|

市場調查報告書

商品編碼

1911318

北美瓦楞紙包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

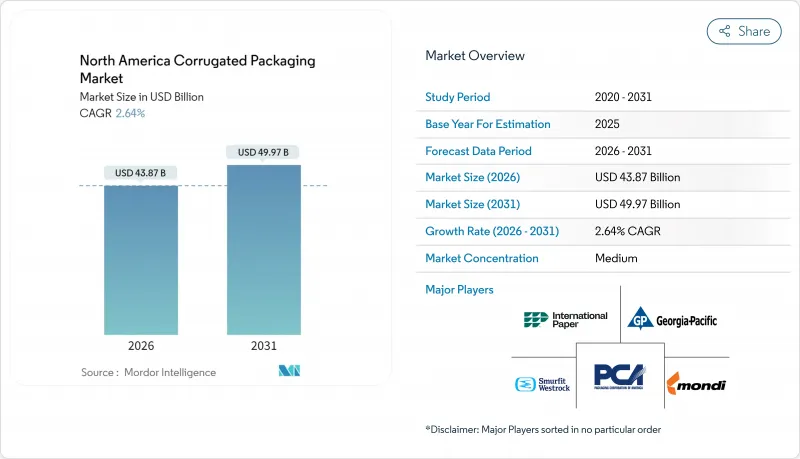

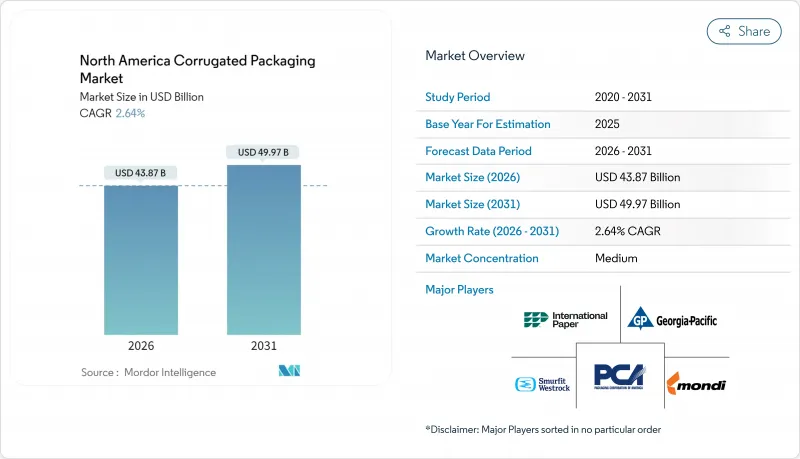

預計北美瓦楞紙包裝市場將從 2025 年的 427.4 億美元成長到 2026 年的 438.7 億美元,到 2031 年將達到 499.7 億美元,2026 年至 2031 年的複合年成長率為 2.64%。

到2024年,再生瓦楞紙板將佔瓦楞紙箱市場佔有率的49.54%,這預示著企業永續性政策正朝著優先考慮再生材料而非原生纖維的方向發展。電子商務履約仍然是最強勁的結構性促進因素,因為合理調整規模的舉措推動了對多樣化瓦楞形狀的需求。同時,製造業近岸外包正將紙箱分銷轉移到更靠近美國和墨西哥生產基地的位置。半化學級和特種級紙箱預計將以3.65%的複合年成長率快速成長,反映出企業對阻隔塗層的投資正在開拓高利潤的食品和製藥應用領域。儘管消費後紙板和原生紙漿價格持續上漲帶來的成本壓力依然存在,但工廠自動化程度的提高和人工智慧驅動的需求預測正幫助領先的製造商維持利潤率和服務水準。

北美瓦楞紙包裝市場趨勢與洞察

電子商務小包裹量快速成長

電子商務配送正在改變市場需求,從托盤式補貨轉向直接面對消費者的小包裹,這需要更堅固、更輕的包裝解決方案。亞馬遜的包裝決策引擎目前每年執行超過10億次尺寸計算,在設計日益複雜的情況下,將材料用量減少15%至20%,同時提升每個包裝箱的價值。訂閱製商務模式增強了穩定性,因為重複訂單使瓦楞紙箱製造商能夠最佳化生產批量和黏合劑設定。更小、更頻繁的配送模式需要更低的紙張重量和更高的邊緣抗壓強度,這有利於採用先進的瓦楞形狀。自動化紙箱組裝機和包裝站直接連接到瓦楞紙箱工廠的ERP系統,從而減少緩衝庫存並縮短前置作業時間。這些營運模式的改變共同推動了瓦楞紙箱市場的發展,將小包裹市場的成長轉化為利潤更高的SKU多樣化。

監管政策轉向可回收包裝和塑膠禁令

加州SB54法案規定,到2032年一次性塑膠的使用量必須減少65%,鼓勵品牌承諾採用「紙質化」策略,以擴大瓦楞紙包裝的使用。美國環保署(EPA)的塑膠污染控制框架協調了各州的生產者延伸責任制計劃,並鼓勵在運輸材料中使用再生紙。隨著跨國公司協調全球規範,歐盟的政策壓力也延伸到了北美包裝規範。擁有內部回收設施的瓦楞紙板廠比必須建立新的回收基礎設施的塑膠加工商具有成本和合規優勢。規定回收比例的採購政策直接增加了對再生箱板紙的需求,在噸位成長放緩的情況下,支撐了纖維需求的穩定性。

舊瓦楞紙板 (OCC) 和原生紙漿價格波動

儘管2024年再生瓦楞紙包裝的價值同比下降了28%,但由於運輸中斷和工廠停產,原生紙漿價格仍然堅挺,給一體化生產商的利潤率帶來了壓力。美國包裝公司(Packaging Corporation of America)在2025年初將箱板紙價格提高了每噸70美元,抵消了成本波動的影響,但也對價格敏感型細分市場的需求彈性構成了風險。再生纖維的供應與市政垃圾收集效率密切相關,而市政垃圾收集效率會隨著消費者行為的波動而改變。匯率波動也使從加拿大採購紙漿變得更加複雜,因為加拿大的紙漿進口以美元計價。為了對沖波動風險,加工商維持著較高的庫存水平,佔用了營運資金,降低了投資回報率,從而抑制了瓦楞紙箱市場的成長勢頭。

細分市場分析

到2025年,再生瓦楞紙板將成為最大的收入來源,佔瓦楞紙箱市佔率的49.02%。受食品蒸餾用防潮內襯需求成長的推動,半化學和特殊瓦楞紙箱的市場規模預計將以3.50%的複合年成長率成長。各大品牌正將再生材料含量目標納入採購評分體系,並鼓勵造紙廠追溯性地整合材料回收設施,以確保纖維原料的穩定供應。 Cascade公司為其Green Pack業務獲得的2.5億美元資金籌措將有助於擴大再生輕量產品的生產,凸顯了貸款機構對循環經濟資產的濃厚興趣。

在對邊緣抗壓強度和防潮性能要求較高的應用中,例如出口包裝箱和大型工業引擎,原生牛皮箱紙板仍然至關重要。賦予牛皮紙耐油性的特殊塗層正在逐步滲透到傳統上由牛皮紙主導的應用領域,但高風險運輸仍要求使用原生材料以確保價值鏈的可靠性。展望未來,有關回收率的監管標準將決定市場佔有率,而高附加價值特種紙板的利潤貢獻預計將超過普通級紙板。

到2025年,單層層級構造將佔總銷售額的39.10%,這主要得益於其製作流程的簡化和成本的降低。然而,受低溫運輸網路擴張和工具機的推動,三層瓦楞紙箱的市場預計將在2031年之前以4.08%的複合年成長率成長。三層瓦楞紙箱市場規模的成長主要得益於更厚的紙板,這種紙板能夠承受多日冷藏運輸過程中的穿刺。同時,單層瓦楞紙箱生產線的自動化使得快速換型成為可能,從而更好地應對電子商務需求的波動。

人事費用上漲迫使加工商投資能夠加工更重的三層壁板而無需人工操作的設備,而黏合劑供應商則透過推出更快固化的配方來維持生產線速度。儘管原料成本高昂,但在風險管理優先於價格敏感性的領域,例如高價值生技藥品和工業機械,對三層壁板的需求仍在成長。同時,單層壁板的輕量化設計透過降低與體積重量相關的運費附加費,維持了市場佔有率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務小包裹量快速成長

- 監管政策轉向可再生包裝和塑膠禁令

- 輕質高強度微型波紋管和材料節約效果

- 人工智慧驅動的合理尺寸和按需包裝盒生產

- 擴大低溫運輸在食材自煮包和藥品物流的應用

- 製造業近岸外包提振了國內紙箱需求

- 市場限制

- 回收紙(OCC)和原生紙漿價格波動

- 柔軟性和硬質塑膠替代品的威脅

- 勞動力短缺導致自動化設備投資負擔加重

- 能源和運輸成本不斷上漲

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

- 產業價值鏈分析

第5章 市場規模與成長預測

第6章:紙板等級

- 再生紙板

- 原生牛皮箱紙板

- 半化學級和特殊級

- 依牆體類型

- 單層

- 雙層壁

- 三層壁

- 按笛型

- 長笛

- 低音長笛

- C調長笛

- E 長笛

- F/N 微型長笛

- 依產品類型

- 狹縫盒

- 硬盒

- 望遠鏡盒

- 文件夾盒

- 布爾克文和奧克塔文

- 按最終用戶行業分類

- 加工食品

- 生鮮食品和農產品

- 飲料

- 紙製品

- 電氣和電子設備

- 個人護理和化妝品

- 其他終端用戶產業

- 透過印刷技術

- 柔版印刷

- 數位印刷

- 石化層壓

- 其他印刷技術

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第7章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- International Paper Company

- Smurfit WestRock

- Packaging Corporation of America

- Georgia-Pacific LLC

- Mondi plc

- Pratt Industries, Inc.

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper(Holdings)Limited

- Oji Holdings Corporation

- Graphic Packaging Holding Company

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Orora Limited

- Rengo Co., Ltd.

- Viking Packaging, LLC

- Sealed Air Corporation

- Menasha Corporation

第8章:市場機會與未來展望

- 閒置頻段與未滿足需求評估

The North America Corrugated Packaging Market is expected to grow from USD 42.74 billion in 2025 to USD 43.87 billion in 2026 and is forecast to reach USD 49.97 billion by 2031 at 2.64% CAGR over 2026-2031.

Recycled containerboard captures 49.54% of the corrugated boxes market share in 2024, demonstrating how corporate sustainability mandates favor recycled inputs over virgin fiber. E-commerce fulfillment remains the strongest structural driver as right-sizing initiatives heighten demand for varied flute profiles, while nearshoring of manufacturing shifts box flows closer to the United States and Mexican production hubs. Semi-chemical and specialty grades grow fastest at 3.65% CAGR, reflecting investments in barrier coatings that unlock higher margin food and pharmaceutical applications. Cost pressures persist due to volatile prices of old corrugated cardboard and virgin pulp; however, greater plant automation and AI-enabled demand forecasting help leading producers defend margins and service levels.

North America Corrugated Packaging Market Trends and Insights

Surge in E-commerce Parcel Volumes

E-commerce shipping has shifted demand from palletized replenishment to direct-to-consumer parcels that require stronger, yet lighter, packaging solutions. Amazon's Package Decision Engine now executes over 1 billion dimensional decisions a year, cutting material usage by 15-20 % while still lifting value per box as designs become more complex. Subscription commerce adds stability because recurring orders allow corrugators to optimize run lengths and glue setups. Smaller but more frequent shipments intensify demand for high edge crush strength at low grammage, favoring advanced flute geometries. Automated case erectors and pack stations tie directly into box plants' ERP systems, shrinking buffer inventories and shortening lead times. Collectively, these operating model shifts underpin the corrugated boxes market by translating parcel growth into higher-margin SKU proliferation.

Regulatory Shift toward Recyclable Packaging and Plastic Bans

California's SB 54 mandates a 65% cut in single-use plastic by 2032, catalyzing brand commitments to "paperization" strategies that amplify corrugated uptake. The United States EPA framework to curb plastic pollution aligns state-level extended producer responsibility programs and incentivizes post-consumer content in shipping materials. Multinational firms harmonize global specifications, so EU policy pressure spills into North American packaging briefs. Corrugated plants with in-house recycling assets gain cost and compliance advantages over plastic converters that must retrofit new collection infrastructures. Procurement policies specifying recycled percentages directly elevate demand for recycled containerboard, supporting stable fiber demand even as overall tonnage growth moderates.

Volatility in OCC and Virgin Pulp Prices

Old corrugated cardboard values fell 28% year-over-year in 2024, yet virgin pulp held firm due to shipping disruptions and mill downtime, squeezing integrated producers' spreads. Packaging Corporation of America lifted linerboard prices by USD 70 per ton in early 2025 to offset cost swings, but the increases risk demand elasticity in the price-sensitive segment. Recycled fiber availability correlates with municipal collection efficiency, which fluctuates with consumer behavior. Currency shifts complicate Canadian sourcing as pulp imports settle in U.S. dollars. To hedge volatility, converters carry higher stock levels, tying up working capital and diluting return on invested capital, thereby tempering the corrugated boxes market momentum.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight High-Strength Micro-Flutes and Material Savings

- AI-Enabled Right-Sizing and On-Demand Box Production

- Substitution Threat from Flexible and Rigid Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recycled containerboard generated the largest 2025 revenue, commanding 49.02% of the corrugated boxes market share. The corrugated boxes market size for semi-chemical and specialty grades is projected to climb at a 3.50% CAGR owing to rising demand for moisture-resistant liners in ready-to-eat meals. Brands embed recycled-content targets into procurement scorecards, encouraging mills to back-integrate into material recovery facilities to secure fiber streams. The Cascades Greenpac refinance of USD 250 million widens recycled lightweight output and highlights lender appetite for circular-economy assets.

Virgin Kraft linerboard remains indispensable where edge crush strength and wet strength matter for export crates and heavy industrial engines. Specialty coatings that add grease resistance let recycled substrates encroach on formerly kraft-dominated applications, but supply chain reliability still dictates virgin usage in high-risk shipments. In the future, regulatory thresholds around recycled percentages will anchor market share, though value-added specialty boards will outpace commodity grades in margin contribution.

Single-wall formats accounted for 39.10% of sales in 2025, favored for streamlined converting and lower material costs. Triple-wall designs, however, are set for a 4.08% CAGR through 2031 as cold-chain networks scale and machine tool exports rise. The corrugated boxes market size for triple-wall is buoyed by thicker boards that resist puncture during multi-day reefer hauls. Automation on single-wall lines allows rapid changeovers, meeting e-commerce variability.

Raised labor costs push converters to invest in equipment that can handle heavier triple-wall grades without manual assists, and adhesive vendors respond with fast-set formulations to maintain line speeds. Despite higher input costs, triple-wall demand grows where risk management outweighs price sensitivity, such as high-value biologics and industrial machinery. Conversely, lightweight programming on single-wall units sustains share by mitigating freight surcharges linked to dimensional weight.

The North America Corrugated Packaging Market Report is Segmented by Board Grade (Recycled Containerboard, and More), Wall Type (Single Wall, Double Wall, and Triple Wall), Flute Type (A-Flute, B-Flute, and More), Product Type (Slotted Boxes, and More), End-User Industry (Processed Foods, and More), Printing Technology (Flexographic Printing, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- International Paper Company

- Smurfit WestRock

- Packaging Corporation of America

- Georgia-Pacific LLC

- Mondi plc

- Pratt Industries, Inc.

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Limited

- Oji Holdings Corporation

- Graphic Packaging Holding Company

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Orora Limited

- Rengo Co., Ltd.

- Viking Packaging, LLC

- Sealed Air Corporation

- Menasha Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in E-commerce Parcel Volumes

- 4.2.2 Regulatory Shift toward Recyclable Packaging and Plastic Bans

- 4.2.3 Lightweight High-Strength Micro-Flutes and Material Savings

- 4.2.4 AI-Enabled Right-Sizing and On-Demand Box Production

- 4.2.5 Cold-Chain Expansion for Meal-Kit and Pharma Logistics

- 4.2.6 Nearshoring of Manufacturing Boosting Domestic Box Demand

- 4.3 Market Restraints

- 4.3.1 Volatility in OCC and Virgin Pulp Prices

- 4.3.2 Substitution Threat from Flexible and Rigid Plastics

- 4.3.3 Labor Shortages Driving Automation Capex Burden

- 4.3.4 Rising Energy and Transportation Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitutes

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 The Impact Of Macroeconomic Factors On The Market

- 4.6 Industry Value Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

6 ;'By Board Grade

- 6.1 Recycled Containerboard

- 6.1.1 Virgin Kraft Linerboard

- 6.1.2 Semi-Chemical and Specialty Grades

- 6.2 By Wall Type

- 6.2.1 Single Wall

- 6.2.2 Double Wall

- 6.2.3 Triple Wall

- 6.3 By Flute Type

- 6.3.1 A-Flute

- 6.3.2 B-Flute

- 6.3.3 C-Flute

- 6.3.4 E-Flute

- 6.3.5 F/N Microflute

- 6.4 By Product Type

- 6.4.1 Slotted Boxes

- 6.4.2 Rigid Boxes

- 6.4.3 Telescope Boxes

- 6.4.4 Folder Boxes

- 6.4.5 Bulk Bins and Octabins

- 6.5 By End-user Industry

- 6.5.1 Processed Foods

- 6.5.2 Fresh Food and Produce

- 6.5.3 Beverages

- 6.5.4 Paper Products

- 6.5.5 Electrical and Electronics

- 6.5.6 Personal Care and Cosmetics

- 6.5.7 Other End-user Industries

- 6.6 By Printing Technology

- 6.6.1 Flexographic Printing

- 6.6.2 Digital Printing

- 6.6.3 Litho-lamination

- 6.6.4 Other Printing Technologies

- 6.7 By Country

- 6.7.1 United States

- 6.7.2 Canada

- 6.7.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 International Paper Company

- 7.4.2 Smurfit WestRock

- 7.4.3 Packaging Corporation of America

- 7.4.4 Georgia-Pacific LLC

- 7.4.5 Mondi plc

- 7.4.6 Pratt Industries, Inc.

- 7.4.7 Cascades Inc.

- 7.4.8 Sonoco Products Company

- 7.4.9 Nine Dragons Paper (Holdings) Limited

- 7.4.10 Oji Holdings Corporation

- 7.4.11 Graphic Packaging Holding Company

- 7.4.12 Stora Enso Oyj

- 7.4.13 Nippon Paper Industries Co., Ltd.

- 7.4.14 Orora Limited

- 7.4.15 Rengo Co., Ltd.

- 7.4.16 Viking Packaging, LLC

- 7.4.17 Sealed Air Corporation

- 7.4.18 Menasha Corporation

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-need Assessment