to Strategic Partnerships

- 23.4. Adoption of New and Innovative Technologies

- 23.5. Growing Biosimilars Market to Contribute to the Growth of the Contract Services Segment

- 23.6. Capability and Expertise Expansions by CMOs to become One Stop Shops

- 23.7. Offshoring Outsourcing Activities to Maximize Profits and Expand Existing Capacities

- 23.8. Challenges Faced by both Sponsors and Service Providers

- 23.9. Factors Influencing the Future of Antibody Contract Manufacturing Market

- 23.10. Concluding Remarks

24. EXECUTIVE INSIGHTS

- 24.1. Chapter Overview

- 24.2. Chief Executive Officer, Company A

- 24.3. Assistant Marketing Manager, Company B

- 24.4. Business Development and Marketing Manager, Company C

- 24.5. Business Development Manager, Company D

- 24.6. Business Development Manager, Company E

- 24.7. Business Development Specialist, Company F

25. APPENDIX 2: TABULATED DATA

26. APPENDIX 3: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 5.1 Key Features of Antibody Isotypes

- Table 5.2 Mechanism of Action of Therapeutic Antibodies against Different Target Classes

- Table 5.3 List of Approved Monoclonal Antibodies

- Table 5.4 Difference between Polyclonal and Monoclonal Antibodies

- Table 6.1 List of Antibody Contract Manufacturers

- Table 6.2 Antibody Contract Manufacturers: Information on Scale of Operation

- Table 6.3 Antibody Contract Manufacturers: Information on Type of Antibody Manufactured

- Table 6.4 Antibody Contract Manufacturers: Information on Type of Expression System Used

- Table 6.5 Antibody Contract Manufacturers: Information on Fill / Finish Services Offered

- Table 8.1 AGC Biologics: Company Overview

- Table 8.2 AGC Biologics: Antibody Contract Manufacturing Service Portfolio

- Table 8.3 AGC Biologics: Recent Development and Future Outlook

- Table 8.4 Aldeveron: Company Overview

- Table 8.5 Aldeveron: Antibody Contract Manufacturing Service Portfolio

- Table 8.6 Aldeveron: Recent Development and Future Outlook

- Table 8.7 Emergent BioSolutions: Company Overview

- Table 8.8 Emergent BioSolutions: Antibody Contract Manufacturing Service Portfolio

- Table 8.9 Emergent BioSolutions: Recent Development and Future Outlook

- Table 8.10 Eurofins CDMO: Company Overview

- Table 8.11 Eurofins CDMO: Antibody Contract Manufacturing Service Portfolio

- Table 8.12 Eurofins CDMO: Recent Development and Future Outlook

- Table 8.13 Fujifilm Diosynth Biotechnologies: Company Overview

- Table 8.14 Fujifilm Diosynth Biotechnologies: Antibody Contract Manufacturing Service Portfolio

- Table 8.15 Fujifilm Diosynth Biotechnologies: Recent Development and Future Outlook

- Table 8.16 KBI Biopharma: Company Overview

- Table 8.17 KBI Biopharma: Antibody Contract Manufacturing Service Portfolio

- Table 8.18 KBI Biopharma: Recent Development and Future Outlook

- Table 8.19 Lonza: Company Overview

- Table 8.20 Lonza: Antibody Contract Manufacturing Service Portfolio

- Table 8.21 Lonza: Recent Development and Future Outlook

- Table 8.22 Nitto Avecia Pharma: Company Overview

- Table 8.23 Nitto Avecia Pharma: Antibody Contract Manufacturing Service Portfolio

- Table 8.24 Nitto Avecia Pharma: Recent Development and Future Outlook

- Table 8.25 Novasep: Company Overview

- Table 8.26 Novasep: Antibody Contract Manufacturing Service Portfolio

- Table 8.27 Novasep: Recent Development and Future Outlook

- Table 8.28 Pierre Fabre: Company Overview

- Table 8.29 Pierre Fabre: Antibody Contract Manufacturing Service Portfolio

- Table 8.30 Pierre Fabre: Recent Development and Future Outlook

- Table 8.31 Samsung Biologics: Company Overview

- Table 8.32 Samsung Biologics: Antibody Contract Manufacturing Service Portfolio

