|

市場調查報告書

商品編碼

1721386

數位轉型市場 (~2035年):技術類型·提供區分·展開·用途·企業規模·經營模式·終端用戶·各地區的產業趨勢與全球預測Digital Transformation Market Forecast till 2035, Distribution by Type of Technology, Type of Offering, Type of Deployment, Type of Application, Company Size, Business Model, End User and, Geographical Region; Industry Trend and Future Forecast. |

||||||

預計到 2035 年,全球數位轉型市場規模將從目前的 14,222.3 億美元增長至 132,631.7 億美元,預測期內複合年增長率為 22.50%。

數位轉型的市場機會:各市場區隔

各技術類型

- 雲端運算

- 巨量資料和分析

- 網路安全

- AI

- IoT

- 商業智慧

- 區塊鏈

各類服務

- 服務

- 解決方案

各部署類型

- 主人型

- 內部部署型

各用途

- 會計

- 財務管理

- IT營運

- 供應鏈管理

- 人事服務

不同企業規模

- 大企業

- 中小企業

不同商業模式

- B2B

- B2C

- B2B2C

各終端用戶

- 銀行·金融服務·保險(BFSI)

- 製造

- IT·通訊

- 零售·消費品

- 醫療保健

- 運輸

- 物流

- 政府機關

- 其他

各地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他的北美各國

- 歐洲

- 奧地利

- 比利時

- 丹麥

- 法國

- 德國

- 愛爾蘭

- 義大利

- 荷蘭

- 挪威

- 俄羅斯

- 西班牙

- 瑞典

- 瑞士

- 英國

- 其他歐洲各國

- 亞洲

- 中國

- 印度

- 日本

- 新加坡

- 韓國

- 其他亞洲各國

- 南美

- 巴西

- 智利

- 哥倫比亞

- 委內瑞拉

- 其他的南美各國

- 中東·北非

- 埃及

- 伊朗

- 伊拉克

- 以色列

- 科威特

- 沙烏地阿拉伯

- UAE

- 其他的中東·北非各國

- 全球其他地區

- 澳洲

- 紐西蘭

- 其他的國家

數位轉型市場:成長與趨勢

隨著科技的快速發展,數位化工具和創新已成為商業世界中不可或缺的一部分,有助於加快決策速度並消除區域限制。數位轉型主要涉及採用雲端運算、大數據分析、人工智慧和物聯網 (IoT) 等數位化解決方案,以提高溝通速度並改善客戶體驗。這些數位轉型工具使企業能夠即時從各種來源收集數據,從而幫助企業做出更準確的業務決策。例如,在金融領域,這些數位創新允許遠端存取系統,使員工能夠在傳統辦公環境之外工作。在製藥領域,機器學習、大數據分析、人工智慧和數位孿生技術等尖端技術工具對於藥物開發相關的即時數據收集至關重要。

由於技術的快速發展,數位工具和創新已成為商業世界中不可或缺的一部分,它們能夠加快決策速度並消除地理限制。數位轉型主要旨在透過整合雲端運算、大數據分析、人工智慧和物聯網等數位解決方案來加快溝通速度並改善客戶體驗。透過利用這些數位轉型工具,企業可以從各種來源即時收集數據,並做出更準確的業務決策。例如,在金融領域,這些數位技術允許遠端存取系統,使員工無需在傳統辦公室工作即可工作。此外,在製藥領域,機器學習、大數據分析、人工智慧和數位孿生技術等尖端技術在藥物開發相關的即時數據收集中發揮著重要作用。

隨著各行各業對數位技術的持續應用,數位轉型市場預計將繼續保持強勁成長。為了滿足日益增長的數位轉型解決方案和技術需求,行業利益相關者正在採取策略性舉措,建立以客戶為中心的服務和自助式數位解決方案入口網站。亞馬遜、谷歌和微軟等知名公司正攜手合作,以增強其雲端解決方案和預測分析工具。

本報告提供全球數位轉型的市場調查、彙整市場概要,背景,市場影響因素的分析,市場規模的轉變·預測,各種區分·各地區的詳細分析,競爭情形,主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 宏觀經濟指標

