|

市場調查報告書

商品編碼

1934782

美國醫學流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)United States Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

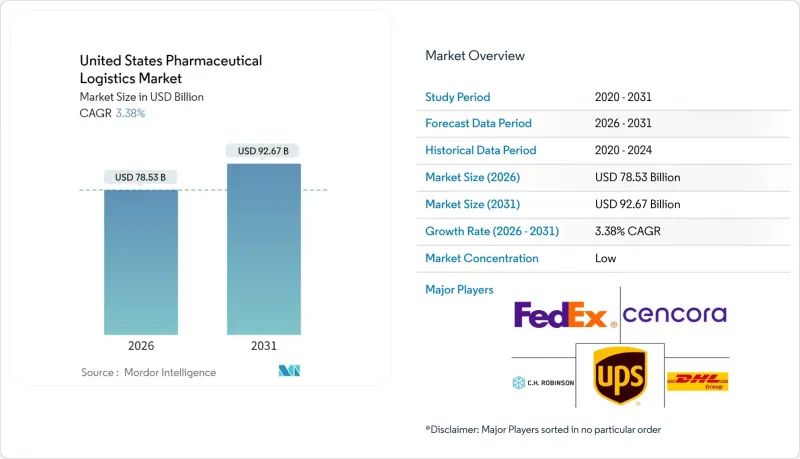

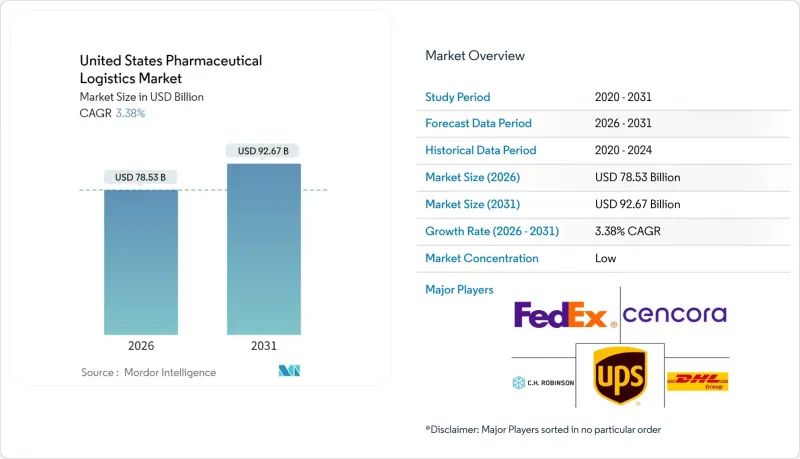

2025年美國醫藥物流市場價值為759.6億美元,預計到2031年將達到926.7億美元,高於2026年的785.3億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.38%。

美國藥品物流市場規模預測報告重點指出,合規期限和生物製藥需求正在重塑成本結構和服務設計。將於2025年8月到期的《藥品供應鏈安全法案》(DSCSA)更為嚴格的實施期限,迫使資金雄厚的運營商進行序列化投資,而這些投資只有在具備相應條件的情況下才可行,從而賦予他們收取溢價的自由裁量權。基於GLP-1的體重管理療法的快速成長、細胞和基因療法的穩步發展以及直接面向患者(DTP)服務的擴張,進一步擴大了美國藥品物流市場,要求運營商迅速提升其溫控能力。同時,製造商正在開發現有藥物的常溫穩定版本,以降低不斷上漲的運輸成本。這減緩了非冷藏配送的相對成長,但為附加價值服務(VAS)供應商創造了新的包裝和標籤業務。區域網路正在重組,中西部地區作為全國樞紐的佔有率不斷擴大,而南部地區的運力擴張則緩解了沿海走廊的擁擠狀況。

美國醫學流市場趨勢與洞察

需要嚴格溫度控制的特殊生技藥品的擴張

溫控運輸成本是常溫運輸的三到五倍,在已開發市場分銷的治療藥物中,目前有80%需要在2-8°C的溫度下儲存,這進一步增加了低溫運輸的複雜性。 UPS採取了先發制人的行動,於2025年4月以16億美元收購了Andlauer Healthcare Group,新增了170萬平方英尺符合GDP認證的倉庫空間,並擴展了其-80°C的冷凍庫網路。生物製藥需要更短的訂單到交貨週期,因此對高頻補貨路線的需求高於大宗貨物運輸。小型承運商難以資金籌措持續監控系統的資金,這些系統需接受FDA的偏差記錄審核,加速了產業的整合。次市場低溫運輸設施的激增為營運商提供了地域上的柔軟性,但也需要在額外的交接點進行庫存調整,這進一步凸顯了基於人工智慧的路線可視性的重要性。