- Table 8.33 Samsung Biologics: Recent Development and Future Outlook

- Table 8.34 Synthon: Company Overview

- Table 8.35 Synthon: Antibody Contract Manufacturing Service Portfolio

- Table 8.36 Synthon: Recent Development and Future Outlook

- Table 8.37 Thermo Fisher Scientific: Company Overview

- Table 8.38 Thermo Fisher Scientific: Antibody Contract Manufacturing Service Portfolio

- Table 8.39 Thermo Fisher Scientific: Recent Development and Future Outlook

- Table 9.1 ABL: Company Overview

- Table 9.2 ABL: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Absolute Antibody: Company Overview

- Table 9.2 Absolute Antibody: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Abzena: Company Overview

- Table 9.2 Abzena: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Allele Biotechnology & Pharmaceuticals: Company Overview

- Table 9.2 Allele Biotechnology & Pharmaceuticals: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Alvotech: Company Overview

- Table 9.2 Alvotech: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Antibody Production Services: Company Overview

- Table 9.2 Antibody Production Services (Division of Life Science Group): Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Arabio: Company Overview

- Table 9.2 Arabio: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Bharat Serums and Vaccines: Company Overview

- Table 9.2 Bharat Serums and Vaccines: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Boehringer Ingelheim: Company Overview

- Table 9.2 Boehringer Ingelheim: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Glenmark Pharmaceuticals: Company Overview

- Table 9.2 Glenmark Pharmaceuticals: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 MilliporeSigma: Company Overview

- Table 9.2 MilliporeSigma: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Siam Bioscience: Company Overview

- Table 9.2 Siam Bioscience: Antibody Contract Manufacturing Service Portfolio

- Table 10.1 Comparison of Strengths and Weaknesses of Small Molecules and Biologics

- Table 10.2 Comparison of Development Characteristics of Small Molecules and Biologics

- Table 11.1 Benchmark Analysis: Information on Peer Groups

- Table 12.1 Antibody Contract Manufacturing: List of Partnerships, Since 2013

- Table 12.2 Antibody Contract Manufacturer Partnerships: Information on Type of Antibodies, Project Scale and Therapeutic Area

- Table 13.1 Antibody Contract Manufacturing: List of Expansions, Since 2017

- Table 13.2 Antibody Contract Manufacturing Expansions: Information on Type of Antibodies

- Table 14.1 Capacity Analysis: Average Capacity for Mammalian Expression System

- Table 14.2 Capacity Analysis: Average Capacity for Microbial Expression System

- Table 14.3 Capacity Analysis: Installed Global Capacity

- Table 14.1 Patent Approval Information of Best-selling Biologics

- Table 26.1 Antibody Contract Manufacturers: Distribution by Year of Establishment

- Table 26.2 Antibody Contract Manufacturers: Distribution by Company Size

- Table 26.3 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Region)

- Table 26.4 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Country)

- Table 26.5 Antibody Contract Manufacturers: Distribution by Location of Manufacturing Facilities

- Table 26.6 Antibody Contract Manufacturers: Distribution by Scale of Operation

- Table 26.7 Antibody Contract Manufacturers: Distribution by Type of Antibody Manufactured

- Table 26.8 Antibody Contract Manufacturers: Distribution by Expression System Used

- Table 26.9 Antibody Contract Manufacturers: Distribution by Fill / Finish Services Offered

- Table 26.12 Small Molecules and Biologics: Historical Trend of FDA Approval, Since 2010

- Table 26.10 Partnerships: Distribution by Year of Partnership

- Table 26.11 Partnerships: Distribution by Type of Partnership

- Table 26.12 Partnerships: Distribution by Year and Type of Partnership

- Table 26.13 Partnerships: Distribution by Type of Antibody

- Table 26.14 Partnerships: Distribution by Project Scale

- Table 26.15 Partnerships: Distribution by Focus Therapeutic Area

- Table 26.16 Partnerships: Most Active Players

- Table 26.17 Partnerships: Country-wise Distribution

- Table 26.18 Recent Expansions: Distribution by Year of Expansion

- Table 26.19 Recent Expansions: Distribution by Type of Expansion

- Table 26.20 Recent Expansions: Distribution by Type of Antibody

- Table 26.21 Recent Expansions: Distribution by Type of Antibody and Type of Expansion

- Table 26.22 Recent Expansions: Distribution by Location of Facility (Region-wise)

- Table 26.23 Recent Expansions: Distribution by Location of Facility (Country-wise)

- Table 26.24 Recent Expansions: Distribution by Location of Manufacturing Facility and Type of Expansion

