|

市場調查報告書

商品編碼

1337769

ADAS與自動駕駛Tier 1研究報告(2023)海外公司版ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies |

||||||

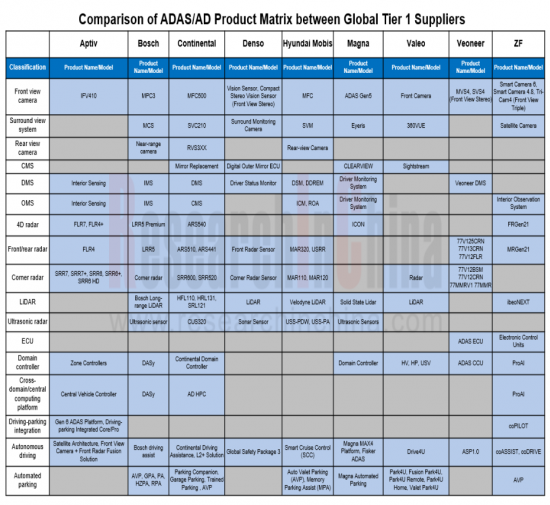

全球ADAS和自動駕駛一級供應商,擁有完整的ADAS/AD產品矩陣,持續發力搶占中國市場。

博世擁有除 CMS 之外的全系列 ADAS/AD 產品。 最新產品是在CES 2023上展出的1550nm長距離激光雷達,探測距離超過200m,功耗小於20W。 車載監控系統(IMS、OMS)預計將於2024年開始量產,OMS攝像頭安裝在中控台屏幕上方或集成到車內後視鏡中。

但在解決方案方面,目前全球一級供應商幾乎沒有部署在中國備受矚目的駕駛停車一體化解決方案。 大陸集團基於 Ambarella CV3 的 L2+ 解決方案就是一個例子,該解決方案於 2021 年 1 月發布,但要到 2026 年才能投入生產。

為了應對目前的被動地位,全球一級供應商也在尋求變革。 例如,博世的駕駛停車一體化解決方案Wave3,由其中國XC部門和德國總部同步開發,其中中國方案將採用雙Orin SoC,預計最早於2023年進入量產。是。 2023年6月,採埃孚宣布對乘用車底盤技術和主動安全技術進行事業部整合,以減少部門決策過程中的內耗,加快產品和解決方案的上市時間。 未來,主動安全可能會創建一個集成所有車輛操作的企業架構,包括駕駛艙和底盤。

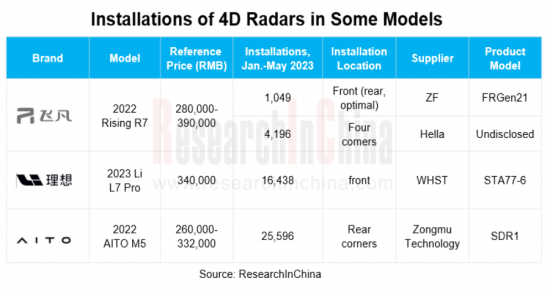

2023年1月至5月,中國新車共安裝4D雷達6.55萬個,其中前視、後視雷達3.57萬個,角雷達2.98萬個,甚至還有一個支架。 確認搭載4D雷達的車型包括瑞星汽車R7、利汽車L7 Pro、AITO M5。

