|

市場調查報告書

商品編碼

1934772

東南亞瓦楞紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)South East Asia Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

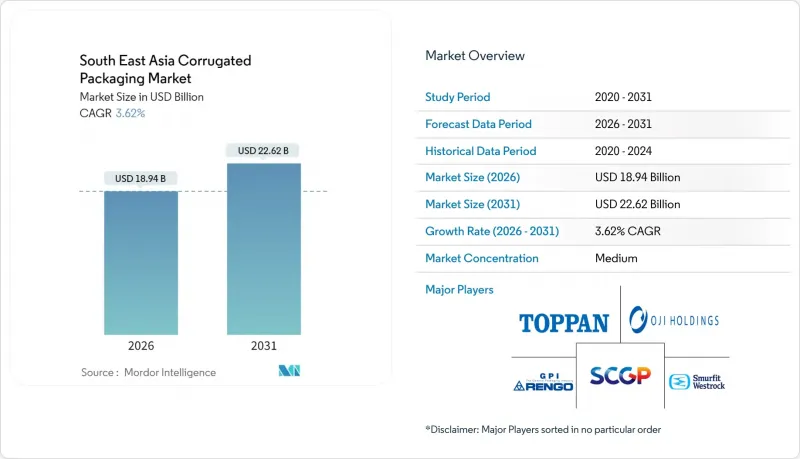

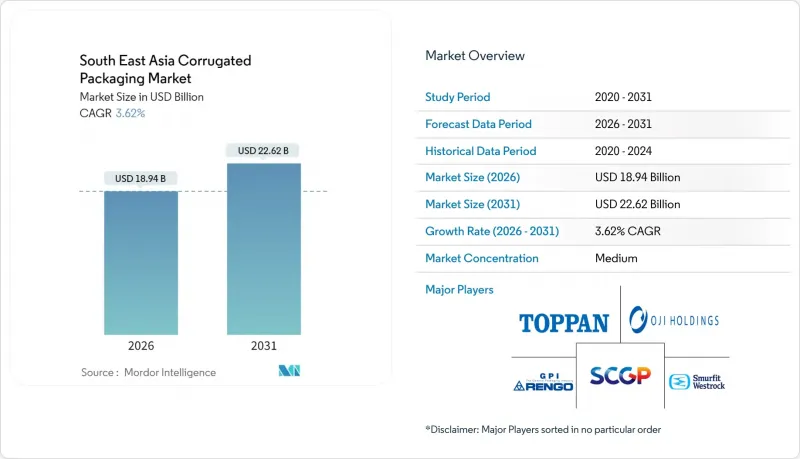

預計東南亞瓦楞紙包裝市場將從 2025 年的 182.8 億美元成長到 2026 年的 189.4 億美元,到 2031 年將達到 226.2 億美元,2026 年至 2031 年的複合年成長率為 3.62%。

電子商務平台小包裹量的激增、食品配送生態系統的崛起以及對一次性塑膠的監管壓力,持續推動採購預算轉向纖維基材料。印尼一體化的供應鏈、越南以出口為導向的製造業基地以及泰國的食品加工叢集,正在推動這一區域性趨勢;同時,對高速數字柔印生產線的投資,正在縮短曾經困擾該地區加工商的前置作業時間。儘管牛皮紙和再生OCC供應帶來的材料成本波動仍然是利潤的主要阻力,但人工林來源的高速紡絲纖維以及人工智慧驅動的設計軟體,透過降低投入成本和提高產量效率,正在部分抵消這種壓力。隨著加工商尋求與食品配送平台和第三方物流運營商簽訂長期契約,競爭的焦點已從價格戰轉向技術應用。

東南亞瓦楞紙包裝市場趨勢與洞察

為因應B2C電子商務小包裹量的爆炸性成長,對尺寸合適的運輸包裝箱的需求日益成長。

電子商務物流的轉型正透過體積重量最佳化和包裝標準化要求,推動瓦楞紙包裝的需求。印尼郵政(PT Pos Indonesia)在2024年處理了超過28億小包裹,較去年同期成長15%。瓦楞紙包裝約佔小包裹總量的65%。印尼國家郵政已在雅加達、泗水和棉蘭建立了自動化分類中心,並制定了有利於瓦楞紙包裝的標準化包裝規範。 Shopee和Lazada等平台的跨境電商帶來了多樣化的包裝需求,而第三方物流(3PL)營運商正在對紙箱尺寸進行標準化,以最佳化倉儲空間和降低配送成本。農村配送網、熱帶氣候和長途運輸等區域基礎設施挑戰,使得高強度瓦楞紙和防潮處理成為更佳選擇,以確保其在整個物流週期中保持結構完整性。

2024年,Shopee印尼公司實施了一項包裝標準化計劃,將履約平台可以透過營運最佳化而非單純的銷售成長來推動對瓦楞紙箱的需求。

食品配送市場的快速成長推動了對防漏紙板餐盒的需求。

預計2024年,越南外送市場規模將達18億美元,年增率達26%。這顯示該地區對專業食品包裝解決方案的需求正在加速成長,其中瓦楞紙餐盒約佔包裝總以重量為準的40%。 Grab Holdings報告稱,2024年東南亞地區的食品配送訂單量將達到24億份,其中越南和印尼佔總量的67%,這為標準化瓦楞紙餐盒帶來了巨大的需求。各大平台從深度折扣模式轉向永續成長模式,顯示其正致力於提升營運效率,這為瓦楞紙供應商創造了機遇,他們可以提供在長時間配送過程中確保食品安全的解決方案,例如防潮處理、防油塗層和可堆疊設計。

2024年,Gojek與印尼紙板製造商PT Fajar Surya Wisesa合作,開發了一種具有更強耐油性的可生物分解餐盒。此次合作使與包裝相關的客戶投訴減少了30%,食品在配送過程中的溫度保持率提高了15%,並透過最佳化餐盒設計和在地採購,降低了8%的材料成本。

牛皮紙和再生OCC的價格波動對加工商的利潤率帶來壓力。

2025年初,牛皮紙廠生產中斷和價格波動影響了區域供應鏈,加劇了原物料成本壓力。據印尼紙漿和造紙協會稱,2024年第四季牛皮紙襯紙的平均價格較第三季上漲了18%,而回收的舊瓦楞紙箱(OCC)價格在每噸180美元至240美元之間波動,給下游加工商的利潤率帶來了壓力。 PT Fajar Surya Wisesa公司報告稱,儘管其對主要客戶實施了動態定價機制,但原物料成本波動仍導致EBITDA獲利率下降了2.3個百分點。

這種波動源自於供需失衡,區域需求年增率4.2%遠超產能成長率2.8%,造成結構性壓力,並在供應中斷期間加劇價格波動。此外,加工企業的盈利也受到主要外送平台和電商營運商定價權不足的進一步壓力,這些平台和營運商均持有包含固定價格條款的年度合約。

細分市場分析

到2025年,食品飲料應用將佔東南亞瓦楞紙包裝市場佔有率的34.62%,這主要得益於該地區餐飲服務業的擴張和低溫運輸基礎設施的發展。預計到2025年,食品飲料市場規模將達到63.3億美元,成長速度將加快,尤其是在越南和印度尼西亞,這兩個國家的食品配送平台對專用包裝解決方案的需求持續成長。電子商務包裝預計將成為成長最快的細分市場,到2031年將以5.17%的複合年成長率成長,這主要得益於Shopee、Lazada等主要營運商的平台整合以及區域郵政服務機構的標準化要求。

2024年,雀巢印尼公司為其泡麵產品推出了新的紙板包裝規格,包裝材料用量減少了12%,並透過提升防潮性能提高了產品的儲存穩定性。這項最佳化措施每年可節省320萬美元的成本,同時確保了產品在印尼不同氣候帶的保護標準。電氣和電子設備包裝主要供應給位於馬來西亞和泰國的區域製造地。面向出口的生產需要堅固耐用的紙板解決方案,以保護零件在國際運輸過程中免受損壞。