- Table 26.25 Recent Expansions: Most Active Players

- Table 26.26 Recent Expansions: Distribution by Local and International Expansions

- Table 26.27 Capacity Analysis: Distribution by Company Size

- Table 26.28 Capacity Analysis: Distribution by Scale of Operation

- Table 26.29 Capacity Analysis: Distribution by Type of Expression System Used

- Table 26.30 Capacity Analysis: Distribution by Location of Manufacturing Facility

- Table 26.31 Demand Analysis: Annual Demand for Antibodies (in Kilograms)

- Table 26.32 Demand Analysis: Distribution by Scale of Operation (in Kilograms)

- Table 26.33 Demand Analysis: Distribution by Geographical Location

- Table 26.34 Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.35 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Table 26.36 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Table 26.37 Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- Table 26.38 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) (USD Billion)

- Table 26.39 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.40 Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) (USD Billion)

- Table 26.41 Antibody Contract Manufacturing Market for Bispecific Antibodies: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.42 Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- Table 26.43 Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) (USD Billion)

- Table 26.44 Antibody Contract Manufacturing Market at Commercial Scale: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.45 Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) (USD Billion)

- Table 26.46 Antibody Contract Manufacturing Market at Clinical Scale: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.47 Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- Table 26.48 Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) (USD Billion)

- Table 26.49 Antibody Contract Manufacturing Market for Mammalian Expression System: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.50 Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) (USD Billion)

- Table 26.51 Antibody Contract Manufacturing Market for Microbial Expression System: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.52 Antibody Contract Manufacturing Market: Distribution by Geographical Region

- Table 26.53 Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) (USD Billion)

- Table 26.54 Antibody Contract Manufacturing Market in North America: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.55 Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) (USD Billion)

- Table 26.56 Antibody Contract Manufacturing Market in Europe: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.57 Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) (USD Billion)

- Table 26.58 Antibody Contract Manufacturing Market in Asia: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.59 Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) (USD Billion)

- Table 26.60 Antibody Contract Manufacturing Market in Latin America: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.61 Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) (USD Billion)

- Table 26.62 Antibody Contract Manufacturing Market in Middle East and North Africa: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentations

- Figure 3.1 Economic and Other Project Specific Consideration: Lesson Learnt from Past Recessions

- Figure 4.1 Executive Summary: Antibody Contract Manufacturing Market Landscape

- Figure 4.2 Executive Summary: Partnerships

- Figure 4.3 Executive Summary: Recent Expansions

- Figure 4.4 Executive Summary: Capacity Analysis

- Figure 4.5 Executive Summary: Demand Analysis

- Figure 4.6 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Historical Timelines of Antibodies

- Figure 5.2 Structure of an Antibody

- Figure 5.3 Mechanism of Action of Antibodies

- Figure 5.4 Monoclonal Antibody Production

- Figure 5.5 Symmetric and Asymmetric Bispecific Antibodies

- Figure 5.6 Mechanism of Action of Bispecific Antibodies

- Figure 5.7 Polyclonal Antibody Production

- Figure 5.8 Applications of Polyclonal Antibodies

- Figure 5.9 Types of Third-Party Service Providers

- Figure 6.1 Antibody Contract Manufacturers: Distribution by Year of Establishment

- Figure 6.2 Antibody Contract Manufacturers: Distribution by Company Size

- Figure 6.3 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Antibody Contract Manufacturers: Distribution by Location of Manufacturing Facilities

- Figure 6.6 Antibody Contract Manufacturers: Distribution by Location Scale of Operation

- Figure 6.7 Antibody Contract Manufacturers: Distribution by Type of Antibody Manufactured

- Figure 6.8 Antibody Contract Manufacturers: Distribution by Type of Expression System Used

- Figure 6.9 Antibody Contract Manufacturers: Distribution by Fill / Finish Services Offered

- Figure 7.1 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in North America

- Figure 7.2 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in North America

- Figure 7.3 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in North America

- Figure 7.4 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in North America

- Figure 7.5 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in Europe

- Figure 7.6 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in Europe

- Figure 7.7 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in Europe

- Figure 7.8 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in Europe

- Figure 7.9 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in Asia

- Figure 7.10 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in Asia

- Figure 7.11 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in Asia

- Figure 7.12 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in Asia

- Figure 10.1 Small Molecules and Biologics: Historical Trend of FDA Approval, Since 2010

- Figure 10.2 Comparison of Key Characteristics of Small Molecules and Biologics

- Figure 10.3 Comparison of Manufacturing Processes of Small Molecules and Biologics

