|

市場調查報告書

商品編碼

1848180

影音監控的全球市場(2025年~2030年)The Global Video Surveillance Business 2025 to 2030 - Cameras, Storage, Software & Analytics Market Analysis |

||||||

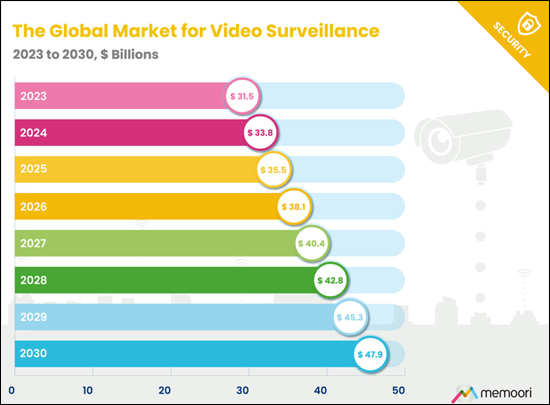

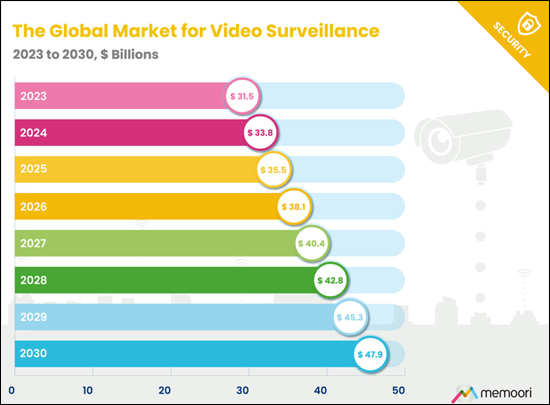

- 預計全球視訊監控設備和軟體的總收入(以出廠價計算)將在2024年達到338億美元,2025年達到355億美元,到2030年達到479億美元。這相當於約6%的複合年增長率,反映了該產業從被動式安全部署轉向策略性、情報驅動的基礎設施投資的轉變。

- 我們的市場分析涵蓋四個核心部分:視訊攝影機硬體、軟體和分析、視訊儲存以及配套硬體基礎設施。這種細分揭示了該行業以軟體功能和經常性收入模式為特徵,其中分析和雲端服務的成長速度是傳統設備銷售的兩倍以上。

- 具備邊緣處理能力的AI賦能攝影機預計在2025年佔全球攝影機出貨量的很大一部分。這些系統提供廣泛的功能,從目標偵測和車牌識別到行為分析和隱私保護的重新編輯,從根本上改變了視訊監控,使其從被動錄製轉變為主動運行智慧。

- 無人機正成為擴展視訊監控能力的關鍵載體。 無人機可以將監控範圍擴展到固定攝影機難以觸及的區域,為事件回應提供快速部署能力,並支援對關鍵基礎設施、大型園區和邊境安全應用進行持續、廣域的監控。將無人機與地面系統和即時犯罪中心結合,從根本上擴展了監控架構,使其從靜態觀察點擴展到動態的行動感測器網路。

地緣政治緊張局勢持續重塑市場准入與競爭格局

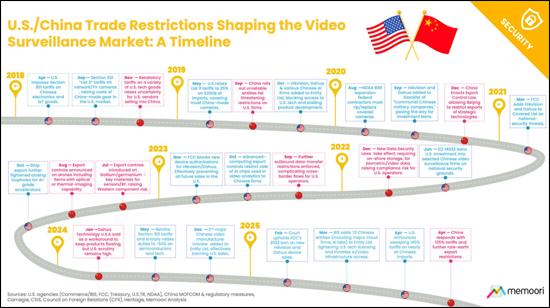

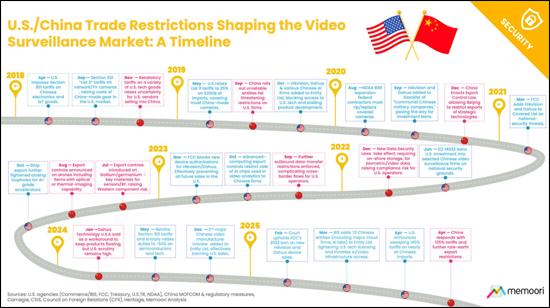

中西方之間的地緣政治緊張局勢正在分裂市場,中國供應商面臨美國採購禁令、FCC設備許可限制以及不斷擴大的出口管制。這些法規為符合 "國防授權法案" (NDAA) 的替代方案創造了持續的機遇,這些替代方案將監管誠信和網路安全透明度作為核心品牌價值。

從2023年9月到2025年8月,共觀察到24件併購交易。同期,投資活動總額達38億美元,涉及38筆交易。主要趨勢包括:整合硬體、軟體和雲端服務的平台整合;私募股權驅動的積極市場重組;策略重點從硬體轉向軟體和經常性收入;人工智慧的融合推動了對電腦視覺和隱私領域新創公司的收購。

本報告探索並分析了全球視訊監控市場,提供了有關市場規模和結構、人工智慧和邊緣運算驅動的變革、地緣政治緊張局勢的影響以及併購、投資和策略聯盟發展情況的資訊。

目錄

序文

摘要整理

第1章 影音監控商務的結構與形狀

- 影音監控市場結構

- 企業的分類與市場佔有率

- 群組A企業

- 群組B企業

- 群組C企業

- 群組D企業

- 銷售·流通管道

第2章 影音監控市場

- 影音監控的採用與投資

- 市場營運狀況

- 主要普及推動因素

- 實體安防支出計畫及預算

- 影音監控的市場規模與成長預測

- 市場整體預測和軌道

- 市場預測的明細:不同類別的

- 市場規模,成長,趨勢:各主要地區

- 北美

- 南美·加勒比海地區

- 中國

- 其他的亞太地區

- 歐洲

- 中東·非洲

- 市場規模,趨勢:各業界

- 公共基礎設施·城市監視

- 辦公室

- 零售

- 運輸

- 醫療

- 教育

- 製造·物流

- 飯店

- 資料中心

- 攝影機

- 影音監控相機

- 市場動態

- IP vs. 類比

- 相機的尺寸規格

- 主要企業·業者情勢

- 身體相機

- 市場規模與成長趨勢

- 市場動態

- 主要企業·業者情勢

- 熱感相機

- 市場規模與成長趨勢

- 市場動態

- 主要企業·業者情勢

- 影音監控軟體·分析

- 市場規模與成長趨勢

- 市場動態

- 主要企業·業者情勢

- VSaaS·雲端

- 市場動態

- VSaaS經營模式和競爭情形

- 技術和運用相關考察

- 與成本法規要素

- 影像儲存裝置硬體設備·服務

- 市場規模與成長趨勢

- 市場動態

- 主要企業·業者情勢

- 影音監控用無人機

- 市場規模與成長趨勢

- 市場動態

- 主要企業·業者情勢

第3章 IP連接性·IoT

- IP 與物聯網的融合

- 物聯網視訊監控的優勢

- 物聯網成長與應用趨勢

- 物聯網應用面臨的挑戰

第4章 與AI機器學習

- 市場採用和成長預測

- 用途和使用案例

- 保全·安全

- 身份識別與存取管理

- ALPR/ANPR·行動

- 運用·商務見解

- 調查·自然地語言搜尋(NLS)

- 邊緣設備·硬體設備啟用

- AI晶片

- AI網路錄影機(NVR)

- AI相機

- 影音監控的AI的課題

- 業者情勢

- 新的趨勢和未來預測

第5章 無線·蜂巢式技術

- 無線傳送方式

- 4G

- Wi-Fi

- 5G

- 私人LTE/5G網路

- 主要的優點與使用案例

- 無線的課題與討論事項

- 無線·5G相機

- 無線

- 5G

第6章 其他的值得注意的技術促進因素

- 畫品質/解析度

- 市場採用與演進

- 特定用途的解析度必要條件

- 技術的考慮事項

- 低照度/紅外線/暗視

- 強化可見光成像

- 整合紅外線照明

- 專門性的成像與非視覺感測

- 多感測器設備

- 市場採用與演進

- 技術的考慮事項

- 先進的威脅偵測系統

- 功能和範疇

- 推動市場要素與採用趨勢

- 關注的供應商與市場的提供

- 整合和互通性

- 互通性的優點

- 開放式平台的演變

- ONVIF規格

- 影音監控,實體安全,大樓系統的整合

第7章 地緣政治學的緊張和貿易壁壘

- 美國和中國的動態

- 其他的國家與地區的貿易限制

- 烏克蘭戰爭

- 對市場的影響

- 競爭情形與地區市場重組

- 供應鏈的重組和生產地區

- 採購趨勢與購買者的行動

- 價格趨勢與成本結構

- 產品策略和技術藍圖

- 預測(~2030年)

第8章 供應鏈趨勢

- 目前供應鏈狀況

- 採購和生產的策略性轉換

- 供應鏈預測(~2030年)

第9章 技術,人力資源,勞工

- 主要課題

- 新機會

第10章 網路安全

- 與主要的威脅漏洞

- 攻擊載體

- 供應鏈和整合的風險

- 威脅形勢

- 網路安全偶發事件和漏洞

- 法規和遵守

- 侵害和漏洞的明確指示

- 緩和的最佳業務實踐

第11章 資料隱私和倫理

- 隱私相關考慮事項

- 隱私法規

- 臉部辨識:法律上的及運用上的阻礙因素

- 倫理性的實行與AI偏壓

第12章 合併和收購

- 過去的M&A的市場動態

- 新M&A交易(2023年9月~2025年8月)

- M&A趨勢與其影響

第13章 策略性聯盟

- 過去的策略性聯盟和市場動態

- 新策略性聯盟(2023年9月~2025年8月)

- 策略性聯盟的趨勢與影響

第14章 投資趨勢

- 過去的投資交易和投資的市場動態

- 新投資議案(2023年9月~2025年8月)

- 投資趨勢的觀察和暗示

This report is an in-depth study providing a detailed market analysis of video surveillance, with a specific focus on revenues generated by cameras, video storage, software & analytics.

This comprehensive study examines the current and anticipated landscape of the global video surveillance market through to 2030. Drawing on expertise in our previous Internet of Things, Artificial Intelligence, and Cybersecurity analysis, this report empowers professionals across the industry, from manufacturers to system integrators, from security consultants to facility managers and building owners.

Key Questions Addressed:

- What is the size and structure of the global video surveillance market in 2025? How is the market divided between cameras, storage, software, and analytics? Where are the dominant geographic markets? How are sales distributed across 12 different industry verticals?

- How are AI and edge computing transforming the industry? What percentage of cameras now ship with built-in AI capabilities? Which applications are driving adoption? How are vendors balancing edge processing with cloud analytics?

- What impact are geopolitical tensions having on market dynamics? How have US-China trade restrictions, NDAA compliance requirements, and supply chain restructuring reshaped competitive positioning? Which vendors are gaining or losing market share as a result?

- How are M&A, investment, and strategic alliances evolving? Which technology areas are attracting capital? How are private equity and strategic buyers reshaping market structure? What does the alliance landscape reveal about platform consolidation versus ecosystem flexibility?

Within its 246 Pages and 18 Charts, This Report Presents All the Key Facts and Draws Conclusions, so you can understand what is Shaping the Future of the Video Surveillance Industry:

- Total global revenues for video surveillance equipment and software at factory gate prices reached $33.8 billion in 2024, with projections of $35.5 billion in 2025 and growth to $47.9 billion by 2030. This represents a compound annual growth rate of nearly 6%, reflecting the sector's transition from reactive security deployments to strategic, intelligence-driven infrastructure investments.

- Our market analysis encompasses 4 core segments: video camera hardware, software and analytics, video storage, and supporting hardware infrastructure. This breakdown reveals an industry increasingly defined by software capabilities and recurring revenue models, with analytics and cloud services growing at more than twice the rate of traditional equipment sales.

- AI-enabled cameras capable of edge processing are projected to account for a significant percentage of global camera shipments in 2025. These systems deliver capabilities ranging from object detection and license plate recognition to behavior analysis and privacy-preserving redaction, fundamentally transforming video surveillance from passive recording to active operational intelligence.

- Drones are emerging as a significant expansion vector for video surveillance capabilities. Drones extend surveillance coverage to areas impractical for fixed cameras, provide rapid-deploy capability for incident response, and enable persistent wide-area monitoring for critical infrastructure, large campuses, and border security applications. The integration of drones with ground-based systems and real-time crime centers represents a fundamental expansion of surveillance architecture from static observation points to dynamic, mobile sensor networks.

At only USD $3,000 for an enterprise license, this report provides essential intelligence for strategic planning, competitive positioning, M&A evaluation, and technology roadmap development.

Geopolitical Tensions Continue to Reshape Market Access and Competitive Dynamics

Geopolitical tensions between China and the West have bifurcated the market, with Chinese vendors facing US procurement bans, FCC equipment authorization restrictions, and expanding export controls. These restrictions have created sustained opportunities for NDAA-compliant alternatives that position regulatory alignment and cybersecurity transparency as core brand values.

Between September 2023 and August 2025, 24 M&A transactions were observed. Investment activity totaled $3.8 billion across 38 deals during the same time period. Key trends include platform consolidation integrating hardware, software, and cloud services; private equity actively reshaping market structure; strategic focus shifting from hardware toward software and recurring revenue; and AI integration driving acquisitions of computer vision and privacy-preserving startup firms.

Who Should Buy This Report?

This report delivers critical intelligence for:

- Security manufacturers and vendors developing product roadmaps, positioning strategies, and go-to-market plans.

- System integrators and service providers evaluating technology partnerships, training investments, and service offerings.

- Private equity and strategic investors assessing M&A targets, market positioning, and competitive dynamics.

- Building owners, facility managers, and corporate security leaders planning capital investments and technology refresh cycles.

- Consultants and advisors supporting clients across procurement, compliance, and strategic planning.

Table of Contents

Preface

Executive Summary

1. The Structure & Shape of the Video Surveillance Business

- 1.1. Video Surveillance Market Structure

- 1.2. Company Classifications & Market Share

- Group A Companies

- Group B Companies

- Group C Companies

- Group D Companies

- 1.3. Sales & Distribution Channels

2. The Video Surveillance Market

- 2.1. Video Surveillance Adoption & Investment

- 2.1.1. Market Operation Conditions

- 2.1.2. Key Adoption Drivers

- 2.1.3. Physical Security Spending Plans & Budgets

- 2.2. Video Surveillance Market Size & Growth Forecasts

- 2.2.1. Overall Market Projections and Trajectory

- 2.2.2. Market Forecast Breakdown by Category

- 2.3. Market Size, Growth & Trends by Major Region

- 2.3.1. North America

- 2.3.2. Latin America & The Caribbean

- 2.3.3. China

- 2.3.4. The Rest of Asia Pacific

- 2.3.5. Europe

- 2.3.6. Middle East & Africa

- 2.4. Market Size & Trends by Vertical

- 2.4.1. Public Infrastructure & City Surveillance

- 2.4.2. Offices

- 2.4.3. Retail

- 2.4.4. Transport

- 2.4.5. Healthcare

- 2.4.6. Education

- 2.4.7. Manufacturing & Logistics

- 2.4.8. Hospitality

- 2.4.9. Data Centers

- 2.5. Video Cameras

- 2.6. Video Surveillance Cameras

- 2.6.1. Market Dynamics

- 2.6.2. IP vs Analog

- 2.6.3. Camera Form Factors

- 2.6.4. Key Players & Vendor Landscape

- 2.7. Body Worn Cameras

- 2.7.1. Market Size & Growth Trends

- 2.7.2. Market Dynamics

- 2.7.3. Key Players & Vendor Landscape

- 2.8. Thermal Cameras

- 2.8.1. Market Size & Growth Trends

- 2.8.2. Market Dynamics

- 2.8.3. Key Players & Vendor Landscape

- 2.9. Video Surveillance Software & Analytics

- 2.9.1. Market Size & Growth Trends

- 2.9.2. Market Dynamics

- 2.9.3. Key Players & Vendor Landscape

- 2.10. VSaaS & Cloud

- 2.10.1. Market Dynamics

- 2.10.2. VSaaS Business Models and Competitive Landscape

- 2.10.3. Technology and Operational Insights

- 2.10.4. Cost and Regulatory Factors

- 2.11. Video Storage Hardware & Services

- 2.11.1. Market Size & Growth Trends

- 2.11.2. Market Dynamics

- 2.11.3. Key Players & Vendor Landscape

- 2.12. Drones for Video Surveillance

- 2.12.1. Market Size & Growth Trends

- 2.12.2. Market Dynamics

- 2.12.3. Key Players & Vendor Landscape

3. IP Connectivity & the IoT

- 3.1. The Convergence of IP and IoT

- 3.2. The Benefits of IoT-Enabled Video Surveillance

- 3.3. IoT Growth & Adoption Trends

- 3.4. Challenges Associated with IoT adoption

4. AI & Machine Learning

- 4.1. Market Adoption & Growth Outlook

- 4.2. Applications and Use Cases

- 4.2.1. Security & Safety

- 4.2.2. Identity & Access Management

- 4.2.3. ALPR/ANPR & Mobility

- 4.2.4. Operational & Business Insight

- 4.2.5. Investigations & Natural-Language Search (NLS)

- 4.3. Edge Devices & Hardware Enablers

- 4.3.1. AI Chips

- 4.3.2. AI Network Video Recorders (NVRs)

- 4.3.3. AI Cameras

- 4.4. Challenges Associated with AI in Video Surveillance

- 4.5. Vendor Landscape

- 4.6. Emerging Trends & Future Outlook

5. Wireless & Cellular Technology

- 5.1. Wireless Transmission Methods

- 5.1.1. 4G

- 5.1.2. WiFi

- 5.1.3. 5G

- 5.1.4. Private LTE/5G Networks

- 5.2. Key Benefits & Use Cases

- 5.3. Challenges & Considerations for Wireless

- 5.4. Wireless & 5G Cameras

- 5.4.1. Wireless

- 5.4.2. 5G

6. Other Notable Technology Drivers

- 6.1. Image Quality/Resolution

- 6.1.1. Market Adoption and Evolution

- 6.1.2. Application-Specific Resolution Requirements

- 6.1.3. Technical Considerations

- 6.2. Low Light / Infra-Red / Night Vision

- 6.2.1. Enhanced Visible-Light Imaging

- 6.2.2. Integrated Infrared Illumination

- 6.2.3. Specialist Imaging and Non-Visual Sensing

- 6.3. Multi-sensor Devices

- 6.3.1. Market Adoption and Evolution

- 6.3.2. Technical Considerations

- 6.4. Advanced Threat Detection Systems

- 6.4.1. Capabilities and Categories

- 6.4.2. Market Drivers and Adoption Dynamics

- 6.4.3. Notable Vendors & Market Offerings

- 6.5. Integration & Interoperability

- 6.5.1. Benefits of Interoperability

- 6.5.2. The Evolution Toward Open Platforms

- 6.5.3. ONVIF Standards

- 6.5.4. Integration Between Video Surveillance, Physical Security, and Building Systems

7. Geopolitical Tensions & Trade Barriers

- 7.1. US/China Dynamics

- 7.2. Trade Restrictions in Other Countries and Regions

- 7.3. The War in Ukraine

- 7.4. Market Implications & Impacts

- 7.4.1. Competitive Landscape and Regional Market Realignment

- 7.4.2. Supply Chain Restructuring and Manufacturing Geography

- 7.4.3. Procurement Trends and Buyer Behavior

- 7.4.4. Pricing Dynamics and Cost Structures

- 7.4.5. Product Strategy and Technology Roadmaps

- 7.5. Outlook to 2030

8. Supply Chain Trends

- 8.1. Current Supply Chain Conditions

- 8.2. Strategic Shifts in Sourcing and Manufacturing

- 8.3. Supply Chain Outlook to 2030

9. Skills, Talent & Labor

- 9.1. Key Challenges

- 9.2. Emerging Opportunities

10. Cybersecurity

- 10.1. Key Threats and Vulnerabilities

- 10.1.1. Attack Vectors

- 10.1.2. Supply Chain and Integration Risks

- 10.1.3. Threat Landscape

- 10.2. Cybersecurity Incidents & Vulnerabilities

- 10.3. Regulations and Compliance

- 10.4. Breach and Vulnerability Disclosure

- 10.5. Mitigation Best Practices

11. Data Privacy & Ethics

- 11.1. Privacy Considerations

- 11.2. Privacy Regulations

- 11.3. Facial Recognition: Legal and Operational Constraints

- 11.4. Ethical Implementation and AI Bias

12. Mergers & Acquisitions

- 12.1. Historic M&A Market Dynamics

- 12.2. New M&A Deals (Sept 2023 to Aug 2025)

- 12.3. M&A Trends and Implications

13. Strategic Alliances

- 13.1. Historic Strategic Alliances & Market Dynamics

- 13.2. New Strategic Alliances (Sept 2023 to Aug 2025)

- 13.3. Strategic Alliance Trends and Implications

14. Investment Trends

- 14.1. Historic Investment Deals & Investment Market Dynamics

- 14.2. New Investment Deals (September 2023 - August 2025)

- 14.3. Investment Trend Observations & Implications

List of Charts and Figures

- Fig 1.1: Video Surveillance Market Structure

- Fig 1.2: Market Share of Global Video Surveillance Sales by Major Vendor 2024

- Fig 1.3: Video Surveillance Sales by Major Grouping, Number of Companies, % of Global Sales in 2024

- Fig 2.1: The Security Market Index (SMI) - Index Value & Overall Rating of Current Business Conditions

- Fig 2.2: The Global Market for Video Surveillance 2023 to 2030, $ Billions

- Fig 2.3: The Global Market for Video Surveillance by Category 2021 to 2030, $ Billions

- Fig 2.4: Video Surveillance Sales by Region in 2024, % of Total Video Surveillance Sales

- Fig 2.5: Video Surveillance Sales by Region 2021 to 2030, $Bn

- Fig 2.6: Video Surveillance Sales by Building Type in 2024, $Bn

- Fig 2.7: Global Sales of Video Surveillance Cameras by Type

- Fig 2.8: Global Video Surveillance Camera Market, Analog & IP Camera Market Share, 2021 to 2030, % of Total

- Fig 2.9: Global Video Surveillance Camera Shipments by Form Factor, 2024 % of Total Shipments

- Fig 2.10: Global Sales of Video Management Software (VMS) & Analytics

- Fig 2.11: Global Sales of Video Storage Hardware & Services 2021 to 2030, $Bn

- Fig 2.12: Global Sales of Drones for Video Surveillance 2024 to 2030 $Bn

- Fig 4.1: Global AI Video Surveillance Camera Shipments, % of Overall Video Surveillance Camera Shipments 2024 to 2030

- Fig 4.2: AI for Security and Access Control in Commercial Buildings, Number of Companies Serving Individual Use Cases

- Fig 7.1: US / China Trade Restrictions Shaping the Video Surveillance Market: A Timeline