第5章 摘要整理

第6章 簡介

第7章 競爭情形

第8章 企業簡介

- 章概要

- Alcor Solutions

- Adobe

- Accenture

- Aexonic Technologies

- Brillio

- Broadcom

- Cognizant

- Equinix

- Dell

- eMudhra

- Happiest Minds

- HCL Technologies

- Marlabs

- Microsoft

- Oracle

- Hewlett Packard Enterprise Development LP

- Interfacing

- IBM

- Kissflow

- SmartStream Technologies

- Scoro Software

- TIBCO Software

- Yash Technologies

第9章 數位轉型市場上Start-Ups生態系統

第10章 價值鏈分析

第11章 SWOT分析

第12章 全球數位轉型市場

第13章 各技術類型的市場機會

第14章 各提供種類的市場機會

第15章 各部署的市場機會

第16章 各用途的市場機會

第17章 各終端用戶的市場機會

第18章 不同企業規模的市場機會

第19章 不同商業模式的市場機會

第20章 北美數位變革的市場機會

第21章 歐洲的數位變革的市場機會

第22章 亞洲的數位變革的市場機會

第23章 中東·北非的數位變革的市場機會

第24章 南美的數位變革的市場機會

第25章 全球其他地區的數位變革的市場機會

第26章 表格形式資料

第27章 企業·團體一覽

第28章 客制化的機會

第29章 ROOTS訂閱服務

第30章 著者詳細內容

GLOBAL DIGITAL TRANSFORMATION MARKET: OVERVIEW

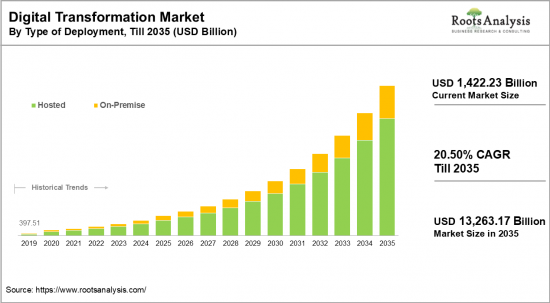

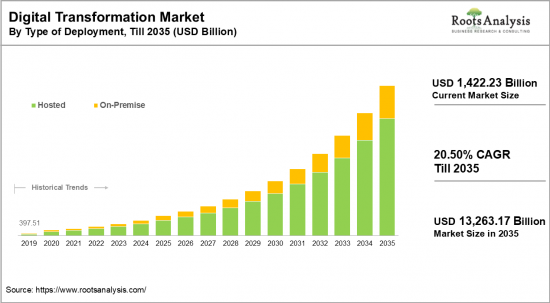

As per Roots Analysis, the global digital transformation market size is estimated to grow from USD 1,422.23 billion in the current year to USD 13,263.17 billion by 2035, at a CAGR of 22.50% during the forecast period, till 2035.

The opportunity for digital transformation market has been distributed across the following segments:

Type of Technology

- Cloud Computing

- Big Data and Analytics

- Cybersecurity

- Artificial Intelligence

- Internet of Things

- Business Intelligence

- Blockchain

Type of Offering

- Services

- Solutions

Type of Deployment

- Hosted

- On-Premise

Type of Application

- Accounting

- Finance Management

- IT Operations

- Supply Chain Management

- HR Services

Company Size

- Large Enterprises

- Small and Medium-sized Enterprises

Business Model

- B2B

- B2C

- B2B2C

End User

- Banking Financial Services and Insurance (BFSI), Manufacturing

- IT and Telecommunications

- Retail and Consumer Goods

- Healthcare

- Transportation

- Logistics

- Government

- Other

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

DIGITAL TRANSFORMATION MARKET: GROWTH AND TRENDS

Due to the rapid advancements in technology, digital tools and innovations have become integral to the business landscape, allowing for quicker decision-making and the elimination of geographical constraints. Digital transformation primarily involves the incorporation of digital solutions, such as cloud computing, big data analytics, artificial intelligence, and the internet of things (IoT) to enhance communication speed and improve customer experiences. With these digital transformation tools, businesses can gather data from diverse sources in real-time, aiding in more accurate business decision-making. For example, in the finance sector, these digital innovations provide remote access to systems, enabling employees to work outside traditional office settings. In the pharmaceutical sector, cutting-edge technological tools like machine learning, big data analytics, artificial intelligence, and digital twin technology are crucial for real-time data collection relevant to drug development.

Given the ongoing trend of adopting digital technologies across various industries, we anticipate that the digital transformation market will continue to expand steadily. To meet the rising demand for digital transformative solutions and technologies, industry stakeholders are undertaking strategic initiatives aimed at creating customer-focused offerings and self-service digital solution portals. Prominent companies such as Amazon, Google, and Microsoft are forging partnerships to strengthen their range of cloud solutions and predictive analytics tools.

In June 2024, Worksoft, a leading provider of intelligent test automation solutions, established a strategic alliance with KPMG, a professional cloud services firm, to set a benchmark for digital transformation in India by providing analytical tools and expertise. Through this partnership, Worksoft will supply automation technology to enhance business process testing, which will aid in navigating the complexities of modern business operations. Likewise, numerous industry leaders are intensifying their research and development efforts to deliver advanced technological solutions across different sectors, making this market appealing for future investment.