- Figure 11.1 Benchmark Analysis: Distribution by Region and Company Size

- Figure 11.2 Benchmark Analysis: Small Players Based in North America (Peer Group I)

- Figure 11.3 Benchmark Analysis: Mid-Sized Players Based in North America (Peer Group II)

- Figure 11.4 Benchmark Analysis: Large Players Based in North America (Peer Group III)

- Figure 11.5 Benchmark Analysis: Very Large Players Based in North America (Peer Group IV)

- Figure 11.6 Benchmark Analysis: Small Players Based in Europe (Peer Group V)

- Figure 11.7 Benchmark Analysis: Mid-Sized Players Based in Europe (Peer Group VI)

- Figure 11.8 Benchmark Analysis: Large Players Based in Europe (Peer Group VII)

- Figure 11.9 Benchmark Analysis: Very Large Players Based in Europe (Peer Group VIII)

- Figure 11.10 Benchmark Analysis: Small Players Based in Asia (Peer Group IX)

- Figure 11.11 Benchmark Analysis: Mid-Sized Players Based in Asia (Peer Group X)

- Figure 11.12 Benchmark Analysis: Large Players Based in Asia (Peer Group XI)

- Figure 11.13 Benchmark Analysis: Very Large Players Based in Asia (Peer Group XII)

- Figure 11.14 Benchmark Analysis: Comparison of Services and Capabilities across Different Peer Groups

- Figure 12.1 Partnerships: Distribution by Year of Partnership

- Figure 12.2 Partnerships: Distribution by Type of Partnership

- Figure 12.3 Partnerships: Distribution by Year and Type of Partnership

- Figure 12.4 Partnerships: Distribution by Type of Antibody Manufactured

- Figure 12.5 Partnerships: Distribution by Project Scale

- Figure 12.6 Partnerships: Distribution by Target Therapeutic Area

- Figure 12.7 Partnerships: Most Active Players

- Figure 12.8 Partnerships: Country-wise Distribution

- Figure 12.9 Partnerships: Continent-wise Distribution

- Figure 13.1 Recent Expansions: Distribution by Year of Expansion

- Figure 13.2 Recent Expansions: Distribution by Type of Expansion

- Figure 13.3 Recent Expansions: Distribution by Type of Antibody

- Figure 13.4 Recent Expansions: Distribution by Type of Antibody and Type of Expansion

- Figure 13.5 Recent Expansions: Distribution by Location of Facility (Region-wise)

- Figure 13.6 Recent Expansions: Distribution by Location of Facility (Country-wise)

- Figure 13.7 Recent Expansions: Distribution by Location of Manufacturing Facility and Type of Expansion

- Figure 13.8 Recent Expansions: Most Active Players

- Figure 13.9 Recent Expansions: Distribution by Local and International Expansions

- Figure 14.1 Capacity Analysis: Distribution by Company Size

- Figure 14.2 Capacity Analysis: Distribution by Scale of Operation

- Figure 14.3 Capacity Analysis: Distribution by Type of Expression System Used

- Figure 14.4 Capacity Analysis: Distribution by Location of Manufacturing Facility

- Figure 14.5 Capacity Analysis: Distribution by Location of Manufacturing Facility and Scale of Operation

- Figure 14.6 Capacity Analysis: Distribution by Location of Manufacturing Facility and Company Size

- Figure 15.1 Global Demand for Antibodies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (in Kilograms)

- Figure 15.2 Global Demand for Antibodies: Distribution by Scale of Operation (in Kilograms)

- Figure 15.3 Global Demand for Antibodies: Distribution by Geographical Region, Till 2035 (in Kilogram)

- Figure 16.1 Antibody Contract Manufacturing: Market Drivers

- Figure 16.2 Antibody Contract Manufacturing: Market Restraints

- Figure 16.3 Antibody Contract Manufacturing: Market Opportunities

- Figure 16.4 Antibody Contract Manufacturing: Market Challenges

- Figure 17.1 Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.2 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 17.3 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 18.1 Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- Figure 18.2 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- Figure 19.2 Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- Figure 20.2 Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Antibody Contract Manufacturing Market: Distribution by Geographical Region

- Figure 21.2 Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.4 Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.5 Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.6 Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.1 Antibody Contract Manufacturing: SWOT Analysis

- Figure 23.2 Comparison of SWOT Factors: Harvey Ball Analysis