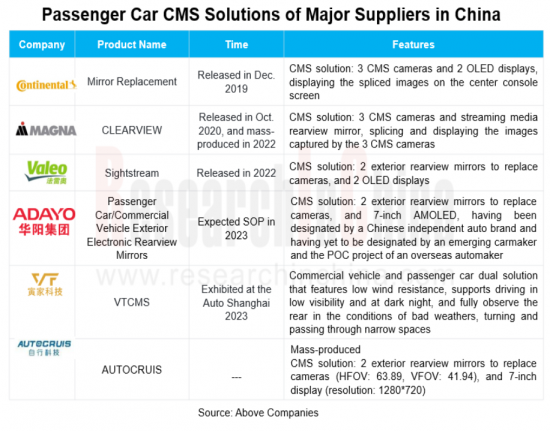

從技術角度來看,目前全球Tier 1供應商採用的主流CMS解決方案是2個CMS攝像頭+2個OLED顯示屏,即左右後視鏡2個後視鏡。它取代了CMS攝像頭(一般廣角相機)。 3個CMS攝像頭+2個OLED顯示屏+流媒體後視攝像頭/中控台屏幕的替代解決方案被相對較少的公司採用,因為它涉及圖像拼接/增強等額外技術。 典型案例為Magna CLEARVIEW,採用3 CMS攝像頭+流媒體、後視鏡、拼接顯示解決方案。 值得注意的是,麥格納還在2017年提出了2 CMS攝像頭+2 OLED顯示屏的方案,但麥格納實際量產的產品仍然是目前的3CMS方案。

隨著車輛架構的升級,車載電子的主控單元也從數百個ECU演變為少數幾個域控制器。 為滿足汽車計算需求,採用以下跨域計算平台(如座艙-停車集成域控制器、行車停車集成域控制器)。 未來將通過一個中央計算平台來完成所有計算任務,實現集中式E/E架構。

現階段,多家全球一級供應商已在2022年發布/宣布多域/中心計算平台解決方案。 這些是取代域控制器產品的下一代解決方案。

本報告審視了全球 ADAS 和自動駕駛一級市場,提供了市場概況,包括全球法規、產品和解決方案開發趨勢以及主要供應商概況。

目錄

第1章全球自動駕駛道路應用法規及發展規劃

- 有關道路自動駕駛應用的全球法規

- 歐盟和歐洲有關道路自動駕駛應用的法規

- 美國有關道路自動駕駛應用的法規

- 日本有關道路自動駕駛應用的法規

- 韓國有關道路自動駕駛應用的法規

第2章全球一級供應商產品及解決方案發展趨勢

- 新產品SOP:開始量產4D雷達

- 法規調整:中國允許在車輛上使用 CMS

- 產品升級:從域控制器到中央計算平台

- 解決方案升級:從自動駕駛停車到駕駛停車一體化

- 研發方向:產品矩陣完善與產品集成

第3章 海外主要自動駕駛一級供應商

- Aptiv

- Bosch

- Continental

- Denso

- Hyundai Mobis

- Magna

- Valeo

- Veoneer

- ZF

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous efforts to grab the Chinese market.

From the ADAS/AD product matrix, it can be seen that some Tier 1 leaders have almost complete product matrix.

For example, Continental's latest products include: cockpit monitoring system (CMS, OMS), configured with an OMS camera and a cockpit radar and expected to be released in 2024; HRL131, a 1550nm long-range LiDAR with a detection range of more than 300m, 128° HFOV, 28° VFOV, expected to be mass-produced in 2024; and CUS320, a ultrasonic radar with a detection range of 0.1m-6m, expected to be spawned in 2024.

Bosch has a full range of ADAS/AD products except CMS. Its latest products include: a 1550nm long-range LiDAR, physically displayed at the CES 2023, with a detection range of over 200m and power consumption of less than 20W; an in-cabin monitoring system (IMS, OMS), configured with an OMS camera installed above the center console screen or integrated with the interior rearview mirror, and expected to come into mass production in 2024.

Yet in terms of solutions, currently few global Tier 1 suppliers deploy driving-parking integrated solutions that are hot in China, mainly because it takes them a period of about 2 or 3 years to launch the solutions after they put forward. One example is Continental's Ambarella CV3-based L2+ solution which was announced in January 2021 but will not be production-ready until 2026.

To cope with the current passive position, global Tier 1 suppliers are also trying to seek changes. For example, Wave3, Bosch's driving-parking integrated solution, is being developed simultaneously by the XC Division in China and the headquarters in Germany, of which the Chinese solution adopts dual Orin SoCs and is scheduled to be mass-produced in 2023 at the earliest; in June 2023, ZF announced the merger of the divisions for passenger car chassis technology and active safety technology to reduce the internal friction between divisions when making decisions and shorten the time-to-market of products and solutions. In the future, ZF may build a corporate architecture where the active safety integrates all the vehicle businesses such as cockpit and chassis.