在醫療保健和製藥行業,監管合規要求和確保低溫運輸完整性的需求推動了抗菌塗層和耐熱性等特殊瓦楞紙板設計的應用。化妝品和個人護理包裝反映了全部區域可支配收入的成長和都市化趨勢。汽車和工業領域正受益於製造多元化和供應鏈本地化措施。食品配送市場的成長以及電子商務的擴張,為提供各種應用解決方案的加工商創造了跨領域的機會。數位印刷技術能夠快速客製化,以滿足不同的終端用戶需求。

到2025年,單層瓦楞紙包裝將保持東南亞瓦楞紙包裝市場38.64%的佔有率,這反映了其在中重型運輸應用和食品配送包裝方面的成本效益,在這些領域,最佳化重量以提升最後一公里物流效率仍然至關重要。預計到2025年,東南亞單層瓦楞紙包裝市場規模將達到70.6億美元,其中食品配送和電子商務領域的需求將保持穩定。三層瓦楞紙包裝將以4.36%的複合年成長率實現最快成長,這主要得益於重工業應用和出口包裝的需求,其更高的抗壓性和承載能力使其具有競爭優勢。

雙層瓦楞紙板主要用於電子包裝和零售展示等中等應用,而單面瓦楞紙板則用於防護包裝和緩衝解決方案等特殊應用。先進瓦楞紙板生產設備的引進,使本地加工商能夠生產出瓦楞形狀精準、黏合劑塗覆均勻的三層瓦楞紙板產品。泰國貨櫃集團對高速瓦楞紙板生產設備的投資,正是製造商為滿足出口市場對卓越包裝性能的高要求而提升產能的典型例證。

2024年,三菱汽車越南公司修訂了出口包裝規範,將雙層瓦楞紙箱更換為三層瓦楞紙箱,以降低汽車零件海運過程中的破損率。雖然這項改變使包裝成本增加了23%,但卻減少了67%的產品破損索賠,每年淨節省180萬美元。採用三層瓦楞紙箱的趨勢反映了跨國製造商在建立區域生產基地時對產品品質日益成長的需求,這也為擁有先進製造能力的加工企業創造了機會。

東南亞瓦楞紙包裝市場報告按終端用戶行業(食品飲料、電子產品、個人護理、醫療保健、汽車等)、紙板類型(單面、單層、雙層、三層)、瓦楞類型(A型、B型、C型、E型、F型、微瓦楞)、印刷技術(柔版印刷、數位印刷、膠版印刷、膠版等)和地區/複合版進行細分。市場預測以美元以金額為準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 為因應B2C電子商務小包裹量的爆炸性成長,對尺寸合適的運輸包裝箱的需求日益成長。

- 食品配送熱潮推動了對防漏紙板餐盒的需求。

- 印尼、越南和泰國將逐步淘汰一次性塑膠製品

- 高速數位柔印生產線的引入大大縮短了中小企業的前置作業時間。

- 利用人工智慧驅動的包裝盒設計軟體減少邊角料廢棄物

- 全部區域轉向人工林種植的速生纖維等級

- 市場限制

- 牛皮紙和再生OCC的價格波動對加工商的利潤率帶來壓力。

- 季風物流週期中較差的防潮性能

- 分散式配電盤物流增加了回程傳輸空車營運成本

- 工業4.0相容型瓦楞紙包裝機熟練操作人員短缺

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素如何影響市場

- 波特五力分析

- 供應商的議價能力

- 買方和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按最終用戶行業分類

- 食品/飲料

- 電氣和電子設備

- 化妝品和個人護理

- 醫療和藥品

- 汽車和工業

- 其他終端用戶產業

- 按紙板類型

- 一邊

- 單層

- 雙層壁

- 三層壁

- 按笛型

- 長笛

- 低音長笛

- C調長笛

- E 長笛

- F調長笛與微型長笛

- 透過印刷技術

- 柔版印刷

- 數位(噴墨)

- 石化層壓

- 其他印刷技術

- 按國家/地區

- 印尼

- 泰國

- 馬來西亞

- 越南

- 菲律賓

- 新加坡

- 其他東南亞國家

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SCG Packaging Public Company Limited

- Rengo Co., Ltd.