DSCSA序列化截止日期推動了追蹤和溯源投資。

美國食品藥物管理局 (FDA) 強制要求處方藥在 2025 年 8 月前實現全程單元級可追溯性,這使得美國藥品物流市場分為兩類:一類是具備序列化能力的供應商,另一類是權限有限的供應商。 TraceLink 的 B2N 網路在 90 天內處理了 600 萬個 EPCIS 事件,但資料錯誤率高達 30%,這可能導致每日產品隔離,凸顯了實施的複雜性。預計每件可售產品的初始系統成本為 0.06 美元,這促使第三方物流專家採用共享解決方案。將 DSCSA 合規性納入附加價值服務(VAS) 包的供應商不僅可以獲得固定費用,還能加深買家對數位生態系統的依賴,從而實現召回管理、缺貨預防和契約製造監管。

燃油價格波動推高了配送成本。

由於2024年至2025年間WTI原油現貨價格波動幅度高達23%,藥品托運商面臨燃油額外費用計算公式不穩定、落後於成本飆升數週的困境。溫控卡車由於冷凍裝置的運作,柴油消耗量增加了12%,加劇了風險。液化天然氣和電動牽引車的試驗前景可觀,但續航里程的限制和充電網路的不足制約了它們在東西向跨大西洋航線上的應用。路線最佳化軟體和多站點運輸模式可以減少空駛里程,但產品完整性規則仍然限制了貨物的整合。

細分市場分析

儘管運輸仍然是收入的基礎,但美國醫藥物流市場正明顯地向一體化解決方案轉型。 2025年,運輸收入佔比為70.45%,但預計從2026年到2031年,附加價值服務將以4.75%的複合年成長率超越運輸收入,這主要得益於客戶對序列化、重新貼標和套件組裝等服務以及貨運需求的增加。公路貨運的佔有率依然強勁,這主要得益於最後一公里配送和向鄉村診所的配送,而感測器和雙隔間拖車的應用也有助於加強合規性。儘管空運成本較高,但它在細胞療法和其他特殊用途貨物的運輸方面仍然佔據著獨特的地位,因為這些貨物的運輸不容延誤。隨著托運人擴大使用溫控冷藏集裝箱來運輸從亞洲到美國的穩定藥物原料藥,海運業務正在擴張,這不僅符合ESG目標,還能在空運運力短缺時提供運力。

由於缺乏符合GDP標準的轉運點,鐵路運輸仍受到限制。由於《藥品分銷安全法》(DSCSA)提高了可追溯性要求,倉儲需求緊張。倉庫正在轉型為數位化序列化中心,以便在出貨前檢驗2D資料矩陣碼,而自動化計劃(視覺系統掃描器和自動托盤運輸車)正在減少合規性檢查的延誤。成長最快的是附加價值服務(VAS)領域,其中包括托盤重新配置、緊急客製化以及進出口差異的記錄。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大需要嚴格溫度控制的特殊生技藥品。

- DSCSA序列化截止日期推動可追溯性投資

- GLP-1類肥胖症和糖尿病藥物分銷的快速成長給低溫運輸能力帶來了壓力。

- 轉變運輸方式,注重永續性:從空運轉向海運

- 直接面向患者的交付模式的成長

- 利用人工智慧驅動的「控制塔」進行路線最佳化和預測性損耗分析,以縮短前置作業時間

- 市場限制

- 燃油價格波動推高了分銷成本。

- 學名藥價格下跌給物流利潤帶來壓力。

- 低溫技術人員和駕駛人短缺

- 針對物聯網冷鏈基礎設施的網路攻擊

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 運輸

- 公路貨運

- 空運

- 海上運輸

- 鐵路貨運

- 倉儲和存儲

- 附加價值服務及更多

- 運輸

- 按操作模式

- 低溫運輸物流

- 非低溫運輸物流

- 依產品類型

- 處方藥

- 非處方藥

- 生物製藥和生物相似藥

- 疫苗和血液製品

- 臨床試驗材料

- 細胞和基因治療

- 醫療設備和診斷試劑

- 動物醫藥

- 其他

- 按地區(美國)

- 東北

- 中西部

- 南部

- 西

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- DHL Supply Chain & Global Forwarding

- FedEx

- UPS

- Cencora

- CH Robinson

- XPO Logistics

- Ryder System

- Penske Logistics

- Expeditors International

- SEKO Logistics

- LifeScience Logistics

- MD Logistics

- DSV

- Kuehne+Nagel

- Hub Group

- Nippon Express

- CEVA Logistics

- GXO Logistics

- KRC Logistics

- Langham Logistics

- Crown LSP Group

第7章 市場機會與未來展望

The United States Pharmaceutical Logistics Market was valued at USD 75.96 billion in 2025 and estimated to grow from USD 78.53 billion in 2026 to reach USD 92.67 billion by 2031, at a CAGR of 3.38% during the forecast period (2026-2031).

The United States pharmaceutical logistics market size projection underscores how compliance deadlines and biologics demand are reshaping cost structures and service design. A tightening Drug Supply Chain Security Act (DSCSA) timetable, expiring in August 2025, forces serialization investments that only well-capitalized providers can execute, granting them premium pricing latitude. Surging GLP-1 weight-management therapies, the steady rise of cell and gene treatments, and direct-to-patient (DTP) fulfillment further enlarge the United States pharmaceutical logistics market, pressing operators to expand temperature-controlled capacity at speed. Manufacturers are simultaneously formulating ambient-stable versions of existing drugs to curb rising freight costs, tempering the relative growth of non-cold-chain flows yet creating new packaging and labeling work for value-added service (VAS) providers. Regional network redesign is underway, with the Midwest gaining share as a national hub while capacity additions in the South ease congestion on coastal corridors.

United States Pharmaceutical Logistics Market Trends and Insights

Expansion of Specialty Biologics Requiring Strict Temperature Control

Temperature-controlled transport costs three to five times more than ambient freight, and 80% of therapies shipped in developed markets now need 2°-8 °C custody, elevating cold-chain complexity. UPS moved early by paying USD 1.6 billion for Andlauer Healthcare Group in April 2025, adding 1.7 million ft2 of GDP-certified storage and extending its -80 °C freezer network. Biologics also shorten order-to-delivery cycles, driving demand for high-frequency replenishment lanes rather than bulk shipments. Smaller carriers struggle to finance the continuous monitoring systems the FDA now audits for excursion logs, accelerating consolidation. As cold-chain nodes multiply in secondary markets, operators gain geographic flexibility but must coordinate inventory at added hand-off points, intensifying the need for AI-driven route visibility.

DSCSA Serialization Deadline Boosting Trace-and-Trace Investments

The FDA requires full unit-level traceability on prescription medicines by August 2025, splitting the United States pharmaceutical logistics market between serialization-ready providers and those facing restricted access. Implementation complexity is evident in TraceLink's B2N network, which processed 6 million EPCIS events in 90 days yet logged a 30% data-error rate that could trigger daily product quarantines. Up-front system costs, estimated at USD 0.06 per saleable unit, invite pooling solutions run by third-party logistics specialists. Providers that embed DSCSA compliance into VAS packages not only lock in retainer fees but also deepen buyer dependence on their digital ecosystems for recall management, shortage mitigation, and contract manufacturing oversight.

Fuel-Price Volatility Inflating Distribution Costs

WTI spot prices swung 23% in 2024-2025, leaving pharma carriers with unmatched fuel-surcharge formulas that lag cost spikes by weeks. Temperature-controlled trucks burn 12% more diesel to power reefers, amplifying exposure. While LNG and electric tractor pilots show promise, range limits and sparse charging networks curtail adoption on coast-to-coast lanes. Route-optimization software and multi-stop milk-run models reduce empty miles, but product-integrity rules still cap load consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Surge in GLP-1 Obesity/Diabetes Drug Volumes Stressing Cold-Chain Capacity

