|

市場調查報告書

商品編碼

1752097

影音監控的全球市場(~2035年):各元件類型,各服務形式,行政機關類別,價格設定模式類別,各終端用戶,不同商業模式,各主要地區,產業趨勢,預測Video Surveillance Market, Till 2035: Distribution by Type of Component, Type of Services, Type of Government and Public Sector, Type of Pricing Model, End User, Business Model and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

視訊監控市場概覽

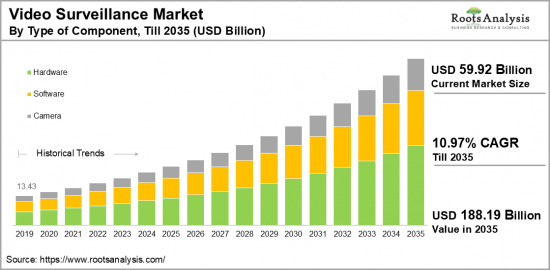

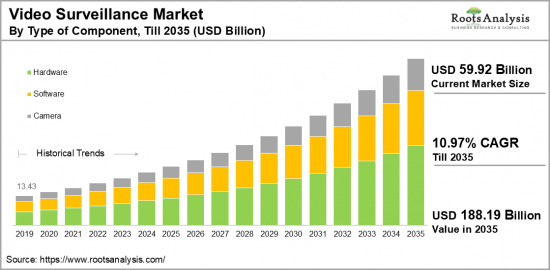

預計到 2035 年,全球視訊監控市場規模將從目前的 599.2 億美元增至 1,881.9 億美元,在預測期內,複合年增長率為 10.97%。

視訊監控市場:成長與趨勢

視訊監控大大改變了安防產業的格局,並已成為不可或缺的一部分。主要得益於顯示技術和人工智慧的進步,它有助於增強安全性,同時提供更優惠的價格。全球視訊監控市場目前正經歷重大轉型期,這得益於基於IP的數位技術的創新,這些技術旨在識別和預防各種不良活動,例如商店行竊、盜竊、故意破壞甚至恐怖事件。

這些技術正在製造業、銀行和金融服務業、運輸業和零售業等各個領域得到應用,從而推動了巨大的需求和市場擴張。這種廣泛採用在美國、英國、印度、中國和巴西等主要經濟體中尤其明顯,這些經濟體擁有許多大型產業,並且對安全需求的意識不斷增強。

視訊分析和先進監視攝影機的不斷發展和整合在行業發展中發揮關鍵作用。監視攝影機的部署可以識別和震懾犯罪分子,有助於降低全球犯罪率。各行各業對整合監控系統的需求日益增長,而視訊監控即服務 (VSaaS) 的進步則進一步增強了這項需求。此外,IP攝影機的普及以及向集中式資料管理解決方案的轉變也帶來了光明的前景。

儘管視訊監控有很多好處,但它也遭到了人權組織和活動人士的反對,他們擔心潛在的隱私侵犯和資訊濫用。為了確保該行業的可持續發展,必須解決這些問題,並確保以合乎道德和負責任的方式使用監控技術,在滿足合法安全需求的同時維護個人隱私權。

然而,由於技術的不斷進步和全球各個行業的日益普及,預計該行業將經歷可觀的增長。先進的監控系統以其易於安裝和維護以及高視訊品質而著稱,預計將在預測期內進一步推動視訊監控市場的成長。

本報告提供全球影音監控市場相關調查,市場規模的估計與機會分析,競爭情形,企業簡介,SWOT分析等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟考慮事項,其他的計劃特有的考慮事項

第4章 宏觀經濟指標

第5章 摘要整理

第6章 簡介

第7章 競爭情形

第8章 企業簡介

- 章概要

- Avigilon

- BCD

- Bosch

- Canon

- Dahua

- Genetec

- HONEYWELL

- Huawei

- IDIS

- Infinova

- Motorola

- Panasonic

第9章 價值鏈分析

第10章 SWOT分析

第11章 全球影音監控市場

第12章 市場機會:各元件類型

第13章 市場機會:各服務形式

第14章 市場機會:行政機關類別

第15章 市場機會:價格設定模式類別

第16章 市場機會:資料儲存類別

第17章 市場機會:各用戶界面

第18章 市場機會:不同企業規模

第19章 市場機會:各終端用戶

第20章 市場機會:不同商業模式

第21章 北美的影音監控市場機會

第22章 歐洲的影音監控市場機會

第23章 亞洲的影音監控市場機會

第24章 中東·北非(MENA)的影音監控市場機會

第25章 南美的影音監控市場機會

第26章 其他地區的影音監控市場機會

第27章 表格形式資料

第28章 企業·團體的清單

第29章 客制化的機會

第30章 Roots的訂閱服務

第31章 著者詳細內容

Video Surveillance Market Overview

As per Roots Analysis, the global video surveillance market size is estimated to grow from USD 59.92 billion in the current year to USD 188.19 billion by 2035, at a CAGR of 10.97% during the forecast period, till 2035.