2. 4D radars begin to find mass adoption, and global Tier 1 suppliers grab first-mover advantages.

According to our data, from January to May 2023, the overall installations of 4D radars in new passenger cars in China were 65,500 units, of which 35,700 units were front view and rear view radars, and 29,800 units were corner radars. Models confirmed to pack 4D radars include Rising Auto R7, Li Auto L7 Pro and AITO M5.

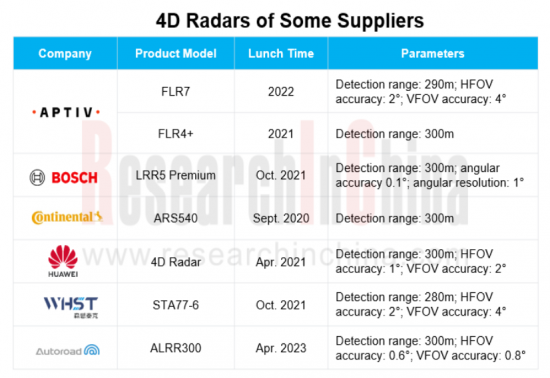

4D radars have passed through three development phases: infancy, growth and SOP.

- Infancy: before 2022, foreign Tier 1 suppliers were the first to start upgrading from conventional 3D radar to 4D radar, for example, Continental went about developing ARS540 early in 2016.

- Growth: during 2022-2024, Chinese suppliers set about deploying 4D radar products. For example, in 2022 Nova Electronics introduced 4D-S front radar and corner radar products, as well as a new 6-cascade product; Freetech released FVR40 in 2022.

- SOP: beyond 2024, it is expected that 4D radars will begin to be spawned and mounted on vehicles.

Currently, 4D radars are still in the verification phase, and whether the installations will rise depends on the following:

- (1) Verify the cost performance of 4D radars (replacing ordinary radars) used in low-level driving assistance solutions (L2-L2+). Examples include Aptiv's satellite architecture-based sensing and computing system that supports L2 and L2+ with 5R5V12U.

- (2) Verify the feasibility of 4D radars replacing LiDAR in high-level intelligent driving solutions (L2.5-L2.9, that is, supporting ADAS in highway NOA and city NOA).

3. China's adjusted regulation allows CMS to be installed in vehicles, and the competition in the new market is fierce.

On July 1, 2023, the GB 15084-2022 Motor Vehicles - Devices for Indirect Vision - Requirements of Performance and Installation came into effect, specifying that Class M/N motor vehicles are allowed to carry electronic rearview mirrors to replace conventional optical exterior rearview mirrors.

At present, a number of global Tier 1 suppliers, Chinese suppliers and automakers have already made layout of CMS products. Wherein, the global Tier 1 suppliers that have unveiled/mass-produced CMS products include Continental, Magna and Valeo; Chinese suppliers include Autocruis, Voyager Technology, Foryou Group and Huawei.

On the whole, global Tier 1 suppliers start CMS layout a little earlier than Chinese companies, due to early introduction of regulations.

From a technical point of view, the mainstream CMS solution currently adopted by global Tier 1 suppliers is 2 CMS cameras + 2 OLED displays, that is, replace the left and right rearview mirrors with 2 rearview CMS cameras (generally wide-angle cameras). Another solution of 3 CMS cameras + 2 OLED displays + streaming rearview camera/center console screen is adopted by relatively few companies, as it involves additional technologies such as image stitching/correction. A typical case is Magna CLEARVIEW that adopts the solution of 3 CMS cameras + streaming media rearview mirror tiled display. Noticeably, Magna also proposed a solution of 2 CMS cameras + 2 OLED displays in 2017, but the product Magna actually produces in quantities is still the current 3CMS solution.

4. As decision products upgrade, a number of Tier 1 suppliers have launched cross-domain/central computing platforms.

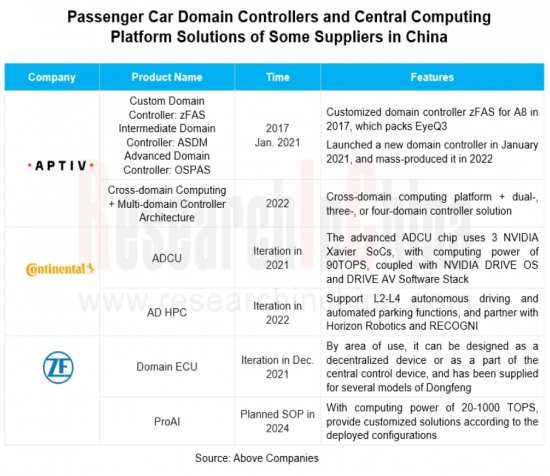

As automotive architecture upgrades, the main control units of vehicle internal electronics have also evolved from hundreds of ECUs to several domain controllers. Next cross-domain computing platforms (e.g., cockpit-parking integrated domain controller and driving-parking integrated domain controller) will be used to meet the computing needs of vehicles. In the future, central computing platforms will be used to complete all the computing tasks and enable centralized E/E architecture.

In current stage, several global Tier 1 suppliers have released/iterated multi-domain/central computing platform solutions in 2022. In terms of time node, they are the next-generation alternative to domain controller products.

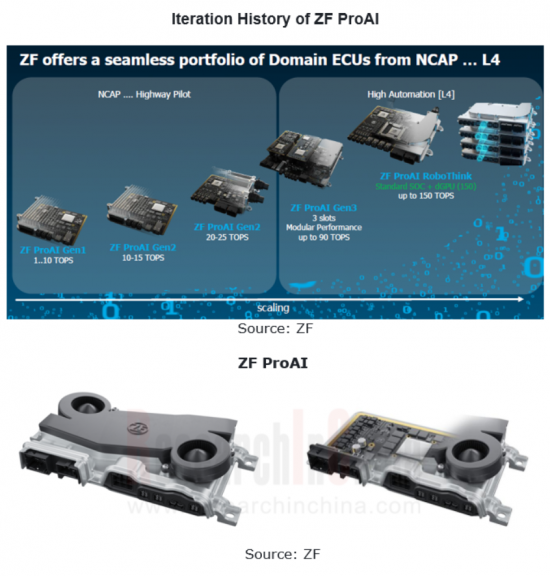

The early solutions include ZF ProAI, which has gone through several iterations, with the computing power increased from 1-10 TOPS to the current 20-1500 TOPS. The latest version of ProAI, scheduled to start volume production in 2024, enables cross-domain computing, packs ZF's domain control middleware, and is optimized for deep learning. Aptiv, on the other hand, puts forward three solutions based on a cross-domain computing platform: a cross-domain computing platform + dual domain controllers, a cross-domain computing platform + three domain controllers, and a cross-domain computing platform + four domain controllers.

Table of Contents

1 Global Regulations on Application of Autonomous Driving on Roads and Development Plans

- 1.1 Global Regulations on Application of Autonomous Driving on Roads

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Main Test Items

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - System Safety and Failsafe Response

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Human Machine Interface (HMI) / Operator information

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Object Event Detection and Data Storage

- 1.1.2 Summary on Autonomous Driving Development Plans of Some Countries/Regions

- 1.2 European Union & Europe's Regulations on Application of Autonomous Driving on Roads

- 1.2.1 Germany's Law on Autonomous Driving

- 1.2.2 EU & Europe's Autonomous Driving Development Plan

- 1.2.3 EU Autonomous Driving Roadmap and 2040 Outlook

- 1.3 United Sates' Regulations on Application of Autonomous Driving on Roads

- 1.3.1 US Autonomous Driving Development Plan

- 1.4 Japan's Regulations on Application of Autonomous Driving on Roads

- 1.4.1 Japan's Action Plan for Realizing and Popularizing Autonomous Driving 4.0

- 1.4.2 Japan's Autonomous Driving Development Plan

- 1.4.3 Japan's "RoAD to the L4 Project" - 4 Major Themes

- 1.5 South Korea's Regulations on Application of Autonomous Driving on Roads

- 1.5.1 South Korea's Autonomous Driving Development Plan

2 Development Trends of Products and Solutions of Global Tier 1 Suppliers

- 2.1 SOP of New Products: the Volume Production of 4D Radars Starts

- 2.2 Regulation Adjustment: China Allows for Use of CMS in Vehicles

- 2.3 Product Upgrade: from Domain Controller to Central Computing Platform

- 2.4 Solution Upgrade: from Automated Driving/Parking to Driving-parking Integration

- 2.5 R&D Direction: Product Matrix Improvement + Product Iteration

3 Key Foreign Autonomous Driving Tier 1 Suppliers

- 3.1 Aptiv

- 3.1.1 Profile

- 3.1.2 Revenue

- 3.1.3 Competitors/Main Customers

- 3.1.4 Product Classification

- 3.1.5 Perception Products - Front View Camera

- 3.1.6 Perception Products - 4D Front Radar

- 3.1.7 Perception Products - Corner Radar

- 3.1.8 Decision Products - Domain Controller/Central Computing Platform

- 3.1.9 Solutions - Driving-parking Integration

- 3.1.10 Solutions - Autonomous Driving

- 3.1.11 Autonomous Driving Layout

- 3.1.12 Product/Market Planning

- 3.1.13 Summary

- 3.2 Bosch

- 3.2.1 Profile

- 3.2.2 Revenue

- 3.2.3 Product Classification

- 3.2.4 Perception Products - Front View Camera

- 3.2.5 Perception Products - Surround View System

- 3.2.6 Perception Products - 4D Front Radar

- 3.2.7 Perception Products - Front Radar

- 3.2.8 Perception Products - Corner Radar

- 3.2.9 Perception Products - LiDAR

- 3.2.10 Perception Products - DMS/OMS

- 3.2.11 Perception Products - Ultrasonic Radar

- 3.2.12 Decision Products - Domain Controller

- 3.2.13 Middleware

- 3.2.14 Solutions - Autonomous Driving

- 3.2.15 Solutions - Automated Parking

- 3.2.16 Recent Development Layout/Planning

- 3.2.17 Autonomous Driving Partners

- 3.2.18 Summary

- 3.3 Continental

- 3.3.1 Profile

- 3.3.2 Revenue

- 3.3.3 Product Classification

- 3.3.4 Perception Products - Front View Camera

- 3.3.5 Perception Products - Rear View Camera

- 3.3.6 Perception Products - Surround View System

- 3.3.7 Perception Products - CMS

- 3.3.8 Perception Products - DMS

- 3.3.9 Perception Products- OMS

- 3.3.10 Perception Products - Front Radar

- 3.3.11 Perception Products - Corner Radar

- 3.3.12 Perception Products - LiDAR

- 3.3.13 Perception Products - Ultrasonic Radar

- 3.3.14 Decision Products - Domain Controller

- 3.3.15 Decision Products - Central Computing Platform

- 3.3.16 Solutions - Autonomous Driving

- 3.3.17 Solutions - Automated Parking

- 3.3.18 Solutions - Road Data Solution

- 3.3.19 Engineering Solutions

- 3.3.20 Robotaxi

- 3.3.21 Autonomous Driving Roadmap

- 3.3.22 Continental China's Autonomous Driving Planning

- 3.3.23 Autonomous Driving Technologies

- 3.3.24 Summary

- 3.4 Denso

- 3.4.1 Profile

- 3.4.2 Revenue

- 3.4.3 Product Classification

- 3.4.4 Perception Products - Front View Camera

- 3.4.5 Perception Products - Surround View System

- 3.4.6 Perception Products - Front Radar

- 3.4.7 Perception Products - LiDAR

- 3.4.8 Perception Products - Ultrasonic Radar

- 3.4.9 Solutions - ADAS

- 3.4.10 Solutions - Autonomous Driving

- 3.4.11 Autonomous Driving Development Roadmap

- 3.4.12 Autonomous Driving Capabilities and R&D Layout

- 3.4.13 Summary

- 3.5 Hyundai Mobis

- 3.5.1 Profile

- 3.5.2 Revenue

- 3.5.3 Perception Products - Front View Camera

- 3.5.4 Perception Products - Surround View System

- 3.5.5 Perception Products - DMS

- 3.5.6 Perception Products - Radar

- 3.5.7 Perception Products - LiDAR & Ultrasonic Radar

- 3.5.8 Solutions - Automated Parking

- 3.5.9 Solutions - Autonomous Driving

- 3.5.10 Autonomous Concept Car

- 3.5.11 Autonomous Driving Development Planning

- 3.5.12 Summary

- 3.6 Magna

- 3.6.1 Profile

- 3.6.2 Revenue

- 3.6.3 Product Classification

- 3.6.4 Perception Products - Front View Camera

- 3.6.5 Perception Products - Surround View System

- 3.6.6 Perception Products - CMS

- 3.6.7 Perception Products - DMS/OMS

- 3.6.8 Perception Products - 4D Front/Corner Radar

- 3.6.9 Perception Products - LiDAR & Ultrasonic Radar

- 3.6.10 Decision Products - Domain Controller

- 3.6.11 Solutions - Autonomous Driving

- 3.6.12 Solutions - Automated Parking

- 3.6.13 Autonomous Driving & Intelligent Connectivity Planning

- 3.6.14 Summary

- 3.7 Valeo

- 3.7.1 Profile

- 3.7.2 Revenue

- 3.7.3 Autonomous Driving Product Layout

- 3.7.4 Automotive Product Layout

- 3.7.5 Distribution of R&D Bases in China

- 3.7.6 Autonomous Driving Products - Front View Camera

- 3.7.7 Autonomous Driving Products - Surround View System

- 3.7.8 Autonomous Driving Products - CMS

- 3.7.9 Autonomous Driving Products - Radar

- 3.7.10 Autonomous Driving Products - LiDAR

- 3.7.11 Autonomous Driving Products - Domain Controller

- 3.7.12 Autonomous Driving Products - Ultrasonic Radar

- 3.7.13 Solutions - Automated Parking

- 3.7.14 Solutions - Autonomous Driving

- 3.7.15 Autonomous Delivery Vehicles

- 3.7.16 Intent Prediction Technology

- 3.7.17 360-degree Autonomous Emergency Braking System

- 3.7.18 Autonomous Driving Product Partners

- 3.7.19 Summary

- 3.8 Veoneer

- 3.8.1 Profile

- 3.8.2 Revenue

- 3.8.3 Corporate Development Roadmap

- 3.8.4 Autonomous Driving Product Layout

- 3.8.5 Summary on Autonomous Driving Products

- 3.8.6 Perception Products - Camera

- 3.8.7 Perception Products - DMS

- 3.8.8 Perception Products - Radar

- 3.8.9 Perception Products - LiDAR

- 3.8.10 Decision Products - Domain Controller

- 3.8.11 Autonomous Driving Products - Positioning System

- 3.8.12 Autonomous Driving Products - V2X

- 3.8.13 Solutions - Autonomous Driving

- 3.8.14 Development History and Planning of Autonomous Driving Solutions

- 3.8.15 Main Partners

- 3.8.16 ADAS Technology Releases, 2021

- 3.8.17 Application of ADAS Products in Vehicles, 2021

- 3.8.18 Distribution of ADAS Product Customers, 2021

- 3.8.19 Summary

- 3.9 ZF

- 3.9.1 Profile

- 3.9.2 Recent Changes in Business Division Structure

- 3.9.3 Revenue

- 3.9.4 Product Classification

- 3.9.5 Perception Products - Front View Camera

- 3.9.6 Perception Products - Surround View System

- 3.9.7 Perception Products - OMS

- 3.9.8 Perception Products - 4D Front Radar

- 3.9.9 Perception Products - Front Radar

- 3.9.10 Perception Products - LiDAR & Sound Sensor

- 3.9.11 Decision Products - Vehicle Computing Platform

- 3.9.12 Decision Products - Domain Controller & Middleware

- 3.9.13 Solutions - Autonomous Driving & Driving-parking Integration

- 3.9.14 Solutions - Automated Parking

- 3.9.15 Development Trends & Layout

- 3.9.16 Summary