- Growth of Direct-to-Patient Distribution Models

- Generic-Drug Price Erosion Squeezing Logistics Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation still anchors revenue, yet the United States pharmaceutical logistics market shows a clear migration toward bundled solutions. In 2025, transportation delivered 70.45% of turnover, but value-added services are expected to outpace at a 4.75% CAGR (2026-2031) as clients seek serialization, relabeling, and kitting alongside freight. Road freight's share remains resilient due to final-mile and rural clinic deliveries, with sensors and dual-compartment trailers adding compliance. Air freight, while costly, preserves its niche for cell therapy and compassionate-use shipments that tolerate no delay. Ocean carriage gains as shippers divert stable formulation APIs to controlled-atmosphere reefers on Asia-to-US lanes, aligning with ESG goals and securing uplift during air-capacity crunches.

Rail remains marginal, hindered by limited GDP-certified hand-off nodes. Warehouse & storage demand tightens as DSCSA elevates traceability, turning depots into digital serialization hubs where 2D data-matrix codes are verified before release. This pushes automation projects-vision-system scanners and autonomous pallet movers-to squeeze latency out of compliance checks. The fastest growth occurs in VAS, including pallet reconfiguration, late-stage customization, and documentation for import-export variance.

The United States Pharmaceutical Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Storage, and Value-Added Services & Others), Mode of Operation (Cold-Chain Logistics and Non-Cold-Chain Logistics), Product Type (Prescription Drugs, Biologics & Biosimilars, Veterinary Medicine, and More), Region (Northeast, Midwest, South, and West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Supply Chain & Global Forwarding

- FedEx

- UPS

- Cencora

- C.H. Robinson

- XPO Logistics

- Ryder System

- Penske Logistics

- Expeditors International

- SEKO Logistics

- LifeScience Logistics

- MD Logistics

- DSV

- Kuehne + Nagel

- Hub Group

- Nippon Express

- CEVA Logistics

- GXO Logistics

- KRC Logistics

- Langham Logistics

- Crown LSP Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of specialty biologics requiring strict temperature control

- 4.2.2 DSCSA serialization deadline boosting trace-and-trace investments

- 4.2.3 Surge in GLP-1 obesity/diabetes drug volumes stressing cold-chain capacity

- 4.2.4 Sustainability-driven modal shift from air to sea freight

- 4.2.5 Growth of direct-to-patient distribution models

- 4.2.6 AI-enabled "control-tower" routing and predictive spoilage analytics reducing lead times

- 4.3 Market Restraints

- 4.3.1 Fuel-price volatility inflating distribution costs

- 4.3.2 Generic-drug price erosion squeezing logistics margins

- 4.3.3 Shortage of ultra-low-temperature technicians & drivers

- 4.3.4 Cyber-attacks on IoT cold-chain infrastructure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road Freight

- 5.1.1.2 Air Freight

- 5.1.1.3 Sea Freight

- 5.1.1.4 Rail Freight

- 5.1.2 Warehousing & Storage

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Mode of Operation

- 5.2.1 Cold-Chain Logistics

- 5.2.2 Non-Cold-Chain Logistics

- 5.3 By Product Type

- 5.3.1 Prescription Drugs

- 5.3.2 OTC Drugs

- 5.3.3 Biologics & Biosimilars

- 5.3.4 Vaccines & Blood Products

- 5.3.5 Clinical Trail Materials

- 5.3.6 Cell & Gene Therapies

- 5.3.7 Medical Devices & Diagnostics

- 5.3.8 Veterinary Medicine

- 5.3.9 Others

- 5.4 By Region (United States)

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 South

- 5.4.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 DHL Supply Chain & Global Forwarding

- 6.4.2 FedEx

- 6.4.3 UPS

- 6.4.4 Cencora

- 6.4.5 C.H. Robinson

- 6.4.6 XPO Logistics

- 6.4.7 Ryder System

- 6.4.8 Penske Logistics

- 6.4.9 Expeditors International

- 6.4.10 SEKO Logistics

- 6.4.11 LifeScience Logistics

- 6.4.12 MD Logistics

- 6.4.13 DSV

- 6.4.14 Kuehne + Nagel

- 6.4.15 Hub Group

- 6.4.16 Nippon Express

- 6.4.17 CEVA Logistics

- 6.4.18 GXO Logistics

- 6.4.19 KRC Logistics

- 6.4.20 Langham Logistics

- 6.4.21 Crown LSP Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment