|

市場調查報告書

商品編碼

1172495

職業中性增長在行業整合中放緩2022:年市場收入接近1000億美元,對運營商行業的健康至關重要,但易受經濟壓力影響,私募股權公司崛起Carrier-neutral Growth Slows in 2022 Amid Consolidation: Market Approaches $100B in Annual Revenues, Still Central to Operator Industry Health, But Not Immune to Economic Pressures, Private Equity Players Ramp Up |

||||||

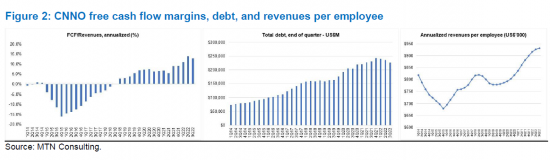

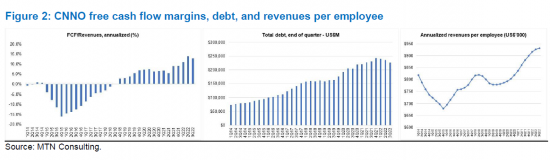

CNNO 收入在 2022 年第三季度達到約 239 億美元(同比增長 3%),年化收入為 948 億美元(同比增長 6%)。 這遠低於 2021 年的年增長率 (12.5%) 和 2011-2021 年的平均年增長率 (16.6%)。 2021 年出現了一系列併購 (M&A) 和資本支出,但它們尚未對收入增長做出太大貢獻。 因素包括銷售週期的延長、重新談判租賃協議的壓力、隨著市場成熟而加劇的價格競爭以及美元走強。 與此同時,CNNO 板塊的盈利能力也越來越強。 在 2011-21 年的大部分時間裡,平均自由現金流量利潤率一直為負,但在過去三個季度中一直處於 11% 至 14% 的範圍內。 隨著利率上升,CNNO 不願承擔更多債務,而是專注於提高利潤率。 CNNO建設網絡是為了提高網絡經濟性,保持更多的網絡流量,端到端地服務關鍵客戶,跨基礎設施類型進行交叉銷售。我認為它會繼續下去。

本報告審視了截至 2022 年第三季度 (2022 年第三季度) 全球運營商中立網絡運營商 (CNNNO) 市場的最新發展。

文本中的圖形

報告中提及的公司

|

|

內容

- 概覽

- 分析運營商中立市場的獨特挑戰

- 市場總收入和增長率

- 主要公司概覽

- 資本投資:未來兩年有可能超過併購 (M&A) 和技術組件的擴展

- 綜合業務模式:PE 行業推動的擴張趨勢

- 附錄

This short note provides a brief review of the development of the carrier-neutral network operator (CNNO) market through the third quarter of 2022 (3Q22).

VISUALS

CNNO revenues were approximately $23.9 billion (B) in 3Q22, up 3% YoY, and $94.8B for the annualized 3Q22 period (4Q21-3Q22), up 6% YoY. These growth rates are significantly less than the 12.5% growth seen in CY2021 and the average growth over the 2011-21 period of 16.6% per year. That's despite the acquisition spree the sector observed in 2021, when M&A spend of $42.1B easily outpaced capex of $31.4B. This M&A and capex spending have expanded the asset base of the sector, but not helped much with revenue growth, yet. Companies point to longer sales cycles, pressure to renegotiate leases, increased price competition as the market matures, and appreciation of the US dollar among the factors keeping a check on revenue growth. However, there are signs that the CNNO sector is becoming more profitable: average free cash flow margin has been in the 11-14% range for the last three quarters, while it was negative for most of the 2011-21 period. Debt remains high, totaling $225B in 3Q22, only slightly down from 3Q21; with higher interest rates, CNNOs are reluctant to take on more debt, instead focusing on margin growth. CNNOs will continue to build out their networks to improve network economics, keep more traffic on-net, provide key customers more of an end-to-end service, and cross sell across infrastructure types.

Private equity firms continue to invest heavily in the sector, and many have "digital infrastructure" funds aiming to combine assets across the three main infrastructure classes: towers, data centers, and fiber. As we argued in a July 2021 report, we continue to expect that "A new breed of integrated owners of infrastructure network assets will emerge over the next 2-3 years, converging towers, data centers, and fiber networks." PE firms' capital inflows are pushing this integration. A large group of well-funded PE firms are pursuing digital infrastructure opportunities. Some are explicitly aiming to assemble portfolios of integrated assets, and/or cobble them together into larger CNNOs able to address multi-sector opportunities from a position of massive scale. Ultimately most PEs do aim for liquidity events from these past investments, though some are content with the relatively steady cash flows spun off by CNNOs.

We will be formally updating our operator forecast soon. This update will include revised projections for the market, incorporating actual market data as reported through 3Q22.

Companies Mentioned:

|

|

Table of Contents

- Summary

- Measurement a unique challenge in carrier-neutral market

- Top line market growth

- Overview of key companies

- Capex likely to exceed M&A in next 2 years, and tech component will rise

- Integrated business models also to pick up, with boost from PE sector

- Appendix

List of Figures and Tables

- Figure 1: CNNO revenues, capex and M&A spending, annualized, 1Q14-3Q22

- Figure 2: CNNO free cash flow margins, debt, and revenues per employee

- Table 1: Overview of key CNNOs - recent financial metrics and M&A activity