The opportunity for video surveillance market has been distributed across the following segments:

Type of Component

- Cameras

- Analog

- IP

- Thermal

- PTZ (Pan-Tilt-Zoom)

- Hardware

- Recorders

- Encoders

- Storage Devices

- Monitors

- Software

- Video Management Software (VMS)

- Video Analytics

Type of Services

- VSaaS

- Installation

- Maintenance

- Consulting

- Management Services

Type of Government and Public Sector

- Public Transportation

- Law Enforcement

- Municipal Surveillance

Type of Pricing Model

- Per Camera

- Per System

- Subscription-Based

- Pay-Per-Use

Type of Data Storage

- Local Storage

- Cloud Storage

- Hybrid Storage

Type of User Interface

- Web-Based Interface

- Mobile App

- Desktop Application

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

End User

- Commercial

- Retail

- Banking and Finance

- Hospitality

- Corporate Offices

- Residential

- Homes

- Apartments

- Gated Communities

- Industrial

- Manufacturing Facilities

- Warehouses

- Construction Sites

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

VIDEO SURVEILLANCE MARKET: GROWTH AND TRENDS

Video surveillance has significantly altered the landscape of the security industry and has now become essential. It has primarily contributed to enhanced security while offering better pricing due to advancements in display technology and artificial intelligence. The global market for video surveillance is currently undergoing a major transformation, propelled by innovations in IP-based digital technologies designed to identify and prevent various unwanted activities such as shoplifting, theft, vandalism, and even terrorist incidents.

These technologies are increasingly being adopted across various sectors including manufacturing, banking, financial services, transportation, and retail, driving substantial demand and market expansion. This widespread uptake is evident in key economies such as the United States, the United Kingdom, India, China, and Brazil, which have a wealth of large-scale industries and a growing awareness of security needs.

The ongoing development and integration of video analytics and advanced surveillance cameras in technology have played a crucial role in the growth of the industry. The deployment of cameras has enabled the identification and deterrence of possible offenders, thereby contributing to a decrease in global crime rates. The industry is experiencing a rise in demand for integrated surveillance systems, further enhanced by advancements in Video Surveillance as a Service (VSaaS). Moreover, the introduction of IP cameras and the move towards centralized data management solutions have opened up promising opportunities.

Despite its advantages, video surveillance has encountered opposition from civil liberties groups and activists, who express concerns regarding potential privacy infringements and the misuse of collected information. It is essential to address these issues to ensure the sustainable progression of the industry, making sure that surveillance technologies are utilized ethically and responsibly, safeguarding individuals' privacy rights while meeting valid security demands.

However, this sector is set for considerable growth, owing to the ongoing technological advancements and increasing adoption across various sectors worldwide. Cutting-edge surveillance systems, noted for their ease of installation, maintenance, and high video quality, are anticipated to further propel the growth of video surveillance market during the forecast period.

VIDEO SURVEILLANCE MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global video surveillance market is segmented into cameras, hardware and software. According to our estimates, currently, cameras segment captures the majority of the market. Notably, the transition from analog cameras to IP cameras marked a significant turning point in the surveillance industry by utilizing internet protocol for the transmission of digital images, resulting in a substantial increase in demand and growth. Innovations, including thermal and PTZ cameras designed for specific environments, highlight the advancements in technology and the corresponding rise in demand for these devices.

Additionally, the integration of more advanced hardware and software technologies has further fueled ongoing growth. Each category of components plays a distinct role in the functionality and efficiency of video surveillance systems, addressing various industry requirements and technological progress.

Market Share by Type of Service

Based on type of services, the video surveillance market is segmented into VSaaS, installation, maintenance, consulting. According to our estimates, currently, VSaaS segment captures the majority of the market. This can be attributed to various advantages offered by VSaaS, such as lower IT expenses, scalability, and seamless integration with other security systems. Additionally, the rising use of IP cameras alongside cloud-based storage has fueled the demand for VSaaS in the industry. VSaaS enables users to store data remotely, facilitating access from various locations while improving security measures.

Market Share by Type of Government and Public Sector

Based on type of government and public sector, the video surveillance market is segmented into public transportation, law enforcement, and municipal surveillance. According to our estimates, currently, public transportation segment captures the majority share of the market. This can be attributed to the fact that in public transportation, video surveillance facilitates real-time observation of passenger behavior, aids in crowd management, and allows for rapid incident response.

As urbanization continues and public transportation networks expand, the need for reliable surveillance systems in this field is ever-increasing. Additionally, the market for in-vehicle video surveillance has proven to be beneficial for law enforcement efforts, owing to its dependability and potential for preventing crime, conducting investigations, and gathering evidence.

Market Share by Type of Pricing Model

Based on type of pricing model, the video surveillance market is segmented into per camera, per system, subscription-based and pay-per-use. According to our estimates, currently, subscription-based pricing model captures the majority share of the market, followed by per-camera pricing model.

The demand in this sector largely depends on the specific industry's needs; for instance, subscription-based models have gained popularity because they offer flexibility and reduced initial costs. This model is particularly favored by technologically adept companies and those in search of scalable, long-term solutions that include regular updates and support. In addition, the lower upfront costs and provision of ongoing updates and support have made it a cost-effective option for many organizations. The demand for video surveillance systems has experienced a notable increase due to their affordability and dependability, and this trend is projected to continue growing in the future.

Market Share by Type of Data Storage

Based on type of data storage, the video surveillance market is segmented into local storage, cloud storage and hybrid storage. According to our estimates, currently, cloud storage captures the majority share of the market. This can be attributed to the growing adoption of Video Surveillance as a Service (VSaaS) and the demand for scalable and secure storage solutions. The ease and flexibility of accessing data from any location have contributed to the increasing popularity of cloud storage.

Market Share by Type of User Interface

Based on type of user interface, the video surveillance market is segmented into web-based interface, mobile app and desktop application. According to our estimates, currently, web-based interface segment captures the majority share of the market. This can be attributed to its accessibility and compatibility with a range of devices and by increased consumer demand.

Market Share by Company Size

Based on company size, the video surveillance market is segmented into large, small and medium sized companies. According to our estimates, currently, large companies segment captures the majority share of the market. This can be attributed to the fact that large firms typically have an established reputation, extensive market presence, and considerable investments in research and development.

Market Share by End User

Based on end user, the video surveillance market is segmented into commercial, retail and industrial. A further breakdown based on end user type includes commercial sectors such as retail, banking, finance, and hospitality. Additionally, there is demand in residential and industrial sectors where surveillance devices are increasingly sought after. Notably, the global video surveillance market is currently experiencing a significant transformation, spurred by improvements in IP-based digital technologies designed to identify and prevent a variety of undesirable actions such as shoplifting, theft, vandalism, and even terrorist acts.

Market Share by Business Model

Based on business model, the video surveillance market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B segment captures the majority share of the market. This can be the rising implementation of global optical technology across various sectors, including education, manufacturing, healthcare, finance, and others. Additionally, the B2C model is projected to experience significant growth rate during this forecast period, as video surveillance technologies become more user-friendly, with consumers increasingly embracing global optical technology for customized applications, smartphone integration, and an enhanced user experience.

Market Share by Geographical Regions

Based on geographical regions, the video surveillance market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the heightened awareness, which has increased the demand in sectors such as retail, banking, and corporate environments. Additionally, government investment has been significant in prioritizing public safety and the protection of critical infrastructure. Moreover, the implementation of advanced video analytics and integrated surveillance systems has substantially enhanced market demand for video surveillance solutions.

However, the market in Asia is expected to grow at a relatively higher CAGR during the forecast period.

Example Players in Video Surveillance Market

- Avigilon

- BCD

- Bosch

- Canon

- CP Plus

- Dahua

- Eagle Eye Networks

- FLIR Systems

- Genetec

- Hanwha Techwin

- Hangzhou Hikvision

- HONEYWELL

- Huawei

- IDIS

- Infinova

- March

- Motorola

- Panasonic

- Pelco

- Robert Bosch GmbH

- Teledyne FLIR

- Tyco

- Verkada

- VIVOTEK

- Zhejiang Uniview

VIDEO SURVEILLANCE MARKET: RESEARCH COVERAGE

The report on the video surveillance market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the video surveillance market, focusing on key market segments, including [A] type of component, [B] type of services, [C] type of government and public sector, [D] type of pricing model, [E] type of data storage, [F] type of user interface, [G] company size, [H] end user, [I] business model and [J] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the video surveillance market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the video surveillance market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in video surveillance market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodities

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Video Surveillance

- 6.2.1. Key Characteristics of video surveillance market

- 6.2.2. Type of Component

- 6.2.3. Type of Services

- 6.2.4. Type of Sector

- 6.2.5. Type of Pricing Model

- 6.2.6. Type of Data Storage

- 6.2.7. Type of User Interface

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Video Surveillance: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. Avigilon*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.8. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.2. BCD

- 8.2.3. Bosch

- 8.2.4. Canon

- 8.2.5. Dahua

- 8.2.6. Genetec

- 8.2.7. HONEYWELL

- 8.2.8. Huawei

- 8.2.9. IDIS

- 8.2.10. Infinova

- 8.2.11. Motorola

- 8.2.12. Panasonic

- 8.2.1. Avigilon*

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL VIDEO SURVEILLANCE MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Video Surveillance Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Video Surveillance Market for Cameras: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.1. Video Surveillance Market for Analog: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.2. Video Surveillance Market for IP: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.3. Video Surveillance Market for Thermal: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.4. Video Surveillance Market for PTZ (Pan-Tilt-Zoom): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Video Surveillance Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.1. Video Surveillance Market for Encoders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.2. Video Surveillance Market for Monitors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.3. Video Surveillance Market for Recorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.4. Video Surveillance Market for Storage Device: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Video Surveillance Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8.1. Video Surveillance Market for Video Management Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8.2. Video Surveillance Market for Video Analytics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF SERVICES

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Video Surveillance Market for VSaaS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Video Surveillance Market for Installation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Video Surveillance Market for Maintenance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Video Surveillance Market for Consulting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Video Surveillance Market for Management Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON GOVERNMENT AND PUBLIC SECTOR

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Video Surveillance Market for Public Transportation (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Video Surveillance Market for On Law Enforcement: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Video Surveillance Market for Municipal Surveillance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF PRICING MODEL

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Video Surveillance Market based on Per Camera: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Video Surveillance Market based on Per System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Video Surveillance Market based on Subscription-Based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Video Surveillance Market based on Pay-Per-Use: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF DATA STORAGE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Video Surveillance Market for Local Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Video Surveillance Market for Cloud Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Video Surveillance Market for Hybrid Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON USER INTERFACE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Video Surveillance Market for Web Based Interface: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Video Surveillance Market for Desktop Application: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Video Surveillance Market for Mobile App: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Video Surveillance Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Video Surveillance Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Video Surveillance Market for Commercial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Video Surveillance Market for Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Video Surveillance Market for Banking, Financial Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Video Surveillance Market for Hospitality: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Video Surveillance Market for Corporate Offices: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Video Surveillance Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.1. Video Surveillance Market for Homes: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.2 Video Surveillance Market for Apartments: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.3. Video Surveillance Market for Gated Communities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Video Surveillance Market for Industries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8.1. Video Surveillance Market for Manufacturing Facilities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9 Video Surveillance Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Video Surveillance Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Video Surveillance Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Video Surveillance Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035))

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN NORTH AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Global Photonics Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Global Photonics Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Global Photonics Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Global Photonics Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Global Photonics Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN EUROPE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Video Surveillance Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Video Surveillance Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Video Surveillance Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Video Surveillance Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Video Surveillance Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Video Surveillance Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Video Surveillance Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.7. Video Surveillance Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.8. Video Surveillance Market in the Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.9. Video Surveillance Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.10. Video Surveillance Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.11. Video Surveillance Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.12. Video Surveillance Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.13. Video Surveillance Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.14. Video Surveillance Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.15. Video Surveillance Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN ASIA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Video Surveillance Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Video Surveillance Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Video Surveillance Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Video Surveillance Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Video Surveillance Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Video Surveillance Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Video Surveillance Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Video Surveillance Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Video Surveillance Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 24.6.2. Video Surveillance Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Video Surveillance Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Video Surveillance Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Video Surveillance Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Video Surveillance Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Video Surveillance Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Video Surveillance Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN LATIN AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Video Surveillance Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Video Surveillance Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Video Surveillance Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Video Surveillance Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Video Surveillance Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Video Surveillance Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Video Surveillance Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN REST OF THE WORLD

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Video Surveillance Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Video Surveillance Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Video Surveillance Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Video Surveillance Market in Other Countries

- 25.7. Data Triangulation and Validation