- Oji Holdings Corporation

- Toppan Inc.

- Smurfit WestRock

- International Paper Company

- Amcor plc

- Huhtamaki Oyj

- Bobst Group SA

- Thai Packaging & Printing Public Company Limited

- Sarnti Packaging Co., Ltd.

- Thai Containers Group Co., Ltd.

- PT Pura Barutama

- Harta Packaging Industries(Selangor)Sdn Bhd

- Trio Paper Mills Sdn. Bhd.

- Vina Kraft Paper Co., Ltd.

- New Asia Industries Co., Ltd.

- Nine Dragons Paper(Holdings)Limited

第7章 市場機會與未來展望

The South-East Asia corrugated packaging market is expected to grow from USD 18.28 billion in 2025 to USD 18.94 billion in 2026 and is forecast to reach USD 22.62 billion by 2031 at 3.62% CAGR over 2026-2031.

Escalating parcel volumes from e-commerce platforms, the rise of food-delivery ecosystems, and regulatory pressure on single-use plastics continue to steer procurement budgets toward fiber-based formats. Indonesia's integrated supply chains, Vietnam's export-oriented manufacturing base, and Thailand's food-processing clusters drive geographic momentum, while investments in high-speed digital flexo lines compress lead times that once hampered regional converters. Material cost volatility linked to kraft liner and recycled OCC supplies remains the primary margin headwind, yet plantation-based fast-growing fiber grades and AI-enabled design software offset part of the squeeze through lower input costs and higher yield efficiencies. Competition centers on technology adoption rather than price warfare as converters chase long-term contracts with food-delivery platforms and 3PL operators.

South East Asia Corrugated Packaging Market Trends and Insights

Explosive B2C E-commerce Parcel Volumes Demanding Right-Sized Shipping Boxes

E-commerce logistics transformation drives corrugated demand through dimensional weight optimization and standardized packaging requirements. PT Pos Indonesia processed over 2.8 billion parcels in 2024, representing 15% year-over-year growth, with corrugated packaging comprising approximately 65% of total parcel volume. The state postal service has invested in automated sorting facilities across Jakarta, Surabaya, and Medan, creating standardized packaging specifications that favor corrugated solutions. Cross-border e-commerce through platforms like Shopee and Lazada generates varied packaging requirements, with 3PLs standardizing box sizes to optimize warehouse space and shipping costs. Regional infrastructure challenges including rural delivery networks, tropical climate conditions, and extended transit times increase preference for robust corrugated grades and moisture-resistant treatments that maintain structural integrity during logistics cycles.

Shopee Indonesia implemented a packaging standardization program in 2024, reducing box size variations from 47 to 12 standard dimensions across its fulfillment network. This initiative resulted in 23% reduction in packaging material usage and 18% improvement in truck loading efficiency, demonstrating how e-commerce platforms drive corrugated demand through operational optimization rather than pure volume growth.

Food-Delivery Boom Accelerating Need for Leak-Resistant Corrugated Meal Boxes

Vietnam's food delivery market expansion to USD 1.8 billion in 2024 with 26% growth exemplifies regional demand acceleration for specialized food packaging solutions, with corrugated meal boxes representing approximately 40% of packaging volume by weight. Grab Holdings reported 2.4 billion food delivery orders across Southeast Asia in 2024, with Vietnam and Indonesia accounting for 67% of total volume, creating massive demand for standardized corrugated meal containers. The shift from heavy discounting to sustainable growth models among major platforms emphasizes operational efficiency initiatives, creating opportunities for corrugated suppliers offering moisture-resistant treatments, grease-proof coatings, and stackable designs that maintain food safety during extended delivery cycles.

Gojek partnered with Indonesian corrugated manufacturer PT Fajar Surya Wisesa in 2024 to develop biodegradable meal boxes with enhanced grease resistance. The collaboration resulted in 30% reduction in packaging-related customer complaints and 15% improvement in food temperature retention during delivery, while reducing material costs by 8% through optimized box design and local sourcing

Kraft Liner and Recycled OCC Price Volatility Squeezing Converter Margins

Raw material cost pressures intensified in early 2025 with kraft paper mills experiencing production disruptions and price volatility affecting regional supply chains. The Indonesian Pulp and Paper Association reported average kraft liner prices increased 18% in Q4 2024 compared to Q3, while recycled OCC prices fluctuated between USD 180-240 per tonne, creating margin compression for downstream converters. PT Fajar Surya Wisesa reported EBITDA margin compression of 2.3 percentage points in 2024 due to raw material cost volatility, despite implementing dynamic pricing mechanisms for major customers.

The volatility stems from supply-demand imbalances as regional demand growth of 4.2% annually outpaces capacity additions of 2.8%, creating structural tightness that amplifies price swings during supply disruptions. Converter profitability faces additional pressure from limited pricing power with major food delivery platforms and e-commerce operators who maintain annual contracts with fixed pricing terms.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Phase-Out of Single-Use Plastics in Indonesia, Vietnam and Thailand

- Installation of High-Speed Digital Flexo Lines Slashing Lead-Times for SMEs

- Inferior Humidity Resistance During Monsoon Logistics Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food and beverage applications commanded 34.62% of the South-East Asia corrugated packaging market share in 2025, benefiting from the region's expanding food service sector and cold chain infrastructure development. The South-East Asia corrugated packaging market size for food and beverage applications reached USD 6.33 billion in 2025, with growth accelerating in Vietnam and Indonesia where food delivery platforms generate consistent demand for specialized packaging solutions. E-commerce packaging emerges as the fastest-growing segment with 5.17% CAGR through 2031, driven by platform consolidation and standardization requirements from major operators including Shopee, Lazada, and regional postal services.

Nestle Indonesia implemented new corrugated packaging specifications in 2024 for its instant noodle products, reducing packaging material usage by 12% while improving shelf stability through enhanced moisture barrier properties. The optimization resulted in annual cost savings of USD 3.2 million while maintaining product protection standards across Indonesia's diverse climate zones. Electrical and electronics packaging serves regional manufacturing hubs, particularly in Malaysia and Thailand, where export-oriented production requires robust corrugated solutions for component protection during international shipping.

Healthcare and pharmaceutical applications gain momentum from regulatory compliance requirements and cold chain integrity demands, with specialized corrugated designs incorporating antimicrobial coatings and temperature-resistant properties. Cosmetics and personal care packaging reflects rising disposable incomes and urbanization trends across the region, while automotive and industrial segments benefit from manufacturing diversification and supply chain regionalization initiatives. The convergence of food delivery growth and e-commerce expansion creates cross-segment opportunities for converters offering multi-application solutions, with digital printing technologies enabling rapid customization across diverse end-user requirements.

Single wall corrugated boards maintained 38.64% of the South-East Asia corrugated packaging market share in 2025, reflecting cost-effectiveness for medium-duty shipping applications and food delivery packaging where weight optimization remains critical for last-mile logistics efficiency. The South-East Asia corrugated packaging market size for single wall applications reached USD 7.06 billion in 2025, with food delivery and e-commerce segments driving consistent demand. Triple wall configurations experience the fastest growth at 4.36% CAGR, driven by heavy-duty industrial applications and export packaging requirements where enhanced crush resistance and stackability provide competitive advantages.

Double wall boards serve intermediate applications including electronics packaging and retail displays, while single face corrugated finds niche applications in protective wrapping and void fill solutions. Advanced corrugator installations enable regional converters to produce consistent triple wall products with precise flute formation and adhesive application. Thai Containers Group's investment in high-speed corrugating equipment demonstrates how manufacturers upgrade capabilities to serve demanding export markets requiring superior packaging performance.

Mitsubishi Motors Vietnam upgraded its export packaging specifications in 2024, transitioning from double wall to triple wall corrugated containers for automotive parts shipments to reduce damage rates during ocean transport. The change increased packaging costs by 23% but reduced product damage claims by 67%, resulting in net savings of USD 1.8 million annually. The trend toward triple wall adoption reflects increasing quality requirements from multinational manufacturers establishing regional production facilities, creating opportunities for converters with advanced manufacturing capabilities.