DIGITAL TRANSFORMATION MARKET: KEY SEGMENTS

Market Share by Type of Technology

Based on the type of technology, the global digital transformation market is segmented into cloud computing, big data and analytics, cybersecurity, artificial intelligence, Internet of Things, Business Intelligence and Blockchain. According to our estimates, currently, cloud computing segment captures the majority share of the market. This can be attributed to the extensive use of cloud services across various industries, providing business flexibility, scalability, and storage options. In addition, leading companies such as IBM, Microsoft, Amazon Web Services, and Google are consistently making significant advancements in cloud solutions that provide immersive experiences and enhance task management capabilities. However, artificial intelligence segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Offering

Based on the type of offering, the digital transformation market is segmented into solutions and services. According to our estimates, currently, solutions segment captures the majority share of the market. This can be attributed to the increasing demand for solutions like artificial intelligence, cybersecurity, Internet of Things, and cloud computing to enhance business efficiency. Additionally, digital solutions have become essential in digital transformation strategies, enabling automation and optimizing resources for peak efficiency in organizations. However, services segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Deployment

Based on the type of deployment, the digital transformation market is segmented into hosted, and on-premise. According to our estimates, currently, hosted (cloud) segment captures the majority share of the market. This can be attributed to the greater scalability, cost-effectiveness, and accessibility that hosted (cloud) solutions provide. Additionally, the on-premise segment maintains the second-largest market share as many industries depend on on-premise solutions for their business functions. On-premise solutions are easily customizable and user-friendly.

Market Share by Type of Application

Based on the type of application, the digital transformation market is segmented into accounting, finance management, IT operations, supply chain management and HR services. According to our estimates, currently, finance management services segment captures the majority share of the market. This can be attributed to the swift implementation of digital transformation solutions within financial services, facilitating real-time financial advice, robotic process automation, and digital banking solutions. These digital transformation solutions are dependent on cloud-based analytics and artificial intelligence to provide a seamless customer experience and efficient financial operations. As a result of the continued adoption in the financial sector, this segment is anticipated to sustain a higher compound annual growth rate (CAGR) throughout the forecast period. Further, it is worth noting that IT operations occupy the second-largest share of the market, driven by the growing utilization of cloud computing and AI-powered management and automation in IT operations and industrial settings.

Market Share by Company Size

Based on the company size, the digital transformation market is segmented into large and small and medium enterprises. According to our estimates, currently, large enterprises segment captures the majority share of the market. This can be attributed to their extensive resources and technological capabilities that support the creation of innovative digital transformation solutions. However, small and medium enterprises segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by End User

Based on the end user, the digital transformation market is segmented into banking, financial services and insurance (BFSI), manufacturing, IT and telecommunications, retail and consumer goods, healthcare, transportation and logistics, government, and other. According to our estimates, currently, BFSI segment captures the majority share of the market. This can be attributed to a heightened emphasis by financial institutions on automation to provide seamless technical assistance to customers. Additionally, the increasing demand for remote services has further driven the need for digital transformation solutions within the BFSI sector. However, healthcare segment is anticipated to grow at a higher CAGR during the forecast period

Market Share by Geographical Regions

Based on the geographical regions, the digital transformation market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the presence of established cloud computing technology developers in this area. These industry leaders are concentrating on creating advanced digital technology solutions, including machine learning, cloud computing, and automation tools for a variety of industrial sectors. Additionally, the increasing use of digital payment solutions in this region has further accelerated the demand for digital transformation solutions. However, digital transformation technology market in the Asia-Pacific region is expected to grow at a CAGR during the forecast period.

Example Players in Digital Transformation Market

- Alcor Solutions

- Adobe

- Accenture

- Aexonic Technologies

- Brillio

- Broadcom

- Cognizant

- Equinix

- Dell

- eMudhra

- Happiest Minds

- HCL Technologies

- Marlabs

- Microsoft

- Oracle

- Hewlett Packard Enterprise Development LP

- Interfacing

- IBM

- Kissflow

- SmartStream Technologies

- Scoro Software

- TIBCO Software

- Yash Technologies

DIGITAL TRANSFORMATION MARKET: RESEARCH COVERAGE

The report on the digital transformation market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the digital transformation market, focusing on key market segments, including [A] type of technology, [B] type of offering, [C] type of deployment, [D] type of application, [E] company size, [F] business model, [G] end user and [H] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the Digital transformation market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the Digital transformation market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] digital transformation portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in digital transformation market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Digital Transformation Market

- 6.2.1. Key Characteristics of Digital Transformation Market

- 6.2.2. Type of Technology

- 6.2.3. Type of Offering

- 6.2.4. Type of Deployment

- 6.2.5. Type of Application

- 6.2.6. Company Size

- 6.2.7. Type of Business Model

- 6.2.8. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Digital Transformation: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Alcor Solutions

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- Similar detail is presented for other below mentioned companies based on information in the public domain

- 8.3. Adobe

- 8.4. Accenture

- 8.5. Aexonic Technologies

- 8.6. Brillio

- 8.7. Broadcom

- 8.8. Cognizant

- 8.9. Equinix

- 8.10. Dell

- 8.11. eMudhra

- 8.12. Google

- 8.13. Happiest Minds

- 8.14. HCL Technologies

- 8.15. Marlabs

- 8.16. Microsoft

- 8.17. Oracle

- 8.18. Hewlett Packard Enterprise Development LP

- 8.19. Interfacing

- 8.20. IBM

- 8.21. Kissflow

- 8.22. SmartStream Technologies

- 8.23. Scoro Software

- 8.24. TIBCO Software

- 8.25. Yash Technologies

9. STARTUP ECOSYSTEM IN THE DIGITAL TRANSFORMATION MARKET

- 9.1. Digital Transformation Market: Market Landscape of Startups

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Company Size and Year of Establishment

- 9.1.4. Analysis by Location of Headquarters

- 9.1.5. Analysis by Company Size and Location of Headquarters

- 9.1.6. Analysis by Ownership Structure

- 9.2. Key Findings

10. VALUE CHAIN ANALYSIS

11. SWOT ANALYSIS

12. GLOBAL DIGITAL TRANSFORMATION MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Trends Disruption Impacting Market

- 12.4. Global Digital Transformation Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.5. Multivariate Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Digital Transformation Market for Cloud Computing Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Digital Transformation Market for Big Data and Analytics : Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Digital Transformation Market for Cybersecurity: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Digital Transformation Market for Artificial Intelligence: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Digital Transformation Market for Internet of Things: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Digital Transformation Market for Business Intelligence: Historical Trends (Since 2019) and Forecasted Estimated (Till 2035)

- 13.12. Digital Transformation Market for Blockchain Technology: Historical Trends (Since 2019) and Forecasted Estimated (Till 2035)

- 13.13. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF OFFERING

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Digital Transformation Market for Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Digital Transformation Market for Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Digital Transformation Market for Hosted: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Digital Transformation Market for On-Premise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Digital Transformation Market for Accounting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Digital Transformation Market for Finance Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Digital Transformation Market for IT Operations: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Digital Transformation Market for Supply Chain Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.10. Digital Transformation Market for HR Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.11. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Digital Transformation Market for Banking, Financial Services and Insurance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Digital Transformation Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Digital Transformation Market for IT and Telecommunications: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Digital Transformation Market for Retail and Consumer Goods: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Digital Transformation Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.11. Digital Transformation Market for Transportation and Logistics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.12. Digital Transformation Market for Government and Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.13. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Digital Transformation Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Digital Transformation Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Digital Transformation Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Digital Transformation Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Digital Transformation Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR DIGITAL TRANSFORMATION IN NORTH AMERICA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Digital Transformation Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Digital Transformation Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Digital Transformation Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Digital Transformation Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Digital Transformation Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR DIGITAL TRANSFORMATION IN EUROPE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Digital Transformation Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Digital Transformation Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Digital Transformation Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Digital Transformation Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Digital Transformation Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Digital Transformation Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Digital Transformation Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.7. Digital Transformation Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.8. Digital Transformation Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.9. Digital Transformation Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.10. Digital Transformation Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.11. Digital Transformation Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.12. Digital Transformation Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.13. Digital Transformation Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.14. Digital Transformation Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.15. Digital Transformation Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR DIGITAL TRANSFORMATION IN ASIA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Digital Transformation Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Digital Transformation Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Digital Transformation Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Digital Transformation Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Digital Transformation Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Digital Transformation Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Digital Transformation Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR DIGITAL TRANSFORMATION IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Digital Transformation Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Digital Transformation Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 23.6.2. Digital Transformation Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Digital Transformation Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Digital Transformation Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Digital Transformation Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Digital Transformation Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. Digital Transformation Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. Digital Transformation Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR DIGITAL TRANSFORMATION IN LATIN AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Digital Transformation Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Digital Transformation Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Digital Transformation Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Digital Transformation Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Digital Transformation Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Digital Transformation Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Digital Transformation Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR DIGITAL TRANSFROMATION IN REST OF THE WORLD

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Digital Transformation Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Digital Transformation Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Digital Transformation Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Digital Transformation Market in Other Countries

- 25.7. Data Triangulation and Validation