The South-East Asia Corrugated Packaging Market Report is Segmented by End-User Industry (Food and Beverage, Electronics, Personal Care, Healthcare, Automotive, and More), Board Type (Single Face, Single Wall, Double Wall, and Triple Wall), Flute Type (A, B, C, E, and F-Flute and Micro-Flutes), Printing Technology (Flexographic, Digital, Litho-Lamination, and More), and Country. Market Forecasts in Value (USD).

List of Companies Covered in this Report:

- SCG Packaging Public Company Limited

- Rengo Co., Ltd.

- Oji Holdings Corporation

- Toppan Inc.

- Smurfit WestRock

- International Paper Company

- Amcor plc

- Huhtamaki Oyj

- Bobst Group SA

- Thai Packaging & Printing Public Company Limited

- Sarnti Packaging Co., Ltd.

- Thai Containers Group Co., Ltd.

- PT Pura Barutama

- Harta Packaging Industries (Selangor) Sdn Bhd

- Trio Paper Mills Sdn. Bhd.

- Vina Kraft Paper Co., Ltd.

- New Asia Industries Co., Ltd.

- Nine Dragons Paper (Holdings) Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive B2C e-commerce parcel volumes demanding right-sized shipping boxes

- 4.2.2 Food-delivery boom accelerating need for leak-resistant corrugated meal boxes

- 4.2.3 Mandated phase-out of single-use plastics in Indonesia, Vietnam and Thailand

- 4.2.4 Installation of high-speed digital flexo lines slashing lead-times for SMEs

- 4.2.5 Adoption of AI-enabled box-design software reducing trim waste

- 4.2.6 Region-wide shift to plantation-based fast-growing fibre grades

- 4.3 Market Restraints

- 4.3.1 Kraft liner and recycled OCC price volatility squeezing converter margins

- 4.3.2 Inferior humidity resistance during monsoon logistics cycles

- 4.3.3 Fragmented panel-board logistics inflating back-haul empty-run costs

- 4.3.4 Skilled-operator shortage for Industry-4.0 corrugators

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-User Industry

- 5.1.1 Food and Beverage

- 5.1.2 Electrical and Electronics

- 5.1.3 Cosmetics and Personal Care

- 5.1.4 Healthcare and Pharmaceutical

- 5.1.5 Automotive and Industrial

- 5.1.6 Other End-User Industries

- 5.2 By Board Type

- 5.2.1 Single Face

- 5.2.2 Single Wall

- 5.2.3 Double Wall

- 5.2.4 Triple Wall

- 5.3 By Flute Type

- 5.3.1 A-Flute

- 5.3.2 B-Flute

- 5.3.3 C-Flute

- 5.3.4 E-Flute

- 5.3.5 F-Flute and Micro-Flutes

- 5.4 By Printing Technology

- 5.4.1 Flexographic

- 5.4.2 Digital (Inkjet)

- 5.4.3 Litho-lamination

- 5.4.4 Other Printing Technologies

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Malaysia

- 5.5.4 Vietnam

- 5.5.5 Philippines

- 5.5.6 Singapore

- 5.5.7 Rest of South-East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SCG Packaging Public Company Limited

- 6.4.2 Rengo Co., Ltd.

- 6.4.3 Oji Holdings Corporation

- 6.4.4 Toppan Inc.

- 6.4.5 Smurfit WestRock

- 6.4.6 International Paper Company

- 6.4.7 Amcor plc

- 6.4.8 Huhtamaki Oyj

- 6.4.9 Bobst Group SA

- 6.4.10 Thai Packaging & Printing Public Company Limited

- 6.4.11 Sarnti Packaging Co., Ltd.

- 6.4.12 Thai Containers Group Co., Ltd.

- 6.4.13 PT Pura Barutama

- 6.4.14 Harta Packaging Industries (Selangor) Sdn Bhd

- 6.4.15 Trio Paper Mills Sdn. Bhd.

- 6.4.16 Vina Kraft Paper Co., Ltd.

- 6.4.17 New Asia Industries Co., Ltd.

- 6.4.18 Nine Dragons Paper (Holdings) Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment